Best Real Estate Analytics Tools for 2025

The commercial real estate (CRE) market in 2025 is complex but full of potential. Mortgage rates are expected to stabilize at 6.7%, with house prices climbing by 3%. To navigate this landscape, analytics tools are essential for CRE professionals, offering insights, automation, and portfolio management. Here are the top tools for 2025:

CoreCast: Focused on real-time insights, portfolio summaries, and deal tracking. Beta pricing starts at $50/month.

Reonomy: Known for its database of over 50 million U.S. properties and predictive tools like the "likely to sell" score. Costs $400/month per user.

Qlik: Offers AI-powered analytics with interactive dashboards and predictive modeling. Pricing depends on usage.

Sisense: Embeds analytics into workflows with strong customization options. Best for large-scale operations.

Domo: A mobile-friendly platform with real-time updates and collaboration features. Pricing starts at $750/year per user.

Each tool caters to different needs, from underwriting to market analysis. Choosing the right one depends on your goals, budget, and workflow requirements.

CoreCast - Transforming Real Estate Forever

1. CoreCast

CoreCast is a real estate intelligence platform designed by industry insiders with expertise in financial analysis, underwriting, and product design. Its goal? To simplify complex real estate data and turn it into actionable insights. By combining real-time analytics, operational tools, and investment strategy features, CoreCast helps professionals make confident decisions while streamlining their workflows. In 2025, it’s positioned as a key player in commercial real estate (CRE) analytics, blending data-driven decision-making with efficient management tools.

This all-in-one platform supports the entire real estate workflow. Whether you're underwriting assets across various classes and risk profiles, managing deal pipelines, analyzing portfolios, or visualizing properties on integrated maps, CoreCast has it covered. It even allows users to create branded reports and maintain stakeholder information - all without juggling multiple systems.

Features and Capabilities

CoreCast’s features are crafted to meet the everyday needs of commercial real estate professionals. Here’s what stands out:

Real-Time Insights: Access up-to-the-minute data to make informed decisions quickly.

Portfolio Summaries: Generate custom reports that provide a clear view of past performance and future opportunities.

Pipeline Tracker: Monitor properties through every deal stage. This feature integrates with forecasting tools, allowing users to model opportunities and see real-time updates.

Construction Management Tools: Track timelines, budgets, and project scopes, making it particularly useful for development-focused teams.

Investor Relations Tools: Create secure investor accounts with access to key documents, personalized returns, and distribution timelines.

Third-Party Integrations: Sync seamlessly with tools like Buildium, QuickBooks, and RealPage to enhance existing workflows.

These capabilities make CoreCast a practical choice for streamlining operations and improving decision-making.

Practical Applications

CoreCast is built with a deep understanding of real estate workflows. It embeds analytics directly into existing applications, making it easier for teams to access and act on critical data without jumping between platforms. Users can track, analyze, and forecast with ease, thanks to its intuitive design.

Currently in its Alpha phase, CoreCast is evolving based on real-world feedback from industry professionals. Regular updates ensure that users benefit from ongoing improvements and new features tailored to their needs.

Integration and Scalability

CoreCast integrates effortlessly with CRMs, MLS databases, and cloud platforms, allowing it to adapt to existing tech stacks. Its scalable design means it works just as well for small agencies as it does for enterprise-level firms, accommodating growth without requiring a complete system overhaul.

This scalability also sets the stage for future AI-driven automation features.

Pricing and Plans

While still in development, CoreCast offers beta pricing at $50 per user per month. Once fully launched, the platform will introduce three pricing tiers:

Free: A basic option for those just starting out.

Essentials: Priced at $75 per user per month, offering expanded features.

Pro: At $100 per user per month, this tier unlocks advanced analytics and tools.

This tiered pricing ensures accessibility for firms of all sizes, aligning cost with the platform’s robust capabilities.

It’s worth noting that CoreCast isn’t a property management or bookkeeping system. Instead, it focuses on its strength: providing intelligence and analytics to support smarter decision-making in real estate.

2. Reonomy

Reonomy leverages advanced algorithms and machine learning to compile and enhance commercial real estate data from various sources. With a database covering over 50 million U.S. properties, the platform excels at identifying off-market investment opportunities by providing accurate property ownership details through billions of contact records. Its predictive analytics and powerful search tools help users uncover actionable insights.

