How to Forecast Property Values Using Data Analytics

Data analytics has transformed how real estate professionals forecast property values. Instead of relying on instinct or basic metrics like square footage and location, advanced tools now incorporate diverse data sources and predictive models. Here's the gist:

Key Data Sources: Property listings, transaction records, local market trends, and economic indicators like employment rates or infrastructure projects.

Methods: Statistical techniques (like regression analysis) and machine learning models (e.g., Automated Valuation Models) provide more precise predictions.

Tools: Platforms like CoreCast streamline data management, forecasting, and decision-making by integrating insights into a single system.

Predictive Analytics: These models analyze historical and current data to anticipate market trends, identify neighborhoods with growth potential, and adapt to economic shifts.

Machine learning transforms property valuations

Data Sources You Need for Property Valuation

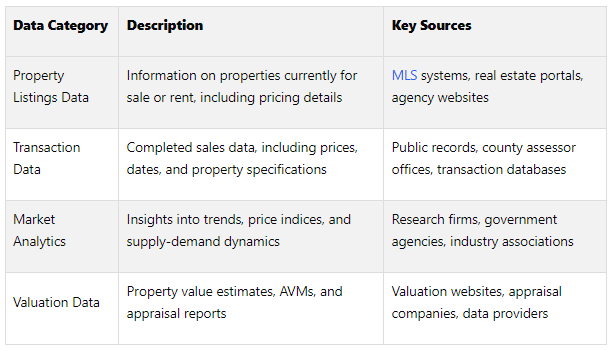

When it comes to forecasting property values, having access to reliable and high-quality data is non-negotiable. Without it, even the most sophisticated analytics tools can produce uncertain or misleading results. Real estate professionals must focus on identifying the most relevant datasets and ensuring their accuracy through rigorous validation. Below, we break down the key data categories essential for accurate property valuation.

The sheer volume of property data available is staggering - spanning decades and covering nearly every property in the U.S. This abundance highlights both the opportunities and challenges of using data effectively for real estate forecasting.

Each of these categories contributes to a well-rounded understanding of property values, starting with transaction data.

Property Sales History and Transaction Records

Transaction records are a goldmine for identifying pricing trends, market cycles, and historical property performance. However, outdated or incomplete data can lead to flawed valuations and poor investment decisions. For accurate analysis, include details like square footage, bedroom and bathroom counts, and any upgrades. This level of detail is critical for comparative analysis and training predictive models that can provide more accurate forecasts.

Local Market and Neighborhood Data

A property's value is deeply influenced by its neighborhood. Factors such as school district ratings, crime rates, proximity to amenities, and local economic conditions can explain why two similar homes in different neighborhoods might have vastly different values.

Geospatial data from GIS systems, government databases, and specialized real estate platforms can provide insights into key factors like walkability, transportation access, and school quality. Census data adds another layer by revealing demographic trends, such as population growth and income levels, which can impact demand and pricing.

For example, neighborhoods experiencing growth in tech industries often attract high-income professionals. This influx drives demand for modern housing and contributes to rising property values. Additionally, local market trends - such as housing inventory, price-per-square-foot comparisons, and average days on the market - help determine whether a neighborhood leans toward a buyer's or seller's market.

But local data is just one piece of the puzzle. Broader economic and infrastructural factors also play a significant role.

Economic Indicators and Infrastructure Changes

Economic trends and infrastructure developments provide critical context for property valuations. For instance, infrastructure upgrades like new subway lines or road expansions often signal future property value increases. Similarly, economic indicators such as employment rates, interest rates, and local business growth shape the broader market landscape.

Data from local building departments - such as building permits and new housing starts - can reveal upcoming supply changes that might affect property prices. Predictive analytics tools can further refine forecasts by analyzing patterns in economic activity, demographic shifts, and investor behavior. Mortgage data, including loan originations and affordability metrics from financial institutions and government agencies, rounds out a comprehensive approach to property valuation.

Analytics Methods for Property Value Forecasting

Turning raw data into precise property value predictions requires the right analytical tools. By leveraging solid data sources and combining statistical techniques with machine learning, you can refine forecasts to make them both reliable and timely. These methods bring together traditional statistical approaches and modern machine learning innovations, ensuring a well-rounded forecasting strategy.

