Excel vs SaaS Platforms for Property Analysis

When it comes to property analysis, real estate professionals have two main tools to choose from: Excel and SaaS platforms like CoreCast. Here's the quick takeaway:

Excel is flexible, cost-effective, and widely used, but it struggles with scalability, collaboration, and error-prone manual processes.

SaaS platforms like CoreCast offer automation, real-time collaboration, and advanced analytics, making them ideal for complex portfolios and large teams.

Key differences include:

Data Handling: Excel relies on manual entry, while CoreCast automates data consolidation.

Collaboration: Excel lacks real-time teamwork features; CoreCast enables multiple users to work simultaneously.

Scalability: Excel hits limits with large datasets, whereas CoreCast handles growing portfolios with ease.

Reporting: CoreCast automates reports; Excel requires manual updates.

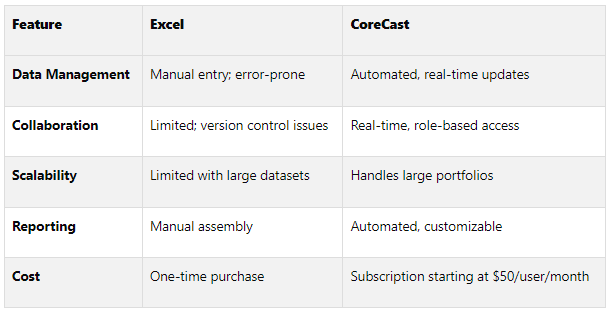

Quick Comparison

For small teams or simple analyses, Excel works well. But for growing operations or complex portfolios, SaaS platforms like CoreCast can save time, reduce errors, and improve efficiency.

A.CRE Team - Watch Me Model a Real Estate Private Equity Technical Interview Exercise in Excel

Excel for Property Analysis: Pros and Cons

Excel continues to play a major role in U.S. real estate, but it’s important to balance its strengths against its shortcomings.

Excel's Advantages

One of Excel's standout features is its flexibility and customization. It allows users to build financial models tailored to specific investment goals, accommodating any layout, structure, or calculation needed for unique scenarios. This adaptability makes it a go-to tool for real estate analysts who require precision and control.

Another major plus is Excel's transparency. Every formula is visible and easy to trace, making it simple to follow the logic behind calculations step by step. This is particularly helpful when presenting large-scale acquisitions to investors, as it provides a clear view of the methodology behind key financial metrics.

“Excel provides powerful functionalities to analyze data, build models, and deliver actionable insights.”

Excel also shines in its analytical depth. With over 500 built-in functions - including financial tools like NPV and IRR - it offers the mathematical backbone needed for nearly any real estate analysis.

Lastly, Excel is cost-effective. Since it’s often included in Office subscriptions, it eliminates the need for additional software expenses.

Excel's Limitations

Despite its strengths, Excel does come with some significant challenges for modern real estate workflows. One major issue is data integrity. Studies show that up to 90% of spreadsheets contain errors, which can lead to costly miscalculations. In a field where precision is vital, even small mistakes can have large financial consequences.

Scalability is another concern. While Excel can handle up to 1,048,576 rows and 16,384 columns per worksheet, these limits can quickly become a bottleneck when working with extensive historical data from large property portfolios.

Collaboration is also a weak point. Excel struggles with version control and often requires manual data uploads, making teamwork inefficient. On top of that, there are security risks. When sensitive financial data is shared via email or stored on local drives, Excel’s built-in security features may not provide sufficient protection.

As models grow more complex - often involving multiple linked workbooks - the maintenance burden increases. This makes spreadsheets harder to manage and more prone to errors.

These challenges underscore why many U.S. real estate teams are turning to modern SaaS platforms, which we’ll explore in the next section.

SaaS Platforms for Property Analysis: CoreCast's Approach

Excel has long been a go-to tool for real estate analysis, but modern SaaS platforms like CoreCast are stepping in to tackle its limitations. Designed specifically for U.S. markets, CoreCast provides a centralized, automated, and scalable solution that brings together diverse data sources into a single, real-time environment. The platform streamlines operations and delivers actionable insights, making property analysis more efficient and effective. Let’s take a closer look at how CoreCast reshapes the property analysis landscape.

