Best Practices for Multi-Asset Class Benchmarking

Multi-asset class benchmarking evaluates portfolio performance across diverse investments like stocks, bonds, real estate, and alternative assets. Unlike single-asset benchmarks (e.g., the S&P 500), this approach provides a more accurate performance measure for mixed portfolios. However, challenges include data inconsistencies, varying risk profiles, and the lack of ready-made benchmarks.

To address these issues:

Use custom benchmarks tailored to your portfolio's unique structure and goals.

Incorporate universal metrics like total return, Sharpe ratio, and volatility for consistency across assets.

Add real estate-specific metrics (e.g., Net Operating Income, cap rates) to capture property performance.

Adjust for global factors like currency fluctuations and regional risks in international portfolios.

Effective benchmarking also requires ongoing review, rebalancing, and leveraging tools like CoreCast for real-time insights and streamlined analysis. By aligning benchmarks with portfolio objectives and engaging stakeholders, you can make better investment decisions and demonstrate value.

Key takeaway: A well-constructed, regularly updated benchmark is essential for accurate performance evaluation in diverse portfolios.

Performance Metrics for Multi-Asset Class Evaluation

Universal Metrics for All Asset Classes

Evaluating a multi-asset portfolio requires metrics that work consistently across different types of investments. These metrics create a standardized way to compare performance, even when the assets themselves are vastly different.

Total return is one of the most important metrics. It combines income (like dividends or interest) and capital appreciation over a specific period. This makes it easier to compare how different asset classes perform overall.

The Sharpe ratio is another key measure, showing how much extra return is earned for every unit of risk taken. A higher Sharpe ratio means better risk-adjusted performance.

Volatility, which is the standard deviation of returns, measures how much an asset's value fluctuates. This is especially important for creating balanced portfolios. For example, while real estate often has lower volatility than stocks, understanding these variations is critical when managing risk.

Drawdown analysis focuses on the largest declines from a peak to a trough, offering insight into how an investment might behave during tough market conditions.

Correlation analysis looks at how assets move in relation to each other. This is essential for understanding diversification. While real estate can provide diversification benefits, it’s worth noting that correlations between asset classes often rise during market stress.

These universal metrics lay the groundwork for evaluating specific asset types.

Real Estate Performance Metrics

Real estate requires additional metrics that go beyond the universal ones, offering a closer look at property-specific performance factors:

Net Operating Income (NOI): This is the income left after subtracting operating expenses from gross rental income. It provides a clear picture of a property's earning potential, excluding the effects of financing or taxes.

Occupancy rates: High occupancy rates are vital for steady cash flow. Low rates can signal issues with property management or weak demand in the market.

Income yield: Calculated as annual income divided by the property’s value, this metric allows comparisons between real estate and other income-generating investments.

Appreciation rates: These track how much a property’s value grows over time. Understanding regional trends can help set realistic expectations for returns.

Cap rates: This is the ratio of NOI to the property’s value, offering a way to compare risk and growth potential across different property types.

Total return: For real estate, this includes income yield, appreciation, transaction costs, and capital improvements, providing a comprehensive view of performance.

Global Portfolio Adjustments

When managing global portfolios, additional considerations come into play to ensure fair comparisons across markets. These adjustments help account for the complexities of international investments:

Currency adjustments: Exchange rate fluctuations can significantly impact reported returns, making currency considerations essential.

Geographic risk factors: Different regions may follow unique economic cycles, leading to variations in market performance.

Local market conditions: Regulatory frameworks, economic environments, and market trends can all affect rental income and property values.

Time zone considerations: Synchronizing performance measurements is important, especially since real estate valuations may not update as frequently as securities traded on global markets.

Regulatory and tax differences: Rules and tax structures vary widely. For instance, U.S. REITs are required to distribute at least 90% of taxable income, whereas international property companies may operate under different regulations.

These global adjustments refine performance metrics, ensuring accurate comparisons across diverse asset classes. They highlight the importance of robust benchmarking to standardize evaluations for portfolios that span multiple regions and asset types.

FE Analytics How to Guide - Portfolio Comparison Report

How to Build and Customize Benchmarks

Your benchmark should align closely with your portfolio's goals. You can opt for standard benchmarks for simplicity or create custom ones for a more tailored performance measurement.

Standard vs Custom Benchmarks

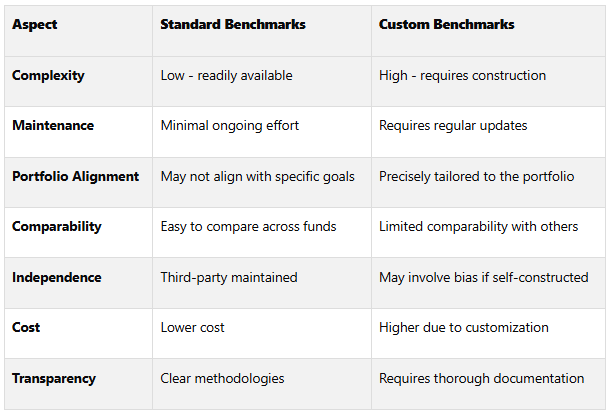

Choosing between standard and custom benchmarks depends on how accurately you want to measure your portfolio's performance. Each option has its strengths and limitations.