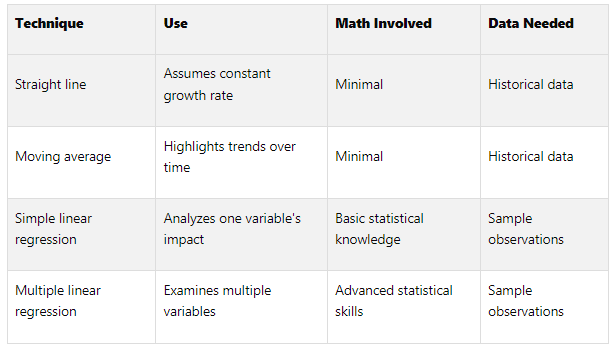

Basic Data Analysis and Statistical Methods

Statistical techniques are the backbone of property value forecasting. They provide clear, interpretable insights and help uncover patterns in real estate data. Among the most commonly used methods is regression analysis, which examines how property values are influenced by factors like location, square footage, and the number of bedrooms.

Simple linear regression focuses on the relationship between one independent variable and the property value.

Multiple regression takes it a step further, analyzing the impact of several variables simultaneously.

Another essential tool is time series analysis, which helps identify seasonal trends in property values. Techniques like moving averages are particularly useful for smoothing out short-term fluctuations, making long-term trends easier to spot.

Machine Learning for Real Estate Predictions

Machine learning takes property forecasting to the next level by processing vast datasets and uncovering patterns that traditional methods might miss. These models excel at handling multiple variables and can adapt to changing market conditions without manual adjustments.

Automated Valuation Models (AVMs) are a prime example of machine learning in action. These systems use algorithms to assess property values with impressive accuracy. Forbes highlights that ML-powered AVMs can achieve an absolute error of under 4% for residential properties and below 6% for commercial ones. Redfin's AVM boasts a 98% accuracy rate for on-market homes and 93% for off-market properties.

Aleksandr Ahramovich, Head of AI/ML Center of Excellence at Itransition, emphasizes the versatility of machine learning in real estate:

“ML in real estate encompasses machine learning algorithms applied for natural language processing (NLP) or computer vision and deployed to facilitate investments, enhance property management, and improve customer experience.”

One of the standout features of machine learning is its ability to incorporate non-traditional factors automatically. For instance, it can weigh variables like the quality of local services, employment rates, and crime statistics alongside conventional indicators. Choosing the right features is critical to fully harnessing these models.

Feature Selection and Model Training

The success of property value forecasting hinges on selecting the right features and training your models effectively. Location remains a primary factor, encompassing proximity to amenities, quality schools, transportation, and regional growth trends. Detailed data on property records and market movements can help capture subtle differences between neighborhoods.

Key property characteristics - such as square footage, number of bedrooms and bathrooms, lot size, and architectural style - also play a major role. The property's condition, including its maintenance history and absence of major issues, further impacts its value. Broader market factors like recent comparable sales and economic drivers (e.g., job growth and population increases) provide essential context.

To avoid overfitting, divide your data into training, validation, and test sets. Even the most advanced algorithms will falter if fed incomplete or inaccurate data. For comparable sales analysis, prioritize properties that closely match the subject property and were sold within the last three to six months. Using multiple comparable properties ensures a more reliable valuation range.

For short-term forecasts, univariate linear models often work best, while multivariate models are better suited for long-term predictions. Proper data management and thoughtful model selection are key to achieving accurate and actionable forecasts.

Using Predictive Analytics to Spot Market Trends

Predictive analytics is changing the game for real estate professionals by refining how they identify and act on market opportunities. By combining historical data with current trends, these tools uncover patterns that traditional methods often overlook. As Gina Baker from HousingWire puts it, "Predictive analytics in real estate combines the use of historical data and algorithms to anticipate future market trends and identify potential sellers".

What sets predictive analytics apart is its ability to process multiple data streams at once. Unlike traditional methods that rely heavily on past sales data, these advanced tools integrate demographics, economic indicators, consumer behavior, and infrastructure developments to create a more complete picture of the market. Below, we’ll explore how predictive analytics is used to forecast property values, assess neighborhood potential, and adapt to economic and policy changes.

