Ultimate Guide to CRE Deal Pipeline Tracking

Managing commercial real estate (CRE) deals without a clear system is a recipe for missed opportunities and poor forecasting. A CRE deal pipeline provides a structured way to track deals from start to finish, ensuring no lead is overlooked and resources are allocated effectively. Here's what you need to know:

What is a CRE Deal Pipeline? It's a visual roadmap that tracks deals through stages like lead generation, qualification, underwriting, due diligence, negotiation, closing, and post-close management.

Why it Matters: CRE deals are complex and lengthy. Pipeline tracking helps identify bottlenecks, improve forecasts, and allocate resources wisely.

Challenges: Poor visibility, pipeline imbalance, data management issues, and outdated tools are common problems that modern software solutions address.

Technology's Role: Platforms like CoreCast streamline tracking, automate tasks, and centralize data, making deal management more efficient.

Best Practices: Maintain a healthy pipeline, track key metrics (e.g., deal volume, conversion rates), and standardize processes for better collaboration and decision-making.

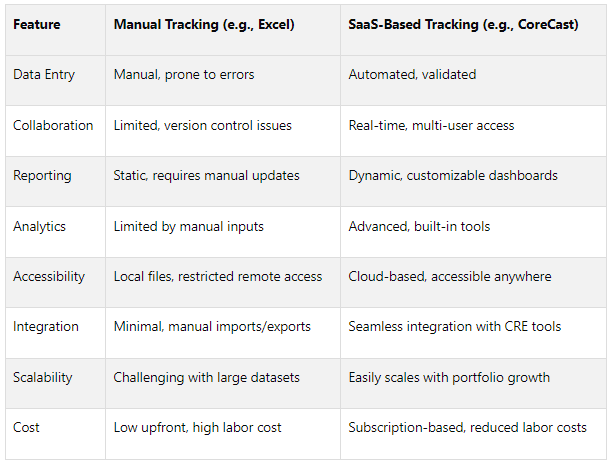

Takeaway: Moving from manual methods (e.g., Excel) to SaaS platforms improves accuracy, collaboration, and scalability, helping CRE professionals stay competitive.

Commercial Real Estate Deal Tracker - Excel Spreadsheet

Key Stages of a CRE Deal Pipeline

Navigating the stages of a commercial real estate (CRE) deal pipeline is essential for staying in control of complex transactions. Each step has a specific role, requiring distinct actions, documents, and decisions to move the deal forward.

Main Pipeline Stages

A typical CRE deal pipeline progresses through seven key stages, each designed to streamline the process:

Lead Generation is where it all begins. Opportunities are identified through networking, referrals, or market research. The aim here is to create a strong pool of prospects that can later be evaluated.

Qualification narrows down the leads to those that align with your strategy. At this stage, you assess whether the opportunity fits your budget, timeline, and investment criteria. Factors like property type, location, asking price, and seller motivation play a crucial role.

Underwriting digs into the financial details. This involves analyzing cash flow, calculating returns, and assessing risks. Teams review rent rolls, operating expenses, market comparables, and financing options to construct a solid investment case.

Due Diligence is the investigative phase. Here, you verify seller information, inspect the property, and review documents. Tasks often include environmental assessments, title searches, and lease reviews to ensure everything checks out.

Negotiation focuses on ironing out the terms. Price, conditions, and other deal specifics are discussed, often through multiple rounds of offers and counteroffers. The goal is to craft an agreement that meets both parties' needs while managing risks effectively.

Closing is the final step where all legal documents are signed, funds are transferred, and ownership officially changes hands. This stage involves close coordination among attorneys, lenders, and other stakeholders to ensure a smooth process.

Post-Close Management doesn’t stop at closing. It involves ongoing performance monitoring, stakeholder updates, and maintaining relationships to ensure the deal continues to meet expectations.

Tracking Deal Status and Progress

To manage deals effectively, it’s crucial to track their status. Common categories include:

Active deals: These are in progress and require regular attention and resources.

Pending deals: Deals waiting for specific actions, like financing approval or inspection results. Monitoring these helps spot potential delays early.

Closed deals: Successfully completed transactions, which provide valuable data for performance analysis.

Canceled deals: Deals that fell through due to issues like financing or inspections. Understanding why these failed can refine future strategies.

These categories help teams prioritize tasks, allocate resources, and identify bottlenecks.

Important Features for Each Stage

Modern pipeline tools offer features that make managing these stages more efficient:

Task management systems assign responsibilities and track progress. For instance, during due diligence, tasks like ordering environmental reports or scheduling inspections can be clearly organized.

Real-time updates notify stakeholders when a deal advances, eliminating the need for constant check-ins.

Customizable dashboards provide tailored insights. Executives can see high-level metrics like pipeline value, while deal managers focus on transaction details.

