How AI Improves Rental Income Projections

AI is transforming rental income forecasting by delivering faster, more precise predictions using advanced data analysis. Here's how it works:

Speed and Accuracy: AI processes vast datasets in seconds, improving forecast accuracy by up to 60%.

Dynamic Updates: Real-time data integration ensures projections adjust to market changes instantly.

Scenario Modeling: AI simulates various market conditions, helping property managers prepare for risks and opportunities.

Core Data Inputs: Factors like tenant behavior, market trends, and economic indicators are analyzed for sharper predictions.

Platforms like CoreCast centralize and simplify these insights, offering tools for underwriters, portfolio analysis, and forecasting. With AI, real estate professionals can make smarter decisions, reduce costs, and increase profitability.

Using AI To Predict Real Estate Market Trends

Data Sources and Inputs for AI Models

AI-driven rental income projections depend on a wide range of data sources that go far beyond traditional methods. The more diverse and detailed the data, the sharper and more reliable the predictions. Let’s break down the key data types that fuel these advanced models.

Core Data Inputs for AI Models

AI models rely on a mix of property-specific, market-level, and economic data to generate accurate rental income forecasts. These inputs include everything from seasonal rent trends to maintenance costs and regulatory risks.

Property-specific data is at the heart of these models. It includes details like unit configurations, amenity performance, maintenance records, and financial metrics such as NOI (Net Operating Income) trends and expense ratios. Tenant-related data - like retention rates, payment histories, and amenity usage - also plays a crucial role in forecasting cash flow.

Market-level data provides the big-picture context. This includes demographics, employment rates, economic indicators, and migration patterns that influence rental demand. Location-specific insights, such as proximity to schools, crime rates, and access to amenities, further refine rental value predictions.

Environmental and regulatory factors add another layer of depth. AI models assess factors like flood risks, air quality, and solar potential, alongside regulations that might affect property values or rental restrictions. This ensures the analysis captures both current conditions and potential future risks.

Rental data itself is a cornerstone of these predictions. AI systems analyze current and historical rental rates for different property types, occupancy and vacancy trends, property amenities, lease terms, and regional growth patterns. For instance, U.S. rental rates are projected to rise by 4.8% in 2025, with studio apartments likely to see the biggest increases.

Real-Time Data Integration

Static data can only take you so far. By incorporating real-time updates, AI models become dynamic, adapting to the latest market conditions. This allows for more precise and responsive rent pricing strategies.

Real-time data sources include real estate listings, property management software, updated housing records, tenant surveys, and even short-term rental platforms. These live streams of information keep rental income projections up-to-date, reflecting shifts in demand, pricing, and other market variables.

This continuous flow of fresh data doesn’t just improve accuracy - it also allows for quicker adjustments in pricing strategies, making the models highly responsive to market changes.

How CoreCast Consolidates Data

Managing all this data can be overwhelming, which is where platforms like CoreCast come in. CoreCast simplifies the process by centralizing data from multiple sources into a single, user-friendly dashboard. Instead of juggling various tools, real estate professionals can access everything they need in one place.

CoreCast doesn’t just gather data - it transforms it into actionable insights using advanced analytics. The platform integrates market demographics, property performance metrics, financial data, and location intelligence, giving users a comprehensive view of market demand, pricing trends, and tenant preferences.

With built-in mapping tools, CoreCast lets users visually compare their properties against competitors. Its portfolio analysis features help identify patterns and opportunities across assets, adding a geographic perspective to rental income forecasting. As CoreCast continues to evolve, integrating more real-time data and automation features, it’s set to make rental income projections even more precise and user-friendly.

Step-by-Step Guide: How AI Improves Rental Income Projections

Understanding how AI reshapes rental income forecasting requires breaking the process into specific, actionable steps. By leveraging advanced workflows, AI adapts to market shifts and becomes more accurate with each new data point.

AI-Driven Rental Projection Workflow

The journey begins with data aggregation and standardization. AI systems pull together information from diverse sources like property records, market trends, demographic data, and economic indicators. Once collected, these datasets are cleaned and standardized to ensure they’re ready for accurate analysis.

