Common Challenges in Data Integration for CRE

Data integration in commercial real estate (CRE) is essential for making smarter investment decisions but comes with several challenges. Here’s a quick breakdown:

Fragmented Data Systems: CRE data is often scattered across multiple platforms, causing inefficiencies. For example, financial, leasing, and operational data may not sync properly, slowing decision-making and increasing costs.

System Compatibility Issues: Legacy systems lack modern connectivity features, making integration with new platforms difficult. Over 75% of large enterprises face major integration hurdles, and 40% of IT budgets are consumed by technical debt.

Data Quality Problems: Poor data quality, such as duplicates and inconsistencies, costs organizations millions annually. CRE firms must standardize, clean, and validate data to ensure reliable insights.

Team Skill Gaps: Many CRE professionals lack technical skills needed for data integration. Training and hiring for these roles are critical to closing this gap.

Security Risks: Integrating third-party systems increases vulnerabilities. Nearly 98% of companies have dealt with vendor-related breaches. Strong security measures and compliance frameworks are essential.

Implementation Challenges: Rushing integration can lead to data corruption and operational disruptions. A phased, step-by-step approach minimizes risks and ensures smoother transitions.

Key Solution: Platforms like CoreCast address these issues by centralizing data, automating processes, and ensuring real-time insights. This helps CRE professionals manage deal pipelines, analyze portfolios, and make informed decisions efficiently.

The stakes are high, but with the right tools and strategies, CRE firms can overcome these challenges and stay competitive.

Future of CRE | Unlocking Asset Management in the Data & AI Era, with symmetRE Co-founder

Fragmented Data Sources and System Compatibility Issues

Bringing together scattered data is a key step in improving deal pipelines in commercial real estate (CRE).

Challenges of Disconnected Data

CRE professionals often grapple with data spread across multiple systems, leading to manual processes, higher costs, inconsistent information, and slower decision-making. For example, financial data might reside in one system, leasing details in another, and operational metrics in yet another. This lack of integration creates inefficiencies.

A telling example is Investa, an Australian CRE company managing over 150 vendors across disconnected platforms. This disjointed setup caused delays, data inconsistencies, and limited real-time visibility. With no centralized system, owners and operators struggle to assess property conditions and make timely decisions. In fact, 74% of facility managers report needing real-time insights to make better decisions, yet many are forced to toggle between platforms to get a full picture.

These fragmented systems not only disrupt workflows but also complicate efforts to connect older systems with modern solutions.

The Complexity of Integrating Systems

Integrating legacy systems with modern platforms is no small feat. While 90% of large enterprises still rely on legacy systems for critical operations, 75% encounter major challenges when attempting integration. These older systems often lack APIs and modern connectivity features, making it difficult to sync with cloud-based solutions. The financial toll is steep - 40% of IT budgets are consumed by technical debt, and 30% of CIOs report spending over 20% of their budgets on addressing these issues.

A big part of the problem lies in differing data formats and protocols. Older systems, built on outdated frameworks, struggle to communicate with modern platforms, leading to costly workarounds. For instance, 34.43% of professionals cite interoperability with legacy systems as their top challenge, while 35.35% face hurdles integrating automation systems and sensors.

Moving Toward Unified Data Systems

The solution to these challenges lies in adopting platforms that support open integration standards and provide centralized dashboards for seamless data management. Modern real estate intelligence platforms can consolidate data from multiple sources into one unified system, addressing many of these issues.

The global system integration market reflects this shift, growing from US$421.1 billion in 2023 to a projected US$805.3 billion by 2032. Successful integration strategies often include comprehensive evaluations of existing systems, active involvement from stakeholders, and the use of specialized tools. Testing integrations in controlled environments before full deployment is also a critical step.

The benefits of unified systems are hard to ignore. For instance, a global financial institution reduced its property management costs by US$150 million - trimming a US$450 million budget by one-third - through vendor consolidation and standardized processes. Platforms like CoreCast exemplify this approach, combining tools for underwriting, pipeline tracking, competitive analysis, and portfolio management into a single interface. By focusing on scalable integrations and implementing monitoring tools with regular updates, organizations can ensure their systems remain aligned with their evolving needs.