Integrated calendars track deadlines, such as due diligence milestones or closing dates, to avoid delays.

Document management centralizes files, making it easier to access critical documents during due diligence.

Analytics and reporting tools track metrics like stage duration and reasons for cancellations, helping teams optimize processes.

Some platforms even include visual drag-and-drop tools for better team coordination. Many users praise these platforms for their ease of use, with some rating them a perfect 5/5 for tracking deals and client activity.

The shift from Excel spreadsheets to comprehensive SaaS platforms reflects the need for real-time collaboration, automated workflows, and detailed analytics - tools that empower teams to make smarter decisions throughout the deal lifecycle.

These structured stages and advanced tools lay the groundwork for effective pipeline management, which will be explored further in the next section.

Best Practices for CRE Deal Pipeline Management

Managing a deal pipeline effectively in the commercial real estate (CRE) industry calls for strategic planning, consistent processes, and smart use of resources. Research shows that companies with clearly defined sales processes generate 18% more revenue than their competitors, while those excelling in pipeline management see as much as 28% revenue growth.

The following practices help create a solid foundation for tracking performance and standardizing processes.

Maintaining a Healthy Pipeline

A thriving pipeline depends on maintaining a steady flow of opportunities at every stage. This involves actively managing your deal mix to avoid the ups and downs that many CRE professionals face.

The first step? Segment your leads. Instead of treating all prospects the same, successful teams categorize them based on factors like deal size, timeline, and likelihood of closing. This segmentation allows you to direct your resources where they’ll make the biggest impact.

“The reason why [the] most productive sellers had smaller pipelines was that they were experts at disqualifying bad deals early in the sales cycle.”

Qualification processes are essential to avoid wasting time on deals that are unlikely to close. With 75% of B2B sales taking at least four months to close - and 18% requiring an additional twelve months - early qualification saves valuable time. Establish clear criteria, such as confirming budgets, identifying decision-makers, and verifying timelines, to ensure only viable leads move forward.

Regular pipeline cleanup is another must. Routinely remove unresponsive prospects or misaligned deals to keep your metrics accurate and your focus sharp.

Finally, use prioritization strategies to tackle the challenges of lengthy sales cycles. With 27% of sales reps citing long cycles as a barrier to success, focus on deals with the highest probability of closing within your target timeframe.

Tracking and Analyzing Key Metrics

Once your pipeline is balanced, tracking the right metrics can reveal areas for improvement and help you stay ahead of potential issues.

Start with deal volume metrics to monitor the quantity and quality of opportunities entering your pipeline. Keep an eye on weekly new leads, monthly qualified prospects, and lead qualification ratios to ensure sustainability.

Stage conversion rates are another critical metric. These rates show where deals typically succeed or stall. For example, tracking how many deals move from qualification to underwriting - or from underwriting to due diligence - can highlight bottlenecks that need attention.

Average closing time offers valuable insights as well. By comparing actual closing times to your target timelines, you can identify deals that may be falling behind.

Pinpointing bottlenecks becomes easier when you measure how long deals spend in each stage. If deals consistently slow down during due diligence, it might indicate a need to streamline document collection or improve coordination with external vendors.

Finally, focus on revenue-related metrics like total pipeline value, weighted pipeline value (adjusted for probability), and average deal size. These figures connect pipeline activity to business outcomes, helping with forecasting and goal-setting.

Standardizing Processes and Collaboration

Tracking metrics is only part of the equation. Standardizing your processes and fostering collaboration ensures that deals move smoothly through the pipeline.

Inconsistent processes often lead to confusion, missed opportunities, and team friction. A standardized approach provides a clear framework for decision-making and encourages teamwork.

“Oftentimes, a sluggish pipeline is the result of a failure to clearly outline procedures… In order for everyone to perform their jobs effectively, they need guidelines.”

Regular pipeline reviews are critical. Individual contributors should review their pipelines daily, while team leaders should conduct weekly reviews. These meetings focus on deal progress, upcoming deadlines, and resource needs, helping to resolve small issues before they escalate.

Use standardized data entry to keep everyone on the same page. Define required fields, create naming conventions, and use dropdown menus for common entries to ensure consistency and improve collaboration.

Establish communication protocols to keep stakeholders informed without overwhelming them. Clear guidelines on when to update deal statuses, whom to notify, and what details to share can maintain transparency throughout the sales cycle.

Leverage team collaboration tools to break down silos between acquisition, asset management, and finance teams. A shared CRM allows team members to update lead statuses while managers monitor the pipeline and share updates, fostering accountability.

To maintain consistency, provide training and documentation for your team. Develop guides that explain key processes, decision criteria, and escalation procedures. Pair these with regular training sessions to ensure everyone stays aligned as workflows evolve.

