How Demographic Shifts Impact Commercial Real Estate

Shifting demographics are transforming the commercial real estate (CRE) market. Here's what you need to know:

Millennials and Gen Z dominate demand: Millennials make up over 50% of U.S. homebuyers, and Gen Z is reshaping workforce needs.

Population growth in the South and West: These regions are seeing rapid expansion, with 82% of future population growth expected here.

Suburban migration and remote work: Suburban areas are thriving, driven by hybrid work models and affordability.

Senior housing demand rising: With 10,000 Baby Boomers retiring daily, healthcare and senior living facilities are key opportunities.

E-commerce and tech trends: Warehouses, logistics centers, and tech-enabled properties are in high demand.

CRE investors must focus on regions with strong growth, align with generational preferences, and rethink outdated property types to stay competitive.

ICP #59 The Future of Commercial Property: Demographic Shifts You Need to Know

Major Population Changes Reshaping Commercial Real Estate

Shifting demographics across the United States are reshaping the commercial real estate (CRE) market. These changes bring new opportunities for investors while challenging traditional property models.

Population Growth and Urban Expansion

As cities grow, so does the demand for commercial real estate. By 2050, 68% of the world’s population is expected to live in urban areas, up from 55% in 2018.

This urbanization impacts various property types. Developments near transit hubs and improved infrastructure are driving up commercial property values. For example, the tech boom in Silicon Valley caused San Jose’s median home price to rise by over 120% between 2010 and 2020. This highlights how population growth can reshape local markets.

E-commerce has also influenced urban real estate needs. Warehouses located within or near cities are in high demand to support last-mile delivery services. As a result, industrial properties in previously overlooked urban areas are gaining value.

These urban trends, combined with generational shifts, are redefining CRE opportunities.

Generational Preferences: Millennials, Gen Z, and Baby Boomers

Different generations have unique real estate needs, shaping demand in distinct ways. Millennials and Gen Z prefer walkable neighborhoods with access to shops, dining, and entertainment, fueling the rise of mixed-use developments.

On the other hand, the aging baby boomer population is driving demand for senior living communities and healthcare-related properties.

Technology is now a must-have across all generations. Smart buildings equipped with Internet of Things (IoT) technology are becoming standard, offering improved energy efficiency, security, and tenant satisfaction. These preferences are pushing the market toward more tech-integrated solutions.

Remote Work and Hybrid Work Models

The rise of remote and hybrid work has transformed how companies use office spaces. Office occupancy in major U.S. cities dropped by 90% from late February to March 2020. Though occupancy has since improved, the long-term effects are reshaping the market.

From 2019 to 2023, companies with minimal onsite work reduced their office space needs by 41%, while those requiring more frequent onsite work saw only a 9% reduction. About half of the largest global employers plan to reduce their office footprints over the next three years.

This shift has fueled demand for flexible leases and shared workspaces. Co-working facilities are becoming a popular, cost-efficient solution for businesses downsizing their permanent office space.

Suburban areas are also benefiting. A 13% increase in suburban home purchases in 2020 has driven demand for suburban office spaces, retail centers, and service-oriented properties.

To adapt, property managers are repurposing unused spaces. Vacant malls, offices, and hotels are being converted into residential units, healthcare facilities, or educational spaces to address underserved needs. These changes reflect how the market is responding to the evolving work landscape.

Regional Migration Patterns

Migration trends are now a key factor in shaping commercial real estate markets. Sun Belt cities and mid-sized metros with lower taxes, strong job growth, and high quality of life are seeing population booms. Meanwhile, high-cost cities like San Francisco, Los Angeles, and New York City continue to experience population declines.

For instance, New York saw a $90 billion drop in office property value between December 2019 and December 2023, underscoring how migration impacts real estate values.

Emerging markets in the Mountain West, Midwest, and Southeast now present attractive investment opportunities. These regions often offer better affordability and growth potential compared to coastal hubs.

Climate concerns are also shaping migration. Rising insurance costs and extreme weather events are influencing where people and businesses choose to settle. Properties in areas less affected by climate risks are becoming more desirable, as buyers and investors prioritize long-term resilience.

Challenges Facing CRE Professionals Due to Population Trends

Shifting demographics are reshaping the commercial real estate (CRE) landscape, pushing professionals to rethink their strategies. What worked in the past now often falls short, forcing adjustments in property design and planning to meet new market demands.

