Portfolio Risk Management with Scenario Modeling

Managing portfolio risk in commercial real estate is more challenging than ever. With market values projected to grow from $3.69 trillion in 2021 to $5.85 trillion by 2030, investors face increased risks like interest rate fluctuations and regulatory changes. Traditional methods often fall short because they rely heavily on historical data and static assumptions, making them less effective in today’s dynamic environment.

Enter scenario modeling. This approach evaluates multiple future outcomes by factoring in economic trends, regulatory shifts, and market-specific variables. Unlike older methods, it helps investors prepare for uncertainties, improve predictions, and make informed decisions. Tools like Monte Carlo simulations and geospatial analysis enhance its accuracy by analyzing diverse market conditions.

While scenario modeling requires more resources and relies on assumptions, it offers flexibility and insights that traditional methods lack. Combining both approaches can balance long-term planning with day-to-day risk controls, ensuring portfolios remain resilient in unpredictable markets.

Here’s the bottom line: Scenario modeling helps investors anticipate risks and opportunities, making it a valuable addition to modern portfolio management strategies.

Scenario modeling a PE investment portfolio

1. Scenario Modeling

Scenario modeling is changing how real estate professionals approach portfolio risk management by enabling them to evaluate multiple potential outcomes. This method builds on the dynamic risk management strategies discussed earlier, going beyond simple forecasts to assess the effects of market shifts.

Flexibility

One of the standout features of scenario modeling is its ability to adapt to various situations. Real estate professionals can tweak variables like market rents, occupancy rates, financing terms, or macroeconomic indicators to reflect different properties and market conditions. For instance, an investor managing a mixed-use development can explore scenarios involving rising construction costs, new zoning rules, or changing tenant demands - all at the same time.

This adaptability extends to the ability to quickly adjust models as new market data becomes available. Portfolio managers can test assumptions across different asset types, from multifamily housing to industrial spaces, while customizing inputs to fit the specific characteristics of each property. This capability supports more precise forecasting and proactive risk management.

Predictive Accuracy

Advanced analytics play a key role in improving the reliability of investment forecasts through scenario modeling. By incorporating empirical data and techniques like Monte Carlo simulations, these models can quantify potential impacts on critical financial metrics such as Loan-to-Value ratios, Debt Service Coverage Ratios, and cash flow volatility under varying market conditions.

Unlike traditional methods that rely on historical averages, scenario modeling explores probability-weighted outcomes based on current market trends and economic forecasts. For example, rather than assuming a fixed rent growth rate, the model evaluates a range of possible outcomes, each weighted by its likelihood.

Geospatial analysis further sharpens predictive accuracy by factoring in location-specific elements that older models often neglect. This advanced approach allows investors to better estimate risks and returns, even in highly diverse market conditions.

Response to New Risks

Scenario modeling doesn’t just improve predictions - it also helps prepare for emerging risks. By simulating the potential effects of new threats, professionals can identify vulnerabilities before they become critical. For example, they can model the impact of sudden regulatory changes, technological advancements, or shifts in tenant preferences.

A continuous monitoring system ensures that models stay updated with fresh market data. When unexpected events arise - like evolving remote work trends reducing office demand or new regulations affecting property values - scenario models can quickly analyze their effects across an entire portfolio. This forward-looking approach is especially useful during volatile periods, helping investors identify which properties are most exposed and adjust their strategies to maintain portfolio stability.

Decision-Making Support

Scenario modeling delivers clear, comparative insights that guide strategic decisions. Portfolio managers can assess how different strategies or market events might impact their investments, pinpointing major risks and uncovering promising opportunities.

By breaking down the effects of key variables, scenario modeling helps develop targeted action plans. These might include risk mitigation measures, contingency strategies, or adjustments to capital allocation based on specific risk tolerance levels.

Tools like CoreCast take this a step further by integrating scenario modeling with real-time portfolio insights. Users can conduct in-depth analyses, track deal pipelines, and generate branded reports for stakeholders - all within a single platform. This streamlined approach not only speeds up decision-making but also ensures that stakeholders receive timely, relevant updates on portfolio performance under various scenarios.

2. Standard Risk Management Methods

While scenario modeling takes a forward-looking approach, traditional risk management methods often fall short in today’s fast-changing market conditions. These conventional strategies aim to identify and address risks, yet they frequently lack the depth and agility needed to handle the complexities of modern challenges.

