How Sales Comps Impact Property Valuation Models

Sales comparables - or "comps" - are vital in real estate valuation. They provide benchmarks for pricing, cap rates, and rent projections. But analyzing comps manually is slow and prone to errors, often relying on spreadsheets and outdated data. Modern platforms like CoreCast solve this by automating comp analysis, ensuring accurate, real-time data and seamless integration with valuation models. This shift reduces errors, saves time, and improves decision-making for real estate professionals managing portfolios or underwriting deals.

Key Takeaways:

- Manual Analysis: Time-intensive, error-prone, and inconsistent. Best for niche cases requiring custom adjustments.

- CoreCast: Automates comp selection, adjustments, and integration. Cuts processing time by 70–80% and reduces valuation disputes by 35%.

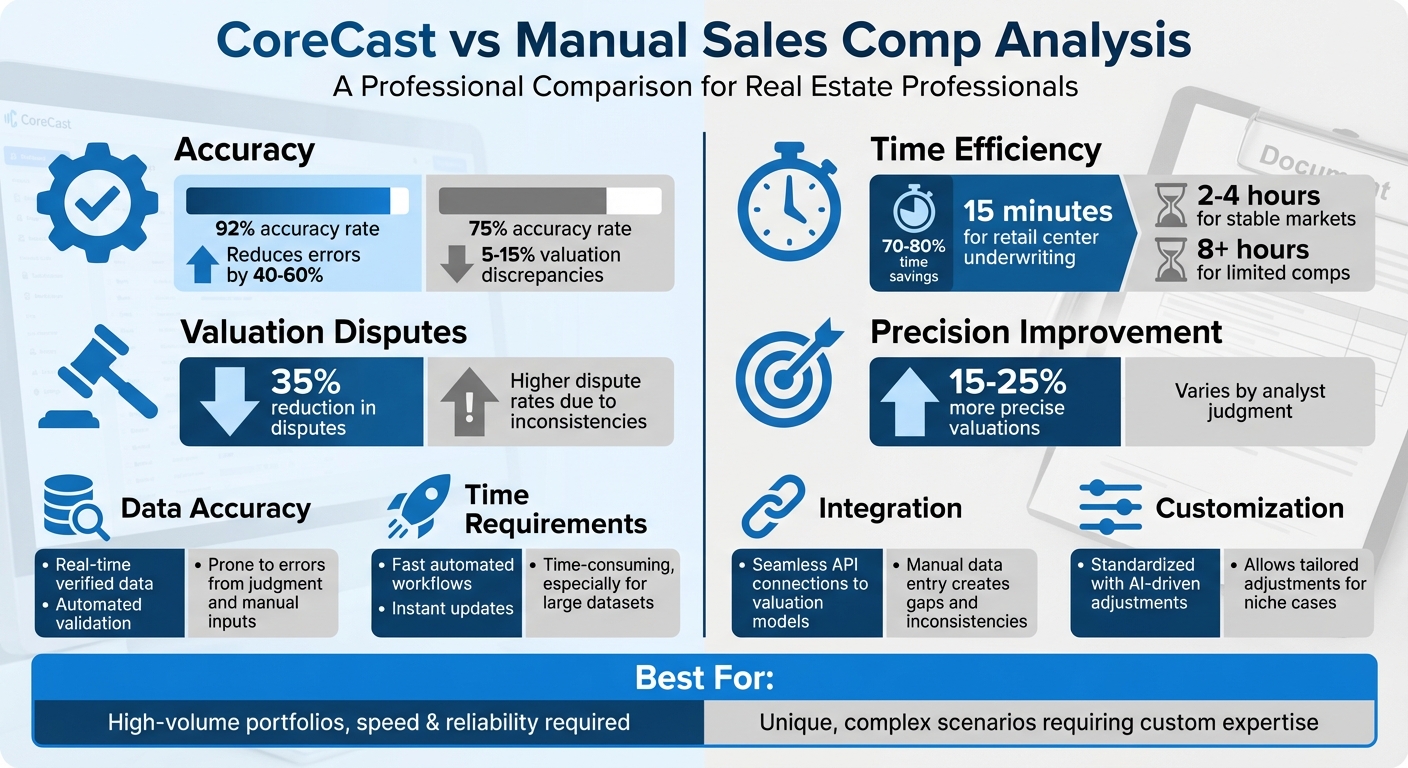

Quick Comparison:

| Aspect | CoreCast | Manual Analysis |

|---|---|---|

| Accuracy | Real-time, verified data reduces errors by 40–60% | Prone to errors from judgment and manual inputs |

| Time Efficiency | Fast, automated workflows | Time-consuming, especially for large datasets |

| Integration | Seamlessly links to valuation models | Manual data entry creates gaps and inconsistencies |

| Customization | Standardized with AI-driven adjustments | Allows for tailored adjustments in niche cases |

For those needing speed and reliability, CoreCast is a game-changer. However, manual methods still work for unique, complex scenarios.

CoreCast vs Manual Sales Comp Analysis: Key Performance Metrics Comparison

1. CoreCast

Accuracy of Data

CoreCast pulls sales comparables from verified sources like MLS, public records, and third-party integrations in real time. The platform uses automated validation to ensure the data is complete and up-to-date, focusing on properties that truly compare in location, size, age, and condition. This process cuts manual errors by 40–60%, with internal benchmarks showing CoreCast achieves 92% accuracy compared to 75% with manual methods[2]. Its AI-driven algorithms select comps within the same area and use, while automatically adjusting for factors like market trends and physical differences. For instance, when analyzing a 50,000 sq ft office building in downtown Chicago, CoreCast identified 12 recent sales within a 1-mile radius, confirmed their arm’s-length status, and adjusted for construction quality (–5%) and market appreciation (+3%). This resulted in an adjusted price per square foot of $285, whereas manual estimates varied by $40 due to overlooked details. Expert appraisers have noted that CoreCast’s methods deliver valuations that are 15–25% more precise, with case studies highlighting how it identified a 4% market trend adjustment that manual methods missed[2]. This rigorous validation process significantly streamlines the analysis phase.

