Revenue Forecasting for Real Estate Assets

Revenue forecasting in real estate predicts future income by analyzing historical data, market trends, and external factors. It helps property owners and investors make informed decisions about acquisitions, budgeting, and risk management. Accurate forecasting is more important than ever, especially with rising vacancy rates and shifting market dynamics in 2025.

Key takeaways:

Why it matters: Helps maximize profitability, optimize resources, and manage risks.

Methods: Historical data analysis, predictive analytics, and sales pipeline tracking.

Technology's role: Tools like CoreCast streamline forecasting by integrating real-time data, automating workflows, and improving accuracy.

Best practices: Maintain high-quality data, include external market trends, and use scenario analysis for better predictions.

Modern platforms and AI are reshaping how real estate professionals forecast revenue, enabling quicker, data-driven decisions in an evolving market.

How to Create a Real Estate Investment Forecast with Excel Template (Step-by-Step Tutorial)

Revenue Forecasting Methods for Real Estate

In real estate, forecasting revenue is a crucial skill. Professionals use several reliable methods to predict future income across various asset classes. The choice of method often depends on the type of properties in the portfolio, current market conditions, and investment timelines. Knowing how and when to apply these techniques can make a big difference in the accuracy of forecasts and the success of investments.

Using Historical Data Analysis

Historical data is the backbone of most revenue forecasting models. By analyzing past performance, seasonal trends, and cyclical patterns, real estate professionals can make informed predictions. This approach is particularly effective for stabilized properties with steady occupancy rates and established rent rolls.

The secret to making historical data work lies in spotting early indicators of change. Metrics like website traffic, customer inquiries, lease renewal rates, and maintenance requests can hint at upcoming revenue shifts before they appear in financial reports. For multifamily properties, tracking historical absorption rates alongside new market supply can help anticipate occupancy changes and rental income adjustments.

Seasonal trends also play a big role in forecasting. For example, student housing properties often see peak leasing activity between February and April, while vacation rentals experience revenue spikes during holiday seasons. Retail and hospitality properties follow distinct seasonal patterns, requiring multi-year analyses to create accurate monthly or quarterly projections.

However, relying solely on historical data has its limits. For instance, a global retail chain improved its forecasting accuracy by 20% by integrating external data - like weather patterns and economic indicators - into its traditional analysis. To get the most out of historical data, it’s essential to combine it with external market reports, economic trends, and competitive intelligence to account for factors that historical trends alone might overlook.

While historical analysis provides a strong foundation, advanced analytics can take revenue forecasting to the next level.

Predictive Analytics and Machine Learning

Predictive analytics and machine learning have transformed revenue forecasting by uncovering patterns that traditional methods often miss. These advanced tools process massive datasets and adapt to shifting market conditions, capturing complex relationships between variables.

One major advantage of machine learning is its ability to improve over time. As models process new data, their predictions become more accurate. Techniques like gradient boosting and neural networks can deliver predictions within 5–10% of actual outcomes.

A great example of predictive analytics in action comes from Blackstone's Invitation Homes. In 2008, they used these tools to identify undervalued single-family homes, acquiring around 80,000 properties and creating a REIT worth over $20 billion. Similarly, AvalonBay Communities leveraged predictive analytics to adjust rental pricing, boosting revenue by 4.7% without significantly affecting occupancy rates.

Properties flagged as "high potential" through predictive models have delivered an average of 25% higher returns compared to those selected using traditional methods. Additionally, investors using predictive timing models have outperformed the market by an average of 15% over five years.

AI-driven analytics also speed up the decision-making process, a critical advantage in competitive markets. By automating data analysis, companies can respond quickly to market changes and seize opportunities faster.

Sales Pipeline and Deal Stage Analysis

Sales pipeline analysis offers a more immediate approach to revenue forecasting by tracking opportunities through different stages and calculating their likelihood of closing. This method is particularly effective for acquisitions, development projects, and leasing activities where deal flow directly impacts revenue.

Well-managed pipelines can deliver impressive results. Companies with structured pipeline systems grow 5.3 times faster than those without. Additionally, businesses that follow three key pipeline practices see a 28% boost in revenue.

