Tracking Migration Patterns for Real Estate Insights

Understanding where and why people move is key to navigating real estate trends. Migration patterns reveal shifts in housing demand, driven by factors like job growth, affordability, and lifestyle changes. States such as Florida, Texas, and Arizona are seeing population gains, while areas like New York and California face outflows.

Key takeaways:

Migration Trends: Sun Belt states lead in population growth due to job opportunities, lower taxes, and housing affordability.

Housing Impacts: Rising migration drives rental demand and home values in growing areas while creating challenges in declining markets.

Data Sources: Tools like Census data, USPS records, and geospatial analytics help track and predict movement.

Investment Tips: Look for markets with population inflows and lagging housing supply for potential opportunities.

Tools like CoreCast turn migration data into actionable insights, helping investors and professionals make better decisions in a shifting landscape.

Finding and Analyzing Migration Data

Key Sources of Migration Data

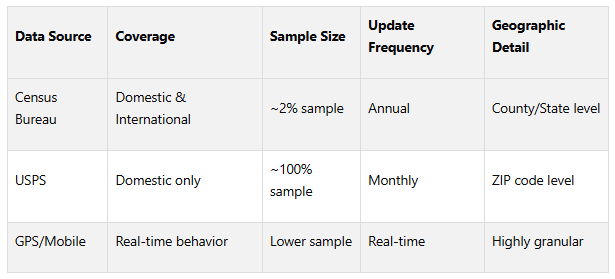

Migration data comes from a variety of sources, each offering unique insights into movement patterns. Government databases provide the most reliable foundation, delivering official statistics on both domestic and international migration.

The U.S. Census Bureau is a primary source for migration estimates, with a 2% sample rate available at the county and state levels. In December 2024, the Census Bureau updated its methodology for estimating net migration, revealing that 2.8 million people moved to the United States between 2023 and 2024 - higher than earlier estimates due to these improvements.

The U.S. Citizenship and Immigration Services (USCIS) offers detailed data on immigration and citizenship trends. Recent figures show the foreign-born population in the U.S. reached 47.8 million in 2023 and is projected to grow to 53.3 million by January 2025, representing 15.8% of the total population.

For tracking domestic movements, United States Postal Service (USPS) change-of-address data is invaluable. With nearly 100% population coverage and monthly updates at the ZIP code level, it provides a detailed view of internal migration. However, it does not account for international moves.

The Migration Policy Institute (MPI) adds context to raw government data, offering tools and analyses to understand migration patterns better. Meanwhile, GPS and mobile data provide near real-time tracking of migration trends, although these sources have smaller sample sizes and limited personal details.

These diverse sources provide the groundwork for understanding migration trends and the factors driving them.

Using Demographics and Psychographics for Better Analysis

Raw migration numbers only scratch the surface. To understand why people move and where they go, you need to combine demographic and psychographic data for a fuller picture.

Factors like population growth, age distribution, employment rates, and income levels all play a role in migration decisions. For example, millennials now make up over 50% of U.S. homebuyers. This generational shift is reshaping real estate markets as millennials prioritize walkable neighborhoods and flexible home designs, unlike baby boomers who often seek homes suited for aging in place.

Motivations for moving also shed light on these patterns. In 2024, 42% of moves were driven by housing reasons, with 36% of REALTORS' clients relocating to a different state. Among them, 30% wanted to be closer to family and friends, while 21% sought more affordable housing.

Psychographic data dives deeper, exploring lifestyle preferences, values, and attitudes. For instance, 70% of buyers today prioritize green-certified homes, which often sell for about 15% more than standard properties. By merging demographic and psychographic insights, real estate professionals can create detailed buyer personas and anticipate market demands. Agencies using this approach have achieved property value predictions with nearly 40% accuracy.

Generational trends also provide valuable context. Nearly one in five Americans now lives in a multigenerational household - a figure that has more than doubled in four decades. This shift influences housing preferences, driving demand for larger, more affordable homes in specific areas.

Using Location Intelligence Tools

While demographic and psychographic data explain who is moving and why, location intelligence tools reveal where these moves are happening. These tools analyze migration patterns geographically, offering insights from neighborhood to regional levels.

Mapping software allows professionals to visualize migration flows and overlay demographic data with geographic boundaries. This makes it easier to spot emerging hotspots or areas in decline that might not be obvious in raw data.

Foot traffic analytics add another layer by tracking real-time activity around retail centers, employment hubs, and residential areas. These insights can signal neighborhood changes before they appear in official statistics. For example, shifts in migration behavior since the pandemic show that overall movement has decreased compared to 2020 and 2021, with most moves now occurring within the same metro area. Urban-to-suburban migration has slowed, and many urban households are relocating within city limits. Additionally, affordable areas near expensive metros are becoming new migration hotspots.

