Real-Time Asset Benchmarking in CRE

Real-time asset benchmarking is transforming how commercial real estate (CRE) professionals evaluate and manage properties. Unlike outdated quarterly or annual reports, this approach uses live data to compare asset performance against market standards instantly. The result? Faster decisions, better risk management, and improved property value.

Key Takeaways:

What it is: Continuous comparison of property performance metrics using live data.

Why it matters: Helps CRE professionals respond quickly to market changes, tenant needs, and operational issues.

Metrics involved: Financial (NOI, IRR), operational (occupancy, tenant turnover), and market (rents, expenses).

Benefits: Improved decision-making, cost savings, better tenant satisfaction, and alignment with ESG goals.

Tools like CoreCast: Centralized platforms simplify data integration, analysis, and reporting.

Real-time benchmarking is the future of CRE management, enabling faster, smarter decisions in a competitive market.

Altus Innovation Summit NYC 2025 - The future of CRE valuation and performance benchmarking

Benefits of Real-Time Asset Benchmarking

Real-time asset benchmarking is becoming a game-changer for commercial real estate (CRE) professionals, offering a proactive way to manage risks and increase asset value. With forecasts from Capital Economics predicting a 10% valuation decline in 2024 and an additional 5% in 2025, having access to live data is more important than ever. This approach enhances decision-making, boosts portfolio performance, and ensures compliance across real estate investments.

Better Decision-Making and Risk Management

Gone are the days of relying on outdated reports. Real-time benchmarking allows CRE professionals to assess risks and address performance issues as they arise, rather than after the damage is done. By comparing a property’s performance against the market in real time, you can quickly determine if it’s on track or facing financial hurdles - a critical insight during acquisitions, refinancing, or sales.

"Benchmarks are both a ruler and a compass that equip commercial mortgage originators and their clients with tools to navigate murky market conditions." - Rob Finlay, Founder and CEO of Thirty Capital

This capability is especially valuable in today’s market, where nearly half of industry leaders anticipate tighter capital availability and higher costs over the next two years. Real-time monitoring and predictive analytics can identify red flags - like excessive operating expenses - early enough to implement cost-saving measures. For example, if your property’s expenses exceed the industry average, benchmarking can highlight inefficiencies, allowing for immediate action. Commercial mortgage originators can also use this data to better support borrowers by providing informed recommendations.

These insights not only address immediate risks but also set the stage for stronger portfolio performance.

Higher Portfolio Performance and Value Creation

Benchmarking in real time offers a clear picture of underperforming assets and uncovers opportunities to add value. By comparing your property data with competitors, you gain an objective view of its performance, enabling faster adjustments to leasing strategies or investment plans. This continuous analysis helps identify operational improvements and best practices that can be applied across your entire portfolio.

Portfolio managers can use these insights to refine investment strategies, focusing on asset types or markets delivering the highest returns. This data-driven approach ensures capital is allocated more effectively, maximizing performance. For instance, if market intelligence shows your rental rates lag behind competitors, you can adjust pricing immediately to stay competitive.

This focus on performance naturally extends to meeting sustainability and compliance objectives.

Meeting Sustainability and Compliance Goals

The rise of ESG regulations has reshaped the CRE landscape. Since 2011, over 1,255 ESG regulations have been introduced globally - a 155% increase in just a decade. Real-time benchmarking equips property managers with the tools to monitor sustainability metrics like energy use, emissions, and waste management, ensuring they stay ahead of evolving requirements.

Continuous tracking allows for the immediate identification of inefficiencies, enabling corrective actions before sustainability goals or compliance standards are compromised. This is particularly valuable as tenants and investors increasingly prioritize properties with strong environmental performance.

However, challenges remain - only about 40% of organizations can automatically source sustainability data. For properties that can track and report these metrics in real time, there’s a significant chance to attract eco-conscious tenants and investors. Benchmarking also helps identify gaps in environmental performance, allowing companies to adopt strategies proven effective by their peers.

Establishing clear KPIs aligned with both internal goals and industry benchmarks is key. Real-time data ensures timely and accurate reporting, fostering transparency and accountability. For CRE professionals, adopting centralized digital filing systems for documents like leases, contracts, and permits can streamline compliance tracking and sustainability reporting. With these tools in place, real-time benchmarking becomes a powerful asset for driving continuous improvement and maintaining a competitive edge.

