Top Market Data Sources for CRE Underwriting

Commercial real estate (CRE) underwriting has shifted dramatically in the past decade, moving from intuition-based practices to data-driven decisions. With access to over 1 trillion data points in 2025 (up from 200 billion in 2020), underwriters now rely on advanced tools and metrics like DSCR, LTV, Cap Rate, and NOI to assess risks and identify opportunities.

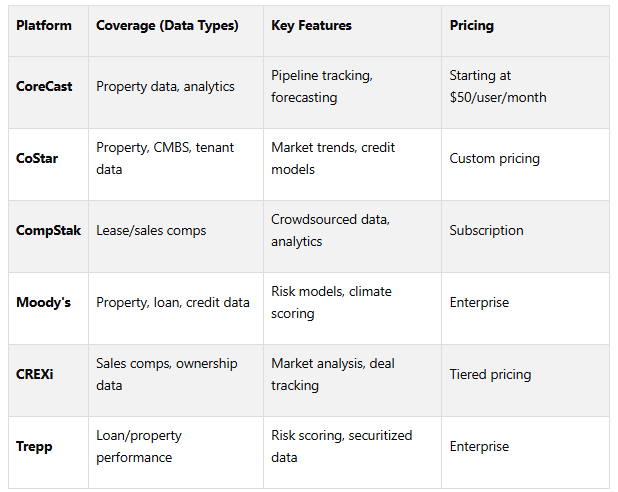

Here are six leading platforms for CRE market data:

CoreCast: Offers real-time property intelligence, pipeline tracking, and portfolio insights for as low as $50/user/month.

CoStar: Features a vast property database, CMBS data, and predictive analytics.

CompStak: Crowdsourced lease and sales data with granular transaction details.

Moody’s Analytics | CRE: Combines property data with credit risk modeling and climate risk scoring.

CREXi Intelligence: Centralizes sales comps, market trends, and ownership details for deal evaluation.

Trepp: Specializes in securitized loan data, risk scoring, and property-level analytics.

Each platform caters to specific needs, from deal tracking to risk assessment and market forecasting.

Quick Comparison

1. CoreCast

CoreCast is an all-in-one real estate intelligence platform designed to turn complex data into actionable insights for commercial real estate (CRE) underwriting. By providing real-time, integrated market intelligence in a single platform, it eliminates the need for juggling multiple tools. This streamlined approach lays the groundwork for CoreCast's extensive capabilities in CRE underwriting.

Key Features

One of CoreCast's standout tools is its Underwriter module, a powerful modeling engine tailored for all major CRE asset classes and investment strategies. By replacing outdated systems, this centralized module ensures efficient, auditable modeling processes.

With built-in machine learning and automation, CoreCast helps underwriters proactively identify both risks and opportunities. Its forecasting tools combine historical data, benchmarks, and user-defined assumptions to deliver precise performance projections.

The Pipeline Tracker provides real-time updates on deal statuses, following properties through every stage - from initial evaluation to final disposition. This feature simplifies deal tracking and has shown measurable results. For instance, a REIT director shared:

"With the Pipeline Tracker, we reduced deal slippage by 30% over two quarters. The visibility and accountability it provides are game-changers."

– Director of Acquisitions, REIT

Data Coverage

CoreCast's data management capabilities go beyond just modeling. It centralizes data across key asset classes - such as office, retail, industrial, and multifamily - ensuring all assets, projects, and datasets are unified. This foundation keeps analyses consistent and up to date.

The Portfolio Insights feature offers a live dashboard showcasing real-time valuations, performance trends, and detailed breakdowns of income and expenses. Unlike static spreadsheets, CoreCast's dynamic portfolios are directly linked to the Underwriter module, ensuring that all analyses remain current and synchronized.

Integration Capabilities

CoreCast integrates effortlessly with popular property management and accounting systems like Buildium, QuickBooks, and RealPage. This connectivity eliminates the need for manual data entry, giving underwriters instant access to the latest property-level information.