"Understanding annual migration trends is important in making informed real estate decisions. Retailers leverage this data to identify high-growth areas for expansion, governments use it to plan for infrastructure needs and adjust tax revenues, and businesses assess it to gauge talent availability in different regions." - Colliers

Location intelligence also supports comparative analysis across geographic scales. Real estate professionals can examine ZIP code-level migration patterns while considering broader county or state trends. This helps identify whether local changes are isolated or part of a larger regional shift.

How migration is dividing the housing market in two

Reading Migration Data for Real Estate Market Information

To make smarter investment decisions, it's crucial to interpret migration data alongside key economic indicators. By combining insights on population movement with market fundamentals, you can uncover opportunities and risks that might not be immediately clear when looking at these datasets in isolation. This approach lays the groundwork for understanding affordability-driven migration and contrasting market dynamics.

Economic indicators like GDP growth, inflation, and unemployment have a direct impact on real estate trends. When these factors align with positive migration patterns, they signal strong potential for real estate opportunities. For example, areas experiencing both job growth and population inflows often see a steady demand for housing across various price points.

Mark Zandi, Chief Economist at Moody's Economy.com, highlights the importance of mobility in the U.S. economy:

"The ability to move to a place where there are better opportunities is important to the health of the US economy and has long made downturns in the USA shorter and shallower than those in other parts of the world".

This mobility creates patterns that real estate professionals can use to refine their investment strategies, especially as economic shifts influence housing demand.

Analyzing Affordability-Driven Migration

Housing affordability is one of the biggest drivers of migration today. When the cost of living in major metropolitan areas becomes unsustainable, many people relocate to more affordable regions, creating ripple effects across multiple markets. For instance, in some cities, the cost of owning a home is over 90% higher than renting. This significant gap often pushes people to move, creating investment opportunities in the areas they migrate to.

Nearly half of all relocations are directly tied to housing affordability. This trend has led to a growing preference for smaller, less expensive metro areas across the country. Popular destinations often include Sun Belt markets and mid-sized cities that offer lower taxes, job growth, and better quality of life.

For investors, this migration creates noticeable impacts. Markets receiving affordability-driven migration typically see a surge in rental demand before home prices begin to rise. Commercial leasing activity often hints at residential growth 12–18 months in advance, making it a useful early signal for investors.

Tracking these patterns involves monitoring the relationship between median home prices and median household incomes in different areas. When this ratio becomes unsustainable in expensive markets, outmigration to more affordable areas tends to increase. On the flip side, markets with improving affordability ratios often emerge as new migration hotspots.

Comparing High-Growth vs. Affordable Markets

As affordability-driven trends reshape the market, it helps to compare high-growth areas with more affordable ones to align your investment strategy. High-growth markets attract people seeking better career opportunities and lifestyles. However, rising housing costs in these areas have started to temper migration trends, which means timing investments in these markets becomes even more critical.

Affordable markets, often found in Sun Belt regions and mid-sized cities, continue to benefit from steady migration as residents look for relief from high living costs. These areas tend to offer more predictable cash flow, even if home price appreciation is slower. Additionally, some emerging markets strike a balance between growth potential and affordability, though they come with moderate risks that require careful timing.

Finding New Investment Opportunities

Once you understand the dynamics of affordability and growth, the next step is to identify emerging markets where migration trends reveal untapped potential. Migration data can spotlight markets before they gain widespread attention.

Start by cross-referencing multiple data sources. Smart investors pair demographic data with local infrastructure plans to separate sustainable growth areas from short-term demand spikes. This helps distinguish long-term opportunities from temporary market fluctuations.

Finding the right properties often means uncovering patterns others miss, guiding stakeholders through complex local trends and shifting demand. Look for areas where migration data shows consistent population inflows, but real estate prices haven’t yet caught up to the new demand.

Other indicators can also point to emerging opportunities. For instance, when migration increases but new construction lags, temporary supply shortages can drive up rents and property values. Tracking housing starts alongside migration statistics can reveal these imbalances early on.

Technology plays a key role in migration analysis. Tools like machine learning, data visualization, and geospatial analysis make it easier to forecast trends with precision. These tools can uncover patterns that traditional methods might overlook.

Another trend to watch is the growing demand for data centers, fueled by the expansion of artificial intelligence. As data center construction brings jobs and infrastructure to new areas, it can create secondary migration opportunities in previously overlooked regions.

Localized factors also matter. For example, climate-related shifts in coastal markets or seasonal buying patterns in mountain towns require careful analysis. Understanding these nuances is key to predicting which migration trends will last and which may reverse.

The best opportunities often arise in areas where migration data, economic trends, and infrastructure developments align to support long-term growth. Properties near upgraded transportation networks or public transit hubs, for example, tend to attract higher demand, enhancing their appeal to investors.

