Workforce Housing as an Investment Class

Workforce housing is a growing investment opportunity that addresses the housing needs of middle-income earners. It serves essential workers like teachers, nurses, and firefighters, offering affordable, quality housing at lower costs than luxury developments. Investors are drawn to its stability, demand resilience, and potential for consistent returns, especially during economic downturns.

Key takeaways:

Target Market: Middle-income households earning 80%-120% of Area Median Income (AMI).

Demand Drivers: Housing affordability crisis, urbanization, and employment growth in key sectors.

Investment Benefits: Lower vacancy rates, stable rent growth, and strong recession performance.

Challenges: Limited supply, tenant financial stability, and older property maintenance.

Public-Private Partnerships: Cities like Boston, Los Angeles, and Detroit are leveraging collaborations to expand workforce housing.

Compared to luxury apartments, workforce housing offers higher cap rates, lower turnover, and steadier demand. Financing options like flexible loans and tax incentives further enhance its appeal. With tools like CoreCast, investors can simplify underwriting, track portfolios, and identify prime locations near employment hubs. Workforce housing stands out as a reliable, impactful investment choice in today’s housing market.

Is Workforce Housing a Strong Investment? (What to Know)

Market Demand and Key Drivers

Economic trends and shifting demographics are fueling the demand for workforce housing, presenting a steady investment opportunity. These factors highlight the sector's resilience and the growing role of public-private partnerships in addressing housing challenges.

Key Demand Drivers

Housing Affordability Crisis

The U.S. is grappling with a severe housing shortage, with a staggering 7.3 million-home gap between demand and availability. This shortage has created an urgent need for workforce housing. Since early 2020, single-family home prices have jumped 50%, while rents have climbed 29%, widening the affordability gap. Middle-income earners are particularly affected. For example, in Tampa-St. Petersburg-Clearwater, the 2021 median family income was $72,700, but a high school teacher's average salary stood at $62,500. This highlights the critical need for housing options for those who don’t qualify for subsidies but can’t afford market rates.

Employment Growth in Key Sectors

Industries like construction, manufacturing, healthcare, and energy are expanding, driving demand for housing among workers earning 80%–120% of the area median income. As the population ages and healthcare needs grow, the demand for affordable housing for medical staff has become increasingly pressing.

Urbanization and Limited Supply

Urbanization trends, combined with a lack of middle-income housing, are further straining the market. While luxury developments cater to high-income renters and subsidized housing relies on government support, workforce housing operates with limited supply. By 2024, rent-to-income ratios are expected to return to pre-pandemic levels of around 22%.

Economic Resilience of Workforce Housing

Workforce housing has proven to be a stable investment, especially during economic downturns. During the 2008 financial crisis, workforce housing outperformed luxury apartment projects, which faced high vacancy rates and required rent concessions. A Fannie Mae analysis even projected that in a recession, Class A properties could see vacancies exceed 10%, while Class B and C properties would remain in the mid-5% range.

This stability was evident in the multifamily sector, where vacancy rates peaked at just over 8% during the crisis, compared to double-digit vacancies in retail and office spaces. Additionally, affordable housing has consistently shown stronger rent and occupancy growth than market-rate apartments during the last three economic downturns. Since 2011, affordable housing investments have delivered an average income return of 4.8%, and workforce housing demand remained steady into early 2024, with Class B properties leading the recovery.

Public-Private Partnership Examples

Public-private partnerships are playing a crucial role in enhancing the viability of workforce housing.

Boston's Conversion Strategy

In Boston, Avanath Capital transformed a market-rate housing community into affordable housing through a partnership with the City of Boston. The city provided a grant in exchange for affordability restrictions and rent protections for existing tenants. Financing support came from CBRE Capital and Fannie Mae.

Los Angeles Multi-Partner Initiative

In Los Angeles, Avanath Capital collaborated with the Housing Authority of the City of Los Angeles (HACLA) and Kaiser Permanente to acquire Baldwin Village, a 669-unit affordable housing community. This partnership allowed Avanath Capital to participate in the Innovative Partnerships Solicitation program and benefit from a real estate tax abatement, enabling 70% of the units to be converted into affordable housing for residents earning 60%–80% of the area median income.