The platform also includes a Reports module, which generates customizable reports with options for branding, visuals, and layouts. Meanwhile, the Stakeholders feature simplifies complex capital structures by linking each stakeholder to their specific tranche, role, and reporting needs. These integrations ensure underwriters can make decisions based on the most accurate and reliable data available.

Relevance to CRE Underwriting

CoreCast brings together multiple analytical tools into one cohesive platform, aligning with the growing trend of data-driven decision-making in CRE. Role-based access safeguards sensitive inputs while maintaining transparency for key decision-makers. Its impact on operational efficiency is undeniable. An asset manager from a mid-market private equity firm noted:

"CoreCast transformed how we communicate portfolio performance to stakeholders. We now spend more time analyzing data, and less time assembling it."

– Asset Manager, Mid-Market Private Equity Firm

The platform also streamlines workflows, reducing tasks that previously took hours to just minutes. At a cost of approximately $105 per user per month, CoreCast offers a scalable solution for organizations of all sizes and is projected to support over 100,000 users by 2030.

2. CoStar

CoStar is the go-to platform for commercial real estate data and analytics, serving as a critical resource for underwriters across the United States. With an investment exceeding $5 billion in research and technology, CoStar has developed one of the most extensive commercial real estate databases available today.

Data Coverage

CoStar's database includes information on over 7.3 million commercial properties and 20 million sale and lease comparables spanning 450 markets and 11,888 submarkets. This level of detail ensures highly localized insights for users .

The platform employs a team of more than 1,600 researchers who continuously update property, transaction, and tenant data. These efforts result in an impressive 3.9 billion updates annually. CoStar covers a wide range of asset types, including multifamily, office, industrial, hospitality, and retail properties. Users can access data on vacancy rates, rental trends, sale comparables, and tenant details.

One standout feature is CoStar’s CMBS dataset, which provides insights into $1 trillion of active debt across 100,000 CMBS loans. When factoring in disposed records over the past two decades, the dataset expands to $2 trillion in debt across 200,000 loans. It also includes 90,000 active commercial lease expirations and 40,000 detailed building operating statements.

Key Features

A cornerstone of CoStar’s offerings is its COMPASS credit default model, a risk assessment tool tested for over 17 years and supported by 18 years of data . This model allows underwriters to assess credit risk and make decisions grounded in validated methodologies.

The platform also provides one-, three-, and five-year forecasts for key performance indicators, which users can adjust to reflect different economic scenarios. This feature helps underwriters evaluate market conditions and refine their assumptions through stress testing.

CoStar offers market and submarket analytics enriched with current commentaries to give context to the data. Users can view properties on interactive maps, generate custom reports, and analyze data based on location, building type, or sales activity. These tools are particularly valuable for benchmarking property performance against market averages. The platform's analytical tools are designed for ease of use and integrate seamlessly into workflows.

Integration Capabilities

CoStar is designed to integrate smoothly into existing underwriting systems. For instance, the COMPASS credit risk model can be incorporated into internal systems via API, allowing organizations to embed CoStar's analytics into their proprietary platforms.

In February 2021, CoStar expanded its integration capabilities by embedding CMBS loan and property data directly into its commercial real estate platform. This enhancement brought in regularly updated financials, including loan performance metrics and detailed property operating statements, offering a more complete view of real estate assets.

CoStar for Lenders takes integration a step further, connecting a user's loan portfolio with CoStar's data, analytics, and the COMPASS model. Andrew Florance, Founder and CEO of CoStar Group, described this innovation:

"For the first time, we've created a live connection between a user's loan portfolio, CoStar's unrivaled data, market analytics, our various online marketplaces and our proprietary COMPASS Credit Default Model. Our clients will now have a lending solution unlike anything the commercial real estate industry has ever seen before."

Relevance to CRE Underwriting

CoStar’s features and integrations empower underwriters to better evaluate risk and property value. The platform provides timely LTV (loan-to-value) and DSCR (debt service coverage ratio) data for entire portfolios, offering detailed property-level insights. This enables underwriters to benchmark property performance and access market intelligence across the commercial real estate landscape.

