10 Metrics for Measuring CapEx Success

Capital Expenditures (CapEx) in real estate are long-term investments aimed at increasing property value and operational efficiency. Tracking the right metrics ensures these investments deliver measurable returns. Here are the top 10 metrics you should monitor:

ROI (Return on Investment): Measures the financial gain relative to the cost of improvements. Formula:

(Net Benefit – Investment Cost) ÷ Investment Cost × 100.NOI (Net Operating Income) Impact: Tracks changes in cash flow by comparing rental income and operating expenses before and after CapEx projects.

Cap Rate (Capitalization Rate) Changes: Reflects property performance by linking NOI to market value. Formula:

NOI ÷ Property Value.Occupancy Rate Uplift: Evaluates how upgrades attract and retain tenants, measured as the percentage of occupied units.

Tenant Retention and Lease Renewal Rates: Assesses how well CapEx investments encourage tenants to renew leases, reducing turnover costs.

OER (Operating Expense Ratio): Tracks operating efficiency by dividing total expenses by gross rental income. Lower ratios are better.

Cash Flow Growth: Measures net cash flow improvements after CapEx investments.

Asset Quality and System Uptime: Focuses on reliability metrics like Mean Time Between Failure (MTBF) to ensure operational performance.

Maintenance Cost per Square Foot: Tracks how CapEx reduces ongoing maintenance expenses, highlighting cost efficiency.

Property Value Appreciation: Measures long-term property value growth resulting from strategic investments.

Why These Metrics Matter

Monitoring these metrics helps property owners make informed decisions, justify budgets, and maximize returns. By focusing on ROI, NOI, and tenant satisfaction, you can ensure CapEx projects align with financial goals and market demands. Tools like CoreCast streamline tracking, offering real-time insights for better portfolio management.

Learn Excel Shortcuts From a Financial Analyst

1. Return on Investment (ROI)

Return on Investment (ROI) is one of the most essential metrics for evaluating the success of capital expenditures (CapEx). It measures how much financial gain a property owner gets compared to the initial cost of an improvement, expressed as a percentage.

Here’s the formula to calculate ROI for CapEx: (Net Benefit – Investment Cost) ÷ Investment Cost × 100. The "net benefit" includes things like higher rental income, lower operating costs, or an increase in property value directly tied to the improvement. For example, if you spend $50,000 on upgrading the HVAC system, and it increases your rental income by $8,000 annually while cutting energy costs by $2,000, your annual ROI would be 20%.

To track ROI accurately, it’s crucial to have a consistent method that accounts for both direct benefits (like rent increases or cost savings) and indirect ones (like better tenant retention). For instance, properties using integrated project monitoring systems see 30% fewer delays. Fewer delays mean fewer unexpected costs, which can significantly boost ROI.

It’s important to align ROI tracking with broader organizational goals. Rather than focusing solely on short-term gains, evaluate each CapEx project based on how it contributes to long-term property value and market competitiveness.

“Capital expenditure planning is the life-blood of successful real estate investment management. Properties with well-laid-out CapEx plans consistently perform better than those without proper planning systems.”

To get the most out of your CapEx investments, follow these best practices:

Conduct feasibility studies and sensitivity analyses to identify projects with the strongest potential returns.

Keep project scope and budget under control during implementation.

Regularly evaluate outcomes to guide future investment decisions.

A proactive approach is key to maximizing ROI. By reviewing your CapEx budget and performance quarterly, you can quickly spot underperforming projects and redirect resources to initiatives with better potential. This ongoing process ensures your investments consistently drive financial success and sets the stage for a comprehensive CapEx performance strategy.

2. Net Operating Income (NOI) Impact

Net Operating Income (NOI) is a straightforward way to measure how your CapEx investments influence your property's cash flow. Essentially, it reflects the dollar-for-dollar impact on your property's financial performance. Keeping a close eye on NOI is critical to ensuring your CapEx efforts align with your overall financial goals.