Detroit's Mixed-Income Development

Detroit saw the development of a 177-unit mixed-income housing project on vacant city land through a partnership between Avanath Capital, the City of Detroit, and private firms. The project complies with Detroit's Inclusionary Housing Ordinance by designating 20% of the units as affordable and focusing on senior residents.

Large-Scale Urban Initiatives

New York City's Housing New York Plan demonstrates the potential of public-private partnerships. Through tax incentives and zoning bonuses, the initiative has led to the construction of over 60,000 new housing units and the preservation of more than 130,000 units.

In Los Angeles, Mayor Karen Bass declared a housing emergency and issued an executive directive to speed up affordable housing permits to within 30 days. She pledged to collaborate with state, federal, and local governments to tackle the housing crisis.

Transit-Oriented Development in Denver

Denver's Regional Transit-Oriented Development Fund highlights another successful collaboration. The City of Denver partnered with private investors to build affordable housing near transit hubs, improving access to jobs and reducing transportation costs for low-income residents.

These examples show how partnerships between municipalities and private developers are addressing housing needs, improving building quality, reducing urban blight, and generating jobs and tax revenue.

With strong demand drivers, proven economic stability, and supportive policies, workforce housing continues to present promising opportunities for investors looking to make a meaningful impact.

Risk and Return Profile of Workforce Housing

Grasping the risk and return dynamics of workforce housing is key to making smart investment choices. This type of real estate strikes a balance between stability and growth, setting it apart from other investment options in the property market.

Risk Profile of Workforce Housing

Workforce housing generally carries less risk than luxury apartments. Why? It caters to "renters by necessity" rather than "renters by choice". This tenant base provides a steady demand, even during economic downturns, making it a safer bet.

For example, by the end of 2024, Class B properties are expected to maintain a strong 95% occupancy rate. This stability underscores how demand for affordable housing holds firm, even in challenging economic times.

History backs this up. During the 2008 Great Financial Crisis, workforce housing properties had more stable occupancy rates and rent collections than luxury apartments. A Fannie Mae analysis conducted before the pandemic even projected that, in a recession, Class A apartment vacancies could rise above 10%, while Class B and C vacancies would stay in the mid-5% range.

Another advantage? Tenant turnover in workforce housing tends to be lower. Middle-income renters often prioritize affordability and stability over luxury amenities, leading to longer leases and more predictable cash flows. However, investors should keep in mind potential risks, such as tenants' financial struggles during tough economic periods or the maintenance needs of older properties.

This combination of stability and resilience forms the foundation for the strong return potential of workforce housing investments.

Return Potential

The consistent occupancy and tenant retention in workforce housing pave the way for solid returns.

One way these properties deliver returns is through value-add strategies. Workforce housing typically offers higher cap rates than Class A apartments, reflecting both a slightly higher risk and greater cash flow potential. For instance, by Q3 2024, national multifamily cap rates had risen to 6.10%, up from 5.70% in Q2 2023.

Multifamily properties, including workforce housing, have also historically outperformed other real estate sectors like office, retail, and industrial. Over the past decade, they achieved average annual returns of over 9%. Rent growth in workforce housing has been steady, too. As of August 2024, Class B rents had increased by roughly 2.5% year-to-date, compared to about 2.0% for Class A properties. This steady growth highlights how serving essential housing needs can translate into profitability.

Value-add opportunities are another big draw. Many workforce housing properties, due to their age and condition, offer room for upgrades that can yield impressive returns. According to CBRE, improvements like energy-efficient appliances, better landscaping, or enhanced security systems can generate low- to mid-teens returns while also reducing operating costs. Interestingly, about 73% of Gen Z and a majority of millennials are open to paying up to 10% more for sustainable housing. These upgrades not only increase rent potential but also attract environmentally conscious tenants.

