AI-Powered Geospatial Analysis: CRE Applications

AI is transforming commercial real estate (CRE) by making geospatial analysis faster, more accurate, and actionable. With data overload and outdated methods slowing decision-making, AI tools are stepping in to process large datasets, predict market trends, and assess risks with precision. Here’s what you need to know:

76% of real estate investment firms already use geospatial analysis.

Properties using these insights see 7.3% higher annual returns.

The geospatial analytics market is projected to hit $96.3 billion by 2025.

Key benefits of AI in CRE:

Faster data processing: AI analyzes satellite imagery, demographic data, and market trends in hours instead of weeks.

Improved forecasts: Predictive models have an 87% success rate in identifying growth areas.

Risk management: AI evaluates risks like climate impact, zoning issues, and structural vulnerabilities.

Portfolio optimization: AI tools help investors achieve 4-5% higher risk-adjusted returns.

With platforms like CoreCast offering self-service tools for $50/month, CRE professionals can now access advanced analytics without specialized expertise. AI is reshaping how properties are selected, priced, and managed, offering a competitive edge in a rapidly evolving market.

Cloud Native Geospatial Analytics at JLL

What AI-Driven Geospatial Analysis Does

Geospatial analysis digs into location-based data to uncover patterns and trends that can make or break commercial real estate (CRE) investments. By combining location, attribute, and time-related data, it reveals insights critical for informed decision-making in the CRE world.

AI takes this a step further by automating workflows that used to take weeks, delivering predictive insights that go beyond what manual methods can achieve. It doesn’t just speed things up - it uncovers patterns and trends in CRE market data that traditional underwriting methods might completely miss. This dual ability to accelerate analysis and identify overlooked opportunities is transforming how the industry operates.

The numbers speak for themselves: the geospatial analytics market is projected to hit $96.3 billion by 2025, growing annually at 12.9%. For CRE professionals, adopting these tools is no longer optional. With U.S. office real estate values expected to drop by over 25% through 2025, staying ahead of the curve is essential.

To better understand how geospatial analysis drives CRE decisions, let’s look at the key types of data that power these insights.

Important Geospatial Data Types for CRE

Effective geospatial analysis depends on specific types of data, each offering critical insights for real estate decisions:

Zoning information: This determines what can be built on a property and how it can be used, forming the backbone of real estate planning.

Infrastructure details: Data on connectivity and accessibility highlights future development potential, directly influencing property values.

Population demographics: Human behavior drives demand. For example, 58% of homebuyers prioritize neighborhood quality, and 44% focus on proximity to work. Understanding these factors helps predict tenant behavior and rental demand.

Environmental hazard data: Risks like flooding or climate-related issues can devastate investments. AT&T, for instance, uses climate data to map U.S. flooding risks through 2050.

Nearby business locations: The economic ecosystem around a property matters. Properties within a quarter-mile of new transit stations appreciated 42% more than similar properties over five years following the announcement of construction.

Transportation data: Accessibility drives growth. In Germany, the Bavarian State Ministry piloted AI to assess road conditions, using predictive analysis to prioritize maintenance before major repairs were needed.

Each of these data types plays a role in shaping smarter, more informed CRE strategies.

AI Methods for Processing Geospatial Data

AI takes geospatial data analysis to the next level, using advanced methods to extract actionable insights from complex datasets.

Neural networks and clustering algorithms: These tools automatically detect key features and group similar properties based on multiple variables, handling datasets far beyond human capacity.

Predictive models: These models can forecast value growth with 87% accuracy over a three-year horizon. By analyzing real-time data, they capture market shifts as they happen, not just historical trends.

Computer vision: This technology extracts structured data from satellite and street-level imagery, assessing property condition and features without costly site visits.

Machine learning: These models process massive datasets, merge them with other data sources, and quickly highlight subtle changes that human analysts might miss. They also clean datasets by identifying and removing errors, ensuring reliable information for decision-making.

These AI-driven methods have proven their worth. For example, infrastructure projects using similar applications have saved millions annually. Investors using advanced geospatial analytics see risk-adjusted returns 4-5% higher than market averages by identifying undervalued locations with strong growth potential.

The market for real estate-specific geospatial technologies is growing at a 15.3% compound annual growth rate (CAGR), with its global value expected to reach $19.2 billion by 2028. Clearly, AI-powered geospatial analysis is reshaping the future of commercial real estate.