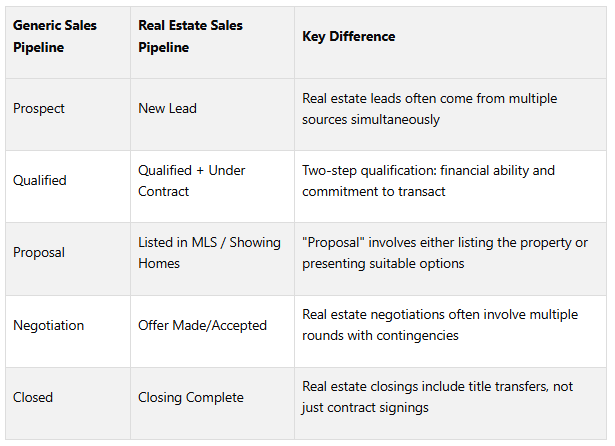

Real estate pipelines are more complex than traditional sales pipelines due to the involvement of multiple stakeholders, financing contingencies, and regulatory requirements. Here's how they compare:

Tracking conversion rates and deal velocity can provide valuable insights. For example, agents who respond to leads within the first hour are nearly seven times more likely to qualify them than those who wait longer.

"The agents who scale aren't necessarily the best at closing deals - they're the best at systematically moving prospects through a repeatable process."

– Travis McClure, Chief Operating Officer at ez Home Search

To improve forecasting accuracy, use weighted pipeline forecasts. Multiply each deal's value by its probability of closing to get more realistic revenue predictions. Regularly reviewing the pipeline can help identify deals likely to close and address potential obstacles before they impact revenue targets.

Long-term relationship management also plays a vital role in pipeline analysis. While 90% of buyers and 87% of sellers say they would work with the same agent again, only about 12% actually do without proper follow-up. Implementing systematic follow-ups can generate additional revenue from referrals and repeat business that might otherwise be missed.

"A sales pipeline isn't static; it's alive and constantly evolving." – Mike Loader

Real estate pipelines require continuous monitoring and adjustment. Changes in market conditions, interest rates, and regulations can all affect conversion rates and deal timelines, making regular analysis essential for accurate revenue forecasting.

Tools and Platforms for Revenue Forecasting

When it comes to modern real estate, having the right tools isn't just helpful - it's essential. Advanced forecasting techniques are only as good as the platforms that bring them to life. Today’s real estate professionals need platforms that can handle massive datasets, provide insights in real time, and simplify complex workflows. The right tool can be the difference between reacting to market changes and staying ahead of them.

Why Integrated SaaS Solutions Matter

The PropTech industry has seen explosive growth, with over 5,000 real estate SaaS companies vying for attention and $9.35 billion in funding fueling 1,000 of them. This surge highlights the industry's shift away from outdated, fragmented tools and manual processes, which simply can’t keep up with the rapid pace of today’s markets.

Unlike older software that requires installation and constant maintenance, cloud-based SaaS platforms are accessible anywhere and stay updated to meet evolving business demands. The numbers back this up: in 2022, the global real estate software market was valued at $10.24 billion and is expected to grow at an annual rate of 12.8% through 2030. SaaS solutions now dominate the cloud service market, holding a 36.6% share and accounting for more than half of the software market overall.

"A successful PropTech SaaS platform goes beyond offering digital solutions - it needs scalability, smooth integration, real-time analytics, automation, and strong security to create real value. Without these capabilities, platforms become inefficient, difficult to use, and costly to maintain." – ORIL Team

Inefficiencies from outdated tools and manual workflows cost companies 20% to 30% of their annual revenue. For revenue forecasting, relying on disconnected systems or spreadsheets can lead to missed opportunities and decisions based on incomplete data. Key features like real-time analytics, seamless integration with property management and CRM systems, and user-friendly interfaces are no longer optional - they’re essential.

Platforms like CoreCast are stepping in to address these challenges, setting a new standard for forecasting accuracy and usability.

