AI for Risk Profiling in Real Estate

AI is transforming risk profiling in real estate by replacing manual, time-consuming processes with faster, data-driven insights. Tools like CoreCast are helping professionals analyze property risks with greater precision, efficiency, and scale. With the U.S. real estate market projected to exceed $4 billion in 2025, AI adoption is becoming essential for staying competitive. Key highlights include:

Improved Accuracy: AI reduces errors and biases, offering real-time risk flags and predictive analytics.

Cost Efficiency: Platforms like CoreCast cost as low as $105 per user per month, compared to legacy systems at $1,000+.

Scalability: AI handles large, complex portfolios effortlessly, analyzing hundreds of opportunities daily.

Data Integration: Consolidates fragmented data into actionable insights, including geospatial analysis.

While manual methods offer transparency and local expertise, they struggle with inefficiency, scalability, and data limitations. AI platforms, despite their "black box" nature, are proving indispensable for modern real estate risk management.

Harnessing Data and AI for Commercial Real Estate Investment Management

1. CoreCast

CoreCast is reshaping how real estate professionals handle risk assessment with its AI-driven intelligence platform. By bringing together multiple tools into a single, streamlined system, it simplifies the traditionally fragmented process of risk profiling. This unified approach tackles key challenges like accuracy, efficiency, scalability, and data integration, offering a comprehensive solution for investors and analysts.

Accuracy

CoreCast takes precision to the next level with machine learning-powered validation checks that ensure data accuracy and completeness. Its real-time risk flagging and deal scoring features alert users to potential issues before they escalate. The Underwriter module allows analysts to create investment-grade models in minutes, ensuring consistency in deal reviews across the organization. With dynamic stress testing, users can examine downside scenarios without the hassle of reworking entire models. Additionally, fixed assumptions and detailed audit trails reinforce compliance and standardize underwriting practices.

Efficiency

By automating time-consuming tasks, CoreCast frees up real estate professionals to focus on strategic decisions rather than mundane data entry. What’s more, it offers this efficiency at a fraction of the cost of legacy solutions, which often exceed $1,000 per user per month. CoreCast is priced at about $105 per user per month, with beta users enjoying rates as low as $50. This affordability makes it accessible without compromising on functionality.

Scalability

CoreCast’s flexible design supports a variety of asset types, from multifamily properties to industrial spaces, ensuring consistent performance regardless of the portfolio’s complexity. Its scalability also simplifies growth for expanding firms. By eliminating the need for multiple software licenses and extensive training, the platform ensures that advanced tools remain accessible as teams grow and portfolios diversify.

Data Integration

Fragmented data sources are no longer a hurdle with CoreCast. The platform consolidates property data from various inputs, delivering a complete picture of market trends, property values, and investment opportunities. By setting consistent data standards and using robust frameworks for collection and processing, CoreCast ensures clean, uniform data. Its geospatial data integration adds another layer of insight, enabling precise visualization of property locations and competitive landscapes.

CoreCast transforms raw data into actionable insights, giving real estate professionals the tools they need to make informed decisions with confidence and clarity. From accuracy to scalability, it’s designed to streamline every aspect of risk profiling.

2. Manual Risk Assessment Methods

Compared to AI-driven solutions, manual risk assessment methods in real estate come with clear challenges. These traditional approaches rely on human expertise, local market insights, and manual analysis. While they’ve been a cornerstone of the industry for decades, they now struggle to keep up with the demands of today’s intricate market. Issues like accuracy, efficiency, scalability, and data integration highlight the growing gap between manual methods and AI-powered tools like those offered by CoreCast.

Accuracy

Manual assessments lean heavily on the judgment and experience of individual analysts. This reliance often introduces human bias and inconsistencies, which can result in overlooked risks or misinterpreted data points. The outcome of these evaluations can vary widely depending on the analyst's background, leading to uneven results across properties. Mistakes, whether from human error or missed market signals, remain a persistent risk.

In contrast, AI systems are proving to be game changers. For example, they’ve been shown to reduce mortgage default rates by 27% and identify 70% of property issues that manual inspections might miss. Manual methods simply can’t match this level of precision, and these accuracy gaps often translate into inefficiencies.

Efficiency

Manual evaluations are notoriously time-consuming. A single assessment can take days or weeks to complete, while underwriting for commercial real estate often drags on for months. This inefficiency creates bottlenecks, slowing down deal cycles and increasing operational costs.

To put this into perspective, up to 40% of expenses in related sectors are tied to underwriting processes - costs that could be significantly reduced through digitization. With $1.8 trillion in commercial loans maturing by 2026, the strain on manual processes is only going to grow.