Outdated Property Types Losing Value

Traditional retail and office spaces are struggling to keep up with changing consumer and tenant preferences. Since Q4 2019, the amount of obsolete retail space has tripled, with large-format retail accounting for 80% of this increase and super regional malls making up 40%. The Midwest has been hit hardest, with an obsolescence rate of 1.8%, while the Northeast has managed to keep this figure lower at 1%. These numbers highlight the dramatic shift in shopping habits and the need for retail spaces to evolve.

Office buildings are also feeling the pressure, as hybrid work reduces demand for traditional layouts. Many older office spaces fall short of modern expectations, lacking features like flexible layouts, wellness amenities, and advanced technology infrastructure. Beyond physical updates, properties that fail to adapt risk losing relevance in the market. Adding to this challenge, younger generations, such as Millennials and Gen Z, are prioritizing sustainability and are willing to pay more for eco-friendly features, further pushing property owners to invest in green upgrades.

Supply Shortages in High-Growth Markets

High-growth markets face a different issue: a severe lack of supply. New U.S. office construction is expected to drop by 73% from its peak, while industrial properties are projected to see a 56% decline in new supply. Renovated buildings are capturing most of the occupancy gains, driving up competition and pricing pressure for investors.

For investors, this supply crunch means properties in high-demand areas are commanding premium prices. Occupancy rates in these markets are now 264 basis points above their long-term averages.

"These investments offer a balance between stability and growth potential, with opportunities for minor improvements to enhance value." – Kaj Lea, Head of the Pacific Northwest and Central Region for Commercial Term Lending at Chase

Meeting Different Tenant Needs

CRE professionals are also grappling with the challenge of meeting increasingly diverse tenant demands. Preferences vary widely across generations, from Gen Z and Millennials to older tenants, making it difficult to create spaces that appeal to everyone. By 2030, Gen Z is expected to make up 30% of the workforce, pushing property owners to adapt to their tech-savvy and flexible space preferences.

However, investing in smart building technology and adaptable layouts isn’t always straightforward. If the current tenant base doesn’t prioritize these features, the investment may not pay off. At the same time, multigenerational living is on the rise, affecting 60 million Americans and driving demand for larger, more versatile spaces. This creates a market where generic solutions no longer suffice. Property owners must choose between specializing for specific demographics or finding ways to accommodate a variety of needs within the same property - both of which require careful planning and significant investment.

Transform Real Estate Data into Confident Decisions

Join Corecast to streamline your real estate operations, gain real-time insights, and make smarter investment decisions with a unified platform.

Solutions for Using Population Changes to Your Advantage

Navigating the challenges of shifting demographics can open up lucrative opportunities for commercial real estate (CRE) professionals. By harnessing demographic data, investors can develop strategies that align with evolving market demands, turning potential obstacles into key advantages.

Using Data Analysis for Better Decisions

Cities offering strong job markets, quality schools, and attractive amenities often see population growth, which naturally fuels real estate demand. The pandemic accelerated a trend of migration from urban centers to suburban areas, driven by the rise of remote work.

For example, between 2021 and 2025, Idaho and South Carolina experienced over 3.0% population growth through relocations. These figures highlight where future demand is likely to concentrate.

Leveraging data analytics helps investors track trends like population shifts, employment rates, and spending habits. Tools like predictive analytics can forecast demand, steering investors toward promising locations and property types. Monitoring city planning documents and demographic reports can reveal areas poised for growth. Similarly, infrastructure projects often signal where development is headed. Recent migration patterns, such as Texas's rapid growth, further confirm where demand is shifting.

Portfolio Diversification by Population Trends

Aligning investments with demographic trends can provide stability and growth. For instance, as baby boomers surpass age 65 by 2030 and the 75+ age group approaches 40 million by 2040, sectors like healthcare and senior housing are becoming increasingly appealing.

Healthcare-focused real estate investment trusts (REITs) are already capitalizing on this trend, reporting 8.0% year-over-year growth in net operating income. The FTSE Nareit Equity Health Care Index has delivered impressive one-year returns of 48.44%, accounting for 13.8% of the FTSE Nareit All Equity Index's market capitalization.

Here's how different age groups are shaping investment opportunities:

Focusing on high-growth regions is also crucial. Between 2023 and 2024, nine of the ten fastest-growing metro areas were in the South. Meanwhile, alternative property types like data centers, life sciences facilities, flexible spaces, and micro-units are gaining traction, reflecting the preferences of younger, tech-savvy generations.

Updating and Reconfiguring Existing Assets

Repositioning existing assets can breathe new life into underperforming properties, especially as demographic preferences shift. With more people moving to the suburbs for affordability and space, urban office buildings can be converted into mixed-use developments or residential units.

