Portfolio Insights for Assets Under Management

Post-acquisition commercial real estate (CRE) management is critical for maximizing long-term investment returns. Managing tenant occupancy, tracking rental growth, and adjusting strategies for economic shifts are key tasks. Tools like CoreCast simplify this process by offering real-time data, integration with existing systems, and decision-making features. Compared to older methods relying on spreadsheets and disconnected systems, platforms like CoreCast save time, reduce errors, and improve communication with stakeholders. However, smaller portfolios may still find manual approaches sufficient. The choice depends on portfolio size, complexity, and growth goals.

Key Takeaways:

CRE management requires ongoing attention after purchase.

Real-time data and integrated tools improve decision-making.

CoreCast offers features like automated alerts, scenario modeling, and investor reporting.

Manual methods can suffice for smaller, simpler portfolios but are less efficient for larger ones.

What Is Real Estate Portfolio Management? - BusinessGuide360.com

1. CoreCast

CoreCast reimagines post-sale commercial real estate (CRE) management by unifying portfolio functions into a single, streamlined system. Unlike traditional tools focused on property management or bookkeeping, CoreCast is built to provide strategic, portfolio-level insights that drive smarter investment decisions throughout the post-sale lifecycle. This unified approach enables real-time monitoring and more agile responses.

Real-Time Data and Insights

CoreCast brings together property metrics, market trends, and competitive data on one intuitive dashboard. This allows managers to track vital indicators - like occupancy rates, rental income, and lease expirations - and take immediate action when needed.

For instance, one CRE firm used CoreCast’s automated alerts to spot a decline in multifamily occupancy. By quickly analyzing the issue, they adjusted their strategy and increased occupancy by 10% in just two months.

The platform also supports performance benchmarking across portfolios, enabling users to compare assets on a normalized basis. This helps with smarter capital allocation and strategic planning. With up-to-date metrics reflecting current market conditions, users can monitor exposure, asset allocation, market concentration, and risk-adjusted returns.

Integration Capabilities

CoreCast seamlessly connects with property management systems and third-party tools, cutting down on manual data entry and reducing errors. This ensures that portfolio data stays accurate and up-to-date.

By integrating with accounting software and market data providers, CoreCast enhances financial reporting and improves property valuations. This creates a connected ecosystem where data flows effortlessly between systems, eliminating the fragmented workflows common in traditional CRE management.

Decision-Making Tools

CoreCast goes beyond data aggregation by offering powerful decision-making tools. These include portfolio analysis features, underwriting modules, and scenario modeling capabilities. Users can evaluate the potential outcomes of strategies like refinancing, asset sales, or capital improvements on overall portfolio performance.

The platform allows for portfolio analysis at any level, using customizable filters and templates for recurring tasks. Users can conduct stress tests, review asset allocations, and benchmark performance against market indices. This helps identify concentration risks and uncover opportunities for diversification across property types, geographic areas, and lease structures.

For example, portfolio managers can model how rising interest rates might affect debt service coverage ratios across their holdings, enabling more informed investment decisions. Automated alerts and predictive tools further enhance decision-making by identifying underperforming assets, forecasting metrics like net operating income (NOI) or occupancy rates, and aiding in critical hold/sell evaluations.

Stakeholder Communication Features

CoreCast simplifies stakeholder communication with a dedicated center that automates the creation of professional, branded reports for investors and partners. This ensures transparency and builds trust among all parties involved in managing CRE assets.

The platform’s centralized relationship matrix tracks key details like capital commitments, distributions, reporting preferences, and communication histories for everyone in the capital stack. Monthly performance updates and market summaries can be shared effortlessly, keeping stakeholders informed and engaged.

With one-click investor reporting, users can generate custom, investor-ready reports using the latest data. This automation eliminates the tedious process of compiling information from multiple sources, freeing up portfolio managers to focus on strategic priorities instead of administrative tasks.

2. Standard Portfolio Management Methods

Managing commercial real estate (CRE) portfolios through traditional methods often relies on disconnected systems and manual workflows. Unlike modern platforms that offer centralized insights, these outdated approaches struggle in areas like real-time data access, system integration, analysis, and communication with stakeholders.

Real-Time Data and Insights

Traditional methods often depend on monthly or quarterly reports pulled from various sources. This lag in reporting delays critical decision-making. Unlike integrated systems that provide up-to-date data, these fragmented methods rely on outdated information, making it harder to spot trends or address issues like declining occupancy or maintenance problems. As a result, problems can linger unnoticed, creating additional challenges in integrating and analyzing data effectively.

