Pipeline Tracking for CRE: Ultimate Guide

Pipeline tracking in commercial real estate (CRE) simplifies deal management by offering clarity at every stage - from lead generation to closing. The process helps professionals stay organized, avoid missed opportunities, and improve decision-making. Here's what you need to know:

Why It Matters: CRE deals are complex, involving long cycles, multiple stakeholders, and challenges like property evaluations and financing. Tracking ensures no deal falls through the cracks.

Key Components:

Clear deal stages (e.g., Lead, Negotiation, Closing)

Real-time data for better decisions

Tools for managing stakeholders

Analytics to identify bottlenecks and improve outcomes

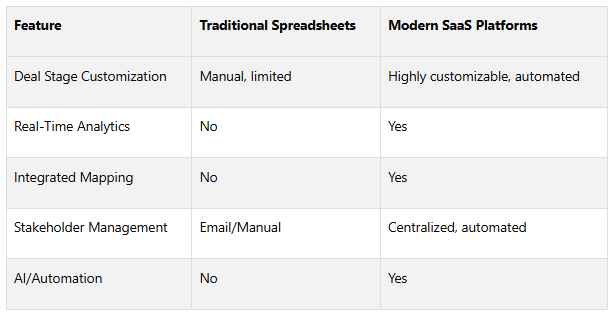

Modern Tools: Centralized platforms like SaaS systems replace outdated spreadsheets, offering features like AI, automation, and mapping for efficiency and accuracy.

Automation Benefits: Saves time, reduces errors, and enhances collaboration while improving metrics like conversion rates and deal velocity.

Takeaway: Adopting modern pipeline tracking tools and strategies can streamline CRE operations, boost productivity, and drive better results.

Have too many deals? Try CoreCast’s Pipeline Tracker

Core Components of CRE Pipeline Tracking Systems

Building on the benefits of centralized platforms, effective pipeline tracking systems blend operational efficiency with analytical depth. These systems are designed to manage deals from start to finish while delivering insights that teams can act on.

Setting Up Deal Stages

Defining clear deal stages with specific transition criteria is a cornerstone of any pipeline tracking system. This approach removes ambiguity and ensures accurate reporting. In most commercial real estate (CRE) pipelines, the workflow typically moves through stages like lead generation, underwriting, negotiation, and closing. Some teams expand these stages to include categories such as Active, Pending, Closed, or Cancelled, offering a more detailed view of deal progress. Standardizing these stages across your team not only improves consistency but also helps identify bottlenecks and allocate resources more effectively.

Customizable Workflows

While standardized stages provide structure, customizable workflows bring the flexibility needed to address the nuances of different deal types, asset classes, and team processes. These workflows allow teams to adjust deal stages, automate tasks based on deal type, and set approval processes that align with transaction specifics. For example, a $50 million acquisition requires a more complex workflow compared to a straightforward retail lease renewal. By tailoring workflows to match real-world business scenarios, teams can ensure better adoption and maintain higher data accuracy.

Real-Time Data and Analytics

Real-time data and analytics take pipeline tracking beyond simple record-keeping, turning it into a strategic decision-making tool. Modern systems provide immediate insights into pipeline health, deal progress, and market trends, making it easier to spot opportunities and risks. Real-time analytics also help teams resolve bottlenecks and improve decision-making. Dashboards displaying metrics like the number of active deals, average closing rates, and conversion rates at each stage empower teams to refine their strategies and drive better results.

Integrated Mapping and Data Visualization

Mapping and data visualization tools bring a spatial perspective that’s critical for making informed CRE decisions. These features allow users to view property locations, analyze competitive landscapes, and overlay market data - all capabilities that go far beyond what spreadsheets can offer. Visualizing geographic distribution helps teams identify market clusters and uncover opportunities in underserved areas. Interactive maps also simplify communication with stakeholders by presenting clear, visual summaries of property locations and market conditions. This spatial insight works hand-in-hand with centralized communication to strengthen stakeholder engagement.

Stakeholder Management Tools

Effective stakeholder management is essential for keeping everyone - investors, lenders, brokers, attorneys, and property managers - on the same page. Aligned with the need for real-time updates, modern systems centralize all communications, documents, and updates in one place. This eliminates the chaos of juggling emails or manual updates. Stakeholder management tools also streamline the process by automatically generating branded reports and distributing updates to the relevant parties. This approach reduces miscommunication, saves time, and ensures that everyone has access to the latest information.