How CRE Professionals Use AI-Powered Geospatial Analysis

AI-powered geospatial analysis is reshaping how commercial real estate (CRE) professionals approach everything from property selection to portfolio management. By delivering sharper insights, these tools are helping investors make better decisions. With the global commercial real estate market expected to expand by $427.3 billion between 2025 and 2029, growing at a 4.6% CAGR, mastering these tools offers a clear edge.

Property Selection and Pricing

AI's ability to analyze multiple data layers simultaneously has transformed property selection. By combining computer vision and high-resolution imagery, it can extract detailed information about properties, neighborhoods, and nearby amenities faster than traditional methods. Geospatial analytics enriches this process by incorporating data from neighborhoods, census tracts, zip codes, and Core-Based Statistical Areas (CBSAs).

As Mo Batran, CEO & Founder of xMap, puts it:

“We focus on delivering quality data tailored to businesses needs from all around the world. Whether you are a restaurant, a hotel, or even a gym, you can empower your operations’ decisions with geo-data.”

By factoring in location intelligence - such as proximity to amenities, traffic patterns, and demographic trends - investors can make well-informed site selection decisions. AI also predicts how infrastructure projects might influence property values in the future, adding another layer of strategic insight.

Once properties are selected, AI takes the lead in predicting market trends.

Predicting Market Changes

AI-powered geospatial tools merge location, demographic, and economic data to forecast market trends, helping CRE professionals identify opportunities before their competitors. Predictive models have been particularly effective in pinpointing neighborhoods likely to see significant value growth within a few years.

Take Blackstone's suburban housing strategy as an example. By analyzing mobility data, search behavior, and demographics, the firm invested over $7 billion in residential acquisitions, outperforming market benchmarks by 22% in just 18 months. Other analyses have shown that mid-sized cities within a two-hour drive of major metropolitan areas have experienced the strongest growth, driven by hybrid work trends. Additionally, AI has revealed that gentrification patterns are now more fragmented, uncovering investment opportunities in smaller, previously overlooked neighborhoods.

Edward Glaeser captures this shift well:

“In real estate, the art of the deal is increasingly becoming the science of the data.”

A project by JLL illustrates this further. By combining mobile tracking data with demographic insights, geospatial analysis helped optimize tenant mixes across 12 shopping centers, resulting in a 31% rise in occupancy rates and an 18% boost in revenue.

These predictive capabilities also play a critical role in managing risks.

Identifying and Managing Risks

AI-powered geospatial tools are redefining risk assessment by analyzing location-based factors that traditional methods often miss. Advanced techniques like data fusion and dynamic forecasting provide real-time insights, helping professionals spot potential issues early. These tools evaluate risks at both the market and property levels, covering areas like structural integrity, environmental vulnerabilities, and compliance challenges. They can even flag financial distress by monitoring corporate filings, municipal bond ratings, and earnings reports.

Climate risk modeling is another critical feature. By integrating climate projections with location data, AI helps investors understand long-term risks. This is particularly important as repair and maintenance costs for office properties have risen by 12.3%. AI also strengthens due diligence, identifying problematic lease clauses, zoning violations, and property misrepresentations, protecting investors from unexpected costs. Early warning systems, powered by satellite imagery and IoT sensors, enable proactive risk management, reducing exposure to market corrections.

These insights feed directly into smarter portfolio strategies.

Improving Investment Portfolios

AI-powered geospatial analysis helps investors build balanced portfolios by integrating diverse data sources. This approach allows for strategies that manage risk while maximizing returns. By identifying undervalued areas with strong growth potential, investors using advanced geospatial tools achieve better risk-adjusted returns.

Simulations powered by AI test different allocation strategies under various economic conditions, ensuring portfolios remain resilient. With comprehensive data visualization, geospatial analytics supports better decision-making on both macro and micro levels, from tenant placement to property management. Instead of relying on one-time analyses, portfolio managers can implement continuous measurement systems. These systems, paired with algorithmic insights and local market expertise, create a feedback loop that drives long-term success.

The Fractional Analyst's AI-Powered Solutions

The Fractional Analyst is changing how commercial real estate (CRE) professionals access and use data. By combining the expertise of seasoned analysts with cutting-edge AI, The Fractional Analyst provides geospatial insights tailored to the CRE sector. This approach tackles the challenges of inefficiency and overwhelming data that often plague the industry.

Direct Service and Self-Service Options

The Fractional Analyst offers two distinct ways to support CRE professionals, depending on the complexity of their projects.