Integration Capabilities

Conventional portfolio management tends to involve multiple systems that don’t work together. For instance, property managers might use one tool to track leases, another for financial reporting, and yet another for maintenance requests. This lack of integration creates a tangled web of data sources that require manual reconciliation.

The manual process of pulling data from different systems - such as accounting software, property management platforms, and market data providers - slows down reporting and makes financial analysis cumbersome. This inefficiency not only delays decision-making but also limits the ability to conduct thorough and timely analyses.

Decision-Making Tools

Traditional methods often rely on static spreadsheets for financial modeling. While spreadsheets can handle basic calculations, they fall short when it comes to complex scenario planning. This reliance increases the risk of errors and makes it difficult to evaluate how strategic decisions will impact the portfolio as a whole. Consequently, risk assessments become both labor-intensive and error-prone, limiting the ability to make informed, data-driven decisions.

These shortcomings also influence how managers communicate with stakeholders.

Stakeholder Communication Features

Traditional systems require manual processes to generate reports, which can lead to delays and inconsistencies in communication. The importance of clear and timely stakeholder communication is evident in industry benchmarks, such as the GRESB score, where Stakeholder Engagement accounts for 34 points - 24.5% of the total score. This highlights how essential effective communication is for portfolio success.

Using fragmented data sources makes ensuring transparency even more difficult. Managers must manually compile data for investor reports, increasing the chances of inconsistencies or delays. This can result in stakeholders receiving outdated or incomplete information about property performance or market conditions.

Another issue is maintaining consistent messaging. Without centralized data, team members may unintentionally provide conflicting information, which can erode trust and damage relationships with stakeholders. Such missteps can undermine confidence in the portfolio management team’s ability to deliver reliable results.

Transform Real Estate Data into Confident Decisions

Join Corecast to streamline your real estate operations, gain real-time insights, and make smarter investment decisions with a unified platform.

Advantages and Disadvantages

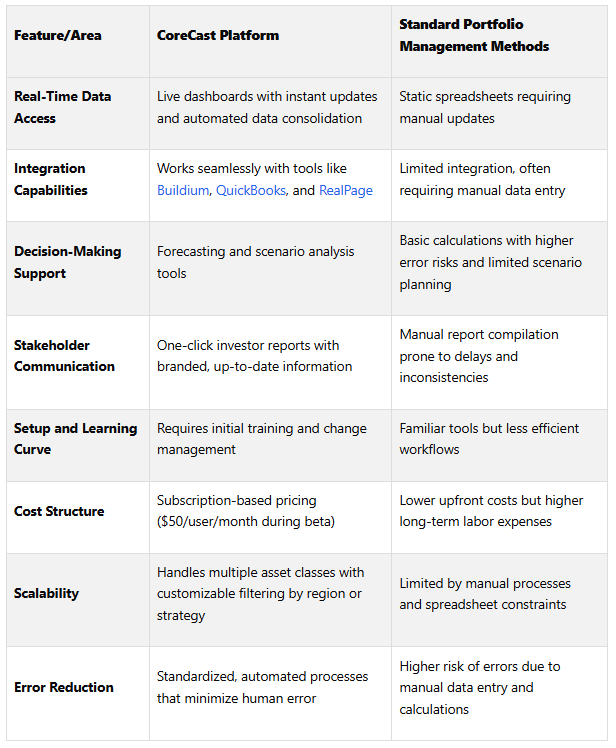

The table below highlights how CoreCast stacks up against traditional portfolio management methods, focusing on key features and areas of functionality.

CoreCast's approach focuses on real-time data and integration, offering a significant edge over traditional methods. For example, users can instantly filter and analyze portfolio performance by region, asset class, or strategy - all with just one click. This real-time capability is a stark contrast to conventional methods, which depend on outdated, manually updated data.

However, adopting platforms like CoreCast isn’t without its challenges. Migrating data from older systems and managing organizational resistance to change are common hurdles. Successful implementation requires high-quality data transfer and effective change management strategies.

That said, traditional methods still hold value, particularly for smaller portfolios or organizations with limited resources. Many real estate professionals are already comfortable using spreadsheets, which reduces the need for extensive training and makes traditional methods a practical choice in some scenarios.