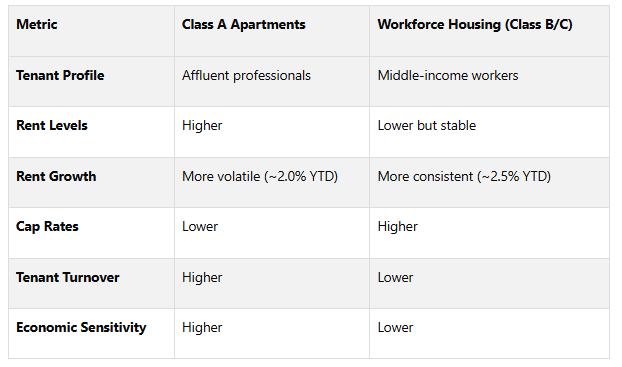

Comparison: Workforce Housing vs. Class A Apartments

The differences between workforce housing and Class A apartments are stark and worth noting:

For instance, while Class A apartments command rents that are about $650 higher per month than workforce housing units, they also come with more volatility. During economic downturns, vacancy rates in luxury apartments can nearly double compared to workforce housing. Although Class A properties often trade at lower cap rates due to their perceived stability, workforce housing offers higher initial yields and competitive total returns. Class A properties are also more vulnerable to risks like oversupply and economic swings, whereas Class B and C properties face challenges like tenant financial stability and the upkeep of older buildings.

Another factor to consider is market "beta." Class A properties tend to be more sensitive to market cycles, making them more volatile. In contrast, workforce housing (Class B/C) can help stabilize an investment portfolio. With institutional investors increasingly interested in workforce housing - driven by a shrinking supply of Class B/C units and steady rent growth - this asset class is poised to remain an attractive option for those seeking reliable performance.

Investment Strategies and Value Creation

Building on the relationship between risk and return, strategic approaches to workforce housing can significantly improve investment outcomes. With its steady demand and reliable returns, workforce housing provides investors with opportunities to create additional value through targeted strategies.

Value-Add Strategies

Value-add strategies focus on making property improvements that attract tenants, justify rent increases, and increase overall returns. This might include updates like replacing worn carpets, installing water-efficient fixtures, or upgrading shared spaces - all of which can yield high returns with relatively modest investments.

"Value-add occurs when the marginal dollar invested in a property produces more than a dollar of value." – Birgo Capital

Operational improvements, such as streamlining management processes or adjusting pro forma income, can also enhance property performance. Renovating kitchens, updating fixtures, and refreshing finishes are often effective ways to increase rents while keeping units affordable. Enhancements to shared amenities - like pool areas, clubhouses, or outdoor spaces - can further boost tenant satisfaction and encourage lease renewals.

For instance, Nuveen reported that over 14,300 unit upgrades led to an average return on cost of 24.4%, with value-add investors generally aiming for annual returns in the low-to-mid teens.

"Value-Add Real Estate remains ideally positioned in the current macro environment. Defensively, its in-place cash flow and enhanced unlevered return profile continues to drive accretive opportunities in the current high-rate environment. Opportunistically, amidst several market challenges, identifying and repositioning viable properties to unlock Alpha, to then capitalize on when the market returns can be key to realizing superior risk-adjusted returns." – Equity Multiple

These strategies lay the groundwork for exploring tailored financing solutions.

Financing Options

Workforce housing projects often require creative financing to bridge funding gaps. Unlike traditional affordable housing, which relies heavily on Low-Income Housing Tax Credits (LIHTC), workforce housing serves households that don't qualify for such credits but still face challenges affording market rents.

To address this, innovative financing options have emerged. For example, JPMorgan Chase's Workforce Housing Solutions and Fannie Mae Multifamily provide flexible loans and underwriting terms to support these projects. A standout example is a project in downtown Los Angeles' Chinatown, where a former food processing facility was transformed into a 376-unit apartment building. This $68.5 million project, designed for households earning up to 80% of Area Median Income (AMI), was completed without relying on LIHTC or other public subsidies.