Finally, implement automated workflows for repetitive tasks like follow-ups, document requests, and deadline reminders. Automation frees up your team to focus on high-value activities while ensuring that processes remain efficient.

Transform Real Estate Data into Confident Decisions

Join Corecast to streamline your real estate operations, gain real-time insights, and make smarter investment decisions with a unified platform.

Using Technology for CRE Pipeline Management

Commercial real estate (CRE) has long relied on spreadsheets, email threads, and an assortment of disconnected tools to manage deal pipelines. While these methods may work initially, they quickly become unmanageable as deal volume grows. Enter modern SaaS platforms - these tools are reshaping the game by offering all-in-one solutions that simplify every step, from capturing leads to closing deals.

Key Benefits of SaaS Platforms for CRE

SaaS platforms tackle the common pain points of traditional pipeline management by offering some standout advantages. For starters, real-time data access ensures teams have the latest deal information at their fingertips, no matter where they are. This eliminates the delays caused by manual updates. Then there's workflow automation, which handles repetitive tasks like sending follow-up reminders or updating deal statuses. This frees up professionals to focus on what really matters: building relationships and negotiating deals.

Another big win? Centralized data. By keeping all deal information in one place, onboarding becomes faster, and collaboration across departments becomes seamless. And as portfolios grow, these platforms scale effortlessly - no need for costly infrastructure upgrades.

CoreCast is a prime example of how a unified platform can redefine CRE pipeline management.

How CoreCast Simplifies Pipeline Tracking

CoreCast makes pipeline tracking a breeze by bringing together tools that traditionally required multiple systems. From underwriting to stakeholder reporting, every stage of the deal process is managed in one place. Here’s what CoreCast brings to the table:

End-to-end real estate intelligence: CoreCast combines pipeline management with underwriting for any asset class, integrated mapping, portfolio analysis, and branded stakeholder reports.

Underwriting within the platform: Teams can analyze assets and risk profiles without leaving the system.

Integrated mapping: Visualize properties and competitors on a single map for better decision-making.

Portfolio analysis: Connect individual deals to larger investment strategies.

Stakeholder reporting: Generate professional, branded reports to streamline communication.

CoreCast doesn’t stop there. It also integrates with third-party tools, ensuring all pipeline management stays centralized without limiting functionality.

Integration Without Overlap

A common worry with comprehensive platforms is whether they might duplicate existing systems or add unnecessary layers of complexity. CoreCast addresses this concern by emphasizing integration over replacement.

For example, CoreCast syncs with tools like Buildium, QuickBooks, and RealPage, allowing teams to maintain their existing workflows while centralizing data. It doesn’t try to replace specialized tools like property management or accounting software. Instead, CoreCast acts as a central hub, connecting these systems and streamlining data flow across CRE operations.

This approach ensures teams can continue using their preferred tools while benefiting from centralized tracking and analysis. By integrating without overlap, CoreCast enhances visibility, simplifies coordination, and supports smarter investment decisions - all without disrupting established workflows.

Reporting and Continuous Improvement

Turning pipeline data into actionable insights is the cornerstone of effective reporting. Without it, businesses risk missing chances to fine-tune their processes and close more deals. Modern reporting tools do more than just track - they uncover patterns, predict outcomes, and guide better decision-making.

The Role of Reporting in Decision-Making

Building on advanced tracking methods, reporting serves as the backbone of effective pipeline management. Dashboards and reports act as a central hub, offering real-time insights into deal progress and status. With a clear view of which deals are moving forward, which are stuck, and where bottlenecks occur, executives can make quick, informed decisions and allocate resources more strategically.

The best reporting systems present critical metrics in easy-to-digest visual formats. For example:

Deal stage summaries: Show the number of opportunities in each phase.

Pipeline velocity metrics: Indicate how quickly deals progress.

Win/loss analysis: Helps teams pinpoint successful strategies and areas needing improvement.

Forecasted revenue reports are particularly valuable, offering a way to predict cash flow and plan for future quarters. By tracking deal size, expected closing dates, and success probabilities, teams can create more accurate financial projections and set achievable goals.

Customizable reports add another layer of depth. Filters by asset class, region, or deal owner allow for focused analysis. For instance, a commercial broker might examine downtown office building trends, while a development firm could assess construction timelines across project types.

Using Analytics to Identify Trends and Improve Processes

Pipeline data analysis reveals trends that might not be obvious during daily operations. By monitoring metrics like deal source, stage duration, and stakeholder involvement, teams can benchmark performance and uncover areas needing attention.