For those working with commercial mortgage-backed securities, CoStar’s CMBS Investor Platform delivers comprehensive data on 191,000 CMBS properties, 1.3 million peer properties, 1.2 million sale comparables, 2.0 million lease comparables, and 500,000 tenants. This breadth of information supports thorough risk analysis and market evaluation.

CoStar’s analytics are backed by a team of experts, including Ph.Ds, CFAs, and CPAs, ensuring the highest level of professional rigor. By streamlining risk management, improving operational efficiency, and delivering deep insights into markets, buildings, and loans, CoStar has become an indispensable tool for modern commercial real estate underwriting.

3. CompStak

CompStak provides detailed, user-sourced lease and sales data across the U.S., offering a level of specificity that's hard to find with traditional data providers. Unlike platforms that rely on anonymized or averaged data, CompStak delivers deal-specific information, giving underwriters the tools they need for accurate property valuations and better risk assessments. This granular data serves as the foundation for CompStak's robust suite of analytical tools.

Data Coverage

CompStak's database spans 3.4 million properties across 105 U.S. markets. It includes 3.5 billion square feet of leased space and supports a community of over 35,000 commercial real estate professionals. The platform thrives on its user-driven model, where members submit comparable transactions via the Exchange platform. Every month, users gain access to more than 60,000 new comparables with detailed metrics like starting rent, lease terms, expiration dates, and net operating income.

Key Features

CompStak's tools are designed to make data-driven analysis straightforward and actionable. Some standout features include:

Market Rent Algorithm: This tool estimates starting rents, helping users make precise income projections.

Chartbuilder: Allows users to create custom, trend-based analyses at both market and submarket levels.

Market Dashboard: Offers interactive visualizations of market trends, rent distributions, and tenant migration patterns.

Map Analytics: Displays geographic data visually for better spatial understanding.

CompStak Portfolios: Helps users benchmark property performance effectively.

These tools integrate seamlessly into workflows, connecting with industry-standard platforms to enhance productivity.

Integration Capabilities

CompStak works effortlessly with several key platforms, including:

Dealpath for automated data retrieval

Trepp for CMBS loan details

RealPage for multifamily property data

Relevance to CRE Underwriting

CompStak's verified and detailed transaction data equips underwriters with the insights needed for precise property valuations and risk mitigation. By leveraging market trends and transaction specifics, users can confidently calculate vacancy allowances, determine net operating income, and establish cap rates based on actual market activity.

"CompStak's data is so reliable that I literally saved my clients money on EVERY transaction since I started using it."

– Benjamin Osgood, Recreate

Propmodo also highlights the platform's value:

"CompStak has very accurate information and is able to share specifics on each deal, unlike some other data providers that anonymize and average it. The data they have is so valuable that it might be able to be the basis for a lot of other tools."

For example, when analyzing a property like 777 Mariners Island Boulevard in San Mateo, California, CompStak users can access detailed leasing data for every tenant. This includes lease transaction sizes, terms, and effective rents, enabling accurate gross rental income calculations and identifying opportunities to improve net operating income. Professionals can even explore the platform with a free account before committing to a paid plan, making it accessible to newcomers and seasoned CRE professionals alike.

4. Moody's Analytics | CRE

Moody's Analytics | CRE combines over four decades of commercial real estate (CRE) data with advanced analytics and credit risk modeling to provide a comprehensive understanding of property performance and tenant credit risk. This dual focus equips underwriters with a clearer picture of investment risks.

Data Coverage

The platform boasts one of the industry's most extensive datasets, covering 8.2 million properties across 275+ markets and 3,000 submarkets in the United States. It offers detailed property-level insights, such as unit mix, asking rents, tax records, deed and mortgage history, and structural performance metrics. Additionally, it incorporates location-based climate risk scoring, spanning multiple asset classes.

