How Policy Changes Affect Foreign Real Estate Buyers

Foreign real estate investors face increasing challenges as governments tighten rules to address housing affordability, national security, and economic concerns. Recent policy updates, like stricter tax laws and ownership restrictions, are reshaping investment strategies. Here’s what you need to know:

New U.S. Tax Rules: Starting September 30, 2025, FIRPTA requires electronic processing for withholding taxes, adding compliance costs.

State-Level Restrictions: States like Texas limit foreign ownership near critical infrastructure, impacting property access.

Global Trends: While some countries, like Saudi Arabia, are easing ownership rules, compliance demands remain high.

Key Risks: Increased scrutiny, higher legal costs, and penalties for non-compliance.

To navigate this shifting landscape, investors must prioritize due diligence, consider alternative ownership structures (e.g., REITs or DSTs), and leverage tools like CoreCast for tracking regulations and streamlining compliance. Staying informed and prepared is essential for success in this evolving market.

Major Policy Changes Affecting Foreign Real Estate Buyers

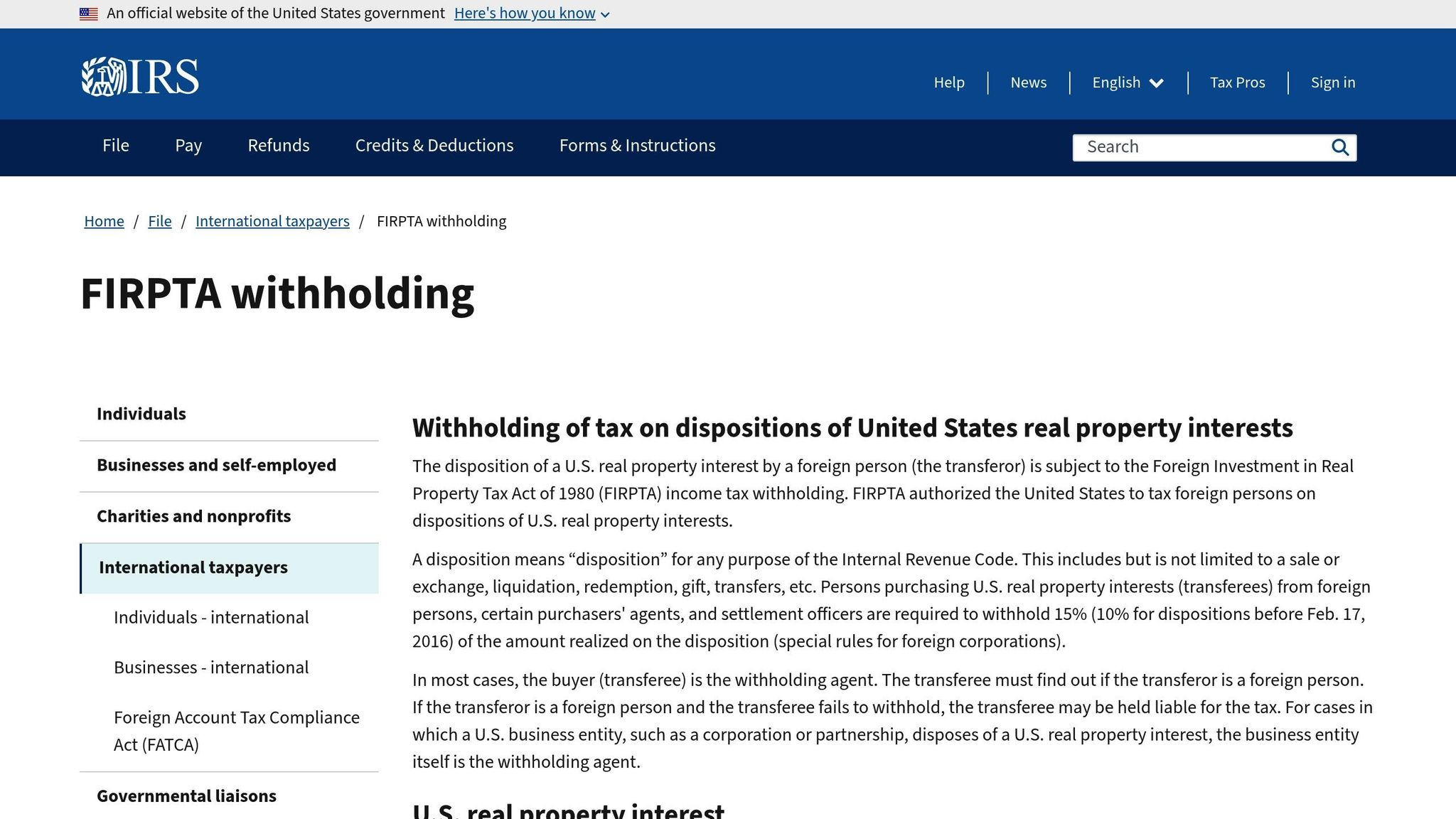

Recent updates to regulations, particularly in tax compliance under the Foreign Investment in Real Property Tax Act (FIRPTA), are influencing how foreign investors approach the U.S. real estate market. Here's a closer look at a significant change impacting investors.