To stay competitive, properties must adapt to evolving tastes. For instance, younger generations often prioritize sustainability and are willing to pay a premium for eco-friendly features. Adding smart building technology, flexible layouts, and wellness amenities can attract tech-savvy tenants while increasing property value.

Properties designed to accommodate multigenerational living or flexible unit configurations are well-suited to meet growing demand. In urban centers experiencing population booms, converting retail spaces into experiential venues, adding coworking spaces to offices, or creating mixed-use developments can help properties stay relevant.

Using Platforms Like CoreCast for Competitive Advantage

Advanced tools like CoreCast make navigating demographic trends more manageable. This real estate intelligence platform provides end-to-end solutions, from underwriting across asset classes to visualizing competitive landscapes on integrated maps.

CoreCast helps investors identify properties aligned with demographic trends and pinpoint those needing repositioning. With real-time insights and pipeline tracking, investors can act quickly on emerging opportunities before they become widely recognized.

The platform also simplifies communication with stakeholders. Features like branded reports and a stakeholder center make it easier to link demographic insights to investment performance, which can be crucial for securing funding for projects tied to demographic shifts.

By integrating demographic data with property performance metrics, CoreCast creates a comprehensive view of how population changes impact portfolios. This holistic perspective enables quicker, more informed decisions in markets where timing is critical.

"Demographic shifts don't happen overnight, but they're among the most dependable long-term indicators of real estate performance." – Industry Expert

Staying attuned to demographic and consumer trends helps investors anticipate market changes and refine their strategies. With the real estate market projected to reach $28.18 trillion by 2028, positioning portfolios to align with these shifts can unlock significant opportunities for growth. These strategies not only enhance current asset performance but also prepare investors for the future.

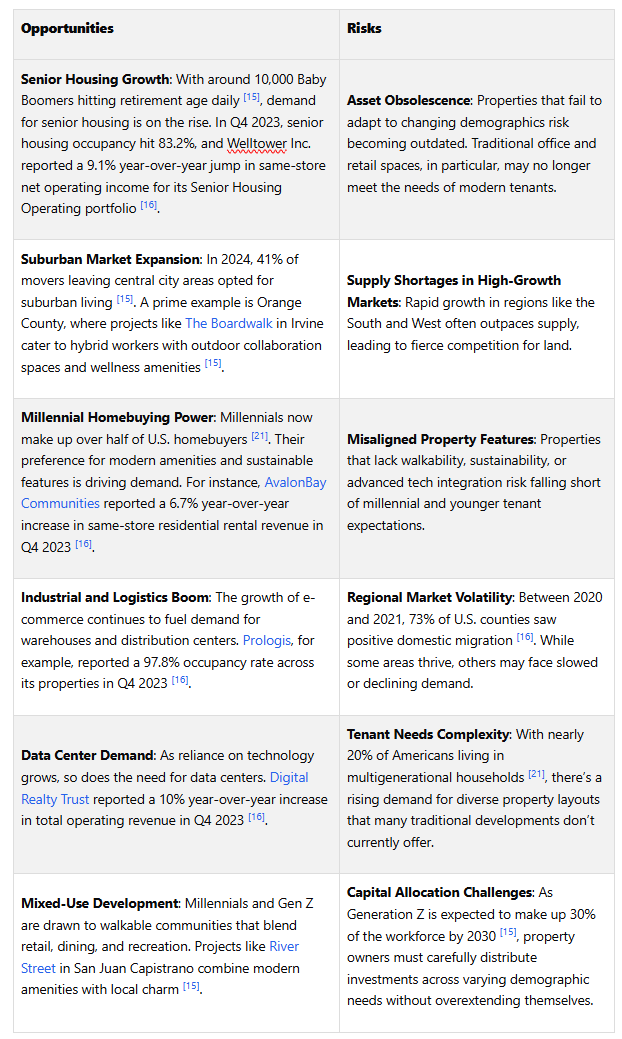

Opportunities and Risks: A Side-by-Side Analysis

Shifting demographics play a big role in shaping market demand and defining property needs. Understanding both the opportunities and risks tied to these changes is critical for effective planning. Below is a breakdown of key opportunities and their corresponding risks in today's dynamic market.

These examples show how investors must carefully navigate the balance between opportunities and risks as regional and demographic trends evolve. Long-term aging patterns, for example, are reshaping demand, while single-person households have grown from 13% in 1960 to 28% in 2021. These shifts are redefining housing needs and preferences.