The formula for NOI is simple: Total Rental Income - Operating Expenses. When you allocate funds to CapEx projects, the primary objectives are to increase rental income and lower operating costs. These two elements work together to enhance NOI, adding measurable value to your property.

Strategic CapEx investments can significantly boost a property's appeal and market value, leading to higher rents and, eventually, a better sale price. For instance, upgrading amenities or modernizing systems can justify rent increases, directly improving NOI. In some cases, renovations may allow for incremental rent adjustments that support long-term NOI growth.

Take Empire Property Management as an example. When they acquired Syracuse Square Power Center, they spent $750,000 replacing an aging roof. While this expenditure didn’t immediately impact NOI, it safeguarded the building’s structural integrity and enhanced tenant satisfaction, ensuring steady long-term income.

Tracking NOI accurately is essential to capturing both the immediate costs of CapEx and the resulting changes in income and expenses. Setting up consistent processes for recording these financial details is crucial for maintaining accurate records. Property management software can simplify this task by centralizing income and expense tracking, making reporting more efficient.

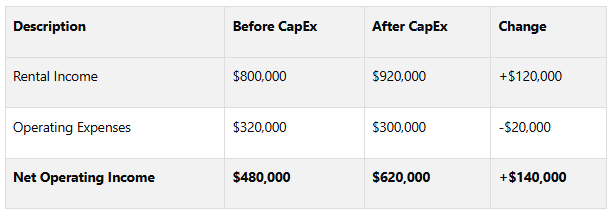

Here’s an example of how a well-executed CapEx project can improve NOI:

Producing monthly NOI reports can provide timely insights. This practice helps you identify trends early, such as higher vacancy rates, tenant payment issues, or unexpected expenses. A rising NOI indicates effective operations and profitability, while a decline signals areas needing attention.

The timeline for NOI improvements will depend on the type of CapEx project. For example, energy-efficient HVAC upgrades might lower expenses immediately, while amenity upgrades could take six to 12 months before translating into higher rental income.

It’s also a good idea to compare your NOI performance against similar properties in your market. This benchmarking lets you see if your CapEx investments are delivering results that match or exceed market expectations. If your property’s NOI outpaces similar buildings, it’s a sign your investments are paying off. On the flip side, underperformance could highlight areas for improvement.

Keep in mind that NOI naturally fluctuates due to factors like occupancy rates, rent adjustments, seasonal trends, and one-time costs. The key is to track these changes consistently and distinguish between variations caused by your CapEx projects and those driven by broader market conditions. Up next, we’ll explore how changes in Cap Rate further reflect the impact of CapEx investments.

3. Capitalization Rate (Cap Rate) Changes

The capitalization rate, or cap rate, is a key metric for assessing how capital expenditures (CapEx) enhance property performance and attractiveness in the market. It links your property's net operating income (NOI) to its current market value, offering a straightforward way to evaluate the success of your investments.

Cap rate is calculated using the formula: NOI ÷ Property Value = Cap Rate. When you invest in CapEx projects, you're essentially working to improve both sides of this equation. Successful CapEx projects often boost NOI and increase property value, which can lead to a lower cap rate - a sign of reduced investment risk. This metric provides a broader perspective on the effects of CapEx, complementing the NOI trends discussed earlier.

Interestingly, cap rates tend to have an inverse relationship with property value. Higher-value properties typically have lower cap rates. Most commercial properties fall within a cap rate range of 3% to 12% or higher. A favorable cap rate usually falls between 5% and 10%, while a rate closer to 4% suggests lower risk but slower investment recovery. Understanding these benchmarks is crucial for evaluating your property's performance and identifying areas for improvement.

Strategic CapEx projects can directly influence cap rates in several ways. For example, renovations that enhance a property's appeal can justify higher rents, boosting NOI and increasing market value simultaneously. Energy-efficient upgrades might immediately cut operating costs, improving NOI right away. On the other hand, aesthetic improvements or added amenities may take longer to translate into higher rents and greater market recognition.