Standard benchmarks, like the S&P 500 or FTSE NAREIT, are widely recognized and straightforward to use. They allow for easy comparisons and require little maintenance. However, they may not fully capture the nuances of your portfolio, particularly if you're managing a multi-asset portfolio that includes real estate alongside traditional investments.

Custom benchmarks, on the other hand, are designed to reflect your portfolio's specific composition and strategy. As Steve Kowal, Head of EMEA Wealth Management at MSCI, puts it:

"A good benchmark is something that is recognised and relevant, and accurately reflects what the investment manager is trying to achieve". – Steve Kowal

Here’s a quick comparison:

Custom benchmarks are especially useful for portfolios with unique strategies or significant real estate allocations.

Creating Custom Benchmarks Step by Step

Developing a custom benchmark involves a structured process that aligns with your portfolio’s objectives and risk profile. Here’s how to approach it:

1. Define your investment objectives. Start by clarifying what you're aiming to achieve. For example, in a multi-asset portfolio with real estate, you might balance income from properties with equity-driven capital appreciation. As Jonathan Gamble, a director at Asset Risk Consultants, notes, the benchmark should represent "the neutral strategic position of the manager".

2. Choose indices that reflect your asset classes. For real estate, you might select indices like FTSE NAREIT for REITs or NCREIF Property Index for direct property investments. For equities, consider indices like the S&P 500 or Russell 3000, depending on your market exposure.

3. Assign policy weights. These weights should match your long-term target allocation rather than current market values.

4. Ensure compliance with CFA UK criteria. Your benchmark should meet the seven criteria: unambiguous, investable, measurable, appropriate, market-reflective, pre-specified, and owned. Clear documentation is critical to ensure the benchmark is replicable.

5. Test with historical data. Analyze how the benchmark performs under past market conditions to assess its volatility and suitability for your clients’ risk tolerance.

6. Document the methodology. Include details like rebalancing rules, index selection, and weight assignments. This transparency is essential for explaining performance to stakeholders and maintaining consistency.

Once established, your benchmark will need regular reviews to stay aligned with market changes and portfolio adjustments.

Regular Review and Rebalancing

Benchmarks aren’t static - they require ongoing evaluation to remain effective. Market dynamics, portfolio strategies, and client objectives all evolve, which can affect a benchmark's relevance.

Review benchmarks quarterly for dynamic portfolios or annually for more stable ones. During these reviews, check if the benchmark still aligns with your strategy and if the indices used are still appropriate.

Adjust benchmarks for material portfolio changes. For example, if you increase your real estate allocation or shift focus from domestic to international properties, your benchmark should reflect these updates. Michael Duranceau from SVB Asset Management highlights:

"When an investment manager deviates from the benchmark, it creates the opportunity for outperformance and, conversely, underperformance". – Michael Duranceau

Rebalance weights periodically. If market movements cause significant drift from your target allocation, reset the weights to their original proportions, similar to rebalancing an actual portfolio.

Reassess indices as conditions evolve. New indices may emerge, or existing ones might change their methodologies, impacting their suitability for your portfolio.

Incorporate client feedback. A clear and well-communicated benchmark helps clients understand your strategy and tolerate short-term underperformance if it aligns with their long-term goals.

Tools and Platforms for Benchmarking Analysis

Using the right technology platform can make multi-asset class benchmarking much more efficient. Instead of juggling multiple tools, modern platforms combine data integration, analysis, and reporting into a single workflow. This not only saves time but also reduces the risk of errors.

The ideal benchmarking platform should offer seamless data integration across various asset types, support both standard and custom benchmarks, and include advanced analytics for performance tracking. These platforms provide real-time insights, simplify portfolio and pipeline monitoring, and let users create reports tailored to specific audiences. Tools like CoreCast take this a step further, delivering even deeper insights.

CoreCast's Benchmarking Features

CoreCast is an all-in-one real estate intelligence platform that brings together essential benchmarking tools. It supports underwriting across all asset classes and risk profiles, adapting to the unique features of each property type while maintaining consistency in your benchmarking process.

One standout feature is its integrated mapping capabilities, which add a spatial dimension to benchmarking. This lets you visualize properties alongside competitors and market trends, uncovering location-based factors that influence performance. This geographic perspective helps pinpoint outliers and benchmark properties against peer groups in specific markets.