Transform Real Estate Data into Confident Decisions

Join Corecast to streamline your real estate operations, gain real-time insights, and make smarter investment decisions with a unified platform.

Understanding Policy and Economic Changes

Decisions made at local, state, and federal levels have a ripple effect, shaping migration trends and real estate markets. Changes in zoning laws, tax policies, and economic conditions play a pivotal role in influencing where people move and how property values shift. By examining these factors, we can better understand how they drive migration patterns.

Tracking Zoning and Tax Policy Changes

Zoning regulations directly affect housing availability and affordability, which in turn impacts migration. For instance, restrictive zoning laws - like those that favor single-family homes over multifamily developments - limit housing options and drive up costs, forcing many residents to look for more affordable alternatives.

Recent zoning reforms have already begun to reshape local housing markets. Take Minneapolis, for example. The city eliminated single-family zoning, and California introduced policies that allow duplexes and small multifamily developments. These changes have led to noticeable shifts in housing production. From 2020 to 2022, Minneapolis experienced a 45% jump in permits issued for 2–4 unit buildings, largely due to reduced parking requirements.

However, even well-meaning policies can produce unexpected results. For instance, inclusionary zoning and transit-oriented development programs have been shown to significantly alter housing supply. Tax incentives and other policy changes also play a role, attracting new residents and businesses, which can further influence migration trends.

Measuring the Effects of Economic Shifts

Policy changes often trigger broader economic effects, particularly in real estate markets. Economic data shows that a 10% rise in migration can lead to a 1.5% increase in housing prices. This highlights how closely tied migration and property values are to policy decisions.

Recent trends in the housing market illustrate this relationship. Between 2020 and 2022, the U.S. National Home Price Index jumped by 34%, while average monthly rents rose by more than 30% during the same period. These soaring costs have pushed many people to relocate to more affordable areas. By 2023, only 15.5% of homes for sale were considered affordable, and the home price-to-income ratio hit a record high in 2022, with housing prices averaging 5.6 times the median household income.

Migration patterns also reflect how economic opportunities influence movement. In 2020, states like Florida, Texas, Arizona, North Carolina, and Washington saw the highest net migration rates. These states combined job growth with relatively affordable housing, making them attractive destinations.

Housing affordability remains the top reason for interstate migration. In 2024, 36% of REALTORS® reported that their clients moved to a different state. Among these moves, 42% were motivated by housing, 26% by family reasons, and 16% by employment opportunities.

Interestingly, some cities are exceeding their permitted housing capacity. Places like Heber, Key West, Hailey, and Boulder have developed more units than zoning laws technically allowed. On the other hand, cities like San Jose, Seattle, and Boston have built fewer units than their zoning permits, leaving room for growth. Similarly, cities such as Tulsa, Oklahoma City, Montgomery, and Toledo have zoning ordinances that allow more units than have been built, signaling potential for expansion.

For real estate professionals, understanding these policy and economic dynamics is crucial. Policymakers must carefully balance growth with broader concerns, as their decisions shape migration trends and open up new opportunities in the real estate market. Staying informed about policy changes, economic trends, and regulatory shifts can help investors and professionals identify where the next wave of migration - and opportunity - might occur.

Using CoreCast for Migration-Based Real Estate Strategies

Understanding migration patterns is one thing, but turning that knowledge into actionable strategies requires the right tools. CoreCast’s real estate intelligence platform takes complex migration data and transforms it into clear, actionable insights. This approach helps real estate professionals spot opportunities that might otherwise go unnoticed using traditional methods. Let’s dive into the specific features that make CoreCast a powerful tool.

Tracking and Viewing Migration Data with CoreCast

CoreCast uses advanced geospatial analytics to map and predict migration trends with impressive detail. By layering multiple data sources - like demographic changes, economic indicators, and environmental risks - directly onto property maps, the platform provides a full view of how migration impacts neighborhoods, zip codes, and even entire metropolitan areas.

One standout feature is real-time tracking. CoreCast consolidates data streams into a single, integrated view, making it easier to monitor trends as they unfold. This is particularly valuable in dynamic markets where migration can quickly shift demand.

Here’s an example: A commercial real estate investor used CoreCast’s geospatial tools to analyze a portfolio spanning several U.S. cities. By tapping into its AI-powered analytics, they pinpointed neighborhoods with strong population growth and low climate risk. This allowed them to strategically reallocate investments, boosting returns while reducing exposure to volatile markets.

CoreCast’s predictive modeling also shines in migration analysis. With an accuracy rate of 87% over three years, the platform helps users anticipate market changes. For instance, data shows that properties within a quarter-mile of new transit stations appreciated 42% more over five years following construction announcements.