One standout feature of CoreCast is its relationship matrix, which builds on its real-time data capabilities. This matrix links stakeholders to their respective tranches and reporting lines, offering full capital stack visibility. Achieving this level of transparency is nearly impossible with traditional methods, where stakeholder information often exists across fragmented systems.

Portfolio complexity plays a big role in deciding which approach works best. Larger portfolios benefit immensely from automated processes and integrated analytics, while smaller operations may find traditional methods sufficient - at least until growth necessitates a more advanced solution. Modern platforms like CoreCast also simplify investor reporting, generating up-to-date, professional reports with a single click. Traditional methods, on the other hand, rely on manual compilation, which is slower and more prone to errors. Platforms like CoreCast eliminate these inefficiencies, offering a faster and more accurate approach to portfolio management.

Conclusion

Portfolio insights are reshaping how post-sale commercial real estate (CRE) management operates, offering real-time visibility and deeper analytics to support smarter decision-making. A comparison between CoreCast and traditional methods highlights how integrated platforms streamline operations, reduce errors, and scale effectively. These tools pave the way for understanding the factors that influence technology adoption in CRE management.

One standout advantage is the reliability and accessibility of data. Research underscores the importance of consistent and repeatable data collection across an entire real estate portfolio to generate actionable insights. CoreCast excels here by consolidating multiple data sources and ensuring access to up-to-date market information.

Beyond data accessibility, decision-making criteria take center stage. Factors like portfolio complexity, risk tolerance, and strategic objectives heavily influence the need for advanced tools. For instance, larger portfolios with diverse asset classes, spread across regions, and involving various stakeholders demand the automation and integration that platforms like CoreCast provide. Similarly, investment strategies - whether focused on core or opportunistic approaches - benefit significantly from the sophisticated analytics these platforms offer.

While transitioning to digital platforms may involve challenges like training and data migration, the advantages often outweigh the hurdles. Automated processes minimize errors, accelerate reporting, and enhance decision-making, making the shift especially worthwhile for expanding portfolios.

The evidence strongly supports adopting a digital-first mindset. These platforms deliver instant reporting and comprehensive capital stack visibility - benefits that traditional methods simply cannot match. As the CRE industry increasingly leans toward data-driven strategies, portfolio managers who integrate technologies like CoreCast position themselves to thrive in a competitive and complex market. Integrated portfolio insights aren’t just tools - they’re the key to post-sale success.

FAQs

-

CoreCast: Revolutionizing Post-Sale CRE Management

CoreCast transforms post-sale commercial real estate (CRE) management by bringing real-time portfolio insights into one streamlined platform. Forget the outdated methods of juggling manual processes and scattered data - CoreCast consolidates everything, from asset details to pipeline updates and market trends. This integration allows you to analyze your portfolio holistically and spot trends effortlessly.

What sets CoreCast apart? You can generate customized reports tailored for stakeholders, monitor deals at every stage, and gain a crystal-clear understanding of both your portfolio and the competitive landscape. By simplifying operations and embracing data-driven strategies, CoreCast helps you make smarter investment decisions and manage your assets more effectively, ensuring you stay ahead in the ever-changing U.S. CRE market.

-

Managing smaller commercial real estate portfolios comes with its own set of hurdles - limited resources, smaller teams, and often, a lack of access to cutting-edge tools. Relying on manual methods can eat up valuable time, lead to errors, and leave you without the up-to-date data you need to make quick, informed decisions.

That’s where CoreCast steps in. By automating data consolidation and delivering real-time portfolio insights, it empowers even small teams to perform advanced analyses with ease. The platform helps streamline day-to-day operations, supports smarter decision-making, and minimizes the chance of expensive errors. It’s a game-changer for managing smaller portfolios with precision and efficiency.

-

Transitioning to CoreCast from traditional commercial real estate (CRE) management requires a thoughtful approach. Begin by assessing your current workflows to pinpoint inefficiencies or areas where data management falls short. This will help you understand where CoreCast can make the biggest impact. Once you've identified these areas, focus on training your team to use CoreCast's tools effectively, including its portfolio insights, real-time analytics, and deal pipeline tracking features. To minimize disruptions, introduce the platform gradually, incorporating it into your existing processes step by step.

Some hurdles you might face include resistance to change, challenges with data migration, and ensuring your team feels confident using the new system. You can tackle these issues by clearly communicating the advantages of CoreCast, providing comprehensive training sessions, and implementing the platform in phases. This phased approach allows your team to adapt comfortably while building trust in the system.