"Workforce housing is an essential tool to increase the supply of housing that is attainable for families of all incomes. Our role is to bring new ideas and resources that can expand housing opportunities between what's available and what's needed." – JP Morgan Chase

Fannie Mae Multifamily requires that at least 20% of units be affordable for households earning 80% of AMI or less, with rents capped at 30% of adjusted AMI for the unit size. Public-private partnerships, including collaborations with healthcare systems, universities, and impact equity funds, can also provide access to vital resources like capital and land. This is particularly important given that in 2022, half of U.S. renter households - 22.4 million in total - spent more than 30% of their income on rent.

With financing in place, the next step is to focus on well-planned exit strategies.

Exit Strategies and Liquidity

A long-term perspective is key to effective exit strategies in workforce housing. Investments tied to LIHTC typically require holding periods of 10 to 15 years to avoid tax credit recapture and maintain steady cash flows.

Flexible syndication structures can help address liquidity concerns by allowing the sale of limited partner interests without disrupting the overall capital structure. Additionally, having multiple exit options - such as portfolio sales, refinancing, or reapplying for Qualified Allocation Plans (QAP) - gives investors the flexibility to adapt to changing market conditions and access equity when needed.

Thorough documentation is crucial for smooth exits. Keeping detailed records of property upgrades, rent rolls, expense histories, and compliance documents ensures accurate valuations during negotiations. Starting due diligence early - by examining title histories, zoning regulations, environmental reports, and property inspections - can also help avoid complications later. The choice of exit strategy ultimately depends on factors like market conditions, investment timelines, tax implications, personal goals, and the specifics of the property.

Transform Real Estate Data into Confident Decisions

Join Corecast to streamline your real estate operations, gain real-time insights, and make smarter investment decisions with a unified platform.

Using CoreCast for Workforce Housing Investments

Investing in workforce housing comes with its own set of challenges - balancing affordability requirements, navigating regulatory constraints, and ensuring compliance. CoreCast simplifies this process with its all-in-one real estate intelligence platform, designed to streamline underwriting, compliance tracking, and data analysis for real estate professionals.

CoreCast for Underwriting and Risk Analysis

Workforce housing underwriting is more complex than traditional market-rate properties. It requires careful evaluation of income tiers, affordability rules, and regulatory demands. CoreCast simplifies this by centralizing valuation and underwriting tools, helping users make informed, data-driven decisions. With everything - assets, projects, and data - in one place, investors can quickly assess critical factors like Area Median Income (AMI) restrictions. Plus, real-time data ensures that forecasts and valuations remain up-to-date. These tools integrate seamlessly into the broader CoreCast platform, supporting smarter decision-making for workforce housing investments.

Pipeline Tracking and Portfolio Insights

Managing workforce housing investments means keeping track of deals as they move through various stages, from initial market analysis to regulatory approvals and closing. CoreCast offers a centralized dashboard that uses stage tags and task assignments to monitor deals at every phase. The pipeline tracker not only maps and lists properties but also benchmarks opportunities against key reference assets. With features like Kanban boards and map views, CoreCast provides clear insights into metrics such as IRR, equity multiple, and cap rate [42, 44].

Beyond deal tracking, CoreCast helps investors monitor portfolio performance. It tracks rent roll data, manages capital expenditures and reserves, and ensures debt compliance with covenant monitoring. Customizable dashboards offer a snapshot of portfolio risks, trends in key performance indicators, and geographic concentration. The Portfolio Insights feature consolidates current valuations, historical trends, and projected income and expenses, making it easier to prepare for monthly, quarterly, and annual reviews.

As one Asset Manager from a mid-market private equity firm shared:

"CoreCast transformed how we communicate portfolio performance to stakeholders. We now spend more time analyzing data, and less time assembling it." – Asset Manager, Mid-Market PE Firm

These tools also extend to location-based analysis, a critical component of workforce housing investments.