Next comes feature engineering, where the system identifies critical factors influencing rental income. Variables like proximity to public transit or seasonal employment trends are prioritized to refine projections, focusing on elements that have the greatest impact.

During model training and validation, machine learning algorithms analyze historical data to uncover patterns that influence rental income. These models are tested against past outcomes to fine-tune their accuracy, enabling them to detect subtle details that traditional methods might miss.

Scenario simulation is another key step. Here, the AI evaluates how different market conditions - like an economic downturn, new construction projects, or regulatory changes - could affect rental income. This allows it to forecast potential outcomes under a variety of circumstances.

Finally, analysis and reporting translate the AI’s computations into actionable insights. Through dashboards, charts, and detailed reports, real estate professionals gain a clear understanding of rental income projections, empowering them to make informed decisions.

This structured workflow not only improves the initial accuracy of forecasts but also ensures the system adapts quickly to changing market conditions.

How AI Responds to Market Changes

AI doesn’t just stop at creating forecasts; it’s designed to adjust as markets evolve. When disruptions occur - like changes in economic policy or unexpected downturns - the system recalibrates its predictions by analyzing historical responses to similar events.

For example, if a major employer moves into a neighborhood or a new transportation line is introduced, the AI updates its projections to reflect the resulting shifts in local demand. Similarly, when new regulations, such as rent control policies or zoning law changes, come into effect, the system integrates these updates to ensure its models stay aligned with current legal frameworks.

This adaptability allows property managers to make real-time adjustments to rental rates, marketing strategies, and investment plans, staying ahead of market trends rather than relying solely on past data.

Continuous Learning for Better Accuracy

One of the standout benefits of AI in rental income forecasting is its ability to learn and improve over time. After the initial model validation, the system continues to refine its predictions by incorporating feedback from actual rental outcomes. If projections don’t align with real-world results, the AI analyzes the discrepancies to enhance future forecasts.

As the system processes more data, it becomes better at spotting subtle market signals - like seasonal demand patterns, demographic changes, or shifts in economic indicators. By recalibrating the importance of these factors, the AI steadily improves its accuracy. This approach has been shown to boost forecasting precision by up to 60% compared to traditional methods.

This continuous learning process ensures that rental income projections stay relevant and reliable, even as the real estate landscape evolves. It’s a dynamic system that grows smarter with each new data point, offering property managers a powerful tool to navigate an ever-changing market.

Benefits of AI-Driven Predictive Modeling

Using AI to improve rental income projections doesn't just make processes smoother - it also elevates investment strategies. By shifting from traditional forecasting methods to AI-driven predictive modeling, real estate professionals gain distinct advantages that go beyond automation. These include better accuracy, faster analysis, and smarter decision-making.

Better Accuracy and Speed

AI-powered models bring a new level of precision to rental income projections while significantly cutting down the time needed for analysis. Traditional methods often depend on smaller datasets and manual calculations, which can lead to costly errors and missed opportunities.

For instance, AI can process rent rolls in minutes with 60% higher accuracy compared to traditional approaches. This accuracy stems from AI's ability to analyze massive datasets and detect patterns that might escape human analysts.

Speed is another game-changer. What used to take days or even weeks can now be done in minutes with AI. This allows property managers to act quickly - whether it's adjusting pricing strategies, seizing market opportunities, or making decisions that directly affect profitability.

The impact is clear: nearly half of real estate business owners report lower operating costs and higher revenues thanks to AI. Automating repetitive tasks, minimizing human error, and delivering actionable insights all contribute to these improvements. And with time saved, property managers can dive deeper into more complex analyses.

Advanced Scenario Analysis

One of AI's standout capabilities is its ability to model complex scenarios. Property managers can explore multiple "what-if" situations at once, understanding how different market conditions might influence rental income.

For example, AI can simulate various factors affecting net operating income (NOI), such as changes in occupancy rates, rising utility costs, or property tax increases. It even assigns probabilities to these scenarios, offering a balanced and nuanced forecast. This approach not only predicts potential outcomes but also highlights how likely each one is.