Features and Capabilities

Reonomy's database spans tens of millions of properties, transactions, and ownership records across 3,100+ counties and 385 metropolitan statistical areas in the U.S.

One of its standout tools is the "likely to sell" score, which uses predictive analytics to identify properties that might soon hit the market. This feature gives brokers and investors a competitive edge by spotlighting opportunities before they surface publicly.

The platform's web application offers detailed property data, enabling users to pinpoint potential investments or new listings. Workflow tools like custom property labels and the ability to add notes directly to property cards make it easy to stay organized and track properties effectively.

“The ability to add custom labels to properties is extremely helpful in staying organized. Additionally, I love how you can search for other properties that an owner has extremely easy.”

Practical Applications

Reonomy transforms complex data into practical insights for commercial real estate professionals. By cutting down on research time, it sharpens market analysis and helps users spot trends, identify up-and-coming neighborhoods, and track changes in property values. Its advanced search features allow professionals to filter properties by type, ownership history, or location, making it easy to zero in on specific opportunities.

The platform also simplifies outreach by enabling users to create targeted campaigns via phone, SMS, or email, connecting directly with property owners to explore potential deals.

“Reonomy is a game changer. It has been instrumental in changing my business for the better! It is easy to use and the data is accurate and comprehensive.”

With weekly updates to its data pipeline, Reonomy ensures users always have access to the latest property information, supporting informed decision-making. Professionals rely on it to uncover leads, analyze market behavior, and gain insights into ownership and transaction history.

Integration and Scalability

Reonomy integrates seamlessly into existing workflows, offering API and data feed solutions for enterprise customers. These tools enable teams to incorporate live data into internal systems or receive bulk data for broader analysis. Users can schedule data updates to match their preferred cadence, ensuring they always work with fresh information.

The platform's Reonomy ID uses AI to standardize and link data across various sources, connecting property, geospatial, company, and contact information into one cohesive system. This feature enhances the usability of the data for deeper analysis.

However, some users have noted challenges with integrating Reonomy into certain CRM systems, which may require additional adjustments for smooth operation.

Pricing and Plans

Reonomy's pricing is straightforward: $4,800 per year per user or $400 per month per user, with discounts available for annual upfront payments. Subscriptions include access to all geographies and property types across the U.S.

New users can take advantage of a 7-day free trial, which provides full access to the platform's features, allowing them to explore its capabilities before committing. For enterprise customers interested in API or data feed solutions, custom pricing is available upon request. Demos are also offered to help organizations evaluate the platform.

Reonomy has earned an average rating of 4.2 out of 5 stars on Capterra. Users frequently highlight its ease of use and extensive data coverage, though some have pointed out occasional inaccuracies, particularly in smaller markets or for vacant land properties.

3. Qlik

Qlik is an analytics platform designed to help commercial real estate professionals make data-driven decisions. With a global presence of over 40,000 customers and being named a leader in the Gartner Magic Quadrant for Analytics and Business Intelligence Platforms for 15 straight years, Qlik brings robust analytics capabilities to the real estate industry.

Its associative data modeling feature allows users to work with multiple datasets without requiring predefined structures, making it easier to analyze data from various sources. Whether it's property valuations, market trends, demographic changes, or financial performance metrics, Qlik offers the tools to explore it all.

Features and Capabilities

Qlik's AI-driven engine provides predictive modeling, easy-to-understand visualizations, and interactive dashboards, giving users instant insights. The self-service analytics functionality empowers users to independently analyze data in real time, covering areas like property sales, rental pricing, and investment opportunities.

The platform also includes advanced features like automated insight generation, natural language search, and AI-assisted data preparation. With tools like AutoML and predictive analytics, users can forecast market trends and spot new opportunities.

“Qlik sets itself apart by allowing us to explore the full depth of our data - not just surface-level factoids.”

Qlik's data-driven alerting system ensures users stay updated on critical market changes, while its mobile-friendly design provides access to insights from anywhere.

Practical Applications

Real estate professionals rely on Qlik to transform raw data into actionable insights. Whether it's portfolio analysis, deal tracking, or creating reports through interactive dashboards, Qlik provides the tools to streamline decision-making. Its collaborative features make it easy for teams to share insights and annotations across departments or with external partners.

For users on the move, iOS and Android apps ensure that key insights are always accessible.