Predicting Future Property Values

Predictive analytics goes far beyond simple trend analysis. By examining a mix of property details, demographic data, sales trends, and consumer behavior, these systems pinpoint the factors that influence future price movements. Sophisticated algorithms continuously refine their predictions, making them more accurate over time.

One of the standout features of AI-driven models is their ability to uncover connections between seemingly unrelated factors. For instance, they might link an uptick in local employment rates to increased housing demand or associate new transportation projects with rising property values in specific areas. This kind of nuanced analysis helps real estate professionals make informed decisions.

These models also incorporate broader economic indicators, allowing for a more refined approach to forecasting. By blending detailed property data with larger market trends, predictive analytics offers a clearer view of where property values are headed.

Assessing Neighborhood Growth Potential

Beyond individual property values, predictive analytics helps identify neighborhoods with long-term growth potential. These tools analyze multiple growth indicators, such as infrastructure projects, demographic changes, and economic trends, to determine which areas are likely to appreciate in value. Instead of focusing solely on current property prices, they dig deeper into the factors driving long-term demand.

Geospatial analytics plays a key role here by evaluating variables like commute times, access to retail, and crime rates - factors that heavily influence a neighborhood’s appeal. By identifying emerging "hot zones", these tools can forecast whether a neighborhood is on the rise or likely to see declining demand.

Demographic trends, such as population growth, shifts in age distribution, and changes in income levels, also provide critical insights into future housing demand. When combined with data on planned infrastructure improvements, new business developments, or school district changes, these models paint a detailed picture of which neighborhoods are poised for growth.

Broader societal shifts, like the move toward urbanization, the demand for energy-efficient homes, or the rise of hybrid work models, also play a role. These macro trends often create ripple effects that can reshape entire neighborhoods over time.

Adapting to Economic and Policy Changes

One of the most powerful aspects of predictive analytics is its ability to adapt to changing economic and policy conditions. These AI-driven tools can navigate regulatory changes and economic shifts, helping investors make smarter, more informed decisions while mitigating risks.

For example, adjustments to interest rates, tax policies, or zoning laws can have complex effects on property values. Predictive models analyze these variables alongside economic indicators to forecast how different scenarios might impact local markets. By continuously updating with new data, these tools ensure that forecasts remain relevant even as conditions evolve.

Economic metrics like employment rates, GDP growth, and inflation are also key inputs for these models. For instance, when the Federal Reserve changes interest rates, predictive analytics can estimate the resulting impact on buyer demand, property prices, and transaction volumes across various market segments.

The rapid growth of AI in real estate highlights its importance. In 2023, the AI-powered real estate market was valued at approximately $164.96 billion and is projected to reach $226.71 billion by 2024. By 2028, it’s expected to soar to $731.59 billion, with a CAGR of 34.0%. This growth underscores how critical predictive analytics has become for staying competitive in today’s market.

To make the most of predictive analytics, it’s essential to work with accurate, complete, and relevant data tailored to your market questions. Choose statistical models and algorithms that align with your forecasting needs, and interpret the results within the specific market context. This approach ensures clear, actionable insights for stakeholders. By weaving together these dynamic elements, predictive analytics provides a robust framework for comprehensive market forecasting.

Transform Real Estate Data into Confident Decisions

Join Corecast to streamline your real estate operations, gain real-time insights, and make smarter investment decisions with a unified platform.

How CoreCast Simplifies Property Forecasting

Predictive analytics can provide powerful insights, but juggling multiple data sources often becomes a headache for real estate professionals. CoreCast tackles this issue by merging various real estate tools into a single platform, offering real-time insights that simplify operations. With everything in one place, CoreCast transforms forecasting from a fragmented process into a seamless workflow. No more jumping between spreadsheets, databases, or other systems - professionals can manage their entire forecasting process from one intuitive dashboard.

This streamlined setup doesn't just save time; it helps users stay focused. Studies reveal that it takes about 23 minutes to regain full concentration after switching tasks. By centralizing tools and data, CoreCast minimizes these distractions, allowing professionals to work more efficiently and with greater clarity.

CoreCast's Main Features for Real Estate Forecasting

At the heart of CoreCast's forecasting power are three primary tools: the Underwriter modeling engine, Portfolio Insights, and the Pipeline Tracker.

The Underwriter supports a wide range of asset classes and investment strategies, giving users flexibility for diverse portfolios.