How CoreCast Improves Revenue Forecasting

CoreCast tackles the issue of fragmented tools by serving as a centralized hub for forecasting. It allows users to underwrite any asset class or risk profile, track deals through their stages, analyze portfolios, and even visualize properties on an integrated map - all within a single platform.

For underwriting, CoreCast simplifies the process of evaluating investments. Instead of juggling multiple tools or relying on static spreadsheets, users can input property data and instantly generate financial projections that consider market trends, comparable sales, and risk factors. This reduces errors and saves time.

Its deal pipeline tracking feature offers clear visibility into the flow of opportunities. Users can assign probability weights to deals, monitor their progress, and calculate weighted pipeline values. This helps identify bottlenecks and flags potential risks to revenue goals early on.

CoreCast’s mapping tools provide a competitive edge by visualizing market activity and property locations. This feature lets users spot trends, identify undervalued areas, and understand how local dynamics might influence revenue.

For portfolio analysis, CoreCast provides a consolidated view of performance across properties and asset classes. This is especially helpful for larger firms that need to see how individual properties contribute to overall returns, enabling smarter management decisions.

Finally, the platform’s reporting tools allow users to create professional, branded reports for stakeholders. Instead of manually compiling data from different sources, CoreCast automatically consolidates information into polished reports for investors, lenders, and other decision-makers.

Transform Real Estate Data into Confident Decisions

Join Corecast to streamline your real estate operations, gain real-time insights, and make smarter investment decisions with a unified platform.

Benefits of Automation and Integration

Automation takes revenue forecasting from being a tedious chore to a powerful strategic tool. By reducing human error and streamlining workflows, automation enhances accuracy and efficiency.

For example, automated systems can pull updated rent rolls, occupancy rates, and market data, ensuring forecasting models stay current without constant manual updates. Stakeholders can access up-to-date financial reports instantly. AI-driven tools are also beginning to analyze historical spending, categorize expenses, and predict budgets with improved precision. These capabilities optimize cash flow, cut unnecessary expenses, and improve investment decisions.

As businesses grow, automated systems can handle larger datasets and more complex calculations, freeing professionals to focus on high-value tasks like market analysis and client relationships rather than routine administrative work.

The combination of automation and integration creates a self-improving system. As these platforms process more data and compare predictions with actual outcomes, their algorithms become more refined. This feedback loop results in forecasts that are far more reliable than what manual methods can achieve. Beyond improving accuracy, these systems establish consistent best practices for revenue forecasting, making them indispensable for modern real estate professionals.

Best Practices for Accurate Revenue Forecasting

Creating accurate revenue forecasts hinges on using reliable data, conducting thorough market analysis, and preparing for various scenarios. The difference between a dependable forecast and one that misses the mark often lies in following proven methods to ensure your data is reliable, your assumptions are realistic, and your models reflect actual market conditions.

Maintaining Data Quality and Regular Updates

Good data is the backbone of accurate forecasting. Poor-quality data doesn't just throw off your numbers - it can lead to massive financial losses. In fact, bad sales data costs U.S. businesses a staggering $3.1 trillion annually. On the flip side, sales teams working with clean data have seen forecast accuracy improve by 20% within the first quarter alone.

This issue is especially critical in real estate. Snehal Joshi of Hitech BPO highlights the stakes:

"Poor real estate data quality doesn't just drain your finances. It erodes your credibility and trust in the market. Bad data leads to lost revenue, diminished reputation, and missed opportunities to stay competitive. Investing in robust property data quality isn't just a solution; it's a strategy." – Snehal Joshi, Hitech BPO

To maintain data quality, start with a structured data governance framework. Clearly define roles for those managing data, set standards for collection and storage, and establish protocols to ensure consistency across platforms. High-quality real estate data should meet four key criteria: accuracy, completeness, timeliness, and consistency.

Regular data audits are another must. These reviews catch and correct errors before they snowball into bigger issues. The 1:10:100 rule illustrates this well: preventing a data error costs $1, fixing it costs $10, and leaving it unchecked can cost $100. For example, Atlassian improved its forecast accuracy from 65% to 87% within two quarters by implementing a structured data quality program.