Integration and Scalability

Qlik connects seamlessly with hundreds of data sources, including cloud providers, databases, and data warehouses. It supports cloud, client-managed, or hybrid deployments, making it adaptable to various organizational needs. The platform also integrates with widely used business applications like Microsoft Office, Salesforce, and SAP. Its open APIs enable customization and embedding within existing real estate systems.

Thanks to its cloud-native architecture, Qlik handles large volumes of both structured and unstructured data in real time, making it ideal for managing extensive real estate portfolios. This scalability is backed by flexible pricing options, ensuring that businesses of all sizes can find a suitable plan.

Pricing and Plans

Qlik offers four pricing tiers - Starter, Standard, Premium, and Enterprise - designed to meet different organizational needs and data volumes. Every plan includes unlimited data movement to Qlik Cloud Analytics and pre-built connectivity to hundreds of sources. Higher-tier plans add real-time Change Data Capture (CDC) and event-driven integration for operational use cases. Businesses can choose between cloud-based or on-premises solutions, selecting what works best for their infrastructure and security requirements.

“Our commitment to making analytics truly agentic - embedding intuitive insights directly into users’ everyday workflows - is what we believe is driving Qlik’s clear momentum in this year’s Magic Quadrant.”

Qlik stands out by combining advanced analytics with flexible deployment options, setting the stage for a detailed comparison with other tools in the next section.

Transform Real Estate Data into Confident Decisions

Join Corecast to streamline your real estate operations, gain real-time insights, and make smarter investment decisions with a unified platform.

4. Sisense

Sisense takes analytics to the next level by embedding them directly into workflows, allowing professionals in commercial real estate to extract actionable insights without ever leaving their applications. With over 93% of users planning to renew their subscriptions and an 84% satisfaction rate for cost versus value, Sisense has established itself as a trusted name in the analytics world. Its seamless integration of analytics aligns perfectly with the evolving demands of real estate professionals.

Features and Capabilities

Sisense stands out with a feature set designed to simplify and elevate analytics. The platform offers a range of APIs and SDKs, enabling app developers to integrate and customize analytics without needing a background in data science. This makes it easier and faster to deploy embedded analytics. Its AI-driven tools include:

Assistant: Build analytics tools using natural language.

Narrative: Generate dashboard summaries automatically.

Explanation: Pinpoint key drivers behind data trends.

Forecast: Predict future market trends.

Trend: Identify patterns and outliers within datasets.

“Instead of just enhancing dashboards, which is what we’re hearing from all analytics vendors, Sisense is … letting developers weave smart, data-driven experiences directly into the apps they already use. It’s a smart play that moves customers beyond simply making more engaging dashboards and reports.”

Sisense’s composable analytics approach empowers real estate firms to create adaptive solutions, featuring natural language queries and AI-generated visualizations that reduce the workload on development teams.

Practical Applications

Sisense makes data exploration intuitive by embedding visualizations and natural language queries into everyday workflows. This approach addresses a common challenge: many organizations struggle to leverage data effectively due to accessibility issues.

“We saw businesses struggling with traditional BI tools that required leaving their workflow to consult dashboards. This inspired us to build a platform that transforms how organizations turn data into business-critical insights.”

The platform’s impact isn’t confined to real estate. For instance, Credit Clear, a fintech company, reported a 35% increase in collections after implementing Sisense’s AI-powered tools, showcasing its ability to drive tangible business results.

Integration and Scalability

Sisense integrates seamlessly with major SQL databases, cloud platforms, and business applications, offering both cloud-based and on-premises deployment options for secure and scalable analytics. Its single-stack BI platform handles everything from data preparation to visualization, simplifying the analytics process.

For businesses managing large-scale operations, Sisense supports multi-tenant SaaS architectures, incorporates In-Chip processing for faster queries, and provides REST APIs for automating workflows. Real estate firms with growing portfolios can take advantage of its APIs to automate user management and other tasks, while autoscaling capabilities on AWS ensure consistent performance as data needs expand. These features align with the industry’s increasing focus on streamlined workflows and real-time analytics.

Pricing and Plans

With a 4.5 out of 5 rating on Capterra based on 384 reviews, Sisense enjoys strong user satisfaction and a high recommendation rate. Its proven ability to deliver integrated analytics makes it a standout choice for real estate firms looking to embed data-driven insights into their daily operations. This combination of technical strength and user trust cements Sisense as a top-tier solution in the analytics space.