Data Quality, Consistency, and Cleaning

In commercial real estate (CRE), poor data quality can derail investment decisions and disrupt portfolio management. While integrating systems is a step in the right direction, maintaining high-quality data is essential for turning those integrations into actionable insights.

Impact of Poor Data Quality

The financial toll of bad data is hard to ignore. Gartner reports that inaccurate data costs organizations an average of $12.9 million annually. Another survey by Gartner pegs this figure even higher, at $15 million per year. For CRE professionals, who deal with high-stakes transactions and intricate portfolios, these costs can escalate significantly.

"One of the biggest values of CRE data is its ability to inform decisions. A data-driven decision is only as good as the data behind it. If you rely on poor-quality data, then poor-quality decisions are likely to follow."

Stephanie O'Neill, JLLT

Common issues like duplicate entries, incomplete datasets, and inconsistent formatting plague CRE operations. For instance, a missing lease term or mismatched property addresses ("123 Main St." versus "123 Main Street") can disrupt automated processes and lead to confusion. These problems are magnified when external data sources are introduced. A 2021 Forrester report found that 70% of CRE organizations rely on multiple data systems and sources to manage their portfolios, creating more opportunities for errors and inconsistencies.

Standardization and Validation

Achieving reliable data requires more than quick fixes - it demands standardized processes and rigorous validation frameworks. Implementing robust validation checkpoints is key. This includes verifying property details against trusted sources, confirming transaction data, and using machine-learning tools to validate property coordinates. Automated monitoring systems can continuously scan for issues, leveraging algorithms to detect anomalies and group similar properties, flagging errors before they spiral out of control.

The cleaning process itself involves several critical steps:

Removing duplicates: Advanced matching algorithms can identify duplicate properties, even with inconsistent address formatting.

Fixing structural errors: This step standardizes naming conventions, corrects typos, and ensures consistent capitalization across datasets.

Handling missing data: Instead of discarding incomplete records, impute missing values using data from comparable properties.

Governance Frameworks

Unified systems must be supported by strong governance to maintain consistent data quality. Governance frameworks establish clear quality standards and ensure that data remains reliable across all platforms. Working effectively with third-party vendors is crucial - this includes defining standards for data delivery, update schedules, and quality metrics. Additionally, mapping key fields between systems helps maintain consistency as information flows between sources.

Documentation plays a central role. Teams should document data sources, transformation rules, and known issues to ensure proper usage. Quality monitoring systems can further enhance governance by automatically flagging anomalies, tracking data freshness, and ensuring compliance with established standards.

Training is another critical component. Regular workshops on data literacy can help team members use data systems correctly, reducing errors caused by human oversight. Governance frameworks should also address data lifecycle management, setting rules for data retention, update schedules, and resolving conflicts from multiple sources.

Platforms like CoreCast can streamline these processes by automating validation, standardization, and ongoing quality monitoring. With these tools in place, CRE professionals are better equipped to make informed, data-driven decisions.

Team Readiness and Data Skills

Even with top-notch data tools and governance frameworks, the true key to success lies in the people who use them. Many commercial real estate (CRE) organizations face hurdles with data integration not because of inadequate technology but due to a lack of team skills and an organizational culture that fully supports leveraging third-party data. To truly unlock the potential of these tools, aligning team capabilities with the demands of data integration is essential.

Skills Gap in CRE Teams

The slow pace of tech adoption in CRE has created a significant skills gap, making data integration a tough challenge. Many teams lack the technical know-how needed to work with third-party data, such as coding, system administration, and cloud computing expertise. On top of that, operational skills like understanding the software development life cycle and project management are often missing, further complicating efforts.

The scale of this issue is hard to ignore. According to a 2022 MIT CISR survey, leaders estimated that nearly 38% of their workforce would need retraining or replacement within three years to address these gaps. Beyond technical skills, soft skills like communication, teamwork, and problem-solving are often undervalued, even though they’re critical for ensuring smooth collaboration across departments. For example, clear communication is vital for defining data requirements and translating them into actionable insights.

Then there’s the challenge of integrating modern PropTech tools with older systems. Many CRE professionals are comfortable with traditional platforms but struggle to adapt to newer, data-driven technologies. Overcoming these technical hurdles requires not just upskilling but also a shift in mindset to embrace data as a core part of operations.