U.S. Policy Changes: FIRPTA Updates

Starting September 30, 2025, FIRPTA will require all withholding tax obligations to be processed electronically. This shift replaces the older paper-based system, aiming to simplify compliance procedures for foreign real estate investors.

Challenges and Risks for Foreign Investors

Recent policy changes have introduced new challenges for foreign investors, particularly in the real estate sector. These adjustments have created obstacles that can affect profitability and complicate the process of completing transactions. Below, we explore how these regulatory updates are reshaping the landscape for foreign investors.

Financial and Tax Implications

The shift to digital FIRPTA compliance has placed new demands on accounting systems and heightened the need for specialized tax advice. Add to this the challenges posed by currency fluctuations and the risk of double taxation, and it becomes clear that tax planning has never been more critical. A stronger U.S. dollar can make meeting tax obligations in the United States more expensive for investors dealing in other currencies. Additionally, double taxation - where investors are taxed both in their home country and in the U.S. - requires careful planning, especially when complex corporate structures or trusts are involved.

Increased Scrutiny and Penalties

Regulatory oversight has become more stringent, further complicating the transaction process. Foreign investors now face more rigorous due diligence requirements from banks and regulators. For instance, banks are increasingly requesting detailed documentation to verify the source of foreign funding, which can lead to delays compared to domestic transactions. Anti-money laundering (AML) regulations have also tightened, requiring extensive disclosure of beneficial ownership details for certain real estate deals. Falling short of these requirements can result in steep financial penalties and increased legal risks.

Ownership Restrictions and Compliance Challenges

Certain states have imposed restrictions on foreign ownership near sensitive areas, such as military bases, critical infrastructure, or agricultural land. These rules can even force divestitures if ownership thresholds are exceeded. Additionally, ongoing disclosure requirements and expanded reviews by the Committee on Foreign Investment in the United States (CFIUS) have added to the compliance burden. CFIUS has widened its scope to include specific real estate transactions in sensitive locations, which can delay deals or require restructuring to meet regulatory demands.

Transform Real Estate Data into Confident Decisions

Join Corecast to streamline your real estate operations, gain real-time insights, and make smarter investment decisions with a unified platform.

Methods for Managing Regulatory Challenges

Foreign investors face a range of regulatory hurdles when entering the U.S. real estate market. However, by adopting well-thought-out strategies, they can navigate these challenges while ensuring their investments remain viable. Below are some practical approaches that focus on structuring investments, conducting thorough due diligence, and leveraging technology to stay ahead of regulatory shifts.

Legal and Financial Structuring

Careful planning around legal and financial structures can help foreign investors minimize regulatory risks while optimizing their investments:

Real Estate Investment Trusts (REITs): Investing in publicly traded REITs offers a way to access the U.S. real estate market without the complications of direct ownership. REITs bypass state-level ownership restrictions and avoid the need for CFIUS reviews tied to direct property acquisitions. Plus, they provide diversification and professional management, easing the compliance burden.

Limited Partnerships: By participating as limited partners while U.S. entities take on the role of general partners, foreign investors can reduce regulatory scrutiny. This structure works particularly well for commercial real estate projects that combine foreign capital with local expertise in compliance management.

Delaware Statutory Trusts (DSTs): These trusts are especially appealing for investors looking to benefit from 1031 exchanges. DSTs allow foreign buyers to hold fractional interests in high-quality properties, while the trust itself handles day-to-day compliance responsibilities.

U.S. Subsidiaries: Establishing a U.S.-based subsidiary can simplify regulatory compliance and streamline future transactions. While this approach involves upfront setup costs and ongoing maintenance, it can reduce documentation requirements for subsequent deals.

No matter the structure, rigorous due diligence is essential to ensure compliance and mitigate risks.