5. Domo

Domo is a cloud-based platform designed to simplify the data journey for commercial real estate professionals. It provides an all-in-one solution that connects data, generates insights, and streamlines decision-making. Let’s dive into what makes Domo stand out.

Features and Capabilities

Domo connects to live data sources, allowing firms to pull up-to-the-minute information from multiple platforms. This ensures that market analyses stay relevant and reflect current conditions. Its AI-powered tools include automated alerts that notify users about market changes or shifts in property values. Interactive dashboards make it easy to turn raw data into actionable insights, while the no-code application builder lets users create custom analytics tools without needing technical expertise. Additionally, integrated social collaboration tools enable teams to make decisions in real time.

“Domo was built to give our customers access to insights so they can make the most out of their data. This solid data insights foundation is more necessary now than ever before as we’ve been hyper-focused on building AI solutions that move the needle for our customers.”

For professionals on the move, Domo's mobile-first dashboards provide critical insights no matter where they are - whether touring properties, meeting clients, or traveling. Other features like automated report scheduling, real-time collaboration, and embedded analytics make sharing insights both secure and effortless.

Practical Applications

Domo’s tools are tailored to meet the needs of commercial real estate operations. Firms can integrate data from CRM systems, financial software, and even social media platforms to streamline workflows and uncover actionable insights. Predictive analytics help professionals make smarter choices about property acquisitions, portfolio strategies, and timing in the market.

Its conversational AI makes exploring data straightforward, helping teams make quick decisions in competitive scenarios. Security remains a priority, with strong encryption and access controls ensuring compliance with industry standards.

Integration and Scalability

Domo supports seamless integration with a wide range of platforms, including Salesforce, SAP, Excel, Google Sheets, and BigQuery. It also works effortlessly with CRM, ERP, HR, and financial systems commonly used in commercial real estate. With an architecture that can handle thousands of users simultaneously, Domo is built for enterprises of all sizes.

“Domo allowed us to move from being an administrative organization to a performance-based organization.”

Pricing and Plans

Domo uses a credit-based pricing model based on factors like data volume, refresh frequency, and feature usage. Pricing starts at $750 per user per year, with three plan options: Standard, Enterprise, and Business Critical. Companies can also take advantage of a 30-day free trial with full platform access. While the platform is considered a significant investment by 89% of its users, its capabilities often justify the cost for many businesses.

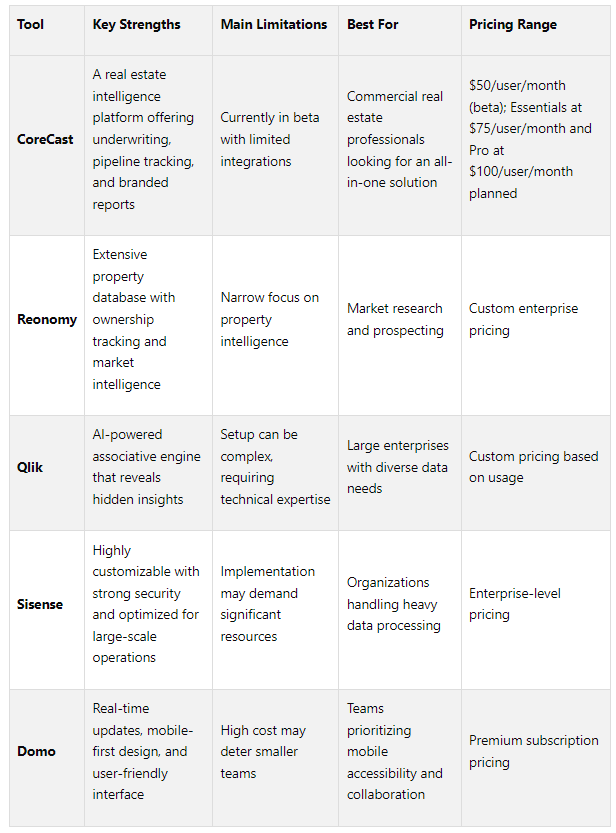

Tool Comparison: Pros and Cons

When choosing an analytics platform, it’s essential to consider your specific needs, budget, and technical requirements. Each tool brings its own strengths and challenges, which can directly influence your real estate operations.

This breakdown helps professionals identify the best tool for their specific needs, ensuring they align features with operational goals. Below, we dive deeper into what makes each platform stand out.