Building a Data-Focused Culture

A successful data integration strategy isn’t just about hiring tech-savvy employees. It demands a complete cultural shift. CRE organizations need to stop viewing data as a secondary asset and start treating it as a fundamental driver of business success.

"To build a digital organization, you've got to take people's amazing talents and create an 'and' strategy for technology. To be relevant and future ready, you for instance need to have your commercial expertise and digital expertise. Scientific expertise and digital. You can have the best technology, but without that integrated way of thinking, it won't transform anything." - Jim Swanson, Executive Vice President and Chief Information Officer, Johnson & Johnson

This transformation starts at the top. When leadership prioritizes data-driven decision-making, it sets the tone for the entire organization. Data literacy then becomes a key part of professional development. The industry is already shifting in this direction, moving toward comprehensive platforms that consolidate data and simplify workflows. Instead of focusing on niche tools, CRE firms are increasingly seeking systems that offer interoperability and broader value.

Creating a learning culture is another important step. Encouraging continuous skill development helps teams stay ahead of new data sources and integration challenges. This cultural evolution ensures that technical advancements in platforms like CoreCast translate into actionable insights that drive business outcomes.

Training and Hiring Strategies

Closing the skills gap requires a mix of training current employees and hiring new talent with data expertise. Both approaches are crucial for building teams capable of tackling complex data integration tasks.

Training programs should focus on real-world applications rather than theoretical concepts. CRE professionals need to understand how to collect, merge, and analyze data in ways that directly impact their daily responsibilities. Effective training also bridges communication gaps by enabling technical staff to explain analytics concepts to non-technical colleagues.

Specialized training tailored to real estate is particularly important. Hiring data engineers, analysts, and scientists with CRE experience can bring both technical skills and industry knowledge to the table. Collaboration across teams - between data scientists, machine learning engineers, and software developers - further ensures that technical solutions align with business goals.

Cybersecurity is another critical element. With 92% of large real estate investment trusts (REITs) identifying cybersecurity as a major threat, training teams in secure data handling is non-negotiable to mitigate risks from third-party integrations.

Platforms like CoreCast can help bridge the gap by offering user-friendly interfaces that simplify data integration. These tools minimize the need for extensive technical expertise, allowing teams to focus on analysis and decision-making rather than wrestling with complex implementations.

Investing in data-ready teams today positions CRE organizations to harness advanced analytics and artificial intelligence as these technologies continue to grow in the sector. The payoff? A workforce equipped to turn data into actionable insights and drive the industry forward.

Transform Real Estate Data into Confident Decisions

Join Corecast to streamline your real estate operations, gain real-time insights, and make smarter investment decisions with a unified platform.

Security, Privacy, and Compliance

Bringing third-party systems into the world of commercial real estate (CRE) opens up a host of opportunities but also exposes businesses to new risks. While these integrations can simplify workflows and provide actionable insights, they also introduce vulnerabilities that could compromise sensitive data. These vulnerabilities demand strong security measures and adherence to strict compliance standards, as outlined below.

Data Security Risks

Every connection to a third-party vendor increases your attack surface. And the numbers are hard to ignore: 98% of global companies have worked with at least one vendor that experienced a breach. Even with strong internal security, your organization remains vulnerable through these external relationships. This is especially concerning in the real estate sector, which manages highly sensitive information like financial records, tenant details, property valuations, and investment strategies - prime targets for cybercriminals.

Recent breaches highlight the dangers. In 2021, a third-party vendor for Volkswagen Group of America Inc. left data unsecured online, impacting 97% of Audi’s customers. Similarly, in 2022, Uber fell victim to a breach when a vendor with access to employee data was compromised.

The risks don’t stop at traditional breaches. As CRE increasingly adopts IoT devices for managing buildings and tenant services, these connected tools become new points of vulnerability. While smart building technologies can boost efficiency, they also open doors for cybercriminals if not properly secured during integration.

"The security risks that third parties can introduce can have a variety of potential impacts on your security, including loss or exposure of sensitive data, financial risk, reputational damage and loss of customer trust, and regulatory compliance risk."

– IONIX

Human error adds another layer of risk. According to CISOs, human mistakes are responsible for three out of four cybersecurity breaches. Even the most advanced security measures can fail without proper training and awareness.

Compliance Standards

Understanding and navigating regulatory requirements is key to safeguarding both your data and your reputation. For CRE businesses, integrating third-party systems means tackling a complex web of compliance standards, especially as U.S. data privacy laws continue to evolve.