Beyond property data, Moody's provides granular details on loans from CMBS, Freddie Mac, and Fannie Mae. Historical economic and demographic time-series data further enhances the ability to assess broader market trends. The platform also integrates credit ratings and risk models to evaluate tenant creditworthiness, offering insights like probability of default for both private and public companies. This allows underwriters to assess not only the physical asset but also the financial health of its income stream.

This robust data foundation supports the platform's advanced analytical tools.

Key Features

Moody's Analytics | CRE includes a suite of specialized tools tailored for CRE analysis:

REIS®: Offers detailed property data and analytics, backed by over 40 years of real estate performance history, aiding in trend analysis and market forecasting.

CMM®: Combines property performance forecasts with mortgage fundamentals to evaluate default and recovery scenarios for CRE mortgages.

CreditLens™: Speeds up credit assessments, enabling financial institutions to make quicker and more informed lending decisions.

RiskCalc™: Provides a comprehensive framework for assessing default and recovery probabilities for private firms, financial institutions, and project finance deals.

Commercial Location Scores (CLS): Uses a proprietary algorithm to evaluate a property's fit within its location, factoring in accessibility, demographics, and market dynamics.

Integration Capabilities

Moody's Analytics | CRE seamlessly integrates into underwriting workflows via bulk data downloads and API access, enabling automation and custom application development. Additionally, Moody's Lending Suite can connect directly with a bank's loan origination systems, creating a streamlined, end-to-end solution for the lending process.

These integration options simplify workflows and enhance underwriting precision.

Relevance to CRE Underwriting

By combining property and tenant risk insights, Moody's Analytics | CRE reflects the industry's growing reliance on data-driven underwriting. The platform eliminates manual tasks, ensuring a transparent and efficient process throughout the CRE lifecycle. It supports lending, underwriting, data ingestion, hold/sell analysis, stress testing, and portfolio monitoring.

Luis Amador, General Manager of CRE Solutions at Moody's Analytics, highlights its importance:

"Commercial real estate has changed rapidly, and we have seen CRE professionals increasingly embrace technology and analytics to stay competitive. However, we continue to hear that most still rely on narrow datasets, disparate systems, and cumbersome manual processes. We are striving to solve those challenges by expanding on the foundation of property data we have built to date. We are investing in intelligent solutions that leverage our unique data and analytics to streamline workflows and surface insights at the point of decision-making."

The platform's influence is evident, with over 1,000 customers relying on Moody's CRE solutions. Moody's also rates more than $400 billion in global CMBS/CRE CLO debt and 193 Equity REITs, while covering over $800 billion in CRE exposure for rated insurance companies. This widespread adoption underscores its role as a trusted resource for high-stakes underwriting decisions.

Transform Real Estate Data into Confident Decisions

Join Corecast to streamline your real estate operations, gain real-time insights, and make smarter investment decisions with a unified platform.

CREXi Intelligence is designed to meet the growing demand for data-driven decision-making in commercial real estate (CRE). It provides a centralized platform that consolidates property and market data, making the underwriting process more efficient.

Data Coverage

The platform boasts an extensive database, including information on millions of U.S. properties. It features over 13 million sales comparables and property history records for more than 1 million sales listings. The data spans a wide range of categories, such as:

Sales comparables and transaction history

Ownership details

Financial metrics, including income, expenses, profitability, and CMBS/loan data

Market trends, such as vacancy rates, rental patterns, demand indicators, and loan maturity dates

This rich dataset serves as the backbone for advanced analytics and insights.

Key Features

CREXi Intelligence leverages its comprehensive database to deliver actionable analytics. Key features include:

Market Analysis and Benchmarking: Lenders can analyze market conditions and compare properties to set competitive loan terms.

Customizable Reports: Users can create tailored presentations that incorporate property history, demographic data, and sales comparables.

Detailed Property Records: Thorough records and comparables aid in due diligence.

Workflow Integration: Data can be exported for seamless use in existing systems.