The cap rate is also a valuable tool for comparing properties and analyzing investments. Factors like location and property class significantly affect cap rate expectations. Properties in prime locations, for instance, are often seen as more valuable and tend to have lower cap rates than similar properties in less desirable areas. Additionally, real estate is often categorized into Class A, B, or C properties. Class A properties, being newer and more desirable, usually have the lowest cap rates, while Class C properties, often older and less appealing, command higher cap rates.

To evaluate cap rate changes effectively, start by identifying the factors driving those changes and consider further strategic investments. Comparing your property's cap rate trends with local market data and similar properties can help you gauge whether your investments are yielding the desired results. Cap rates reflect a mix of market conditions and property performance. Investing during periods of cap rate compression - when property values are rising - can maximize the impact of your CapEx projects. By aligning your investments with favorable market trends, you can enhance both your property's cap rate and overall value.

4. Occupancy Rate Uplift

Occupancy rate uplift measures how capital expenditures (CapEx) improve tenant attraction and, in turn, rental income. It's one of the clearest metrics for evaluating the success of property improvement projects.

Occupancy rate is calculated as the percentage of occupied units or square footage compared to the total available space. By comparing this percentage before and after CapEx projects, you can directly assess how your investments are influencing tenant attraction and retention. A noticeable increase in occupancy following renovations is a strong indicator of the project's success, offering a straightforward way to gauge the effectiveness of your improvements.

Strategic investments often lead to higher occupancy rates by addressing tenant preferences and market trends. For example, upgrading common areas or adding new amenities can make a property more appealing to renters and improve its standing in a competitive market. Modernizing HVAC systems or installing energy-efficient LED lighting not only reduces utility costs but also aligns with what today’s tenants value, further boosting occupancy. Similarly, smart building technologies, like automated security systems or smart thermostats, attract tenants while simultaneously lowering property management expenses.

Keeping properties updated through timely CapEx investments is key to maintaining market competitiveness and driving occupancy growth. Even adjustments to interior layouts can make units more appealing, which can directly impact occupancy rates.

Tracking occupancy trends over time is essential for distinguishing the effects of CapEx projects from broader market dynamics. Analyzing tenant turnover can also shed light on why tenants leave, helping to identify which improvements might address these issues.

To achieve the greatest occupancy rate uplift, prioritize projects that deliver significant benefits, whether by enhancing property value or reducing long-term operational costs. Upgrades such as modern HVAC systems, enhanced common areas, or advanced security features not only attract new tenants but also encourage lease renewals, minimizing vacancies and turnover expenses.

Investing in CapEx projects that draw and retain quality tenants creates a positive cycle: higher occupancy rates lead to increased rental income, which can fund further improvements. This cycle not only boosts tenant satisfaction but also enhances property value. Monitoring these trends closely is critical, especially as they tie directly into related metrics like tenant retention rates.

5. Tenant Retention and Lease Renewal Rates

Tenant retention and lease renewal rates are essential for maintaining tenant satisfaction and ensuring long-term occupancy. These metrics not only reduce turnover costs but also stabilize rental income, making them a cornerstone of successful property management. Just like ROI and NOI, tenant retention plays a pivotal role in assessing the success of capital expenditures (CapEx) and their impact on a property's overall performance.

Tenant retention rate reflects the percentage of tenants who decide to renew their leases upon expiration. This figure offers a clear view of whether your CapEx investments are delivering value that tenants notice and appreciate. Upgrades and enhancements can significantly influence lease renewals, benefiting both property owners and tenants. Research supports this: satisfied tenants are over three times more likely to renew their leases compared to dissatisfied ones. Even minor improvements in tenant satisfaction can make a big difference. For example, a one-point increase in satisfaction on the Kingsley survey corresponded to an 18% lower likelihood of tenants leaving and an 8% increase in renewal intent.

High tenant turnover can be expensive. Replacing a tenant may cost as much as five months' rent, with typical turnover expenses ranging between $1,000 and $5,000 per property. These costs include marketing, tenant screening, lease negotiations, cleaning, repairs, and lost rental income during vacancies.

“Tenant retention is the backbone of successful property management. Long-term tenants mean reduced turnover costs, consistent cash flow, and, often, stronger community ties within your properties.”