Automation can also make a big difference. Automated data cleansing tools can spot and fix errors faster than manual processes. Real-time analytics, meanwhile, help track market trends and property values as they shift, keeping your forecasting models up-to-date without constant manual intervention.

Finally, training your team to prioritize data quality is essential. When everyone understands their role in maintaining clean data, errors decrease, and your forecasts become more reliable. As one Director of RevOps at Atlassian put it:

"Clean data doesn't just improve forecasting - it transforms your entire revenue operation. It's the foundation that everything else is built upon." – Director of RevOps, Atlassian

Once your internal data is in order, it's time to factor in external market trends to refine your revenue predictions.

Including External Market Data

Internal data is only part of the picture. Incorporating external market factors - like economic indicators, demographic trends, and regulatory changes - can significantly enhance forecast accuracy. Ignoring these elements risks missing key market shifts.

A study in Lisbon, Portugal, highlights this point. Researchers used an eXtreme Gradient Boosting (XGBoost) machine learning model to predict real estate prices. By integrating diverse open data sources, they reduced the model's Mean Absolute Error (MAE) by 8.24%, improving its predictive accuracy.

Economic indicators are particularly important. Metrics like GDP growth, employment levels, inflation, and consumer confidence directly impact real estate demand and pricing. Scenario analysis based on these indicators can help you anticipate how different economic conditions might affect your revenue.

Other external data sources, such as geographic information systems, social media sentiment, credit card transaction data, and migration patterns, can also provide insights into future market dynamics. AI models can analyze relationships between traditional real estate data and these high-frequency external inputs, leading to more precise forecasts.

Customer behavior analysis adds another layer of value. For instance, 39% of buyers consider detailed property information one of the most critical features when searching online. Including this behavioral data in your forecasts can make them even more accurate.

Scenario Analysis and Asset Class Customization

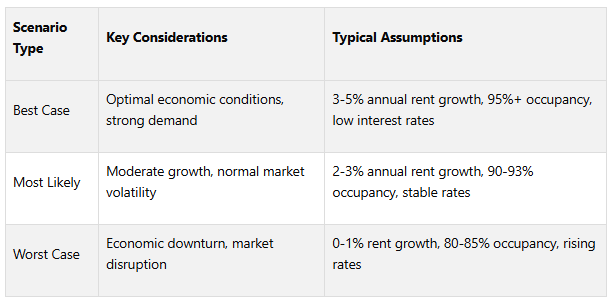

Scenario analysis allows you to prepare for a range of market conditions by evaluating baseline, best-case, worst-case, and most likely outcomes. This approach helps identify risks and opportunities, ensuring you're ready for whatever the market throws your way.

Start by building a baseline scenario that reflects current market conditions, including property values, rental rates, occupancy levels, and economic indicators. Use this as a foundation to develop best-case, worst-case, and most likely scenarios.

Best-case scenarios assume optimal conditions, such as strong economic growth, job creation, and favorable regulations.

Worst-case scenarios account for challenges like economic slowdowns, rising interest rates, or major disruptions.

Most likely scenarios strike a balance, incorporating moderate growth and typical market volatility.

Tailor these scenarios to fit each real estate asset class. For example, multifamily properties are often influenced by employment rates and population growth, while retail properties are more sensitive to consumer spending and e-commerce trends. Industrial properties, on the other hand, may depend on supply chain activity and logistics demand.

Cash flow modeling under different scenarios can reveal how market shifts might impact your investments. Consider factors like rental income, operating expenses, financing costs, and capital expenditures to assess financial viability across various conditions.

Stress testing takes this a step further by simulating extreme market events, such as economic recessions, natural disasters, or significant regulatory changes. This process helps gauge how well your investments can withstand adverse conditions.

Historical data also plays a key role in scenario analysis. Looking at how similar properties performed during past market cycles can help identify patterns and validate your assumptions, making your models more reliable.

The key to effective scenario analysis is keeping it dynamic. As market conditions evolve and new data becomes available, regularly updating your scenarios ensures your forecasts stay relevant and actionable.