Flexibility

Traditional risk management tends to rely on a one-size-fits-all framework, which can overlook the unique characteristics of individual properties or shifting economic trends. For instance, a single-tenant property leased to a national brand might appear secure under standard metrics. However, these methods might fail to account for broader economic changes that could disrupt the tenant’s industry. This lack of adaptability makes it harder to forecast risks and respond effectively when circumstances change.

Predictive Accuracy

Conventional methods heavily depend on historical data and fixed assumptions, which can blind them to rare but significant events. This limitation, often referred to as "Black Swan Blindness", highlights the inability to predict extreme, high-impact occurrences that fall outside of established patterns. Moreover, traditional approaches often misjudge diversification by treating interconnected risks as separate issues, failing to grasp their combined impact. Static models, which assume that risk factors remain stable, also struggle to keep up with the fast-paced and unpredictable nature of real estate markets.

Response to New Risks

Emerging or unanticipated risks pose another challenge for traditional methods. These approaches typically focus on risks specific to a single enterprise, often missing external, systemic threats that can ripple across entire markets. For example, abrupt changes in workplace habits that reduce office space demand or new regulatory requirements can catch these frameworks off guard. Designed for structured and predictable systems, traditional methods often lack the agility to respond to sudden and complex shifts.

"The core problem with conventional risk management is its separation from decision-making processes. In complex adaptive systems, risks emerge from the interactions between components rather than residing in individual elements." – Alex Sidorenko, Group Head of Risk, Insurance and Internal Audit

This reactive approach delays mitigation efforts, leading to higher costs and operational disruptions. As a result, organizations may find themselves unprepared to act swiftly, which can hinder both risk management and strategic planning.

Decision-Making Support

One of the most glaring weaknesses of standard risk management is its disconnect from strategic decision-making. By treating risks as isolated events, these methods can oversimplify the intricate relationships that influence overall portfolio performance. Unlike scenario modeling, which allows for real-time adjustments, traditional risk registers often create a false sense of security. They fail to capture the dynamic interplay of risks as they evolve. Additionally, the rigid controls typical of these frameworks can slow an organization’s ability to adapt to sudden market disruptions.

"Traditional frameworks give us structure, but often struggle when systems are in motion, interdependent, and unpredictable...risks are too often treated as isolated events - oversimplifying the complex mechanisms that connect them, which can lead to blind spots and poor decision-making." – Santiago Verguizas, Project Manager

Transform Real Estate Data into Confident Decisions

Join Corecast to streamline your real estate operations, gain real-time insights, and make smarter investment decisions with a unified platform.

Advantages and Disadvantages

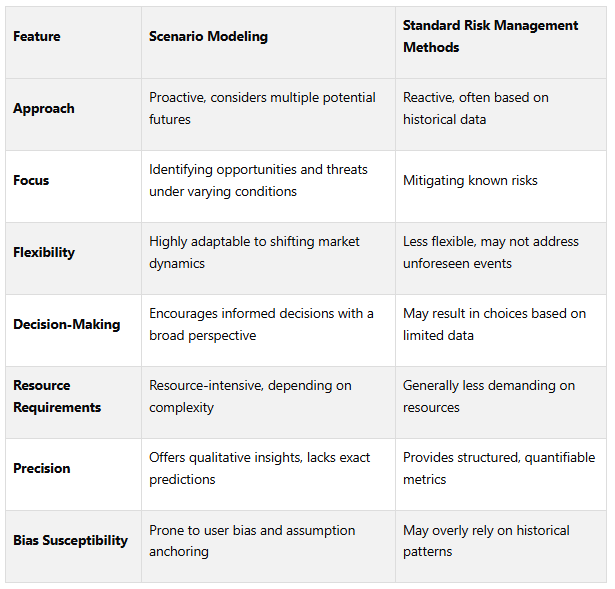

Comparing scenario modeling to traditional risk management methods reveals the trade-offs that influence portfolio strategies. Each approach has unique strengths and weaknesses, shaping how they impact investment decisions.

Scenario Modeling Strengths

Scenario modeling shines in its ability to look ahead, helping investors envision how portfolios might perform under a range of economic scenarios. Its adaptability is a standout feature, allowing it to quickly integrate new market data and adjust to shifting conditions. This flexibility is especially valuable in today’s fast-changing real estate landscape, where being proactive can make all the difference.

Scenario Modeling Limitations

However, scenario modeling isn’t without its challenges. Its reliance on assumptions makes it highly sensitive; small changes in input can lead to vastly different results. Developing multiple scenarios also demands significant time and resources, which can strain teams and budgets. Additionally, decision-makers might unconsciously favor certain scenarios due to personal biases, and the method can struggle to account for unprecedented events that fall outside its modeled parameters.