Handling tenant and financial data comes with heightened responsibilities. Laws like the California Consumer Privacy Act (CCPA) and Virginia Consumer Data Protection Act (VCDPA) set strict rules for managing personal and financial information. Real estate transactions, which often involve sensitive financial data, must also comply with federal banking and financial regulations when integrating payment systems or financial data sources.

For organizations operating across state lines - or internationally - the compliance landscape becomes even more intricate. Each jurisdiction may impose unique requirements for data residency, cross-border data transfers, and breach notifications. Vendors must prove they comply with all relevant regulations, not just in their home region but in every area where the data is processed or stored.

Regulators also demand thorough documentation. Organizations must maintain detailed records of data flows, processing activities, and security protocols. This means third-party integrations need to include robust audit trails and reporting tools to demonstrate compliance at all times.

Best Practices for Secure Integration

Securing third-party integrations requires a layered approach that combines technical safeguards with organizational practices. These strategies not only reduce risk but also ensure CRE operations remain efficient and resilient.

Vendor Risk Assessment: Before integrating any third-party system, evaluate the vendor’s security policies, data handling procedures, and incident response capabilities. Review their compliance certifications, audit results, and history of breaches.

Role-Based Access Controls (RBAC): Limit vendor access to only the data and systems they need. Define specific access profiles for each integration, and regularly review permissions to ensure they remain appropriate as relationships evolve.

Encryption and Secure APIs: Use strong encryption protocols and secure API connections for all data exchanges. Ensure data remains encrypted even when stored in external systems, and use certificate-based authentication for system-to-system communications.

Continuous Monitoring: Detect issues early with tools like External Attack Surface Management (EASM), which monitor vendor-related assets for vulnerabilities. Automated systems can significantly reduce the time to identify and contain breaches - organizations using these tools in 2023 responded 108 days faster.

Network Segmentation: Isolate integrated systems from your core infrastructure to limit the damage of potential breaches. Two-factor authentication adds another layer of protection for all connected systems.

Regular Security Audits: Conduct quarterly reviews of all third-party connections, assessing data flows, access permissions, and security measures. Remove outdated integrations and ensure proper data deletion when vendor contracts end.

Platforms like CoreCast can simplify these efforts by offering centralized security controls and compliance features. Instead of juggling multiple integrations with varying standards, a unified platform ensures consistent policies and streamlined monitoring across all data sources.

Step-by-Step Implementation and Change Management

It can be tempting for leadership to dive headfirst into integrating all systems at once, especially when the benefits of unified data systems are clear. However, rushing into full-scale data integration without a solid plan and phased execution often leads to costly mistakes and operational chaos. This can set commercial real estate (CRE) teams back considerably. A carefully planned, phased strategy is essential to turn fragmented data into actionable insights. Let’s explore how a step-by-step approach minimizes risks while improving outcomes.

Risks of All-at-Once Integration

Trying to integrate multiple data sources simultaneously can overwhelm even the most prepared CRE teams. Connecting systems like property management platforms, market data feeds, financial tools, and analytics systems all at once often creates more problems than it solves.

One major risk is losing access to critical data. If a core system fails during a large-scale rollout, teams may find themselves unable to retrieve tenant information or access vital market data. This can leave property managers, analysts, and investment teams scrambling to perform their jobs effectively.

Simultaneous synchronization also increases the chance of data corruption. For example, property valuations might be overwritten, tenant records duplicated, or financial data rendered inconsistent across platforms. Fixing these errors often requires rolling back to earlier system states, which can delay progress significantly.

Budget overruns are another common issue. Technical teams frequently underestimate the complexity of integrating disparate systems. This can lead to extended timelines, unexpected costs, and resistance from employees struggling to adapt to new workflows without adequate training or support.

Benefits of Step-by-Step Approaches

A phased approach significantly reduces these risks while allowing for steady, measurable progress. Starting small - by piloting specific integrations - helps teams test their strategy, identify potential roadblocks, and refine their methods before tackling larger, mission-critical systems.

During the initial phases, teams can focus on integrating the most valuable data sources first. For instance, a CRE firm might begin by connecting market data feeds to its property analysis tools instead of attempting to integrate every system at once. This targeted approach ensures early wins and builds momentum.