Strategic CapEx investments can directly boost tenant retention, as shown by Essex Property Trust. The company achieved an average of 3.8% renewal increases while maintaining a 60% retention rate. Additionally, they saw a 5% rise in tenant retention after introducing digital lease renewal systems.

Sustainability upgrades are another way to appeal to tenants. According to JLL's "Decarbonizing the Built Environment" report, 63% of investors believe green initiatives can enhance tenant retention. Tenants interested in eco-friendly living are often willing to pay more, with green-certified buildings commanding 7% higher net effective rents.

Technology also plays a critical role in tenant satisfaction. For example, FirstService Residential implemented a mobile work order system that reduced average service response times from 72 hours to just 24 hours. Properties with high tenant satisfaction report 20% fewer maintenance issues, creating a positive feedback loop of better operations and happier tenants.

“Property managers know that investing in tenant experience yields strong retention and solid brand equity.”

To make the most of your CapEx investments, consider conducting regular tenant satisfaction surveys. These surveys can help identify areas for improvement before they become major concerns. Start renewal discussions at least 90 days before a lease expires to allow room for negotiation and to show tenants that you value their long-term presence.

Exit interviews can also provide valuable insights into systemic issues that CapEx projects might address. By using tenant feedback and aligning investments with market demands, you can ensure your CapEx efforts support retention goals. Together with other performance metrics, retention rates offer a complete picture of how strategic investments contribute to a property's overall value.

6. Operating Expense Ratio (OER)

The Operating Expense Ratio (OER) measures the percentage of gross rental income used to cover operating expenses. Smart CapEx investments can help lower this ratio by reducing maintenance costs and improving efficiency.

To calculate OER, divide total operating expenses by gross rental income, then multiply the result by 100 to express it as a percentage. A lower OER indicates more efficient property management since a smaller portion of income is spent on daily operational costs.

“A property with a consistently low OER may be more attractive to investors, as it suggests higher net operating income and potential profitability.”

OER Benchmarks by Property Type

OER benchmarks vary depending on the type of property:

Multifamily properties: Typically range between 35% and 45%.

Office buildings: Fall within 35% to 55%.

Retail properties: Tend to have higher ratios, generally between 60% and 80%, due to more intensive operational needs.

These benchmarks can guide CapEx strategies aimed at improving efficiency and reducing costs.

Strategic CapEx Investments to Lower OER

Investing in targeted upgrades can have a significant impact on OER. One of the most effective strategies involves energy-efficient upgrades. According to McKinsey and Co., improvements like energy-efficient windows and advanced HVAC controls not only cut costs but also reduce emissions. Shore Agents highlights similar upgrades, such as LED lighting, smart thermostats, and energy-efficient appliances, as excellent ways to achieve long-term utility savings.

“Directing capital expenditures to areas that reduce operating costs is always important but is particularly so during inflationary periods.”

Smart building technology is another game-changer. By using IoT sensors to optimize building systems, it can significantly reduce utility bills and maintenance expenses.

Focus Areas for CapEx Investments

To effectively lower OER, prioritize CapEx spending on areas that directly influence operating costs, such as:

Property taxes

Insurance premiums

Common area maintenance (CAM)

Administrative fees [25]

Investments in automation and technology can reduce reliance on manual labor, while proactive maintenance programs can minimize costly emergency repairs and extend the lifespan of building systems. These improvements often yield a compounding effect, where the initial investment continues to generate savings over time.

Monitoring OER Trends

Regularly tracking OER trends is essential to determine whether your CapEx investments are delivering the desired results. Comparing your property's OER to similar ones in the same market helps gauge relative performance. For commercial real estate, a typical OER falls between 30% and 50%, offering a useful benchmark for evaluation [25].

While OER excludes debt service and CapEx, it provides valuable insights when combined with other metrics like Net Operating Income (NOI) and cash flow growth. Together, these metrics reveal how well your investments are improving operational efficiency and controlling ongoing costs.