Portfolio Insights consolidates key data into a single view, helping users monitor portfolio health and performance.

The Pipeline Tracker provides real-time updates on deal statuses, covering every stage from initial evaluation to final disposition.

CoreCast uses a mix of historical data, market benchmarks, and user-defined assumptions to create detailed performance forecasts. Built-in validation logic ensures accuracy by flagging any input inconsistencies, boosting the reliability of projections.

One standout feature is the Pipeline Tracker, which has proven its value in reducing inefficiencies. As a Director of Acquisitions at a REIT shared:

“With the Pipeline Tracker, we reduced deal slippage by 30% over two quarters. The visibility and accountability it provides are game-changers.”

Another key advantage is CoreCast's dynamic portfolio system, which is live-linked to the Underwriter. This means forecasts are automatically updated as market conditions shift or new data is added, providing users with continuous, real-time insights.

Workflow Integration and Custom Data Output

CoreCast doesn't just centralize tools - it also automates repetitive tasks like data consolidation, model updates, and investor reporting. This reduces manual errors and saves time, allowing professionals to focus on analysis rather than tedious administrative work. The platform acts as a single source of truth for financial and operational data, fostering seamless collaboration with features like in-platform commenting, issue flagging, and change tracking.

Custom dashboards are another highlight. These can be tailored to meet the needs of different stakeholders, whether you're presenting to investors, updating asset managers, or briefing acquisition teams. CoreCast ensures outputs are formatted professionally, adhering to U.S. currency and date styles. Additionally, the platform supports scenario modeling, enabling users to adjust key variables like rent growth, cap rate changes, and operating expense inflation.

Better Decision-Making with Combined Insights

By integrating workflows and data analysis, CoreCast empowers users to make smarter, faster decisions. The platform combines property analysis, market trends, and portfolio management into one cohesive system. This makes it easy to evaluate acquisitions, reforecast business plans, or stress-test portfolio outcomes - all without the hassle of switching between outdated tools like Excel, SharePoint, or ARGUS.

As an Asset Manager at a Mid-Market Private Equity Firm explained:

“CoreCast transformed how we communicate portfolio performance to stakeholders. We now spend more time analyzing data, and less time assembling it.”

This unified approach allows professionals to quickly identify opportunities and risks, giving them an edge in today’s complex real estate market. Whether you're assessing a new deal or refining a long-term strategy, CoreCast ensures you have the insights you need, all in one place.

Best Practices for Long-Term Forecasting Success

Long-term forecasting in real estate is an evolving process. The market is always shifting, and to keep up, your forecasting methods need to adapt. Establishing systems that prioritize accuracy and flexibility is key to staying ahead. Here are some strategies to ensure your forecasting remains reliable and responsive to market changes.

Data Management and Quality Control

Accurate forecasting starts with clean, reliable data. Poor-quality data can lead to costly errors, so maintaining high standards is non-negotiable. Consistency across data sources ensures your models are working with dependable information.

Set up data validation protocols to catch inconsistencies, missing entries, and outliers before they affect your forecasts. Automated alerts for out-of-range values can help flag potential issues early. Regularly updating critical data - like recent sales trends, rental prices, and local economic indicators - keeps your forecasting models sharp and relevant.

Regular Model Testing and Updates

Even with the best data, forecasting models need regular evaluation to stay effective. AI can adapt to market trends, but it still requires oversight and fine-tuning. Ongoing monitoring helps ensure your predictions remain accurate over time.

Test your models by comparing their predictions to actual market outcomes. If you notice consistent over- or under-predictions, it could indicate a need for adjustments. These patterns often signal market changes that your current approach may not fully account for.

As new data becomes available, use it to refine your models. Any discrepancies between predicted and actual outcomes should be analyzed and used to improve future forecasts. Real-time data integration is especially valuable, allowing you to respond quickly to market shifts. Setting benchmarks and reviewing performance regularly helps maintain the reliability of your forecasting systems.

Adding New Data Sources

Incorporating new data sources can significantly improve forecasting accuracy. In fact, 60% of real estate trend predictors now use non-traditional factors. Expanding your data inputs helps capture dynamics that traditional metrics might miss.

For example, climate impact data can highlight how properties in flood-prone or extreme weather areas might follow different value trends compared to more stable regions. Including climate risk assessments in your forecasting can uncover long-term patterns.