Take a real-world example: a regional real estate investment trust (REIT) avoided over $2 million in potential losses by using AI to identify leases in flood-prone areas. By combining rental data with climate insights, they turned a looming risk into a manageable challenge.

AI also excels at stress-testing investment assumptions. Property managers can evaluate how shifts in interest rates, tenant defaults, or economic downturns might affect their portfolios. This level of risk analysis helps uncover vulnerabilities before they escalate, empowering managers to make more informed decisions.

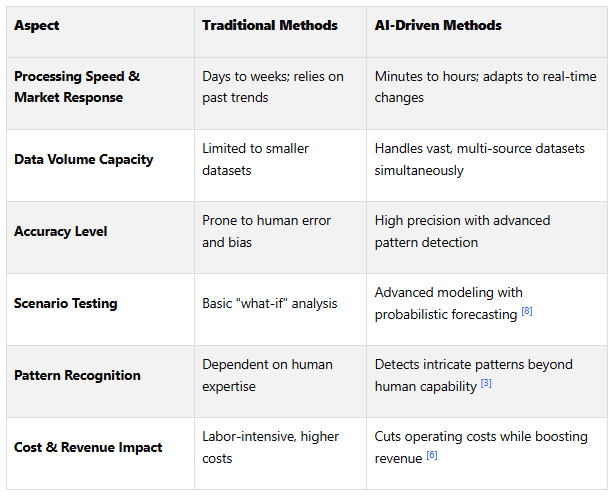

AI-Driven vs. Traditional Methods Comparison

When comparing AI-driven methods to traditional forecasting, the differences are striking. Here's a breakdown of how these approaches stack up:

AI's ability to uncover patterns and trends in data that humans might miss is its defining advantage. While traditional methods provide valuable human insight, they can't compete with AI's computational power and precision.

This speed and accuracy enable property managers to quickly adapt to market changes - an essential capability in competitive rental markets where timing is everything.

Reflecting its growing importance, the AI market in real estate is expected to surge from $164.96 billion in 2023 to $226.71 billion in 2024, with a compound annual growth rate (CAGR) of 37.4%. This growth highlights how AI is becoming a cornerstone for real estate professionals looking to refine rental income projections and improve overall business performance.

Transform Real Estate Data into Confident Decisions

Join Corecast to streamline your real estate operations, gain real-time insights, and make smarter investment decisions with a unified platform.

CoreCast: End-to-End Platform for AI-Driven Rental Projections

CoreCast combines all the tools real estate professionals need for rental income projections into one streamlined platform. It offers real-time insights, simplifies operations, and provides advanced investment analysis, all in a single, integrated system.

By leveraging proven AI capabilities, CoreCast simplifies the process of generating rental projections through a unified approach.

Features for Rental Income Projections

CoreCast excels at bringing together assets, projects, and data into one seamless environment, replacing outdated tools like Excel, SharePoint, and ARGUS. Its modern design is tailored to tackle the complexities of today’s real estate landscape.

Underwriter: This feature models various asset classes and investment strategies, managing the intricate calculations required for rental income projections. It adapts to different property types and fluctuating market conditions with ease.

Portfolio Insights: By linking portfolios directly to the Underwriter, this tool provides real-time updates. Rental projections automatically adjust as new data comes in. For instance, an asset manager overseeing 15 properties across five cities can quickly identify performance trends, flag underperforming assets, and export tailored data views for meetings.

Pipeline Tracker: Designed for acquisitions teams, this tool monitors deal progress and highlights underwriting issues. One REIT reported a 30% reduction in deal slippage over two quarters after implementing this feature.

"With the Pipeline Tracker, we reduced deal slippage by 30% over two quarters. The visibility and accountability it provides are game-changers." - Director of Acquisitions, REIT

Forecasting Tools: Powered by machine learning and automation, these tools analyze patterns and predict future rental income. Property managers gain actionable insights, helping them make smarter decisions. Customizable dashboards also simplify sharing rental projections and portfolio updates with investors, partners, and team members.