Scalability

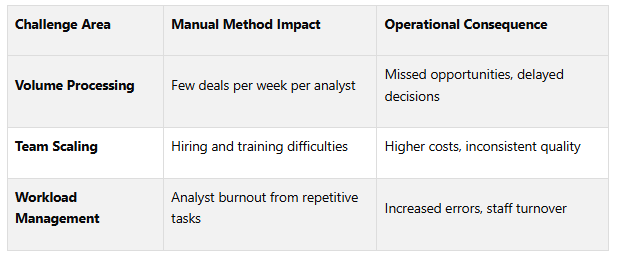

Scaling manual risk assessments is another major hurdle, especially when dealing with large, diverse property portfolios. Analysts face mounting workloads, which can lead to burnout, hiring challenges, and higher operational costs.

AI systems, on the other hand, can analyze hundreds of opportunities daily without compromising quality. Compare this to manual methods, where an analyst might only handle a few deals a week. The disparity in capacity underscores the scalability issues inherent in manual approaches.

The challenges intensify when assessing diverse asset classes, each requiring specialized knowledge and unique risk criteria. Manual methods often fail to maintain consistent evaluations across varying property types and geographic regions. Beyond scalability, another critical issue lies in handling fragmented data.

Data Integration

Perhaps the most glaring limitation of manual risk assessment is the difficulty in integrating data from multiple sources. Consolidating this information manually creates inefficiencies, and companies without a cohesive data strategy can face operational costs up to 25% higher.

By contrast, integrated analytics platforms can cut manual reporting time by as much as 30%.

"Valuers have traditionally taken a qualitative approach, based on their professional opinion. We are starting to look at it in another way, by developing a spectrum of factors that impact value. To collect and assess those factors, we lean heavily on data and analytics."

Tyrone Hodge, Global Head of Risk Advisory, Value and Risk Advisory at JLL

Fragmented data sources bring further challenges, such as siloed information, inconsistent metrics, and the inability to maintain a comprehensive view of the market. Manual reporting also eats up valuable time, diverting focus from strategic priorities and reducing productivity.

As the real estate market grows more complex and unpredictable, the shortcomings of manual risk assessments become even more pronounced. Adjusting strategies to align with current market conditions, rather than relying solely on past trends, is no longer optional.

Transform Real Estate Data into Confident Decisions

Join Corecast to streamline your real estate operations, gain real-time insights, and make smarter investment decisions with a unified platform.

Advantages and Disadvantages

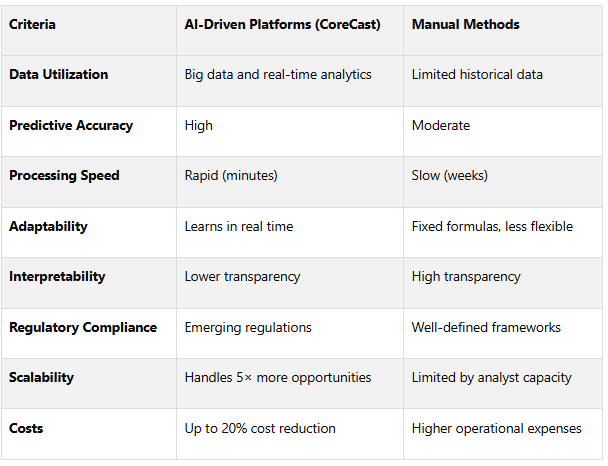

When it comes to real estate investment, both AI-driven platforms and manual methods offer their own set of strengths and challenges. The approach you choose can significantly influence your outcomes, depending on your priorities and operational needs.

AI-Driven Platforms

AI-powered tools bring a level of efficiency and precision that manual methods often can't match. These systems process massive amounts of data, identifying patterns that might otherwise go unnoticed. For example, AI has reduced mortgage application fraud by 50% across the industry. It also slashes processing times from weeks to minutes and cuts underwriting costs by up to 20%.

Take CoreCast, for instance. This platform integrates multiple data streams, eliminating the headaches of juggling isolated spreadsheets. It allows users to underwrite across asset classes, track pipelines, and conduct portfolio analyses - all within one system. AI-driven underwriting doesn’t just save time; it scales operations without adding extra staff. In fact, AI can handle up to five times more opportunities while maintaining rigorous standards. Tasks that might take 3–4 weeks with manual due diligence can be completed in mere minutes.

However, while AI platforms excel in speed and scalability, they sometimes lack the interpretive clarity that manual methods offer. This "black box" nature of AI can make it difficult to explain decisions to stakeholders or regulatory bodies.

Manual Methods

Traditional approaches, on the other hand, have their own advantages, particularly when it comes to transparency and interpretability. Every decision stems from human judgment, making it easier to explain outcomes to clients or regulators. This is especially useful in complex investment scenarios where understanding local market nuances is critical. Additionally, manual methods operate within well-defined compliance frameworks, whereas AI systems often face scrutiny due to evolving regulations.

Comparing AI and Manual Methods

The gap in accuracy between these two methods is growing. For instance, Fannie Mae analyzed over one million appraisals and found that computer vision models achieved a 98% accuracy rate - often surpassing human capabilities in processing complex data patterns.