These components collectively form a robust pipeline tracking system that supports daily operations while enabling long-term strategic planning. The challenge lies in choosing a platform that seamlessly integrates these features, avoiding the inefficiencies of disconnected tools.

Tools and Technologies for CRE Pipeline Tracking

Commercial Real Estate (CRE) pipeline tracking has come a long way from simple spreadsheets. Today, integrated platforms provide a more sophisticated approach, combining multiple tools and features to streamline operations. Knowing what’s available and how these tools work can help you choose the right solution for managing your pipeline.

End-to-End SaaS Platforms

Modern SaaS platforms bring everything you need into one place - deal tracking, underwriting, mapping, analytics, and stakeholder management. These systems ensure data consistency across functions, simplify user management, and adapt as your business grows. They also connect seamlessly with databases, cloud services, and APIs, making them ready for future technology needs.

Many of these platforms include pre-built connectors to key CRE tools, ensuring smooth integration with your existing systems. This level of connectivity prepares your operations for advanced features, such as AI-driven insights, that can elevate your pipeline management.

Automation and AI Features

AI and automation are reshaping how CRE pipelines are managed. These technologies handle tasks like lead scoring, deal progression, and task assignments automatically, which improves efficiency and reduces errors. They also provide predictive analytics, helping you allocate resources more effectively.

Consider these statistics: 87% of organizations view AI as critical to their revenue strategies, and companies using AI-powered tools report a 25% boost in sales productivity. AI-driven pipeline management can cut pipeline leakage by up to 30%, while sales forecasting accuracy improves by 10–15% with AI. Additionally, organizations using AI automation see up to a 50% reduction in forecasting errors, and 60% report fewer manual mistakes. These advancements make AI an essential part of modern CRE pipeline tracking.

CoreCast: A Comprehensive Solution

CoreCast takes pipeline management to the next level by offering an all-in-one real estate intelligence platform. It combines key functions - pipeline tracking, underwriting, mapping, analytics, and stakeholder management - into a single system. This eliminates the inefficiencies of juggling multiple tools and ensures data stays consistent across all operations.

With CoreCast, users can track deals through customizable stages while maintaining full visibility of their progress. Its underwriting tools support analysis for various asset classes, including office, retail, industrial, and multifamily properties, all within the same platform.

The platform also integrates mapping and competitive analysis, giving users a spatial perspective on property locations and market dynamics. This helps identify market opportunities by overlaying property data with competitive landscapes and other market insights.

Stakeholder communication is simplified with automated, branded reporting that keeps everyone on the same page. For firms managing diverse properties or strategies, CoreCast’s portfolio analysis tools provide a bird’s-eye view of performance metrics, trends, and detailed reports, enabling smarter strategic decisions.

CoreCast doesn’t stop at internal capabilities - it connects with external CRE tools to create a unified intelligence platform. Its AI-driven automation features enhance efficiency by taking care of routine tasks and offering predictive insights. However, it still leaves room for human judgment in complex transactions, striking the right balance between automation and oversight.

Strategies for Effective Pipeline Management

Managing a pipeline in commercial real estate isn't just about keeping track of deals - it's about turning that pipeline into a well-oiled revenue machine. This requires a mix of strategic planning and consistent execution.

Standardize Deal Stages and Processes

Having clear and consistent deal stages is a game-changer for pipeline management. When everyone on your team knows exactly what each stage involves and what actions are required, deals flow more smoothly. In fact, standardized processes can increase revenue by 18%. Why? Because they eliminate confusion and ensure no crucial steps are overlooked.

Your process should include key stages like prospecting, lead qualification, property analysis, proposal development, negotiation, and closing. To keep things moving, each stage needs specific entry criteria. For instance, a deal shouldn’t progress to the proposal stage unless the prospect’s needs have been thoroughly assessed and their budget and timeline confirmed. This clarity not only simplifies decision-making but also helps allocate resources effectively. Once you’ve nailed down these stages, automation can take your efficiency to the next level.

Use Automation for Efficiency

Repetitive tasks can drain time and lead to mistakes, but automation can step in to handle those. For example, leads followed up within five minutes are far more likely to convert, making automated response systems invaluable. Tools like AI-powered chatbots can respond instantly, qualify prospects, and even schedule appointments - all without manual input.

Beyond lead management, automation can streamline workflows in other areas. Tasks like updating your CRM, publishing new listings to major platforms, and preparing documents can all run on autopilot. This frees your team to focus on what truly matters: building relationships and closing deals.