Future AI Features

CoreCast is set to expand its capabilities with upcoming AI-driven features. These enhancements aim to automate routine tasks, improve reporting depth, and integrate with property management systems to align forecasts with actual performance. Additional tools in development include construction management features to oversee development projects and investor relations tools to streamline communication with stakeholders.

Why CoreCast Works

CoreCast tackles a key challenge in real estate: fragmented data. Instead of juggling multiple systems to gather and reconcile information, users can access everything they need in one integrated platform.

"CoreCast improved portfolio performance reporting. We now spend more time analyzing data, and less time assembling it." - Asset Manager, Mid-Market Private Equity Firm

Its all-in-one design allows users to underwrite any asset class or risk profile, track deals through every stage, analyze properties alongside their competitive landscape, and generate detailed reports - all without the hassle of transferring data between disconnected tools. This integration not only saves time but also minimizes errors caused by manual data handling.

Currently available in beta for $50/user/month, CoreCast will soon offer three pricing tiers: Free, Essentials ($75/user/month), and Pro ($100/user/month). These options make AI-powered rental income projections accessible to real estate professionals of all scales and budgets.

Conclusion

AI-driven rental income projections are transforming how real estate professionals make investment decisions. Consider this: 77% of companies are either using or exploring AI, and 83% rank it as a top priority for their business strategies. The numbers speak volumes - by 2024, the global AI real estate market is expected to hit $2.9 billion, and by 2033, it’s projected to skyrocket to $41.5 billion, growing at an annual rate of 30.5%. AI isn’t just a competitive edge anymore; it’s becoming an essential tool for staying relevant in the industry.

One of AI’s biggest advantages is its ability to analyze immense volumes of real estate data in mere seconds. This capability allows professionals to make smarter, data-backed decisions, keeping them ahead in a fast-paced market. Industry leaders emphasize that adopting smart technologies is no longer optional - it’s critical for maintaining competitiveness.

Take CoreCast as an example. This platform simplifies the entire rental projection process by offering a single, integrated solution. Instead of juggling multiple tools or relying on manual calculations, users can underwrite assets from any class, monitor deals through every stage, and create highly accurate projections. With real-time data updates and machine learning insights, CoreCast eliminates the operational inefficiencies that have long plagued the industry. This streamlined approach allows teams to shift their focus to deeper strategic analysis, unlocking opportunities to capture more market value.

Generative AI alone could contribute between $110 billion and $180 billion in value to the sector. Platforms like CoreCast make these advanced tools accessible through flexible pricing options, ensuring that professionals across the industry can leverage AI-powered rental projections without breaking the bank. This democratization of cutting-edge forecasting tools is reshaping the future of real estate.

FAQs

-

AI takes rental income projections to a new level of precision by analyzing massive, real-time datasets. These include everything from market trends and property features to neighborhood dynamics. Traditional methods, on the other hand, often depend on older data or manual calculations, leaving room for inaccuracies and bias. AI, however, processes current market conditions and property-specific details with incredible speed and accuracy.

By minimizing human error and leveraging the most up-to-date information, AI gives real estate professionals a clearer picture of potential rental income. This allows them to make more informed investment choices and adapt quickly to shifting market conditions.

-

How AI Predicts Rental Income

AI-powered tools for rental income forecasting draw on several important data types to generate precise projections. These include financial metrics like rental rates and operating costs, historical property performance, market trends, and time series data. By analyzing this mix of information, AI models can spot patterns and estimate future income potential.

To make these predictions work, AI systems preprocess and merge these data points into predictive models. This ensures the output remains both accurate and relevant. With these insights, real estate professionals can better understand market dynamics, anticipate changes, and make more informed investment choices.

-

CoreCast enhances rental income projections using AI-powered predictive modeling to dig into historical data, market trends, and performance benchmarks. This approach helps real estate professionals generate precise forecasts tailored to individual properties and specific market conditions.

The platform brings together essential tools like data analysis, trend monitoring, and anomaly detection. This allows users to spot potential risks - like overly optimistic rent growth expectations or unusually low cap rates - early on. By simplifying workflows and delivering actionable insights, CoreCast helps investors make informed decisions and avoid unexpected setbacks.