CoreCast also excels in portfolio analysis, aggregating data across your entire portfolio to create blended benchmarks that reflect your actual asset allocation. This approach is more precise than relying on generic indices.

The platform supports both standard and custom benchmarks, allowing users to combine multiple asset class indices with clear documentation of how benchmarks are constructed. This transparency ensures you understand the methodology behind your performance metrics.

CoreCast Benefits for Real Estate Professionals

CoreCast offers real-time analytics, centralized data management, and customizable reports that can be automatically sent to key stakeholders. This ensures everyone stays informed with the latest market conditions, rather than relying on outdated quarterly data.

The platform also allows for branded reports tailored to different audience needs. These reports can highlight specific metrics that matter most to investors, partners, or management, ensuring clear and relevant communication.

Planned integration with property management systems will further enhance CoreCast’s functionality. By automating the flow of operational and financial data, the platform reduces manual data entry and keeps performance metrics accurate and up to date.

CoreCast is built to scale, making it suitable for portfolios of any size or complexity. Whether you’re analyzing a single property or a diverse multi-asset portfolio, the platform maintains consistent benchmarking and reporting standards.

These features make CoreCast a strong choice for professionals managing diverse portfolios.

Choosing Tools That Match Your Goals

When selecting a benchmarking platform, focus on how well it aligns with your asset classes and investment strategies. The platform should handle your specific property types and risk profiles without requiring additional tools or workarounds.

Also, consider the platform’s ability to integrate with your existing systems. Seamless data integration eliminates manual processes, reduces errors, and ensures your benchmarking reflects real-time performance. Look for tools that work with your current technology stack to avoid costly system overhauls.

Pay attention to the quality of analytics, visualization, and reporting features. The platform should go beyond raw data, offering insights you can act on. Tools like performance dashboards and integrated mapping make it easier to spot trends and outliers that might be missed in spreadsheets.

Ease of use and scalability are also key. Choose a platform that your team can adopt quickly without extensive training and that can grow with your portfolio. A user-friendly interface paired with robust analysis tools ensures long-term success.

Finally, ensure the platform meets your organization’s security and compliance requirements. Data protection and audit trails are essential, especially for institutional investors.

Your benchmarking needs will evolve as your portfolio grows and market conditions shift. Look for a platform that supports custom and blended benchmarks to adapt to these changes without requiring a complete overhaul of your benchmarking framework.

CoreCast checks all these boxes, providing a flexible and reliable solution to meet the demands of a growing portfolio.

Transform Real Estate Data into Confident Decisions

Join Corecast to streamline your real estate operations, gain real-time insights, and make smarter investment decisions with a unified platform.

Best Practices for Benchmarking Success

Achieving success in multi-asset class benchmarking involves setting clear guidelines, incorporating benchmarking into your risk management strategy, and ensuring strong stakeholder involvement. These steps build upon the methodologies covered earlier, creating a solid foundation for evaluating real estate portfolio performance.

Set Clear Benchmarking Standards

At the heart of effective benchmarking lies transparency. Start by establishing well-documented criteria that align your benchmarks with your investment policies and goals. Be clear about why specific benchmarks were chosen and how they support your broader investment strategy.

Your benchmarks need to reflect the nature of your portfolio. For instance, a commercial real estate portfolio shouldn’t be evaluated against residential-focused benchmarks. Similarly, a growth-oriented strategy demands different benchmarks than a value-driven approach. Time horizon matters, too - short-term trading strategies require different performance measures compared to long-term investments.

Risk alignment is just as important. Benchmarks should match your portfolio's risk profile. Comparing a high-risk portfolio to a conservative benchmark can lead to skewed conclusions. To maintain relevance, consider using custom benchmarks, but ensure they are well-documented and regularly reviewed as your portfolio evolves.

It’s also useful to compare your portfolio’s volatility to the benchmark. This helps ensure that your risk tolerance and financial goals remain aligned with your investment strategy. Such comparisons can highlight when your portfolio's risk profile deviates from its intended structure.

By setting these clear standards, you create a pathway for integrating benchmarking into your overall risk management framework.

Apply Benchmarking to Risk Management

When used effectively, benchmarking becomes a valuable tool for managing risk. It allows you to spot performance gaps, identify best practices, and establish baseline risk tolerance levels by comparing your metrics to industry standards.

Incorporate benchmarking into your risk management process to enable data-driven decisions. This shifts decision-making from instinct to evidence-based analysis, offering a more objective approach.

A comparative analysis with industry standards can reveal vulnerabilities in your risk framework. For example, if your portfolio consistently underperforms in specific areas, it could indicate weaknesses that need immediate attention.

"Comparing total return to a proper benchmark or index is the preferred means for assessing performance relative to risk and investment objectives." – Government Finance Officers Association

Regularly evaluate your risk management performance against industry benchmarks. This continuous review not only helps you stay ahead of emerging risks but also uncovers opportunities that might not be visible through internal assessments alone.