Use Real-Time Data for Better Decisions

Real-time data is like having a crystal ball for your pipeline. It helps you spot bottlenecks early and make informed decisions. CEOs who prioritize pipeline management with real-time data outperform their peers in revenue and profitability by up to 80%.

For example, if multiple deals are stuck in the "Proposal Sent" stage for over two weeks, you can address the issue before it causes delays across the board. AI tools can also speed up property valuations from weeks to minutes, giving you up-to-date market insights for competitive pricing and offers. Predictive analytics can even forecast which deals are most likely to close, helping you allocate resources effectively and project revenue with greater accuracy.

Maintain Transparency with Stakeholders

Keeping everyone in the loop - without overwhelming your team - requires smart communication. Automated branded reports can handle this efficiently. Did you know that 80% of leads need five to twelve touchpoints before making a decision, yet only 8% of reps follow up more than five times? Automation ensures consistent follow-ups and personalized updates.

For example, investors might receive portfolio performance summaries, while clients get updates tailored to their specific deals. This approach builds trust and keeps stakeholders engaged, even during lengthy negotiations.

Monitor Pipeline Metrics Continuously

To truly optimize your pipeline, you need to track metrics regularly. Key performance indicators (KPIs) like conversion rates, average deal size, time spent in each stage, and overall pipeline velocity provide actionable insights. For instance, the occupancy rate shows how much of your portfolio is leased, while Net Operating Income (NOI) measures profitability by subtracting operating costs from rental revenue.

Another critical metric is the Debt Service Coverage Ratio (DSCR), which evaluates a property’s ability to cover its debt. Lenders typically look for a DSCR between 1.25 and 1.5. Monitoring this ratio can help you flag financing risks early. Tenant retention rate is equally important - one client improved their NOI by 15% simply by renegotiating lease terms to match current market rates.

Tracking these metrics isn’t just about collecting data - it’s about acting on it. If your conversion rate from initial contact to qualified lead drops, it might be time to revisit your qualification criteria. Or, if deals are stalling in negotiation, your pricing strategies might need tweaking. Establishing baseline metrics and watching for deviations can uncover opportunities for improvement or highlight issues that need immediate attention.

Transform Real Estate Data into Confident Decisions

Join Corecast to streamline your real estate operations, gain real-time insights, and make smarter investment decisions with a unified platform.

Benefits of Automation in CRE Pipeline Tracking

Automation transforms the often tedious and error-filled process of commercial real estate (CRE) pipeline tracking into an efficient, results-driven system. Its advantages go well beyond saving time - it enhances team collaboration, sharpens decision-making, and supports revenue growth.

Increased Efficiency

One of the most noticeable advantages of automation is how it cuts down on repetitive tasks. Instead of spending hours manually updating records, chasing follow-ups, or creating reports, teams can focus on high-impact activities like building client relationships or closing deals. Automated tools handle tasks like lead qualification, scheduling, updating CRM systems, publishing property listings, and generating reports. This shift not only saves time but also allows teams to dedicate their energy to activities that directly contribute to revenue. Plus, the streamlined process leads to more reliable data and faster reporting.

Better Accuracy and Reporting

Manual data entry is notoriously prone to errors - studies show that nearly 90% of spreadsheets contain mistakes. These inaccuracies can lead to costly missteps in CRE transactions. Automation solves this by standardizing data collection and processing, ensuring every deal follows a consistent process. Tasks like property valuations, market analysis, and financial projections are handled using real-time data, significantly boosting accuracy. Additionally, automated systems can generate detailed reports in minutes, incorporating the latest market data and performance metrics. This allows teams to make quicker, more informed decisions with confidence.

Improved Collaboration

Automation creates a more collaborative work environment by giving everyone access to the same up-to-date information. Centralized systems reduce miscommunication and eliminate the need for redundant updates. With automated updates keeping everyone in the loop, team members can easily track the status of deals without constant check-ins. This transparency enhances internal coordination and strengthens relationships with clients and investors. For example, RevOps automation brings together CRM data, campaign metrics, and engagement insights, offering a clear view of pipeline health in real time. It’s worth noting that companies with strong sales pipeline management are 33% more likely to meet their revenue targets.

Impact on Pipeline Metrics

The benefits of automation extend to measurable improvements in pipeline performance. For instance, integrating RevOps data has been shown to improve campaign-to-revenue attribution by 27%. Automation also supports predictive modeling, allowing teams to identify and address potential bottlenecks before they become issues. Over time, as these systems continuously gather and analyze data, they become even more effective, driving sustained growth and better revenue outcomes. These tangible results highlight how automation can revolutionize pipeline management in the CRE sector, making it smarter and more agile.