"AI-driven credit risk models outperform traditional methodologies in predictive accuracy, adaptability, and risk mitigation." - Jessie Anderson

That said, the "black box" nature of AI can make its decision-making process harder to explain, which might complicate client discussions or regulatory reviews.

Cost and Adaptability

AI platforms also have a clear edge in cost efficiency. With 85% of mortgage lenders now using AI for fraud detection, the economic benefits are undeniable. Meanwhile, manual methods face rising operational costs and require specialized expertise to remain effective.

Adaptability is another area where AI shines. Traditional methods rely on historical data and fixed formulas, making them less responsive to sudden market changes. In contrast, AI models learn continuously, adjusting to real-time market dynamics.

Finding the Right Balance

The choice between AI and manual methods often comes down to the specific needs of your operation. Large-scale firms managing diverse portfolios usually benefit from AI platforms like CoreCast, which ensure consistent evaluation standards across multiple asset classes. On the other hand, smaller firms that rely on local expertise and relationship-driven insights may still find manual methods valuable.

Interestingly, hybrid approaches are becoming more popular. These combine the efficiency of AI with the oversight and clarity of manual evaluations. As Fannie Mae observed, appraisers who remain methodical in their work are likely to maintain a competitive edge, while less precise evaluations could lead to higher defect rates. Balancing AI's speed and scalability with the interpretability of manual methods can help real estate professionals optimize risk management and decision-making.

Conclusion

AI-powered platforms are reshaping risk management in real estate. While traditional approaches provide clarity and compliance, tools like CoreCast are revolutionizing the field by analyzing massive datasets and offering actionable insights across various asset types.

The numbers speak for themselves. AI has the potential to automate 37% of real estate tasks, unlocking $34 billion in operational efficiencies by 2030. CoreCast is a prime example, delivering tailored risk profiling that aligns with diverse asset classes and risk scenarios. These advancements highlight why the industry is rapidly embracing AI-based solutions.

The sentiment among industry leaders is clear: 89% of C-suite executives believe AI can address significant challenges in commercial real estate. AI also enhances property valuation accuracy by 15%. Moreover, professionals using AI tools can handle around 40% more properties or transactions compared to those relying on manual processes. These stats underscore AI's growing importance in modern real estate risk strategies.

Raj Singh of JLL Spark notes, "Data quality, workflow integration, and intuitive output interfaces are key for successful AI adoption".

CoreCast aligns with these priorities, integrating smoothly into existing systems while ensuring data integrity across all asset categories.

The shift is already evident. In Q1 2023, AI-enabled platforms supported one in five Capital Markets pipeline opportunities globally. Projections suggest that AI-driven productivity could boost global GDP by 14% by 2030.

For firms sticking to manual methods, the gap is widening. The speed, precision, and scalability offered by AI platforms aren’t just advantages - they’re becoming essential for navigating today’s complex real estate landscape. AI is no longer a luxury; it's a critical tool for staying competitive in risk management.

FAQs

-

AI is transforming risk profiling in real estate by analyzing massive datasets to uncover patterns and trends that might be missed with manual methods. This not only minimizes human error but also provides instant, data-backed insights that support smarter decision-making.

When it comes to efficiency, AI takes over tasks like gathering, analyzing, and updating data - tasks that typically require a lot of time and effort. Unlike traditional approaches, which can be slow and influenced by personal judgment, AI offers consistent, objective outcomes. This allows real estate professionals to evaluate risks with greater speed and confidence.

-

Using AI platforms like CoreCast for real estate risk assessment comes with its own set of challenges. One major concern is data privacy - safeguarding sensitive information is critical. There's also the risk of algorithmic biases, which can skew results if not properly addressed. Plus, achieving accurate insights depends heavily on having high-quality, complete datasets. When the data is flawed or incomplete, the outputs can be unreliable.

Beyond data-related issues, there are technical hurdles to consider during implementation, which can make the process more complex than expected. The upfront costs of adopting AI tools might also be a sticking point for some organizations. On top of that, teams unfamiliar with AI may show resistance to change, requiring extra effort to encourage adoption. Lastly, regulatory compliance and ethical challenges, such as ensuring fairness and accountability in decisions, demand thoughtful oversight throughout the process.

-

Real estate professionals can use AI tools to tackle data-intensive tasks like property analysis, risk assessments, and forecasting market trends. By doing this, they free up time to focus on the areas where human expertise truly shines - like understanding local market dynamics and making nuanced decisions. This balance ensures that AI works as a supportive tool rather than replacing the personal connections and experience that are so vital in real estate.

To get started, professionals can introduce AI gradually, targeting specific tasks such as property valuation or portfolio analysis. Keeping human oversight in place and aligning AI applications with their unique objectives allows them to boost efficiency, simplify processes, and make smarter decisions. At the same time, they retain the personal touch and judgment that clients appreciate. AI should enhance human capabilities, not replace them.