Enhanced Features for CREXi PRO Users: Subscribers gain access to additional tools, such as CMBS data, private loan details, and ownership contact information .

Integration Capabilities

The platform integrates with LinkedIn to enhance networking opportunities and includes export functions for easy incorporation into underwriting workflows . These features simplify the process of managing and analyzing data, making underwriting more efficient.

Relevance to CRE Underwriting

CREXi Intelligence empowers underwriters by consolidating critical data and analytics into one platform. This allows them to:

Evaluate deals with greater accuracy

Compare historical transactions

Quickly assess current market conditions

By providing insights into loan maturities, the platform also helps lenders identify potential opportunities for business development. This data-centric approach ensures that decisions are aligned with market trends, optimizing both returns and net operating income.

Dan Sterba, Vice President of LCD Commercial Lending, highlights the platform’s value in educating stakeholders:

"Education is a huge part of what we do. We work with many commercial stakeholders that are just dipping their toes into commercial real estate, and Crexi has been a great tool with which to advise people."

With over 50 million lifetime users, CREXi Intelligence supports buyers, sellers, and investors throughout the CRE deal cycle. Its tools enhance data quality and provide actionable insights, enabling underwriters to evaluate project viability with greater confidence.

6. Trepp

Trepp continues to push the boundaries of data-driven decision-making in commercial real estate (CRE) underwriting with its specialized platform. With over four decades of experience and a client base exceeding 1,000 firms, Trepp offers a trusted source for data, insights, and technology tailored to structured finance, CRE, and banking needs [40,45].

Data Coverage

TreppCRE provides an extensive view of the U.S. commercial property landscape, tracking data on more than 4 million properties. Its platform consolidates securitized property data, sales records, lease details, and tax assessments, creating a comprehensive market overview. Covering all major property types - such as Industrial, Lodging, Mixed-Use, Multifamily, Office, Retail, and Alternative Properties - Trepp also boasts the largest catalog of securitized loans, complete with detailed loan-level data. Additional offerings include geographic statistics, benchmarking tools, historic revenue data, and decades of performance metrics at both property and market levels [41,45].

Key Features

TreppCRE leverages machine learning to deliver advanced analytics and precise risk assessments. Its AI-driven comparables engine provides accurate transaction and appraisal data, while enhanced search tools make it easier for professionals to navigate and extract insights. The platform also offers customizable risk analysis, generating risk scores for properties nationwide to help underwriters evaluate potential investments quickly. Users can set up alerts to track changes in tenants, appraisal values, or recent sales. TreppInsights, another standout feature, includes dashboards that allow users to refine searches with specific metrics and visually benchmark properties, loans, and markets. These tools simplify underwriting and accelerate risk evaluation.

Integration Capabilities

Trepp supports seamless integration with internal systems through APIs, Data Lake solutions, and Advisory Services. These options enable cashflow reporting, credit risk tracking, performance analysis, fair value validation, and custom analytics. For portfolio management, TreppPort integrates clients' CRE portfolios with Trepp's public market data, which includes information on 150,000 loans. This software-as-a-service solution centralizes the management, analysis, and benchmarking of CRE bonds, loans, and properties in one platform [43,44].

Relevance to CRE Underwriting

Trepp aligns with the growing demand for data-centric decision-making in the CRE industry. The platform equips underwriters with the tools to analyze property data, transactions, and market trends cohesively. It also streamlines deal pre-qualification and facilitates benchmarking across different markets. By presenting data in context, Trepp helps users connect market performance statistics, underwriting trends, and lending activity more effectively. Additionally, it provides critical insights into acquisitions, refinancing, and market-specific deal opportunities [41,45].

Platform Comparison Table

When it comes to selecting the right market data source for CRE underwriting, understanding the key differences between platforms is essential. The table below breaks down each platform's data coverage, geographic reach, integration capabilities, core features, and pricing transparency.