Transform Real Estate Data into Confident Decisions

Join Corecast to streamline your real estate operations, gain real-time insights, and make smarter investment decisions with a unified platform.

7. Cash Flow Growth

Cash flow growth is all about understanding how much your property's net cash flow improves after making CapEx investments. It's a straightforward way to see how your capital improvements are boosting your property's ability to generate income. Essentially, it measures the difference in net cash flow before and after your project, giving you a clear sense of whether your investment is delivering results.

Just like ROI or NOI, cash flow growth provides a concrete, dollar-based way to assess the success of your CapEx initiatives.

Understanding the Cash Flow Impact

Cash flow growth highlights how effectively your CapEx investments translate into increased income or reduced costs. For example, if you invest in revenue-focused CapEx projects - those designed to generate more income - you should notice a positive shift in your monthly cash flow within a reasonable period.

“Number one: cash is king.”

Measuring Cash Flow Growth Effectively

To measure cash flow growth accurately, start by establishing a baseline. Track your property's net cash flow over 3–6 months before starting the project to account for seasonal fluctuations. Once your CapEx project is complete, monitor monthly cash flow and compare it to your initial projections. Studies show that 87% of real estate investors who consistently use cash flow projections see higher profitability than those who don't.

Regularly comparing actual cash flow against your forecasts helps you evaluate the success of your investments and refine your approach for future projects.

High-Impact CapEx Projects for Cash Flow Growth

Some CapEx projects are particularly effective at driving cash flow growth. For instance, expansion CapEx projects - like adding new rental units, creating amenities that justify higher rents, or upgrading systems to allow for premium pricing - can significantly boost your property's income potential.

Tracking and Optimization Strategies

To stay on top of your cash flow, consider using property management software that provides real-time financial tracking. Access to up-to-date data lets you assess your property's financial health at any given moment.

When planning CapEx investments, aim for projects that balance immediate needs with long-term goals. Evaluate how each project impacts cash flow, profitability, and overall property value. A smart strategy often involves allocating funds to both maintenance and growth-focused CapEx, ensuring smooth operations while setting the stage for higher returns down the road.

Successful property owners use cash flow growth not just as a metric but as a strategic tool. By consistently tracking this figure, you can pinpoint which investments yield the best results and apply those winning strategies across your entire portfolio.

8. Asset Quality and Building System Uptime

When evaluating the success of your investments, asset quality and system uptime are key indicators of operational performance. Upgrades like modernizing HVAC systems, replacing elevators, or updating electrical infrastructure aren’t just about aesthetics - they’re about ensuring reliability. Tracking system performance helps pinpoint areas that need attention while showcasing improvements in dependability.

The goal is to build a more reliable and efficient environment. This not only keeps tenants happy but also helps control operational costs, aligning with the broader aim of maximizing the impact of your capital expenditures (CapEx).

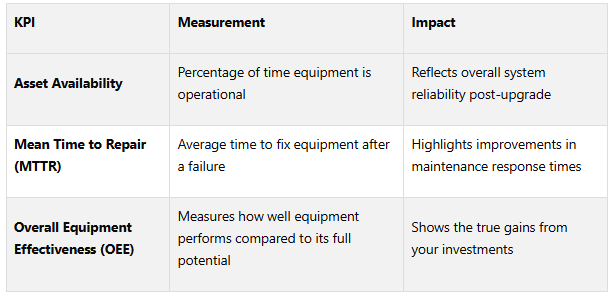

Understanding Reliability Through Key Metrics

One of the most effective ways to measure reliability is through Mean Time Between Failure (MTBF). This metric calculates the average time between equipment failures, providing a clear snapshot of system dependability.

“Mean Time Between Failure (MTBF) is a reliability metric that measures the average time between failures, which helps inform an asset’s reliability.”

For critical systems, property managers often target MTBF levels in the hundreds or even thousands of hours.

The Financial Impact of System Reliability

System uptime isn’t just a technical goal - it’s a financial one. Unplanned equipment failures can cost companies an average of $25,000 per hour. Additionally, 60% to 95% of an asset's lifecycle costs stem from decisions made during the CapEx phase. In other words, today’s investments have long-lasting effects on your bottom line.