Align your KPIs with your risk tolerance and strategic objectives. Benchmarking provides the necessary context to assess whether your key performance indicators are appropriately set and actionable.

Improve Processes and Engage Stakeholders

Strong stakeholder engagement is key to refining and implementing effective benchmarking practices. This involves a combination of communication, collaboration, and feedback.

Start by identifying your stakeholders - anyone impacted by or influencing the benchmarking process. This includes investors, portfolio managers, risk committees, and external advisors who depend on benchmarking data for decision-making.

Tailor your communication to meet the needs of different stakeholders. While some may prefer high-level summaries, others might require detailed breakdowns of metrics. Present information clearly, addressing uncertainties and explaining how stakeholders can contribute to the process.

Encourage feedback by creating opportunities for interaction and information exchange. Regular feedback sessions can help uncover blind spots and highlight areas for improvement in your benchmarking approach.

Be prepared to adapt your strategies based on stakeholder input and changing market conditions. What works in a stable market might need adjustments during periods of volatility.

Lastly, provide regular updates and reports to keep stakeholders informed about the benchmarking outcomes and how their feedback has influenced decisions. This not only maintains engagement but also demonstrates the value of the benchmarking process.

Key Takeaways for Multi-Asset Class Benchmarking

Achieving success in multi-asset class benchmarking relies on three core principles: customized benchmarks, integrated technology platforms, and consistent best practices. Together, these elements form a solid foundation for better investment analysis and performance evaluation.

Tailored benchmarks address the limitations of single-index evaluations by providing a more accurate representation of your portfolio. A single index, like the S&P 500, often fails to reflect the diversity within a portfolio. Instead, creating blended benchmarks that align with your actual asset allocation is key. For instance, the 7Twelve Diversified Index Model allocates 8.33% to each of 12 underlying indexes, offering a diversified benchmark that mirrors a broad mix of assets. Your custom benchmark should reflect the unique composition of your portfolio, whether it includes commercial, residential, industrial, or other real estate assets.

"No single benchmark can answer all performance questions for a portfolio; a mosaic of benchmarks is needed for a comprehensive evaluation." – Cambridge Associates

In addition to customized benchmarks, integrated technology platforms simplify and enhance the benchmarking process. Tools like CoreCast streamline workflows by automating tasks such as underwriting, tracking deal pipelines, analyzing competition, and generating stakeholder reports - all within a unified system. This eliminates data silos and provides real-time insights, enabling more efficient and informed decision-making.

Maintaining consistent best practices is equally important for long-term success. This involves establishing strong governance for benchmark construction, employing transparent methodologies, and ensuring data quality. Regularly reviewing and rebalancing benchmarks helps keep them aligned with changing portfolio goals and market conditions. For example, the GIPS standards emphasize the need for transparency by requiring disclosure of benchmark composition and weights. Such practices not only improve clarity but also strengthen your overall strategic approach.

Lastly, engaging stakeholders is crucial to sustaining effective benchmarking over time. Open communication channels, regular updates, and incorporating feedback ensure alignment and adaptability. By including multiple reference points - such as policy, peer, and asset class benchmarks - you can address a wide range of performance questions comprehensively.

FAQs

-

Building a Custom Benchmark for a Multi-Asset Portfolio with Real Estate

Creating a custom benchmark for a multi-asset portfolio that includes real estate starts with selecting benchmarks for each asset class in your portfolio. These might include equities, fixed income, cash, and real estate. The next step is combining these benchmarks into a single composite benchmark that mirrors your portfolio's target asset allocation and investment objectives. Be sure to assign weights to each asset class that reflect its importance and role in your overall strategy.

When it comes to real estate, you can use property-specific indices or evaluate private investments against public REITs to gauge performance. This tailored approach allows your benchmark to align closely with the unique aspects of your portfolio, helping you track performance accurately and make well-informed strategic decisions.

-

Integrated platforms such as CoreCast make it easier to benchmark across multiple asset classes by bringing all your data together in real time. This streamlined setup lets users monitor, analyze, and compare the performance of various investments from one place. The result? Better decision-making, more effective risk management, and smoother workflow processes.

With tools like portfolio insights, pipeline tracking, and advanced reporting, CoreCast equips professionals to assess performance metrics efficiently and make smarter, data-backed investment choices - all without needing to juggle multiple systems.

-

It’s a good idea to review your benchmarks at least once a year to make sure they still match your portfolio’s goals and any shifts in market conditions. Annual reviews strike a balance between keeping things updated and avoiding excessive transaction costs.

If you have a more active portfolio or markets are experiencing significant swings, checking in every six months might be a better fit. The key is to choose a review schedule that aligns with your investment strategy, risk tolerance, and financial objectives. Regular check-ins help ensure your benchmarks remain a reliable tool for measuring performance.