The Future of Real Estate Revenue Forecasting

The way we forecast revenue in real estate is evolving rapidly, thanks to advancements in AI and machine learning. These technologies are opening doors to more precise and efficient forecasting methods across various asset classes.

Key Takeaways

Accurate forecasting depends on three pillars: high-quality data, advanced analytics, and market insight. Modern platforms are integrating forecasting, underwriting, and portfolio analysis into centralized systems, streamlining the entire process.

By blending internal property data with external market information - such as economic indicators, demographic shifts, and even social media sentiment - professionals can better navigate changing market conditions. To make the most of these tools, maintaining rigorous data governance and regularly updating systems is crucial for delivering real-time insights.

These advancements highlight how AI is reshaping the forecasting landscape in real estate.

How Forecasting Tools Are Changing

AI and machine learning are taking real estate forecasting to the next level. In fact, the AI market in real estate is expected to grow from $222.65 billion in 2024 to $303.06 billion in 2025, emphasizing its increasing role in the industry. These tools analyze massive amounts of historical and real-time data, including market trends, economic signals, and even social media activity, to deliver highly accurate predictions.

Machine learning is already delivering impressive results. According to McKinsey, machine learning models can predict rent rate changes with 90% accuracy and other property metrics with 60% accuracy. These models continuously adapt and refine their forecasts as new data becomes available, ensuring predictions stay relevant.

"AI is helping to streamline our industry. As venture capital investors, we have seen many experiments with the latest AI capabilities, and the key to making the leap from pilots to successful products hinges on data quality, workflow integration and intuitive output interfaces." – Raj Singh, Managing Partner, JLL Spark

AI-powered tools are also transforming property valuation. Automated Valuation Models (AVMs) can process thousands of data points in seconds, offering instant, reliable property assessments. Companies like HouseCanary are already leveraging these models, providing detailed valuations and market forecasts for over 136 million properties across the U.S..

These advancements are not just about better accuracy; they’re about redefining productivity. AI-driven efficiencies are projected to contribute a 14% boost to global GDP by 2030, with AI-related GDP growing at an annual rate of 18.6% during the same period.

Looking ahead, the explainable AI market is expected to grow by 40%, reaching nearly $11 billion by 2026. Meanwhile, the property technology sector is forecasted to expand by 70%, hitting $32.2 billion by 2030. As these technologies mature, they’re moving from experimental stages to becoming essential tools that provide a competitive edge in the real estate industry.

For real estate professionals, this means access to smarter forecasting tools, faster transactions, and deeper insights into market dynamics. By embracing these advancements - and prioritizing data quality, seamless workflows, and actionable insights - they can stay ahead in an increasingly AI-driven industry.

FAQs

-

Predictive analytics takes revenue forecasting in real estate to the next level by utilizing historical data, market trends, and economic indicators to predict future outcomes. This method allows professionals to estimate property values, gauge demand, and spot potential market changes with a higher degree of accuracy.

Armed with these data-driven insights, real estate professionals can make better decisions, pinpoint lucrative opportunities, and minimize risks. The result? More dependable revenue projections and sharper investment strategies.

-

AI and machine learning are transforming real estate revenue forecasting by delivering precision and speed in analyzing massive, complex datasets. These tools can identify patterns and trends that traditional methods might miss, offering a more comprehensive understanding of market dynamics. Plus, they process new data in real time, enabling professionals to predict market shifts and property performance with greater certainty.

By automating routine tasks and providing richer insights, AI frees up time for real estate experts to refine their revenue strategies and make smarter investment choices. The result? Stronger risk management, smoother operations, and enhanced financial results across different property types.

-

High-quality data plays a crucial role in accurate revenue forecasting within the real estate sector. It serves as the backbone for dependable analysis and informed decision-making. When data quality is poor, the results can be costly - leading to off-target forecasts, wasted resources, and poorly designed strategies. These missteps can hurt profitability and derail long-term investment goals.

On the flip side, accurate data empowers you to assess risks more effectively, optimize your portfolio, and make smarter investment decisions. Tools like CoreCast take this a step further by offering real-time insights, cutting-edge analytics, and a centralized platform to manage various asset classes. This ensures your forecasts are not only precise but also actionable.