Key Components of Real-Time Benchmarking

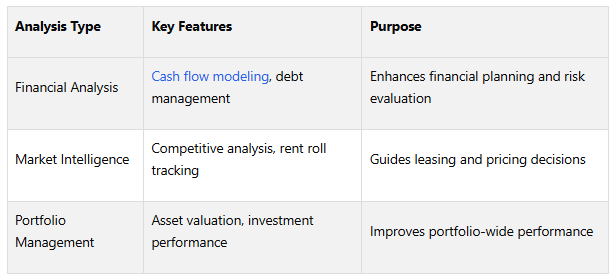

Real-time benchmarking in commercial real estate (CRE) hinges on three core elements: data integration, strategic analysis, and automated monitoring. Together, these components transform raw data into actionable insights that enhance investment decisions and overall portfolio performance.

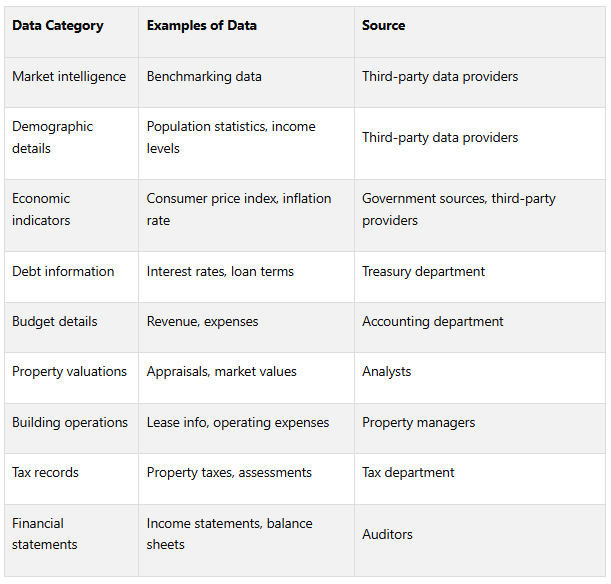

Data Sources and Integration

The backbone of effective benchmarking lies in bringing together diverse data streams. Real estate organizations that successfully integrate multiple data sources can deliver accurate analyses and consistent reporting, enabling better decision-making. This task becomes even more complex when you consider the sheer variety of data a typical real estate fund relies on: market intelligence for benchmarking, demographic trends for projections, economic indicators, debt and budget details, property valuations, building operations data, tax records, and audited financial statements.

Internal property data plays a pivotal role in benchmarking. This includes details like lease rolls, operating expenses, capital expenditures, tenant profiles, and financial metrics. For example, 90% of CRE teams use tools such as CAFM (Computer-Aided Facility Management) and IWMS (Integrated Workplace Management Systems) for tasks like space management, asset tracking, and facility operations. Additionally, 97% of companies integrate external data feeds into these systems, with HR data being the most commonly used, cited by 88% of organizations.

External market data provides the comparative context necessary for meaningful benchmarking. This includes information like rental rates, vacancy trends, transaction volumes, and local market insights. Third-party integrations further enrich this ecosystem by connecting with appraisal services, economic databases, and industry research platforms.

Data integration also requires standardization. Normalizing and standardizing the data minimizes cleanup efforts, which is critical as many analysts spend a significant portion of their time preparing data for use. To streamline this process, businesses should start by defining their desired outcomes and then profile the necessary data - considering factors like frequency, structure, format, and delivery methods. Data repositories play a key role here: data warehouses store structured, processed information, while data lakes hold raw, granular data.

This unified data framework enables both detailed property-level and broader portfolio-level analysis, which are explored in the next section.

Asset-Level vs. Portfolio-Level Benchmarking

Once data integration is achieved, the focus shifts to tailoring benchmarking strategies for individual assets and entire portfolios. The choice between these approaches depends on the goals of the analysis.

Asset-level benchmarking dives into the specifics of a property's performance, examining metrics like rent per square foot, expense ratios, and occupancy rates. This granular perspective is especially useful during due diligence, as it can help uncover potential concerns or opportunities, such as operating costs that exceed market norms.

On the other hand, portfolio-level benchmarking looks at performance across multiple properties or investment strategies. This approach helps identify broader trends, optimize capital allocation, and compare overall results against industry benchmarks. The most effective strategies often combine both approaches: portfolio-level analysis highlights trends and outliers, while asset-level data provides the insights needed for precise action.