Tracking Performance Improvements

To measure how your upgrades are performing, focus on these key metrics:

Studies suggest that most manufacturers achieve an OEE of around 55–60%, far from the original "world-class" benchmark of 85%. Your investments should aim to push performance closer to these higher standards.

Tenant Satisfaction and Retention Benefits

System reliability has a direct impact on tenant satisfaction. Research shows that 70% of tenants are more likely to renew their lease if maintenance issues are resolved within 24 hours. Fast response times can also lead to a 20% increase in overall tenant satisfaction.

Take, for example, an urban apartment complex that implemented a proactive maintenance system after significant CapEx upgrades. By addressing repair requests within 24 hours and using smart maintenance tools, the property reduced tenant turnover by 25%. Complaints related to maintenance dropped by 30%, boosting retention rates and enhancing the property’s reputation.

Implementing Effective Tracking Systems

To fully realize the benefits of improved reliability, it’s crucial to continuously monitor and standardize maintenance data collection. Track metrics like equipment failures, downtime, and repair times to calculate MTBF. Conducting root cause analyses can prevent recurring issues, ensuring your investments lead to lasting improvements.

Preventative maintenance is another essential strategy. It can cut repair costs by up to 18% when compared to reactive maintenance. A robust maintenance management system simplifies data collection and analysis, helping you track how systems perform under both routine and emergency scenarios. Regularly compare actual performance against budgeted expectations to identify areas for improvement.

9. Maintenance Cost per Square Foot

Understanding maintenance cost per square foot can reveal whether your capital expenditures (CapEx) are effectively reducing ongoing maintenance costs.

For instance, property owners who take a reactive approach to maintenance typically spend about 25¢ per square foot annually. In contrast, those who prioritize routine inspections and proactive repairs spend around 14¢ per square foot. That’s a 44% savings, highlighting the financial benefits of a well-planned maintenance strategy.

“Proactive versus reactive maintenance is a good place to start.”

Kevin Krolczyk, President of Mint Roofing, Inc., uses a relatable analogy to explain the importance of proactive maintenance:

“I like to use the analogy of the dentist, do you want to wait until it hurts, or do you want to prevent it from hurting?”

The Long-Term Impact of Strategic CapEx

Investing in capital improvements doesn’t just address immediate issues - it reshapes the long-term maintenance landscape of a property. While the average annual maintenance budget is typically around $1 per square foot, effective CapEx can reduce this baseline over time.

Take roofing, for example. A proactively maintained roof lasts an average of 21 years, compared to just 13 years for a roof maintained reactively. This extended lifespan translates directly into lower annual maintenance costs per square foot.

Calculating and Tracking Your Progress

To gauge how well your CapEx projects are working, it’s essential to track maintenance costs digitally. Implementing a system to collect and analyze this data allows you to see the impact of your investments over time. For example, you can compare costs before and after a CapEx project to measure improvements. A good rule of thumb is to allocate 10% to 15% of annual rental income toward capital improvements. This approach ensures you’re targeting the areas that will yield the greatest reduction in ongoing maintenance expenses.

Tomisin Kamiyo, Facilities and Operations Manager at Reidius Design, emphasizes the importance of this data-driven approach:

“As built environment managers, my key KPI to measure is a. User experience satisfaction and b. Maintenance cost savings. These matter most to me because, when my direct users like stakeholders, tenants/occupiers have assurance in the money spent to maintain and I can handle it efficiently. This is my ultimate success. The maintenance team plays a crucial role in achieving maintenance cost savings.”

Focusing on High-Impact Improvements

Lowering maintenance costs per square foot starts with focusing on impactful improvements. Strategic upgrades not only enhance safety and functionality but also improve the overall performance of a property. For example, replacing outdated siding with energy-efficient materials can extend the building’s lifespan while reducing utility bills. Similarly, prioritizing safety upgrades and modernizing key areas like kitchens and bathrooms can boost property value and reduce ongoing maintenance expenses.