Integrated Mapping and Reporting

Location is everything in workforce housing. Properties need to be accessible to working populations while maintaining economic viability. CoreCast’s mapping tools provide the geographic insights investors need, allowing them to visualize property locations alongside competitive landscapes. This helps assess factors like proximity to jobs, transportation options, and affordable housing availability.

CoreCast also includes a stakeholder management center, which simplifies communication with investors, public partners, and community stakeholders. The platform generates customizable, branded reports tailored for investment committees, executives, and regulators. Using historical data, market benchmarks, and user-defined assumptions, CoreCast forecasts future performance scenarios, offering stakeholders a clear picture of workforce housing investment opportunities.

Conclusion: Workforce Housing Investment Potential

Workforce housing offers a promising investment opportunity, catering to middle-income households and addressing a critical gap in the housing market. The numbers speak volumes: historically low vacancy rates (5.1% in 2015) and steady rent growth (3.4% for Class B properties in 2018) highlight a persistent supply-demand imbalance that continues to draw institutional investors. These trends underscore the sector's strong performance and its ability to weather economic fluctuations.

One of the standout features of workforce housing is its resilience during economic downturns. Unlike luxury apartments, it maintains consistent demand even in challenging times. As CBRE points out:

"Value-add multifamily asset investments that involve significant property upgrades generally provide returns in the low- to mid-teens, offer stable income, and hold their value, often outperforming other real estate sectors during periods of economic volatility." – CBRE

Shifting demographics and rising affordability challenges further bolster the long-term appeal of workforce housing. In 2024, an estimated 770,000 Americans were without homes - an 18% increase compared to 2023. Meanwhile, the median age of first-time homebuyers has climbed from 29 years in 1981 to 35 years by 2023. Adding to this, about 73% of Gen Z and a significant portion of millennials are willing to pay up to 10% more for housing that incorporates sustainable practices.

Technology also plays a pivotal role in maximizing investment potential. Tools like CoreCast streamline processes such as underwriting, pipeline tracking, and mapping. With its advanced mapping capabilities, CoreCast helps identify prime locations near employment hubs, while customizable reporting ensures stakeholders stay informed throughout every stage of the investment process.

FAQs

-

Investing in workforce housing isn't without its hurdles. Common roadblocks include difficulty accessing traditional financing, zoning restrictions, and infrastructure shortcomings. These factors can increase costs and slow down project timelines, making this type of investment a test of creativity and collaboration.

To overcome these issues, investors can consider alternative financing options, like public-private partnerships or leveraging tax incentives, to secure the necessary funding. Partnering with local governments to push for simpler zoning regulations and improvements to infrastructure can also help cut costs and accelerate development. Building strong ties within the community and staying up-to-date on local policies are essential strategies for navigating the complexities of this investment space.

-

The Role of Public-Private Partnerships in Workforce Housing

Public-private partnerships (PPPs) are key players in addressing workforce housing challenges. By pooling together the resources, funding, and expertise from both public and private sectors, these collaborations can speed up project timelines, enhance efficiency, and share financial risks more effectively.

One of the standout benefits of PPPs is how they make workforce housing projects more practical and achievable. These partnerships often open doors to zoning perks, subsidies, and other incentives that might not be available otherwise. Beyond just getting the projects off the ground, PPPs also promote high-quality construction practices and ensure that housing solutions remain reliable and accessible for working families over the long term.

-

Workforce housing and Class A apartments cater to different tenant demographics, which directly impacts their risk and return profiles.

Workforce housing is known for its stability and resilience. It serves middle-income tenants, a group that consistently drives demand, even during economic downturns. This steady demand often leads to lower vacancy rates and reliable rental income. For investors looking to minimize risk, workforce housing can be an appealing option, especially in uncertain economic times.

In contrast, Class A apartments come with a higher level of risk. These properties are more sensitive to changes in market conditions and economic cycles. However, they also have the potential for higher returns, thanks to premium rents and property appreciation in thriving markets. While the rewards can be substantial, the investment carries greater exposure to market volatility. For those seeking long-term dependability, workforce housing tends to stand out as the more stable choice.