CoreCast is the next generation real estate workflow solution, purpose built for the commercial real estate industry. The platform is enhanced by partner integrations, deep machine learning, and artificial intelligence.

Reonomy is a go-to option for market research and prospecting. Its extensive property database provides detailed insights into property attributes and ownership, offering a solid foundation for property intelligence tasks.

Qlik takes a different approach by using an AI-powered associative engine that uncovers relationships within datasets. This feature provides users with deeper insights, but the platform’s complexity means that technical expertise is often required for setup and ongoing use.

Sisense shines in environments where large-scale data processing and customization are priorities. Its dashboards and robust security make it a strong choice for organizations with demanding data needs. However, the implementation process can be resource-intensive, making it better suited for larger teams.

Domo focuses on accessibility and collaboration, offering real-time updates and a mobile-first design. This makes it ideal for teams that need to stay connected on the go. That said, its premium pricing might not fit every budget.

With the real estate market projected to reach $731.59 billion by 2028, investing in the right analytics platform is more important than ever. Evaluate your technical expertise, budget, and workflow to make the best choice for your operations.

Final Thoughts

Before diving into platform evaluations, it's essential to pinpoint your primary goals - whether it's prospecting, underwriting, portfolio analysis, or stakeholder reporting. Clear objectives will guide you toward the right tools for your needs.

For professionals in the U.S., two factors stand out: data accuracy and seamless integration. These are crucial for avoiding data silos and ensuring smooth workflows. Your chosen platform should integrate effortlessly with existing systems like CRMs, property management software, and other business tools. This is especially important as the U.S. commercial real estate analytics market is projected to grow at a 12.1% CAGR from 2023 to 2028, fueled by the increasing reliance on data-driven strategies.

Take, for example, a mid-sized U.S. real estate firm that implemented Qlik alongside its CRM system. Within a year, they reduced manual reporting by 40% and saw a 15% increase in deal closures. This highlights how integration and automation can directly impact efficiency and success.

To avoid common pitfalls, conduct a detailed needs assessment and prioritize platforms with a track record of success in the U.S. market. Overlooking integration capabilities or underestimating the importance of data quality can lead to expensive delays and poor adoption rates.

Cost considerations are just as important. Look beyond the initial price tag and evaluate total costs, including licensing, integration, and training, all in USD. Tools that streamline manual processes or offer exclusive market insights often deliver a strong return on investment by improving operational efficiency and decision-making.

Looking ahead, the future of analytics will bring advanced AI-driven insights, better mobile accessibility, and user-friendly visualizations tailored for U.S. businesses. Make sure to choose a platform that not only meets your current needs but also has the flexibility to grow and adapt alongside emerging technologies.

FAQs

-

To choose the best real estate analytics tool for your business, start by outlining your primary objectives. Are you focused on market analysis, property valuation, or deal tracking? Pinpointing your priorities will guide you toward tools with the right features, such as predictive analytics, customizable dashboards, and smooth integration with your current systems.

You’ll also want to weigh practical considerations like scalability, data security, and pricing. Make sure the tool can grow with your business and fits within your budget. Finally, assess how effectively it simplifies workflows and supports data-driven decision-making. The right choice will enhance your operations while staying financially manageable.

-

Real estate analytics tools, such as CoreCast, bring a game-changing edge to managing commercial property portfolios. They deliver detailed insights into property performance, enabling professionals to make smarter, data-backed decisions while improving overall portfolio management. Tasks like underwriting, deal tracking, and stakeholder reporting become more straightforward, saving time and minimizing mistakes.

CoreCast stands out with features like market forecasting, precise property valuation, and risk analysis. These capabilities help professionals plan strategically and navigate uncertainty with greater confidence. By streamlining workflows and boosting operational efficiency, tools like this equip real estate experts to enhance profitability and secure long-term investment success.

-

Real estate analytics tools play a key role in helping stakeholders understand market dynamics. By examining historical data, economic trends, and property metrics, these tools identify patterns and provide insights into potential future market shifts.

Using advanced algorithms and machine learning, they can forecast property values, spot up-and-coming areas, and highlight possible risks. This data-driven approach enables stakeholders to make smarter decisions, fine-tune their investments, and navigate uncertainties with greater confidence. Additionally, these tools simplify processes, enhance strategic planning, and contribute to building stronger, more adaptable real estate portfolios.