10. Property Value Appreciation

Property value appreciation reflects how your investments in a property translate into long-term wealth. While other metrics often focus on operational improvements, this one highlights how strategic spending builds actual equity over time.

Ben Luxon from Landlord Studio puts it succinctly:

“CapEx in real estate simply refers to all the expenses and improvements you can make to enhance the long-term value of a property. The return on these strategic investments includes higher rental income, reduced operational costs, and overall appreciation in value.”

How Value Is Created

Unlike routine maintenance, capital expenditures (CapEx) are designed to actively enhance a property's market appeal. These upgrades - whether it's modernizing key systems or adding sought-after amenities - create a ripple effect, boosting the property's value. Real estate expert Harm Meijer explains:

“What really matters is a property’s ability to generate consistent rental growth while keeping capital expenditures low. These factors create a compounding effect that increases the overall value.”

Accurately Measuring Appreciation

To track property value appreciation effectively, it's essential to combine different valuation methods. Relying on just one approach can lead to an incomplete picture of how your CapEx investments are performing.

Absolute valuation methods assess the property's intrinsic value by focusing on its income potential.

Relative valuation methods compare your property to similar assets in the local market.

The most accurate results come from blending these two methods. Start by calculating your property's capitalization rate based on its improved income potential. Then, compare these figures with comparable properties in your area. This dual approach not only highlights the financial benefits of your upgrades but also shows how your property stands competitively in the market.

Timing Matters

To fully understand the impact of your capital improvements, evaluate property appreciation over a 5–10 year period. This timeframe captures both immediate gains and the long-term benefits of enhanced appeal and reduced operational costs.

A practical guideline is to allocate 1% to 2% of your property's value annually toward CapEx. This steady investment strategy supports consistent value growth while keeping your property competitive.

Prioritizing High-Impact Projects

Not all CapEx projects are created equal. High-impact upgrades - such as replacing a roof, modernizing electrical systems, or adding new amenities - tend to deliver the strongest returns.

To maximize results, align your investments with local rental market trends. Research tenant preferences and market demands before committing to major projects. This targeted approach ensures your spending leads to sustained value growth.

Safeguarding Your Investment in Tough Times

Strategic CapEx planning also accounts for market downturns. As Harm Meijer advises:

“You want to ensure your valuations are ‘bulletproof’ during downturns. If [properties] are priced so low that they protect against further declines, you’ve found a good opportunity.”

This means focusing on improvements that enhance your property's core appeal and operational efficiency rather than superficial upgrades. By doing so, you protect your investment during challenging market conditions and strengthen the overall performance of your CapEx strategy.

Using Real Estate Intelligence Platforms for CapEx Tracking

Effective CapEx tracking hinges on having the right tools to streamline the process. Relying on fragmented spreadsheets often leads to delays and inefficiencies. As Quincy Oswald, Senior Product Manager at AppFolio, puts it:

“Firms using fragmented systems spend more time looking for data than they do making decisions.”

Real estate intelligence platforms solve this issue by consolidating property data into a single, unified view. This simplifies CapEx tracking, making it faster and easier to monitor key metrics with clarity and precision.

Centralized Data and Streamlined Operations

These platforms bring all your data together in one dashboard, offering real-time insights. This centralization enables 40% faster decision-making by providing instant access to advanced analytics. Instead of waiting weeks for updated financial reports, you can quickly assess how property upgrades affect key metrics like NOI and cash flow.

With these insights, you can allocate capital more effectively, identifying which upgrades will deliver the most impact. Properties managed through these systems often see a 20% increase in ROI on equipment investments.

Automation plays a big role here, cutting administrative work by 65%. Tasks like generating reports for stakeholders, tracking project milestones, and updating financial projections are automated, freeing up your team to focus on strategic initiatives.

Enhanced Stakeholder Communication

Investor confidence thrives on transparency. It’s no surprise that 87% of investors say real-time data access increases trust in their investment manager. Real estate intelligence platforms provide stakeholders with up-to-date insights into capital improvement projects, including costs and performance impacts, fostering trust and improving communication. This kind of transparency helps ensure proactive management of both maintenance and portfolio growth.