Importance of Due Diligence

Thorough research and preparation are key for foreign investors to avoid costly regulatory missteps. Here’s how:

Regulatory Mapping: Each U.S. state has its own rules regarding foreign ownership, particularly for agricultural land or properties near sensitive sites. Understanding these regulations before making a purchase is critical, as retroactive compliance can be both expensive and, in some cases, impossible.

CFIUS Sensitivity Analyses: Properties located near military bases, critical infrastructure, or government facilities may trigger a mandatory CFIUS review, potentially delaying transactions by 75-90 days. Identifying these risks early allows investors to adjust their plans or explore alternative properties.

Banking Relationships: Partnering with banks experienced in foreign transactions can help avoid financing delays. These institutions often have streamlined processes and are familiar with the documentation needs of international buyers, making the transaction smoother.

Tax Treaty Optimization: Bilateral tax agreements between the investor’s home country and the United States can help minimize withholding taxes and prevent double taxation. Consulting with tax advisors who specialize in international real estate can uncover opportunities to structure deals in line with favorable treaty provisions.

By combining these due diligence practices with modern technology, investors can further simplify compliance.

Using Technology for Compliance

Technology plays a vital role in managing regulatory complexities. Here’s how foreign investors can use it to their advantage:

Automated Policy Tracking: Software tools can monitor regulatory changes across different jurisdictions, providing real-time alerts about new rules, filing deadlines, or compliance updates. This reduces the risk of costly oversights.

Digital Documentation Platforms: These platforms help organize ownership records, funding documents, and compliance filings. They also send automated reminders to ensure critical deadlines are met, saving time and reducing errors.

Integrated Real Estate Intelligence: Advanced platforms combine regulatory tracking with market analysis, offering investors valuable insights into both compliance requirements and potential opportunities. This integrated approach helps investors make well-informed decisions while staying ahead of regulatory challenges.

Using CoreCast for Regulatory and Market Insights

CoreCast provides tailored solutions to address financial, tax, and compliance challenges, aligning with the ever-changing U.S. real estate regulatory environment. For foreign investors, navigating this landscape can be daunting, but CoreCast’s all-in-one platform simplifies the process with detailed data analysis and real-time tracking. This combination helps investors anticipate policy changes, manage portfolios effectively, and develop forward-looking investment strategies.

Tracking Policy-Driven Market Trends

CoreCast combines real-time market data, historical trends, and an interactive map to identify areas impacted by new regulations while uncovering emerging opportunities. By consolidating regulatory information across jurisdictions, the platform allows users to compare investment climates and spot trends before they gain widespread attention.

Historical data plays a key role in helping investors understand how past policies have shaped the market. This insight empowers foreign investors to predict how upcoming regulations might influence their investments, enabling them to refine their strategies proactively.

Another standout feature is CoreCast’s ability to monitor multiple asset classes - commercial, residential, and industrial - simultaneously. This adaptability allows investors to shift their focus as regulations evolve, ensuring they remain agile even when certain property types face new restrictions or increased scrutiny.

Better Portfolio Management and Reporting

Effective asset management is just as important as market insights, and CoreCast excels in this area. The platform helps investors stay compliant by tracking exposure to various regulatory environments and monitoring deals at every stage of compliance. Its customizable reports and centralized stakeholder tools make it easier to communicate with partners and regulators.

For instance, CoreCast’s pipeline tracking feature keeps investors informed during lengthy regulatory review periods, such as those conducted by CFIUS. By monitoring each stage of a transaction, investors can better manage timelines and avoid unnecessary delays.

The platform also generates branded, customizable reports tailored to different audiences, whether they are overseas investors, legal teams, or regulatory bodies. These reports are crucial for meeting disclosure requirements and providing documentation during regulatory reviews.

Future third-party integrations will further simplify compliance by connecting CoreCast with legal and accounting systems, streamlining the preparation of regulatory documentation and reports.

Future-Proofing Investments with CoreCast

CoreCast’s planned AI automation and forecasting tools will allow investors to model the impact of regulatory changes and adjust strategies ahead of time. Features like compliance dashboards and seamless integration with legal and accounting systems will help ensure that all regulatory obligations are met.

As regulations grow more complex, CoreCast’s transaction management tools become even more essential. The platform tracks documentation requirements, filing deadlines, and compliance milestones, reducing the risk of missed obligations. Its upcoming investor relations features will also enhance transparency, helping stakeholders stay informed about compliance risks and statuses - a critical factor in maintaining trust during uncertain times.

For development projects, CoreCast’s expanding construction management capabilities will integrate regulatory compliance tracking with project progress monitoring. This comprehensive approach ensures that regulatory requirements are addressed at every stage of development.