The direct service connects clients with a team of top-tier financial analysts who provide custom solutions for specific CRE challenges. This option is ideal for institutional investors managing large-scale acquisitions or developers navigating complex zoning regulations. For instance, one CRE investor used this service to analyze a portfolio of properties across multiple U.S. cities. By leveraging AI-powered geospatial tools, the team pinpointed neighborhoods with strong demographic growth and low climate risk. This insight led to a strategic reallocation of investments, boosting returns while minimizing exposure to market volatility.

The self-service option is powered by the CoreCast platform, which lets users independently conduct geospatial analyses, run predictive models, and access financial tools. This flexibility allows professionals to choose the level of support that aligns with their project needs. During its beta phase, CoreCast is available for $50 per user per month, with the price set to increase to $105. This pricing makes advanced CRE insights accessible without requiring specialized expertise.

CoreCast Platform Features

CoreCast is packed with features designed to simplify and enhance CRE analysis. It offers advanced geospatial analytics through tools like high-resolution mapping, predictive modeling, and customizable financial models. Users can layer various data sources - such as demographic trends, economic indicators, and environmental risks - onto property maps, creating a detailed and comprehensive market view.

The platform provides granular analysis at multiple levels, including neighborhoods, census tracts, zip codes, and Core-Based Statistical Areas (CBSAs). CoreCast also includes tools for scenario analysis, automated reporting, and visualizing market trends. For example, its AI-driven automated valuation models (AVMs) can assess property values in seconds, dramatically reducing the time and cost compared to traditional methods. Additionally, users can track market trends in real-time, enabling them to adjust strategies quickly and optimize their portfolios continuously.

Advantages for CRE Professionals

The Fractional Analyst's AI-powered solutions offer several key benefits for CRE professionals. First, the platform delivers more precise and timely forecasts by processing vast datasets, including high-resolution imagery, demographic information, and environmental factors.

It also streamlines reporting, turning tasks that once required weeks into automated processes completed in just hours. This efficiency translates to cost savings, as users can access sophisticated analytics without needing to hire specialized analysts for every project.

With both direct analyst support and self-service tools, CRE professionals can continuously monitor their portfolios, identify underperforming assets, and uncover new opportunities. The platform simplifies complex data into actionable insights, giving users a comprehensive market perspective and the flexibility to adapt to changes quickly. This dual approach ensures that advanced geospatial intelligence is available to everyone - from institutional investors managing billion-dollar portfolios to independent brokers working on smaller deals - regardless of project size or budget.

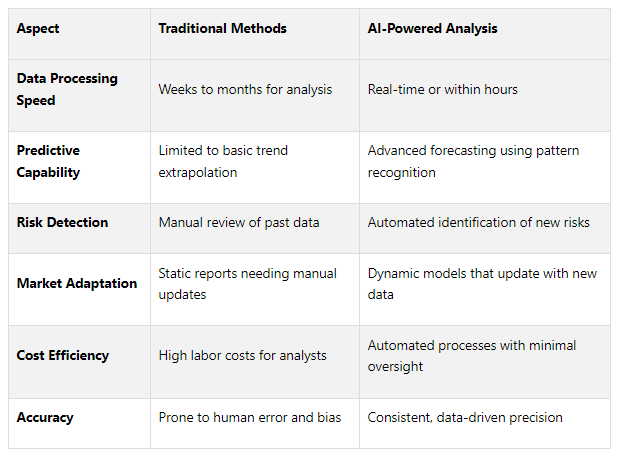

Comparing Old Methods vs. AI-Powered Analysis

For years, traditional geospatial analysis was the go-to for CRE professionals. But in today’s fast-moving market, these methods are struggling to keep up. The numbers tell the story: the global Geospatial Analytics Artificial Intelligence Market reached $47.7 billion in 2024, is expected to grow to $60.4 billion in 2025, and could surpass $470 billion by 2034, with an impressive annual growth rate of 25.7%.

The issue with traditional methods lies in their reliance on historical data and manual processes. These approaches often produce static reports that quickly become outdated. While they’re fine for analyzing past trends, they fall short when it comes to predicting future market shifts or identifying emerging opportunities.

AI-powered systems, on the other hand, are game-changers. Using machine learning and deep learning algorithms, they analyze massive volumes of real-time data, delivering insights in seconds instead of weeks. This ability to process data at lightning speed is reshaping the industry.

The investment world has taken note. Between 2019 and 2022, more than $200 billion was poured into geospatial technology. The reason? AI-driven methods outperform traditional ones across multiple metrics, as highlighted in the comparison below.