Taking it one step at a time also provides a deeper understanding of the data being processed. Teams can carefully analyze each data source’s role and purpose, which helps prevent compatibility issues that often arise from rushed implementations.

Quality control improves as well. By integrating systems incrementally, teams can verify data formats, check for errors, and address any inconsistencies before they ripple through the entire network. This methodical approach ensures that each integration is solid before moving on to the next.

Additionally, focusing on one integration at a time allows for better preparation. Teams can design effective synchronization mechanisms and clearly map out dependencies between systems without the added pressure of managing multiple connections simultaneously. Testing each phase thoroughly ensures data flows accurately and consistently, making it easier to catch and fix issues early - before they become costly problems.

Monitoring and Feedback Loops

Gradual rollouts transform data integration from a one-time project into an ongoing optimization process. This approach gives employees time to adapt, learn, and provide valuable feedback based on their day-to-day experiences.

Monitoring is key to success. Define clear metrics for each phase, such as data accuracy, system response times, user adoption rates, and error frequencies. These benchmarks help teams identify and address issues before moving forward.

Establish regular feedback loops - starting with weekly check-ins and transitioning to monthly reviews - to gather insights from users. Documenting common challenges, suggestions, and workflow improvements ensures that future integration phases are informed by real-world experiences.

A phased approach also supports continuous development. Teams can address errors as they arise, expand integrations based on proven successes, and maintain system stability throughout the process. This iterative method not only reduces risks but also builds organizational confidence and expertise.

Platforms like CoreCast can simplify this process by offering centralized tools for integration management and monitoring. Instead of juggling multiple projects separately, CRE teams can track progress, measure performance, and gather feedback through a unified interface designed to scale with their timeline.

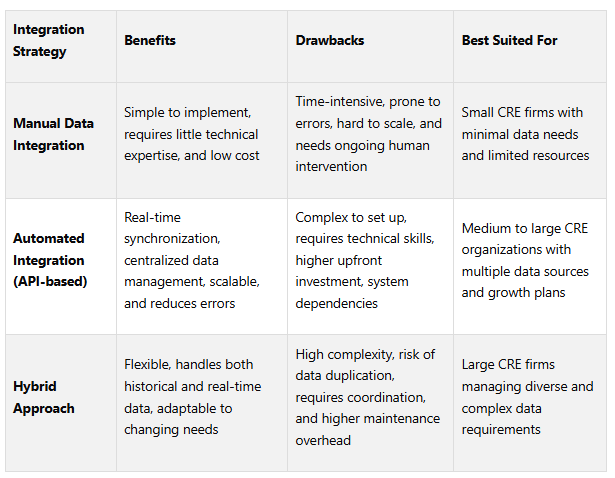

Comparison Table: Integration Strategies

Integration Strategy Comparison

Given the challenges posed by fragmented data and inconsistent quality, having a well-thought-out strategy for data integration is essential. With 94% of organizations aiming for data system modernization in 2024, the stakes are high. Picking the wrong strategy can mean wasted resources, frustrated teams, and missed opportunities in an increasingly competitive market.

Each integration strategy comes with its own set of advantages and trade-offs. From initial costs to long-term scalability, understanding these differences is key. Below is a comparison of the primary integration strategies, outlining their benefits, drawbacks, and ideal use cases in the commercial real estate (CRE) sector:

A statistic from IDC highlights the importance of automation: professionals spend 80% of their time preparing data, leaving only 20% for generating insights. This makes automation a game-changer as your data needs increase.

For small-scale operations, manual data integration can work well for basic analyses. However, as data volumes grow, this approach quickly becomes inefficient. Automated integration, particularly API-based, is ideal for ensuring consistent and reliable data flows. For modern CRE firms juggling multiple property management systems, market data feeds, and financial platforms, API connections provide real-time synchronization. While the initial setup can be challenging, the improvements in accuracy and efficiency often justify the effort.

Hybrid approaches offer the flexibility to handle both historical and real-time data, making them a solid choice for large investment firms. These firms often need to analyze long-term trends while staying responsive to immediate market shifts.

"Data integration is more than a technical process; it's the backbone of agile, insight-driven organizations." - Lumenalta

As you evaluate these strategies, think about your firm's current and future data needs. With $1.8 trillion in commercial loans maturing by 2026, having a robust integration system in place will be crucial for navigating upcoming challenges.