Predictive Maintenance and Proactive Management

By integrating with IoT devices and building management systems, these platforms enable a shift from reactive to predictive maintenance. They analyze data like equipment performance, occupancy trends, and historical maintenance records to flag potential issues early. This not only reduces maintenance costs per square foot but also improves system uptime and optimizes operating expenses.

Scalable Portfolio Management

Whether managing a single building or an expansive portfolio, these platforms scale to meet your needs. You can maintain consistent CapEx tracking standards across all properties without juggling multiple systems. This scalability also simplifies performance comparisons and helps identify best practices. Plus, the ability to manage diverse asset classes - such as retail, office, industrial, and multifamily properties - ensures rigorous CapEx standards are applied throughout your portfolio.

Proactive Issue Resolution

Real-time tracking ensures you can spot and address issues before they escalate. By continuously monitoring metrics like tenant retention, operating expenses, and cash flow, you can implement corrective actions promptly, avoiding the delays typical of traditional reporting cycles. This proactive approach transforms CapEx management into a strategic advantage.

Platforms like CoreCast take this a step further by integrating property data and automating workflows. With tools like these, real estate professionals can seamlessly track, analyze, and forecast CapEx performance, making it a cornerstone of their overall strategy.

Conclusion

Keeping an eye on CapEx success metrics transforms essential spending into a strategic opportunity to protect and grow the long-term value of your assets. The ten metrics we’ve covered here provide a solid framework for assessing property performance and supporting overall portfolio growth.

Regularly monitoring metrics like ROI, NOI impact, and cash flow growth helps identify which improvements bring the most value. It also allows you to distinguish between necessary CapEx - like essential repairs - and value-add CapEx that boosts property value. By tying these metrics to your budgeting process, you can justify future expenditures and align spending with broader business goals.

Technology plays a crucial role in refining this process. By analyzing CapEx metrics alongside other performance indicators, you gain a more complete view of your operations. Advanced analytical tools make this easier, and platforms like CoreCast allow you to track metrics in real time, enabling faster and more informed decisions.

When you combine consistent tracking with the right technology, your CapEx strategy becomes not only more efficient but also more adaptable. Using data effectively ensures you’re protecting your assets while driving long-term growth, creating a stronger and more resilient portfolio.

FAQs

-

Real estate investors can gauge how CapEx investments affect property value by monitoring critical metrics like return on investment (ROI), net operating income (NOI), and shifts in property valuation over time. Regularly analyzing these figures ensures that specific upgrades are delivering measurable benefits.

Keeping thorough records of all major property improvements - complete with costs and timelines - is crucial. When paired with depreciation schedules, this information helps investors evaluate how these projects contribute to long-term value growth. Tools such as real estate intelligence platforms can simplify tracking and offer actionable insights to support smarter investment decisions.

-

Real estate intelligence platforms bring a new level of efficiency to managing and tracking CapEx projects. They offer real-time data insights, which means you can make sharper investment analyses and smarter decisions. By pulling together data from various sources, these platforms give you a comprehensive view of your portfolio, keep tabs on project pipelines, and monitor performance metrics - all in one place.

What’s more, they excel at advanced forecasting and scenario analysis, helping you balance risk and maximize returns. With tools like these, strategic planning becomes more effective, and operational processes run smoother, making them a must-have for managing CapEx projects with confidence.

-

The Role of Strategic CapEx Investments in Tenant Satisfaction

Strategic capital expenditures (CapEx) are a game-changer when it comes to keeping tenants happy and encouraging them to stick around. By upgrading properties to meet tenant needs and expectations, landlords can create spaces that are not just functional but also inviting - making tenants more likely to renew their leases.

These thoughtful investments also help properties stay competitive in the market. When you maintain high standards and adapt to changing tenant demands, you’re more likely to keep occupancy rates strong and vacancies low. This approach builds tenant loyalty, ensuring stable retention and better lease renewal rates in the long run.