Side-by-Side Comparison: Old vs. AI Methods

These differences go beyond speed - they highlight operational advantages. For example, traditional underwriting often misses subtle patterns signaling borrower risk, while AI tools can uncover these trends. AI even compares loan risks across entire portfolios, allowing for more tailored loan terms and interest rates. This precision is critical as U.S. office real estate values are predicted to drop over 25% by 2025, according to Moody’s.

AI also shines in property management. It detects issues like HVAC malfunctions or leaks in real time, avoiding costly damage. This not only reduces utility costs by as much as 30% but also prevents incidents that can cost $50,000 or more. With repair and maintenance costs for office properties climbing 12.3%, predictive maintenance has become a necessity.

Unlike traditional methods that rely on outdated data and gut instincts, AI uses real-time analysis to pinpoint risks and assess project profitability. Tools like thermal imaging and geospatial technology make it possible to identify problems and opportunities faster than ever.

Scalability is another major advantage. Traditional methods often require hiring more analysts for larger projects, driving up costs. AI-powered platforms, however, handle increased workloads effortlessly. This allows CRE professionals to evaluate entire portfolios at once, quickly spotting underperforming assets and uncovering new opportunities across multiple markets.

Key Points and Takeaways

AI-powered geospatial analysis is reshaping how decisions are made in commercial real estate (CRE). Real estate investors using advanced geospatial analytics are seeing risk-adjusted returns that are 4–5% higher than market averages by pinpointing undervalued locations with strong growth potential.

The benefits of AI-driven geospatial tools touch nearly every aspect of CRE operations. For instance, buildings equipped with AI-powered management systems have achieved energy savings of 20–30%.

These tools also open up real-world opportunities for professionals. By processing real-time data from a variety of sources, AI enables professionals to spot emerging trends and opportunities. This provides a crucial edge in deal sourcing and perfect timing for investments.

Responding to these needs, The Fractional Analyst offers both direct service and self-service solutions. Their team of financial analysts delivers custom underwriting, asset management support, and market research. Meanwhile, the CoreCast platform provides scalable real estate intelligence. Currently priced at $50 per user per month during beta testing, CoreCast simplifies operations, tracks performance, and uncovers new opportunities using proven AI principles.

AI's impact goes beyond market forecasting. By automating time-consuming tasks, AI allows professionals to focus on strategic decisions while reducing errors and providing measurable outcomes. This approach stands in stark contrast to traditional methods, which often rely heavily on intuition and limited experience.

Portfolio management also benefits significantly from AI. Algorithms can analyze buyer preferences, budgets, and behaviors to deliver tailored property recommendations. Predictive analytics offer more precise market trend forecasts. For developers, AI evaluates migration patterns, market conditions, and zoning regulations to identify the best construction sites - a level of insight that traditional methods simply cannot achieve.

Professionals who integrate these advanced technologies into their workflows are positioning themselves as leaders in an evolving industry. Adapting quickly to these changes is essential for staying competitive in the CRE landscape.

FAQs

-

AI-driven geospatial analysis is transforming how investors approach risks in commercial real estate. By offering detailed insights into property risks, predicting market trends, and identifying regions with promising growth, these tools enable investors to make smarter, more informed decisions while minimizing unexpected challenges.

Through the evaluation of factors such as environmental hazards, shifting market conditions, and demographic changes, AI provides a deeper perspective on potential investments. This approach not only helps refine portfolio strategies but also enhances long-term investment success.

-

Effective AI-powered geospatial analysis in commercial real estate depends on a variety of data sources. These include property details, which provide information about specific buildings or parcels, and demographics, which help identify the characteristics of the local population. Understanding points of interest - like schools, shopping centers, and hospitals - alongside mobility patterns such as traffic flow and commuting trends, adds valuable context. Infrastructure information, like roads and utilities, further enriches the analysis.

Geographic data is equally important, covering elements like addresses, land cover, topography, and hydrological features. These details create a clearer picture of the physical and environmental aspects of a site. Tools like satellite imagery and GIS data formats, including vector and raster data, are vital for visualizing and analyzing these elements effectively.

When combined, these datasets support smarter decision-making in areas like market analysis, site selection, and optimizing real estate portfolios.

-

AI-driven geospatial tools are reshaping the way commercial real estate professionals evaluate markets. By processing massive datasets, these tools can pinpoint trends, predict property values, and highlight areas primed for investment.

Using advanced algorithms, they identify emerging hotspots, track market fluctuations, and reveal growth opportunities with impressive precision. When paired with geospatial analysis, AI allows investors and asset managers to make smarter, data-backed decisions. This combination helps optimize portfolios and adapt to market changes, giving users a clear advantage in spotting high-potential opportunities in an ever-evolving real estate market.