CoreCast's Main Features

CoreCast is an all-in-one real estate intelligence platform, designed to manage every aspect of property analysis under one roof. Whether you’re dealing with multifamily properties or mixed-use developments, CoreCast brings all the tools you need into a single, cohesive system.

Portfolio Insights: This module offers a centralized dashboard that presents current valuations, historical trends, and essential performance metrics like NOI, IRR, and cap rates. Users can customize dashboards to display the most relevant data for their specific needs, ensuring stakeholders get the information that matters most.

Pipeline Tracker: By providing real-time updates and intuitive task management tools, this feature helps teams collaborate more effectively. A Director of Acquisitions at a REIT noted its impact:

“With the Pipeline Tracker, we reduced deal slippage by 30% over two quarters. The visibility and accountability it provides are game-changers.”

Underwriter: This tool generates detailed 10-year cash flow projections and IRR forecasts. It relies on standardized assumptions and includes a library for maintaining consistency across deals. Additional features like version histories and comparison views make it easier to track changes and ensure accuracy.

Forecasting Tools: Using historical data and benchmarks, this module allows users to simulate performance scenarios. Variables like rent growth, cap rate changes, and operating expense inflation can be adjusted, while built-in validation logic flags any unusual inputs.

Portfolios Module: This feature links directly to the Underwriter, creating dynamic, real-time connections for comprehensive portfolio analysis. It enables users to track key metrics and assess risk-adjusted returns across their entire portfolio.

Reports: CoreCast simplifies reporting by offering customizable, real-time reports with tailored visuals and branding. The platform supports multi-language and multi-currency options, making it a versatile choice for teams operating across different markets.

CoreCast also incorporates machine learning and automation into every module. These technologies surface critical insights, identify potential risks or opportunities, and flag anomalies in real time, helping users stay ahead of the curve.

Benefits for U.S. Real Estate Teams

CoreCast addresses many of the challenges that U.S. real estate teams face, offering a level of collaboration and scalability that Excel simply can’t match. With its cloud-based infrastructure, multiple users can work simultaneously without worrying about version control issues or manual data uploads.

The platform’s scalability is particularly valuable for managing large portfolios. Where Excel may falter under the weight of complex datasets, CoreCast thrives, accommodating everyone from smaller firms to multibillion-dollar enterprises. By automating tasks like data entry, document management, and lead tracking, CoreCast not only minimizes errors but also speeds up workflows.

The results speak for themselves. An Asset Manager at a Mid-Market Private Equity Firm shared:

“CoreCast transformed how we communicate portfolio performance to stakeholders. We now spend more time analyzing data, and less time assembling it.”

Additionally, CoreCast offers a budget-friendly option, with plans starting at $50 per user per month during its alpha phase. This pricing makes it an accessible and attractive upgrade from Excel, especially for teams looking to streamline their workflows and improve efficiency.

Transform Real Estate Data into Confident Decisions

Join Corecast to streamline your real estate operations, gain real-time insights, and make smarter investment decisions with a unified platform.

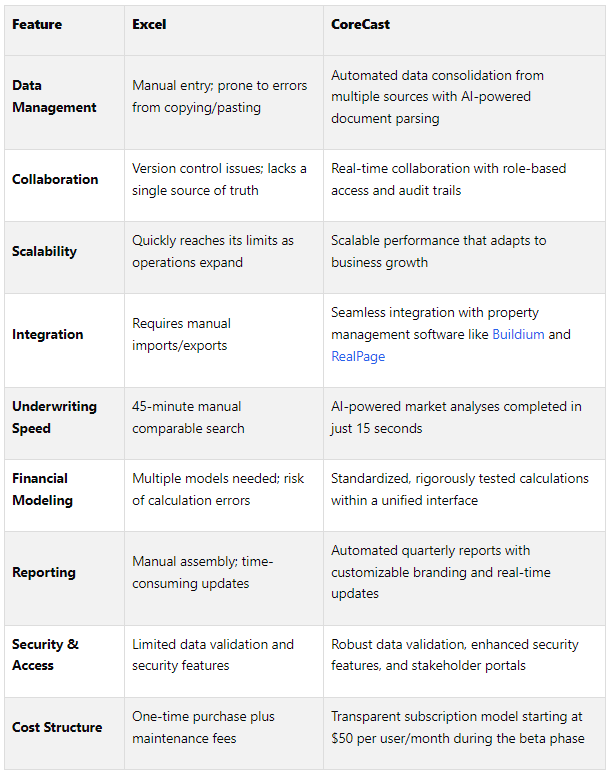

Excel vs SaaS Platforms: Side-by-Side Comparison

Building on the earlier discussion of pros and cons, this comparison highlights the distinct ways Excel and CoreCast streamline property analysis. Choosing the right tool can significantly shape your daily workflow, especially when analyzing data and collaborating with teams.