"Enter it once and use it many times. Ideally, you want data to be able to be shared with every system in your environment from asset management to accounting. Each group should be able to look at that data from their own lens and apply what is important to them."

Don Bleaney, Senior Director at One11 Advisors. This philosophy underscores the importance of a shared data foundation that supports both strategic oversight and operational precision.

Using Dashboards and Automation

The power of real-time benchmarking is amplified when paired with automated dashboards that provide instant access to key performance indicators. These dashboards eliminate the need for manual data compilation, freeing up teams to focus on strategic decisions. They also visually highlight performance gaps and opportunities, making it easier to act on insights.

Real-time updates ensure that the data stays current and actionable. As Amy Tippet, Senior Solutions Architect, notes:

"Repeatable data is important for forecasting. You need to be able to get data from one source on a regular basis so you don't have to rewrite templates and reports every time."

. Automation further enhances this process by introducing alerts for deviations, such as unexpected increases in vacancy rates or operating expenses that exceed budget projections.

Despite advancements in technology, challenges persist. While 77% of organizations report some level of technology maturity, none have reached the highest maturity level (Level 5), indicating room for improvement. Establishing strong quality controls early in the data pipeline - such as normalizing databases to resolve inconsistencies - ensures that automated dashboards remain reliable tools for gaining a competitive edge through better market insights.

These elements equip CRE professionals with the tools they need to make data-driven decisions, leveraging real-time insights to optimize their portfolios and maintain a strategic advantage.

Transform Real Estate Data into Confident Decisions

Join Corecast to streamline your real estate operations, gain real-time insights, and make smarter investment decisions with a unified platform.

Steps for Implementing Real-Time Asset Benchmarking

Implementing real-time asset benchmarking involves turning scattered data into actionable insights. This process unfolds in three main phases: building a strong data foundation, setting precise performance goals, and establishing systems for ongoing monitoring and adjustment.

Collecting and Integrating Data

The backbone of real-time benchmarking is a centralized, secure, cloud-based system for storing data. This ensures easy access for teams while maintaining security standards. Using data integration tools helps unify information from various sources, overcoming differences in formats, terminologies, and structures.

Data collection should be purposeful - start with clear objectives to ensure the information supports your benchmarking goals. Sources like public records, surveys, and digital platforms are valuable, but always cross-check data with multiple references to ensure accuracy. Regular audits are essential for maintaining data quality.

To keep data consistent, establish standardized naming conventions, data entry rules, and access protocols. Training team members on best practices for data management is critical. Security measures, such as encryption and regular assessments, should also be in place, and collection methods need to evolve with data changes.

Once your data is reliable and well-organized, you can move on to defining performance benchmarks tailored to your portfolio.

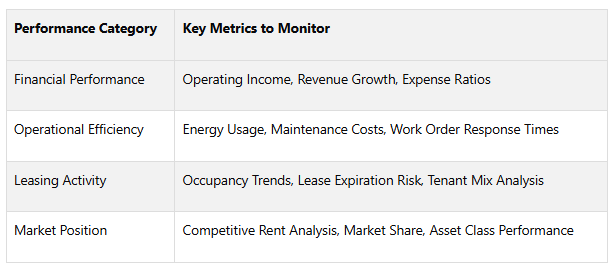

Setting Benchmarks and Performance Targets

With a solid data foundation, the next step is to create benchmarks that align with your portfolio's characteristics. Start by analyzing historical data - metrics like net operating income (NOI), revenue, and expenses - and compare them to industry standards, peer data, and market averages to identify gaps.

Key performance indicators (KPIs) should reflect your property's financial health. Metrics to monitor include occupancy rates, average rental income per unit, operating expenses as a percentage of revenue, and NOI. Financial ratios like ROI and capitalization rate are equally important and should be measured against industry averages.

"Benchmarking allows you to pinpoint areas where your property outperforms competitors and areas where improvement is needed, so you can focus resources on areas with the greatest potential for enhancement.” – Kimberly Gangi, Head of the Outsource Accounting Services Group

Budget variance analysis is another valuable tool. It compares actual performance against budgeted expectations to highlight overly optimistic or conservative assumptions. For example, NOI benchmarking can reveal whether underperformance is due to market conditions or property-specific issues. A comprehensive approach should include analyzing revenue trends, expense patterns, occupancy dynamics, and market conditions. Regular reviews and updates to benchmarks ensure they remain relevant as market conditions evolve.