Looking ahead, CoreCast’s advanced reporting features will include real-time compliance dashboards, giving foreign investors a clear view of their regulatory status across multiple jurisdictions and property types. This level of visibility and control makes CoreCast an invaluable tool for navigating the complexities of U.S. real estate investments.

Conclusion: Adapting to Changing Regulatory Conditions

The rules and regulations surrounding foreign real estate investments in the U.S. are shifting at a rapid pace. From updates to FIRPTA to state-specific restrictions like those in Texas, these changes are redefining how international investors approach the market. Thriving in this environment takes more than just financial resources - it calls for smart strategies, advanced tools, and a proactive approach to staying compliant.

Key Takeaways for Foreign Investors

Due diligence is no longer optional - it’s essential. Straightforward property acquisitions are becoming a thing of the past. Today’s foreign investors must navigate intricate disclosure requirements, longer review processes, and increased scrutiny from agencies like CFIUS. Compliance must be a priority from the very beginning of any investment decision, not an afterthought.

Real-time insights and tracking tools are game-changers. Platforms like CoreCast enable investors to manage regulatory complexity by monitoring multiple jurisdictions and generating detailed compliance reports - all in one place. This kind of technology is crucial for staying competitive in today’s market.

Diversification is key to managing risk. Spreading investments across various jurisdictions and asset types provides a safety net when new restrictions arise in one area. CoreCast’s unified platform makes managing diverse portfolios easier, ensuring investors can adapt to policy shifts without losing momentum.

Partnering with experts is non-negotiable. The complexity of today’s regulations means investors can’t go it alone. Building relationships with specialized attorneys, tax advisors, and compliance professionals is critical for long-term success.

These strategies form a solid foundation for navigating the ever-changing regulatory landscape.

Preparing for Future Policy Changes

Looking ahead, the regulatory environment is likely to grow even more complex as global tensions influence domestic policies. Staying ahead of the curve means being ready to adjust strategies quickly as new rules and restrictions emerge. This requires both a robust technological framework and the ability to act swiftly.

Monitoring policy changes at all levels - federal, state, and local - has never been more important. Tools like CoreCast, which will soon include AI-driven automation features, can help track these developments efficiently. However, human expertise remains irreplaceable in interpreting and applying these changes effectively.

Integrating compliance into investment strategies from the outset saves both time and money. Investors who prioritize compliance early on are better positioned to identify opportunities that others might overlook due to regulatory hurdles.

As policies continue to evolve, leveraging digital platforms like CoreCast will be essential. Success will belong to those who see regulatory compliance not as a burden but as a competitive edge. By embracing technology, staying flexible, and aligning strategies with the shifting landscape, foreign investors can uncover opportunities others might miss and build sustainable, compliant portfolios for the future.

FAQs

-

Starting September 30, 2025, the IRS will mandate that all FIRPTA (Foreign Investment in Real Property Tax Act) payments be submitted electronically. By moving away from paper checks, this update is set to streamline the withholding process, offering a quicker and more seamless approach for foreign investors dealing with U.S. real estate transactions.

The goal of this change is to simplify compliance and minimize processing delays, making it easier for investors to adhere to FIRPTA regulations.

-

Foreign real estate investors looking to avoid complications with state restrictions near critical infrastructure should focus on properties located at least 10 miles away from these protected areas. These locations typically face fewer regulations and offer a safer environment for investment. It's also crucial to familiarize yourself with specific state laws, like those recently introduced in Alabama, Indiana, and Montana, to steer clear of compliance pitfalls.

To navigate the ever-evolving regulatory landscape, consulting with legal and regulatory experts is a smart move. These professionals can help evaluate potential risks and ensure investments comply with all relevant laws, including any reviews by the Committee on Foreign Investment in the United States (CFIUS). Staying proactive in understanding and adjusting to these rules not only reduces risks but also opens the door to promising investment opportunities.

-

Platforms such as CoreCast make life easier for foreign real estate investors by simplifying compliance and keeping them up to date with regulatory changes. With tools like real-time data analysis, automated alerts for policy updates, and built-in reporting features, investors can stay on top of legal requirements and adjust quickly to any changes.

CoreCast also takes the hassle out of compliance management with features like document tracking, KYC (Know Your Customer) processes, and centralized dashboards. These tools help investors reduce risks, comply with regulations such as AML (Anti-Money Laundering) and CFIUS (Committee on Foreign Investment in the United States), and make informed, data-backed decisions with greater confidence.