The main difference between these tools lies in their approach to handling data and collaboration. Excel relies on manual data entry and frequent copying and pasting, which increases the risk of errors. On the other hand, CoreCast centralizes data from multiple sources, automatically normalizes it, and offers a live operating dashboard that updates in real time.

Feature Comparison Table

The table clearly shows how CoreCast simplifies collaboration with features like real-time, role-based access and audit trails. Automation within CoreCast reduces context-switching delays, which can cost users about 23 minutes of refocusing time per interruption when using Excel.

Scalability is another critical factor, especially in markets with fluctuating conditions. Julie Whelan, global head of occupier research at CBRE, explains:

“It’s important to note that the 19% vacancy [in Q3 2024] is not spread evenly across markets. Major gateway downtown markets have been hit hardest, but even within those markets, the best quality space is often outperforming the overall market metric. It is a varied story market to market and even within submarkets.”

CoreCast addresses these complexities with features like pipeline views enhanced by geospatial mapping, enabling users to track deals geographically. It also provides portfolio-level insights for analyzing multiple properties and markets simultaneously.

When it comes to accuracy and speed, SaaS platforms like CoreCast stand out. Modern AI tools now outperform consumer-site estimates by an average of 18%. Real estate investors have reported significant time savings, with deal speed increasing from a 45-minute manual comparable search to AI-driven market analyses completed in just 15 seconds.

Cost is another area where CoreCast shines. While Excel involves a one-time purchase plus maintenance fees, CoreCast’s subscription model starts at $50 per user/month during its beta phase. This makes it a practical option for teams looking to enhance their analytical capabilities without a hefty upfront investment. Given that 78% of firms already use SaaS solutions and the North American property management market is expected to grow from $9.32 billion in 2025 to $16.50 billion by 2032, the shift toward SaaS is becoming increasingly evident.

These differences make it easier to evaluate which tool aligns best with your property analysis needs.

Choosing the Right Tool for Your Property Analysis

Picking the right tool can make or break your property analysis process. You need something that fits your current workflow but also supports your business as it grows and evolves. Let’s dive into the key factors to consider when choosing the best tool for your needs.

Decision Factors for Real Estate Professionals

Here are some essential considerations to help you weigh your options and make an informed choice between tools like Excel and CoreCast.

Team Size and Collaboration Needs

If you're a solo investor or part of a small team handling just a few deals a year, Excel's familiar and straightforward interface might be all you need. However, larger teams will likely benefit from CoreCast’s real-time collaboration features and role-based access controls, which streamline teamwork.

Portfolio Complexity and Risk of Errors

Excel gives you full visibility into your calculations, which is great for simpler portfolios. But as your portfolio grows, manual inputs increase the chance of costly errors. CoreCast, with its standardized formulas, is designed to handle the complexity of multi-asset analyses while reducing risks.

Geographic Spread

Managing properties across multiple regions? Excel requires manual data entry and research for each market, which can be tedious. CoreCast, on the other hand, integrates geospatial mapping and market data, making it much easier to maintain consistency across different areas.

Regulatory Compliance and Reporting

For those dealing with strict compliance standards, CoreCast’s automated reporting, complete with audit trails and version control, is a game-changer. It ensures you meet lender, investor, and regulatory requirements without the hassle of piecing together reports manually in Excel.

Budget Considerations

At first glance, Excel might seem like the cheaper option. But hidden costs - like time spent fixing errors, maintaining formulas, or handling inefficiencies - can add up. CoreCast’s $50 per user per month subscription covers updates, support, and new features, offering a predictable cost structure.

Integration with Other Systems

Excel often requires manual data transfers, which can slow things down. CoreCast simplifies this with automated integrations, seamlessly connecting to your existing systems.