Consumer behavior is another valuable area to explore. Remote work trends, for instance, have shifted demand from urban to suburban markets. By tracking job posting data, commuting habits, and workplace policies, you can better anticipate changes in neighborhood demand.

Broader economic indicators like employment rates, permit activity, and crime statistics also add depth. For instance, a rise in commercial permits could point to increasing property values, while declining employment might signal downward pressure.

Machine learning models, when properly trained, can achieve over 90% accuracy in predicting rents.

“Prioritizing quality data in 2023 will be a must for real estate professionals. With the help of the data sources above, industry pros can better understand their customers and help more people reach their goals of homeownership.”

Real estate teams should also monitor trends like urbanization, demand for energy-efficient homes, and the impact of hybrid work models. When adding new data sources, take a gradual approach - introduce one data type at a time to measure its impact without overwhelming your systems. This measured strategy ensures smoother integration and more reliable results.

Conclusion: Making Smarter Real Estate Decisions with Data Analytics

The real estate industry is undergoing a transformation, moving away from intuition-based decisions and toward a more data-driven approach - an essential shift to stay competitive in today’s intricate market. Data analytics has reshaped property value forecasting by using quantitative insights to minimize uncertainty and improve accuracy. By examining historical trends and incorporating unconventional data sources, these tools refine property valuation in ways that traditional methods simply cannot match.

This change is not just theoretical; it’s being embraced by industry leaders. Signal Ventures LLC highlights this shift, stating:

“Data-driven decision-making revolutionizes commercial real estate investing by offering precise insights and enhancing risk management.”

But the power of data analytics doesn’t stop at forecasting. Machine learning is playing a pivotal role in optimizing portfolios and simplifying decision-making processes. Meanwhile, hyperlocal data uncovers emerging neighborhoods with untapped opportunities. These advanced models often outperform traditional analytics, especially when explaining rent fluctuations.

A prime example of this integration is CoreCast. This platform combines real-time insights, portfolio tracking, and advanced analytics into one cohesive system. By consolidating these features, CoreCast eliminates the inefficiencies of juggling multiple platforms, ensuring seamless and consistent data management.

In a market defined by increasing demands and operational challenges, adopting data-driven strategies is no longer optional - it’s a necessity for maximizing profitability. Access to real-time, accurate data enables evidence-based investments and precise risk assessments, safeguarding and growing portfolios. These insights pave the way for streamlined forecasting solutions that simplify complexity.

To thrive in today’s competitive landscape, real estate professionals need the right tools and strategies to turn raw data into actionable insights. Johan Hajji, Co-founder & Co-CEO of The BnB Group, captures this sentiment perfectly:

“Embracing Data Driven Decision Making isn’t just about keeping pace - it’s about forging the future of property management through informed, impactful choices.”

FAQs

-

Machine learning (ML) models bring a new level of precision to property value predictions by analyzing complex patterns hidden in large datasets. Unlike traditional statistical methods, which depend on fixed assumptions about how data is related, ML algorithms can work with various data types and reveal nonlinear trends that might otherwise go unnoticed.

One of the standout advantages of ML is its ability to learn and improve over time. As new data becomes available, these models refine their predictions, making them especially useful in fast-moving real estate markets. This means professionals can rely on more accurate and timely forecasts, which helps sharpen investment strategies and refine market analyses.

-

Economic indicators like GDP growth, housing starts, and consumer confidence are key to understanding and predicting property values. These metrics offer a snapshot of the market's overall health and can signal changes in demand or potential price shifts.

On top of that, infrastructure developments - such as new transportation systems, urban projects, or facility upgrades - can significantly impact the appeal and value of properties. Keeping an eye on these changes and incorporating them into analytical models gives real estate professionals an edge in anticipating market movements.

When these factors are combined with historical data, the result is sharper forecasting. This enables professionals to make smarter decisions and build more effective investment strategies.

-

CoreCast makes forecasting property values easier with its real-time analytics and predictive tools, crafted specifically for real estate pros. It enables users to dive into market trends, assess property performance, and predict future values with accuracy.

Some standout features include portfolio insights, deal tracking, and integrated forecasting tools. These tools simplify data analysis, helping professionals make smarter investment decisions, minimize risks, and manage assets more effectively - all through a platform designed for the real estate world.