Consistent reporting shines a light on recurring delays and missed deadlines, prompting adjustments like reallocating resources, revising timelines, or introducing new workflows. Regular pipeline reviews - focusing on conversion rates, average deal size, and time-to-close - help establish a culture of continuous improvement, ensuring processes evolve based on data-driven insights.

These practices highlight the differences between traditional and modern tracking methods.

Manual vs SaaS-Based Tracking Comparison

While manual tracking systems like Excel may seem straightforward at first, they quickly become cumbersome as the volume of deals increases. Outdated data and version control issues can lead to inefficiencies and hidden labor costs.

On the other hand, SaaS platforms like CoreCast automate data capture, provide instant updates, and offer advanced analytics. These platforms streamline tasks across the board - whether it's underwriting various asset classes, tracking pipeline progress, or generating branded stakeholder reports. Teams no longer need to juggle multiple tools, saving time and improving accuracy.

Conclusion

Tracking a CRE deal pipeline has shifted from being a helpful tool to an absolute necessity for commercial real estate professionals. The ability to keep tabs on deals, collaborate effectively, and make timely, informed decisions often separates thriving firms from those that struggle to keep up.

Key Points Recap

At the heart of efficient pipeline management are three key elements: visibility, standardized processes, and integrated technology. These elements help firms avoid losing deals, streamline workflows, and make smarter decisions based on data. When every team member follows a consistent process - updating deal stages, logging communications, and meeting deadlines - the entire operation runs more efficiently.

Analytics and reporting take this a step further by turning raw data into clear, actionable insights. Teams that regularly evaluate deal flow, conversion rates, and stage durations can spot patterns, fix recurring problems, and refine their strategies. This approach leads to smarter resource use, more accurate forecasting, and, ultimately, better outcomes.

These principles mark the shift from outdated, manual methods to a more data-driven way of working.

Final Thoughts on Adopting Modern Solutions

The commercial real estate industry is at a turning point. Firms that adopt modern pipeline management tools position themselves for long-term success, while those sticking to outdated methods risk falling behind in an increasingly competitive landscape. Modern solutions are no longer a luxury - they’re a necessity for staying efficient and competitive.

Platforms like CoreCast are leading the charge by offering a comprehensive solution for CRE deal management. By combining underwriting, tracking, analysis, and reporting into one system, these platforms eliminate the need for multiple tools, reduce manual errors, and deliver real-time insights for faster decision-making. A single, unified platform that works across asset classes provides a distinct competitive advantage.

The benefits of switching to modern tools are clear: greater accuracy, better communication with stakeholders, and the ability to scale operations effectively. As deals grow more complex and investor demands increase, robust tracking and reporting capabilities become essential for maintaining strong client relationships and securing future opportunities.

The inefficiencies of outdated methods come at a high cost, far outweighing the investment in modern solutions. The real question isn’t whether to adopt these tools, but how quickly you can implement them to start seeing the rewards of streamlined, data-driven operations.

FAQs

-

A SaaS platform like CoreCast redefines how you handle your CRE deal pipeline by automating essential tasks and centralizing important data. Unlike spreadsheets - where manual updates are constant and errors are common - CoreCast delivers real-time data tracking, automated deal stage management, and built-in analytics. This means less time wasted on repetitive work and more accurate, up-to-the-minute information at your fingertips.

CoreCast also brings together multiple tools into one easy-to-use platform, covering everything from portfolio analysis and property insights to stakeholder communication. By combining these functions, it simplifies operations, speeds up decision-making, and eliminates the hassle of managing separate tools or outdated spreadsheets. The outcome? A smoother, more efficient workflow designed to meet the unique demands of commercial real estate.

-

Managing a commercial real estate (CRE) deal pipeline often comes with its fair share of hurdles. Common challenges include limited visibility into deal progress, tedious manual tasks, data scattered across various tools, and delays in decision-making. These roadblocks can drag out deal closures and lead to inefficiencies.

Fortunately, modern tools like CoreCast are changing the game. By centralizing data, offering real-time insights, and automating workflows, platforms like this help professionals stay on top of their pipelines. Features such as integrated deal tracking, visual pipeline management, and advanced analytics make it easier to pinpoint bottlenecks, streamline processes, and make smarter, faster decisions. The result? Improved productivity and higher closing rates.

-

A thriving deal pipeline is the backbone of commercial real estate, ensuring steady opportunities for growth and revenue while helping businesses sidestep periods of inactivity. It empowers professionals to keep deal flow on track, anticipate outcomes, and make smart, forward-thinking decisions that support long-term success.

To keep your pipeline robust, prioritize consistent prospecting, cultivate strong relationships with clients and investors, and take advantage of powerful tools like CoreCast. These tools help track deals at every stage and provide insights into market trends. By combining these strategies, you can reduce the risk of deal shortages and make more informed, strategic investment decisions.