The platforms above showcase a variety of strengths tailored to different aspects of CRE underwriting. For instance, CoreCast stands out with its transparent pricing and all-in-one platform that combines tools like pipeline tracking and branded reporting. On the other hand, CoStar boasts an extensive database with real-time demographic insights, making it a go-to for professionals analyzing market trends.

CompStak takes a unique approach with its crowdsourced data model, offering lease comps and metrics that cover over 10 billion square feet. Meanwhile, Moody's Analytics leans on decades of financial expertise, providing vetted datasets and market forecasting. For those focused on loan performance, Trepp offers advanced risk assessment tools and a comprehensive securitized loan database. Lastly, CREXi Intelligence emphasizes deal sourcing and market-specific insights for investors.

Choosing the right platform often depends on specific underwriting needs. For example, an investor tracking demographic trends might find CoStar's ESRI-powered data invaluable, while a lender assessing loan performance might prefer Trepp's advanced analytics. The right combination of data integration, geographic coverage, and pricing clarity can help CRE professionals make faster, more informed decisions.

Conclusion

Market data plays a key role in accurate commercial real estate (CRE) underwriting. With market conditions constantly changing and operational costs climbing, having access to reliable, up-to-date information is essential for making smart investment choices.

These evolving dynamics highlight the need for selecting the right data tools. Andrew Hulbert, MSc FIWFM, puts it well:

"Prioritizing data quality and relevance in a CRE benchmarking tool is crucial. Ensure the tool sources accurate, up-to-date data from reputable sources, aligning with your market and property types. Evaluate the cost and value proposition of a CRE benchmarking tool by considering the total ownership expenses, including licensing, implementation, and maintenance costs. Balance this against the tool's value in delivering actionable insights, efficiency gains, and strategic advantages."

When assessing market data platforms, CRE professionals should keep usability, scalability, and cost-effectiveness front and center. The best platforms strike a balance between broad data coverage and user-friendly interfaces, helping users make decisions quickly and confidently.

Integrated platforms like CoreCast are reshaping the way CRE professionals handle underwriting. By combining tools for data analysis, pipeline tracking, competitive mapping, and reporting into one seamless solution, these platforms eliminate the need for juggling multiple systems. This shift represents a major step forward in turning raw data into actionable insights.

As the move toward integrated platforms gains momentum, it’s clear that successful underwriting now hinges on tools that deliver real-time insights from comprehensive data. The future belongs to CRE professionals who embrace these intelligent systems to make faster, more informed decisions in an increasingly competitive landscape.

FAQs

-

CoreCast is an all-in-one real estate intelligence platform designed to handle everything from underwriting and pipeline tracking to portfolio analysis and stakeholder communication. By bringing all these tools together, it streamlines the process of evaluating any type of asset or risk profile. Plus, it offers real-time insights and customizable reports tailored to meet the needs of key stakeholders.

What sets CoreCast apart is its unique features, such as interactive mapping for competitive analysis, a centralized hub for stakeholder collaboration, and branded reporting tools. With a focus on delivering a smooth and intuitive experience, CoreCast helps real estate professionals make smarter investment decisions and operate more efficiently.

-

Data-driven platforms like CoreCast are changing the game for commercial real estate (CRE) underwriting. By utilizing cutting-edge technology, these tools simplify the underwriting process, making property evaluations both quicker and more accurate. This not only saves time but also minimizes the risk of human error.

With capabilities like real-time data analysis, risk assessment, and predictive insights, platforms such as CoreCast give professionals the tools they need to make smarter, more informed decisions. They also improve investment strategies by offering a full picture of property performance, market trends, and competitive dynamics - all through a single, integrated system.

-

Integrating property management and accounting systems with CoreCast takes its functionality to the next level. It simplifies workflows, automates financial tasks, and minimizes manual mistakes. Plus, this connection provides real-time access to property performance metrics, making financial analysis and decision-making more precise.

By bringing essential data into a single platform, commercial real estate professionals can save time, boost efficiency, and concentrate on crafting smarter investment strategies. In the long run, this integration supports improved portfolio management and helps drive profitability.