Traditional Risk Management Benefits

On the other hand, traditional risk management methods bring structure and consistency, which many organizations value. These approaches offer well-established frameworks for key areas like portfolio diversification, property monitoring, and insurance strategies. They are generally less resource-intensive and quicker to implement compared to scenario modeling. Another advantage is their ability to quantify known risks using metrics like debt-to-equity ratios, cash flow stability, and volatility measures.

Traditional Risk Management Drawbacks

Despite these benefits, traditional methods can fall short in rapidly evolving markets. Their reactive nature often creates blind spots, especially when dealing with non-financial risks like political or social changes. This approach’s tendency toward inflexibility - a "one-size-fits-all" mindset - may not work for all property types or market conditions, leaving portfolios exposed to new risks. Moreover, heavy reliance on historical data can be a liability in markets where the past doesn’t reliably predict the future.

Practical Implementation Considerations

Using both methods together can strike a balance between strategic foresight and operational reliability. Neither scenario modeling nor traditional risk management alone is sufficient for comprehensive risk planning. Many real estate professionals find that combining the two delivers the best results. For instance, scenario modeling can explore potential futures, while traditional methods handle day-to-day risk controls. Complementary tools like sensitivity analysis and Monte Carlo simulations can further refine these strategies.

Ultimately, the choice between these approaches depends on factors like portfolio size, available resources, and investment timelines. Smaller portfolios may benefit from the simplicity of traditional methods, while larger, more complex portfolios often require the nuanced insights that scenario modeling provides. By understanding these trade-offs, professionals can craft a risk management strategy that aligns with their specific needs, balancing thorough analysis with practical constraints.

Conclusion

Scenario modeling is reshaping how portfolio risk management is approached. Unlike traditional methods that lean heavily on historical data, this forward-looking technique anticipates potential market changes before they happen. It doesn’t just highlight risks - it equips investors with the tools to prepare for them, fostering smarter and more strategic decision-making.

The numbers speak for themselves: adopting proactive risk strategies helps investors stay ahead of market shifts rather than being blindsided by them. Scenario modeling empowers portfolio managers to craft well-rounded strategies that not only address potential challenges but also uncover opportunities across a variety of economic conditions.

This forward-thinking approach naturally ties into advanced digital tools. For instance, integrating scenario modeling with CoreCast's real estate intelligence platform elevates portfolio management to a new level. The platform enables sophisticated analysis, real-time tracking, and actionable reporting, all in one seamless workflow. Whether it’s underwriting any asset class, managing deal pipelines, or creating personalized reports for stakeholders, CoreCast ensures that scenario analysis moves beyond theory, becoming a practical, indispensable tool for managing portfolios. This combination of real-time insights and scenario modeling creates a robust foundation for data-driven decisions that align with long-term investment goals.

Adopting scenario modeling isn’t just about mitigating risks - it’s about building resilience. By planning for various future scenarios, investors can confidently navigate the complexities of today’s competitive real estate market, turning uncertainty into a strategic advantage.

FAQs

-

Scenario Modeling in Risk Management

Scenario modeling takes risk management to another level by giving real estate investors the tools to evaluate different potential future scenarios and how they might impact portfolio performance. Unlike conventional approaches that primarily aim to avoid or reduce risks, this method adopts a more forward-thinking, data-focused strategy to navigate uncertainties and prepare for a variety of outcomes.

This approach allows for detailed stress testing, helping investors uncover weak spots and spot potential opportunities across different market conditions. Incorporating scenario modeling into portfolio planning empowers investors to make more informed choices and strengthen their portfolios against market swings.

-

Scenario modeling with tools like CoreCast helps sharpen real estate portfolio risk management by offering a better grasp of how market changes might influence your investments. It allows you to explore various scenarios, evaluate risks, and make informed, data-backed decisions.

When incorporated into a platform like CoreCast, scenario modeling simplifies intricate analyses, speeds up reporting, and delivers real-time insights into portfolio performance. This approach not only boosts efficiency but also equips you to respond swiftly to market shifts, enabling more strategic and well-informed investment choices.

-

Scenario modeling gives real estate investors a way to navigate potential risks by simulating different market conditions - think economic slowdowns, rising interest rates, or changes in demand. By analyzing how these factors might affect their portfolios, investors can pinpoint weaknesses and craft strategies to reduce risk while staying resilient.

This method supports forward-thinking decisions, enabling investors to respond swiftly to shifting market trends and protect their assets. Tools like CoreCast take scenario modeling to the next level, offering real-time insights, detailed portfolio analysis, and simplified forecasting - all in one convenient platform.