With benchmarks in place, the focus shifts to continuous monitoring and analysis.

Monitoring, Reporting, and Analyzing Results

Monitoring transforms raw benchmarking data into actionable insights. Tools like dashboards and heatmaps provide a clear, real-time overview of asset health and performance. Automated alerts can notify teams when metrics deviate from expected ranges.

Trend analysis is particularly useful for spotting inefficiencies or potential issues. For instance, rising operating temperatures in HVAC systems may indicate equipment problems. Companies using asset performance monitoring have reported a 22% reduction in maintenance costs, a 15% increase in equipment uptime, and a 25% boost in labor productivity.

Consistency in tracking KPIs is essential for meaningful analysis. Asset management software can automate workflows, reducing manual effort and ensuring accurate reporting. Data validation processes further enhance the reliability of collected information. Regular reporting helps assess whether goals are being met and identifies when adjustments are needed. Shifting from reactive to proactive maintenance - servicing equipment before it fails - can significantly improve asset utilization.

Select metrics that align with your organization's size, industry, and business priorities. For example, effective stock management can cut costs by 10%.

"Monitoring assets' performance and the value they contribute is vital for optimizing their use. By employing asset performance monitoring, wastage of resources and expenditures made on vague assumptions about an asset's functionality can be effectively circumvented.” – Connixt

CoreCast: Centralized Real-Time Intelligence for CRE

CoreCast builds on the foundation of effective data integration and benchmarking methods by offering a centralized platform that brings these elements together. While implementing real-time asset benchmarking can be complex, CoreCast simplifies the process by unifying data and providing actionable insights. It's designed to address the challenges commercial real estate (CRE) professionals face when consolidating multiple data sources and making informed decisions.

Overview of CoreCast Features

CoreCast operates as an all-in-one intelligence platform for commercial real estate, streamlining operations across various asset classes - multifamily, office, industrial, retail, and mixed-use. It supports underwriting for any risk profile, allowing professionals to manage their portfolios seamlessly within a single system.

The platform's standout feature is its ability to unify workflows. Users can track deal stages, analyze competitive landscapes with integrated maps, perform portfolio analyses, and create branded reports for stakeholders - all in one place. This integration enhances real-time decision-making, giving users a clearer picture of their operations.

Key features include:

Pipeline Tracker: Offers visibility into deal progression.

Portfolio Insights: Delivers detailed performance analytics.

Forecasting Tools: Uses historical data and market trends to predict future performance.

Currently, CoreCast is in its beta phase and available for $50 per user per month. Once fully developed, the platform’s pricing is expected to increase to around $105 per user per month.

Real-Time Benchmarking with CoreCast

CoreCast takes the hassle out of asset benchmarking by consolidating data into a unified, real-time dashboard. This dashboard provides a snapshot of portfolio health, eliminating the need for tedious manual data gathering. It also offers dynamic performance metrics across various timeframes, helping teams identify trends, catch anomalies, and make meaningful comparisons without extensive manual effort. Dashboards can be customized to suit the needs of different users - whether it's asset managers diving into operational specifics or investors looking for high-level insights.

"CoreCast transformed how we communicate portfolio performance to stakeholders. We now spend more time analyzing data, and less time assembling it." – Asset Manager, Mid-Market Private Equity Firm

The platform automates repetitive tasks like document tagging, report creation, and pipeline updates, freeing up time for professionals to focus on strategic decisions. By standardizing reporting and enforcing consistent processes, CoreCast helps demonstrate operational excellence. These efficiencies allow for more frequent benchmarking and quicker responses to market shifts, setting the stage for even more advanced features in the future.

Future Capabilities of CoreCast

CoreCast has ambitious plans to expand its capabilities, with a focus on integrating automation and machine learning into its workflows. These enhancements will introduce predictive analytics, enabling users to forecast trends and address potential issues before they escalate.

Planned features include:

Construction Management Tools: Real-time visibility into project progress.

Advanced Reporting: Sophisticated visualizations and customizable analytics.

Investor Relations Module: Streamlined communication and automated report distribution.