Conducting Portfolio Analysis with Migration Data

Leveraging migration insights, CoreCast enhances portfolio management with tools designed for major commercial real estate asset classes. These tools help evaluate how migration trends influence different property types in your portfolio.

CoreCast provides custom portfolio summaries and real-time dashboards that combine migration data with critical metrics like net operating income, occupancy rates, and cash flow. This integration offers a clearer picture of past performance and potential future outcomes.

Another key feature is CoreCast’s AI-driven automated valuation models, which quickly assess property values by factoring in migration-related data. In fast-moving markets, this can make a big difference - investors using advanced geospatial analytics have reported risk-adjusted returns 4–5% higher than market averages. Additionally, CoreCast’s continuous monitoring tools help identify underperforming assets, offering opportunities to capitalize on migration-driven demand while automating much of the analysis, due diligence, and market research processes.

Improving Stakeholder Communication

Effectively sharing these insights with stakeholders is just as important as generating them. CoreCast simplifies this process with branded reporting tools and a centralized stakeholder center.

Branded reports translate complex migration data into clear, easy-to-understand formats for non-technical audiences. These reports highlight how demographic shifts, policy changes, and economic trends create opportunities in specific markets.

The stakeholder center enhances collaboration by giving key parties instant access to updated migration analysis and portfolio performance data. This transparency builds confidence in your strategies. Integrated mapping tools further help visualize trends, making it easier to show how population movements influence investment decisions.

"Transform complex real estate data into confident decisions." - CoreCast

This ability to clearly communicate insights is crucial, especially when justifying investments in emerging markets or explaining challenges in areas experiencing outmigration. With the geospatial analytics market expected to hit $96.3 billion by 2025, having access to these tools early on can give you a competitive edge.

Conclusion: Using Migration Data for Real Estate Opportunities

Migration data has become a powerful resource for real estate professionals aiming to anticipate market changes and uncover profitable opportunities. With around 10% of the U.S. population moving annually - and roughly 15% of those movers crossing state lines - tracking these patterns can be the difference between a smart investment and a missed chance.

One major insight is that migration trends pinpoint where demand is likely to grow. States like Arizona, Florida, Idaho, Oregon, South Carolina, and Texas are seeing steady population inflows, while states such as New York, New Jersey, California, and Illinois are experiencing a significant outflow of residents. This movement reflects a broader shift as Americans increasingly gravitate toward smaller, more affordable metropolitan areas, driven by changing lifestyles and work habits.

The data also reveals clear demographic splits: younger individuals often head to large coastal cities for career opportunities, while more established households tend to favor secondary and tertiary markets for their affordability and quality of life. These patterns are crucial for investors, as they guide decisions about which property types to focus on and where to invest. This is where tools that turn raw data into actionable insights become invaluable.

CoreCast steps in by transforming migration data into actionable insights through integrated analytics. It helps real estate professionals align emerging demographic trends with investment opportunities, offering a comprehensive perspective that incorporates market trends, economic factors, policy updates, and even environmental risks.

In today’s competitive market, understanding migration trends is essential. For example, housing inventory is rapidly expanding in the South, while remaining tight in regions like the Midwest and Northeast. Success in such a complex landscape requires tools that simplify data and provide clear, actionable guidance.

CoreCast bridges the gap between data and strategy, helping real estate professionals make timely, informed decisions by connecting migration patterns to investment opportunities. From in-depth analysis to detailed reporting, it equips investors to seize opportunities as they arise.

FAQs

-

Real estate investors can use migration data as a powerful tool to spot areas where populations are growing. This growth often indicates a rising demand for both housing and commercial properties. By examining net migration trends at state and local levels, investors can identify regions with promising economic conditions and demographic changes that align with potential market expansion.

With tools like CoreCast, investors can integrate migration trends with other real estate analytics to assess opportunities and risks more thoroughly. This combination of insights enables more informed, data-driven decisions tailored specifically to the dynamics of the U.S. real estate market.

-

Migration to Sun Belt states is fueled by a mix of warmer weather, affordable living, job opportunities, and lifestyle perks. These regions are particularly appealing to people looking for budget-friendly housing, promising career prospects, and an overall improved way of life.

This wave of new residents has a noticeable effect on local real estate markets. Housing demand surges, vacancy rates drop, and new construction projects spring up to meet the needs of the growing population. As property values climb, real estate professionals find opportunities to thrive in these expanding markets, though they must also navigate challenges like rising affordability concerns.

-

CoreCast uses geospatial analytics to dive into location-based data, giving real estate professionals a clearer picture of trends and opportunities. By analyzing factors like migration patterns, property values, and neighborhood changes, the platform pinpoints areas with growth potential and flags potential risks, helping users make more informed decisions.

These insights empower users to fine-tune their strategies, evaluate market competition, and make choices backed by solid data - all through one streamlined, all-in-one platform.