Time Sensitivity

In fast-moving markets, speed matters. Excel’s manual processes can be time-consuming, while CoreCast’s automation helps you analyze properties quickly, giving you a competitive edge.

Future Growth

Planning to grow your team, increase deal volume, or expand into new markets? Starting with CoreCast can save you the hassle of switching tools mid-growth, ensuring a smoother transition as your needs evolve.

Technical Expertise

Excel demands a certain level of expertise to maintain formulas and troubleshoot issues. If your team lacks dedicated analysts, CoreCast’s user-friendly platform takes care of the technical heavy lifting, accommodating teams with varying skill levels.

If you find that your current process involves too much manual data entry, creates confusion with multiple analysis versions, or causes delays that lead to missed opportunities, it might be time to consider CoreCast.

While Excel can handle simpler, budget-friendly analyses, CoreCast offers the kind of integrated, scalable solution that professional real estate operations need to stay competitive today.

Conclusion: Selecting Your Property Analysis Solution

Choosing between Excel and CoreCast depends entirely on your real estate business's current needs and future ambitions. Excel works well for smaller, simpler analyses, but as your portfolio grows, its limitations become harder to ignore. Studies reveal that spreadsheets contain an average of one error per 20 cells, highlighting the risks of relying on them for large-scale operations.

This is where CoreCast steps in, offering a streamlined, automated approach to property analysis. By integrating real-time data and automating key processes, CoreCast transforms the way businesses handle analysis. Users have reported significant boosts in efficiency and collaboration. With features like automated data imports, real-time dashboards, and integrated reporting, CoreCast drastically reduces the time spent on manual tasks compared to spreadsheet-based methods.

Financial modeling is another area where CoreCast outshines Excel. While Excel may seem cost-effective at first glance, the hidden expenses of manual processes and fixing errors often outweigh the initial savings. As one client of The Fractional Analyst shared:

“Before CoreCast, it took hours to consolidate financials from different systems. Now, we generate insights in minutes.”

The real estate industry is rapidly evolving, and integrated, automated solutions are becoming a necessity. Between 2022 and 2023, PropTech investment tripled, reaching $13.4 billion. Meanwhile, the property management software market is expected to hit $9.68 billion by 2030, growing at an annual rate of 8.9%. These numbers reflect a clear shift toward platforms designed to handle the increasing complexity of real estate operations.

For professionals looking to scale their operations, improve accuracy, and remain competitive, CoreCast offers a path forward. It’s more than just a tool - it’s a step toward comprehensive real estate intelligence. The decision ultimately comes down to whether your current methods are holding you back from achieving greater efficiency and growth.

FAQs

-

SaaS platforms like CoreCast bring a whole new level of efficiency and collaboration to property analysis, leaving Excel in the dust. They make real-time teamwork a breeze, allowing multiple team members to work on the same project without worrying about version mix-ups. Plus, they handle time-consuming tasks like deal management and portfolio analysis automatically, cutting down on errors and freeing up valuable time.

What’s more, these platforms are flexible and easy to access, letting you work from any device with an internet connection. They’re designed to grow with your business, adapting as your needs evolve. With built-in features for data integration and analysis, SaaS tools simplify workflows, boost accuracy, and empower real estate professionals to make quicker, smarter decisions.

-

CoreCast takes data accuracy to the next level by integrating automated data validation and real-time error detection into its platform. These tools catch missing, inconsistent, or incorrect data right at the entry point, cutting out the typical errors that come with manual Excel workflows.

By automating these essential processes, CoreCast delivers dependable, high-quality data for property analysis. The result? You save time and gain greater confidence in your outcomes, enabling more informed decision-making in the commercial real estate space.

-

When weighing the decision to shift from Excel to a SaaS platform for property analysis, there are several important factors to keep in mind:

Data security: SaaS platforms typically come with advanced measures to protect your data and ensure compliance with industry standards.

Scalability: These solutions are built to manage larger datasets and support multiple users without breaking a sweat.

Integration: They often integrate smoothly with the tools and systems you already rely on, creating a more connected workflow.

Ease of use: Features like automation, real-time collaboration, and remote access can make day-to-day tasks faster and more efficient.

Beyond these, consider ongoing costs, the quality of technical support, and whether the platform can grow alongside your business. While SaaS platforms can simplify processes and boost efficiency, it’s crucial to assess how well they align with your specific needs and goals.