Conclusion

The evolution of pipeline tracking is transforming how CRE operations function, blending strategic insights with technological advancements. Today, tools like CRM and pipeline management systems are not just optional add-ons - they're driving measurable results. For instance, these tools have been shown to boost sales by up to 29%, enhance productivity by 34%, and improve forecast accuracy by 42%.

The move toward end-to-end SaaS platforms marks a significant shift in the industry. Fragmented tools and outdated methods, like juggling spreadsheets or disconnected software, are quickly becoming obsolete. Modern CRE professionals need streamlined systems that manage every step - from capturing leads to closing deals - while offering real-time insights and fostering collaboration.

Automation is leading the charge in this transformation. By automating tedious tasks like data entry, reducing human errors, and freeing up time for more strategic work, teams can operate more efficiently. The benefits are clear: faster deal cycles, improved forecasting, and smarter resource allocation - all vital in a highly competitive market.

Key Takeaways

Successful pipeline tracking combines the right technology with well-established processes. Top-performing CRE teams focus on standardizing deal stages, automating repetitive tasks, and using real-time data to guide their decisions. Transparency with stakeholders and consistent monitoring of pipeline metrics are also key to identifying trends and improving performance.

Some of the most impactful pipeline management features include:

Customizable deal stages

Real-time analytics

Integrated mapping tools

Stakeholder management capabilities

Comprehensive reporting

These features work together to provide the visibility and control needed to make smarter decisions and achieve better outcomes. When teams can pinpoint where deals stand, resolve bottlenecks before they escalate, and allocate resources effectively, they set themselves up to exceed revenue targets and strengthen client relationships.

Final Thoughts on CoreCast

CoreCast stands out as a forward-thinking solution in the CRE pipeline management space. By offering a unified platform, it addresses the industry's biggest pain points - eliminating the inefficiencies caused by disconnected tools. CoreCast integrates underwriting, deal tracking, mapping, portfolio analysis, and stakeholder communication into one seamless system.

What sets CoreCast apart is its all-in-one approach to real estate intelligence. It not only simplifies pipeline management but also introduces AI-driven automation and advanced reporting features to further enhance productivity and decision-making. For teams ready to move beyond spreadsheets and siloed systems, CoreCast provides a clear path to streamlined operations and better results.

Designed to fit into existing workflows while offering room for growth, CoreCast is a solution built for the future of CRE. Whether you're looking to optimize your current processes or prepare for the next phase of your business, this platform delivers the tools and insights you need to succeed.

FAQs

-

Pipeline tracking systems give teams real-time insights into every step of a commercial real estate deal. This visibility allows teams to quickly pinpoint delays and address them before they escalate. By breaking down deal progress in detail, these systems make it easier to identify where bottlenecks or inefficiencies are slowing things down.

Features like customizable dashboards and detailed reporting tools let teams zero in on problem areas and take action where it matters most. This kind of targeted approach not only streamlines communication but also enhances overall efficiency, helping deals move forward faster and with fewer hiccups.

-

How AI and Automation Transform CRE Pipeline Tracking

Leveraging AI and automation in tracking commercial real estate (CRE) pipelines offers advantages that traditional methods simply can't replicate. These cutting-edge technologies bring real-time data analysis to the table, cut down on manual tasks, and enhance accuracy - making decision-making faster and more dependable.

AI-powered tools can handle tasks like automatically updating deal stages, forecasting pipeline performance, and spotting risks or opportunities in record time. Meanwhile, automation simplifies workflows, reduces the chance of human error, and ensures consistent data management. This combination is a game-changer for investors and professionals striving to stay ahead in the fast-moving US real estate market.

-

Customizable Workflows in Pipeline Tracking Systems

Pipeline tracking systems with customizable workflows give commercial real estate professionals the tools to fine-tune processes for each deal's unique requirements. By adjusting deal stages, automating repetitive tasks, and creating personalized alerts, users can handle a variety of transactions more effectively - whether it's a straightforward property purchase or a multi-layered development project.

For example, a complex development deal might need extra review or approval steps, while a simple acquisition could move through a leaner process. This adaptability ensures each transaction follows the right path, minimizing delays, keeping things organized, and improving the odds of closing deals successfully. Custom workflows make it easier to align pipeline management with the specific needs of different transaction types, saving time and boosting overall efficiency.