Migration trends and changing tenant expectations further highlight the importance of taking a long-term view. The most successful investors focus on multiyear strategies, even as they face macroeconomic fluctuations, geopolitical uncertainties, and regional disparities. This demands a more targeted, selective approach to investment.

Take the retail sector as an example. While traditional retail faces challenges, reimagining spaces with experiential concepts that appeal to today’s consumers can unlock new opportunities.

Investors should prioritize markets where population growth is outpacing supply, and where rising wages can support higher rents. Properties must also be designed with flexibility and operational efficiency in mind. Urbanization adds another layer of complexity. The United Nations projects that 68% of the global population will live in urban areas by 2050, up from 55% in 2018. This trend creates openings for urban multifamily and mixed-use developments, even as it may dampen demand for rural commercial properties.

These dynamics lay the groundwork for discussing strategies to adapt in an ever-changing market.

Conclusion: Preparing for a Changing Future in Commercial Real Estate

The commercial real estate world is undergoing a transformation, driven by demographic trends that will shape the next decade. Millennials now make up more than 50% of U.S. homebuyers, Gen Z is expected to account for 30% of the workforce by 2030, nearly 20% of Americans live in multigenerational households, and around 10,000 Baby Boomers reach retirement age every day. These shifts are rewriting the playbook for success in the industry.

To navigate this evolving landscape, three key strategies stand out: data-informed decision-making, diversifying portfolios based on demographic trends, and staying flexible to meet changing tenant needs. Properties that can adapt to these shifts will outperform those stuck in outdated models.

Investors are already pivoting toward this approach. They're focusing on high-growth, supply-constrained markets where wage increases support rising rents. Additionally, they're diversifying their investments by considering factors like age, income, household size, and migration trends.

"Staying aligned with demographic currents isn't about chasing trends - it's about anticipating tomorrow's demand before it becomes obvious." - Alliance CGC

Technology is a powerful ally in this shift. Tools like CoreCast allow real estate professionals to track demographic changes, analyze competitive markets, and conduct in-depth portfolio evaluations - all in one platform. This comprehensive approach helps investors assess various asset classes while keeping an eye on how demographic shifts influence both their pipeline and existing properties. As technology becomes more critical to staying competitive, the urgency to adapt grows stronger.

The clock is ticking. With 41% of people moving from city centers to suburban areas and remote work permanently altering space demands, only those who embrace these changes will succeed.

Incorporating demographic data into your strategy isn't optional anymore - it's a necessity for thriving in an industry where generational shifts are rewriting the rules.

The future belongs to those who can see these changes coming and act on them. The question isn't whether demographics will reshape commercial real estate - it’s whether you’ll be ready when they do.

FAQs

-

Demographic shifts are playing a major role in shaping the demand for commercial real estate across the U.S. One clear example is the aging population, which has sparked a growing interest in senior housing. At the same time, the rise of remote work and the increasing reliance on digital infrastructure are driving up the need for data centers. On another front, the preference for more flexible living arrangements has led to a surge in built-to-rent properties.

Urban migration patterns and changes in workforce demographics are also steering investment strategies in new directions. Developers and businesses are adjusting their approaches to better serve the evolving needs of diverse communities. These trends underscore how important it is to stay attuned to demographic changes in order to uncover fresh opportunities and navigate potential challenges in the commercial real estate market.

-

To address the growing need for senior housing and healthcare facilities, investors have several promising strategies to consider. One effective approach is expanding into independent and assisted living communities, which serve a wide range of senior lifestyles and care requirements. Another opportunity lies in creating luxury senior living developments aimed at affluent retirees, a market segment with significant potential for high returns.

Incorporating advancements in medical technology and remote monitoring can also elevate the quality of care and attract residents seeking modern, tech-enabled facilities. Furthermore, with demand often exceeding supply in many regions, there’s a chance to benefit from this disparity by developing or acquiring properties in areas with high demand. These strategies not only address current market gaps but also set the stage for sustained growth in the senior living sector.

-

The rise of remote and hybrid work models is reshaping suburban office spaces. Companies are now looking for workplaces that offer flexibility to accommodate employees splitting their time between home and the office. This shift has sparked the development of suburban offices equipped with collaborative spaces, shared amenities, and advanced technology to support effortless remote connectivity.

Simultaneously, businesses are moving away from a heavy reliance on urban office hubs, fueling a trend toward decentralization. This change has driven up demand for modern, versatile office spaces in suburban areas. Meanwhile, some urban office buildings are being converted into residential or mixed-use developments, reflecting the evolving needs of the workforce and communities.