The best approach depends on your operational scale and growth trajectory. Smaller firms might start with manual methods and transition to automation as they expand, while larger organizations often benefit from starting with automated or hybrid systems to minimize future risks.

CoreCast simplifies this decision by offering integrated, flexible tools that grow with your data needs. Instead of locking into rigid options, you gain access to a unified intelligence platform tailored for modern CRE operations. This comparison provides a foundation for making strategic decisions about data integration.

Conclusion

As discussed earlier, tackling fragmented data and refining operational workflows is critical for success in commercial real estate (CRE). These aren't just technical hurdles - they're significant barriers to making smarter investment decisions in a competitive landscape. Consider this: 60% of CRE professionals report struggling with data silos and consolidation, while 55% still depend on manual data manipulation for reporting tasks. These inefficiencies can lead to costly mistakes or missed opportunities worth millions.

To overcome these challenges, CRE firms need to focus on five key areas: fragmented data sources and system compatibility, data quality and consistency, team readiness and skills gaps, security and compliance risks, and strategic implementation. Solutions range from adopting centralized platforms with robust API capabilities to establishing strong data governance practices and investing in upskilling teams.

The stakes are high. In today’s fast-moving market, CRE firms must have unified systems that deliver real-time insights and streamline workflows. Relying on manual processes or disconnected systems simply won’t cut it when timely, accurate analysis is essential.

This is where CoreCast comes in. As a comprehensive real estate intelligence platform, CoreCast centralizes data across multiple sources, supports third-party integrations, and automates reporting processes that traditionally require hours of manual effort. With CoreCast, CRE professionals can underwrite any asset class, monitor deal pipelines, analyze portfolios, and produce branded reports - all within a single platform.

By automating time-intensive tasks, CoreCast allows professionals to focus on generating actionable insights and making strategic decisions. Its integrated mapping, portfolio analysis, and stakeholder reporting tools eliminate data silos, creating a single source of truth for all investment activities. This not only addresses current inefficiencies but also equips CRE teams to meet future market demands head-on.

The choice is clear: continue struggling with fragmented systems and outdated workflows, or embrace integrated solutions that enhance operations and unlock actionable insights. For those ready to streamline deal pipelines and make data-driven decisions, the tools to solve these challenges are already here.

FAQs

-

To address system compatibility issues in commercial real estate (CRE) data integration, the first step is to standardize data formats and protocols. This approach helps different systems communicate effectively and minimizes the chances of data inconsistencies. Leveraging tools like APIs and other integration technologies can simplify this process and make it more efficient.

Another important measure is to establish strong monitoring and error-handling systems. These mechanisms allow you to detect and fix compatibility problems quickly. Conducting regular audits of your data pipelines can further ensure smooth operations and reduce potential disruptions. Focusing on these strategies can lead to a more efficient and dependable integration workflow.

-

To address skill gaps and strengthen data integration, CRE firms should invest in continuous training and upskilling initiatives focused on data management, analytics, and modern technology platforms. This approach ensures that teams are well-prepared to use current tools and workflows efficiently.

On top of that, implementing automation and AI-powered solutions can reduce the burden of repetitive tasks, freeing up teams to focus on more strategic, value-driven projects. By blending skill-building efforts with cutting-edge technology, firms can improve their data integration capabilities and maintain a competitive edge in today’s data-centric landscape.

-

When integrating third-party systems in commercial real estate, safeguarding sensitive data and adhering to compliance standards should be top priorities. One way to achieve this is by using data encryption to protect information both when it’s stored and while it’s being transmitted. This ensures that even if data is intercepted, it remains unreadable to unauthorized parties.

Another key measure is implementing role-based access controls. By restricting access to specific information based on a user's role, organizations can minimize the risk of unauthorized data exposure.

It’s also crucial to perform regular security audits and compliance checks to identify potential vulnerabilities and ensure alignment with regulatory frameworks like GDPR or CCPA. These assessments help organizations stay ahead of risks and maintain adherence to legal requirements.

Lastly, conducting thorough due diligence on third-party providers is essential. Evaluating their security measures, certifications, and overall protocols can help ensure that your data remains secure and compliant with industry standards. This extra step can make a significant difference in protecting data integrity.