By 2030, CoreCast aims to serve over 100,000 users. As the platform grows, it will continue to incorporate new data sources and analytical tools, solidifying its role as a central hub for intelligence and analytics. While CoreCast will integrate with property management systems, its primary focus will remain on delivering strategic insights rather than handling day-to-day property management or bookkeeping tasks.

These upcoming features highlight CoreCast's commitment to simplifying benchmarking and supporting data-driven decision-making in commercial real estate. Its evolution reflects the industry's shift toward real-time performance monitoring and the increasing reliance on centralized, intelligent platforms.

Conclusion and Key Takeaways

Real-time asset benchmarking has become a critical tool for thriving in today’s commercial real estate (CRE) landscape. It empowers asset managers to track performance metrics instantly and make informed decisions, giving high-performing portfolios a clear edge in a rapidly changing market.

Why Real-Time Benchmarking Matters

The benefits of adopting real-time benchmarking go well beyond just keeping tabs on performance. Here’s how it stands out:

Quicker decision-making: With access to up-to-date data, asset managers can act swiftly, whether it’s addressing underperforming properties or seizing new market opportunities. No more waiting for outdated quarterly reports.

Proactive issue management: Continuous monitoring helps catch potential problems early. Real-time alerts ensure small issues don’t snowball into costly setbacks.

Support for sustainability goals: As ESG (Environmental, Social, and Governance) standards become more stringent, real-time benchmarking helps meet compliance requirements while uncovering efficiency improvements that save money.

These advantages lead to stronger financial performance. Properties that consistently measure up to market standards tend to maintain higher occupancy rates, command premium rents, and attract tenants who value well-managed spaces.

If you haven’t already, it’s time to evaluate your current practices to unlock these benefits.

Next Steps for CRE Professionals

To fully embrace the potential of real-time benchmarking, CRE professionals should focus on upgrading their systems and processes. Here are the key steps to get started:

Streamline data collection and integration: Build a system that consolidates internal property data - such as rents, occupancy rates, and operating expenses - alongside external market data. This creates a unified data source, eliminating the inefficiencies of juggling multiple systems.

Define benchmarks and KPIs: Establish clear performance metrics and set realistic targets based on current market trends. Regularly update these benchmarks (at least annually) to keep pace with evolving conditions.

Select the right tools: Choose platforms like CoreCast that offer real-time analytics and seamless integration. Avoid forcing a one-size-fits-all solution; instead, find technology tailored to your asset classes and investment strategy.

Focus on adoption: Technology only delivers results when it’s used effectively. Roll out new systems thoughtfully by piloting them with stakeholders, gathering feedback, and investing in thorough onboarding and training.

The CRE industry is moving toward a future driven by instant data and agile decision-making. Those who adopt real-time benchmarking early will gain a competitive edge, while others risk falling behind. The question is: Will you lead the charge or play catch-up? The time to act is now.

FAQs

-

Real-time asset benchmarking is changing how decisions are made in commercial real estate by providing current performance insights. With this approach, property owners and investors can pinpoint inefficiencies, tweak strategies, and fine-tune operations as market conditions evolve.

Traditional benchmarking often relies on outdated or periodic data, which can leave stakeholders a step behind. Real-time insights, on the other hand, allow for quicker, smarter decisions. This ability to adapt not only helps improve profitability but also enhances operational efficiency and builds resilience in a highly competitive industry.

-

To successfully implement real-time asset benchmarking in commercial real estate (CRE), having reliable data sources and powerful tools is essential. The right data sources, such as market analytics platforms, provide current property information, rent trends, and competitive insights. These resources keep you updated on market changes and help you assess asset performance effectively.

In terms of tools, specialized analytics platforms and software tailored for CRE are key. These tools allow you to centralize data, evaluate performance metrics, and create forecasts. By combining real-time data with predictive analytics, you can benchmark assets more efficiently and refine your portfolio strategy with confidence.

-

Real-time asset benchmarking equips commercial real estate professionals with current and precise data on asset performance, making it easier to meet sustainability and compliance objectives. By keeping track of key metrics such as energy usage, emissions, and environmental impact, it ensures properties stay aligned with regulatory standards and industry expectations.

This tool provides actionable insights that help lower regulatory risks, enhance ESG reporting, and showcase a dedication to sustainability. With this forward-thinking strategy, professionals can make better decisions and prepare assets for long-term success in a fast-changing market.