Efficiency in Application

CoreCast automates every step of sales comp analysis, from selecting relevant comparables and making adjustments to integrating results into valuation models. Its integrated map view of the competitive landscape makes this process intuitive. Users report saving 70–80% of the time typically spent on manual grid-based methods. In one example, a retail center was underwritten in just 15 minutes, compared to 4 hours manually. For large portfolios, CoreCast keeps sales comps updated across all deal stages, cutting down analysis time while maintaining detailed audit trails that meet lender and investor standards. These efficiencies are particularly valuable for high-volume transactions, ensuring teams can work faster without sacrificing thoroughness.

Integration with Valuation Models

CoreCast doesn’t just stop at accurate data collection - it integrates seamlessly with valuation models. Adjusted comp metrics feed directly into discounted cash flow analyses and cap rate calculations, with API connections to tools like Excel and other valuation software. For example, CoreCast was used to assess a 200-unit multifamily asset, pulling effective gross income multipliers - averaging 10.2 times from five local transactions - and combining them with proforma income to estimate a value of $25 million. The platform also auto-reconciles ranges based on comp reliability, weighting factors like recentness (40%) and proximity (30%), aligning with Fannie Mae’s guidelines that require at least three closed comps and clear adjustment documentation. CoreCast supports underwriting for all asset types and risk profiles, creating a unified framework for core, value-add, and opportunistic strategies. Each underwriting file links directly to its comps and adjustment rationale, building an audit trail that can be revisited for changing market conditions or investor due diligence. A 2024 study of 500 deals found that using integrated comps reduced valuation disputes by 35%, reinforcing the value of working from a consistent, centralized data source.

Sales Comparison Approach to Value

2. Manual Sales Comp Analysis

Relying on human expertise, manual sales comp analysis depends heavily on an analyst's judgment, which can lead to varying levels of accuracy and efficiency.

Accuracy of Data

In manual sales comp analysis, analysts sift through data sources like public records, MLS listings, and broker reports to identify comparable transactions. They focus on arm's-length sales while excluding atypical deals, such as foreclosures or related-party transactions. Adjustments are then applied to reflect the subject property's unique characteristics.

For instance, imagine a 50,000 sq ft office building where a comparable property sold for $10,000,000, including $500,000 worth of furniture. After removing the furniture value, the adjusted price becomes $9,500,000. Further adjustments for market or locational factors refine the estimate. However, failing to account for non-realty components could inflate the value by about 5%. Even with thorough verification, manual methods often result in valuation discrepancies ranging from 5% to 15% [2].

While this hands-on approach allows for detailed adjustments, it often sacrifices speed and consistency, which are discussed next.

Efficiency in Application

Manual analysis is a time-consuming process. Analysts spend hours collecting and reconciling data from multiple sources, often working within spreadsheets. For properties in stable retail markets, this process might take 2 to 4 hours. But for industrial assets with limited comparable sales, the analysis can stretch beyond 8 hours.

Another drawback is the lack of real-time updates. Completing a full valuation may take one to two days, and any significant market change could require starting from scratch. Experts point out that while heuristic adjustment grids work adequately for small datasets, manual methods struggle to scale efficiently. This becomes a bottleneck for analyzing large portfolios or handling high transaction volumes, especially when compared to automated statistical tools [2].

Integration with Valuation Models

Manual sales comp data also presents challenges when integrated into valuation models.

Key metrics like price per square foot, cap rates, or income multipliers are derived from adjusted comps and feed directly into valuation models. For example, if three comparable multifamily properties yield an average cap rate of 7%, applying that rate to a subject property's net operating income of $500,000 results in a value estimate of around $7,140,000.

However, the manual process often introduces inconsistencies in adjustment methods and weighting decisions. Analysts might prioritize closer or more recent sales, assigning them heavier weight - sometimes over 50% - but these choices vary from person to person. Additionally, manual processes can create gaps when integrating data into discounted cash flow models or reconciling it with income-based approaches. These limitations highlight the benefits of standardized platforms like CoreCast, which streamline data integration, reduce subjectivity, and deliver consistent, auditable valuations across asset types [2].

sbb-itb-99d029f

Advantages and Disadvantages

Deciding between CoreCast and manual sales comp analysis boils down to how well each method handles data accuracy, time efficiency, and model compatibility. CoreCast stands out with its real-time updates and centralized data management, reducing the need for manual recalculations and ensuring more reliable, data-driven valuations. On the other hand, manual analysis relies on gathering data from sources like public records and broker reports - a process that's not only time-intensive but also more prone to errors.

CoreCast simplifies valuation workflows by instantly generating portfolio summaries and updating outputs in real time. In contrast, manual methods demand significantly more effort, especially when dealing with complex assets, as they require extensive data collection and recalculations.

That said, manual analysis does have its strengths. It allows for tailored adjustments in unique cases, such as handling properties affected by eminent domain or those with unusual topographical challenges. While CoreCast supports all major commercial real estate asset classes - ranging from multifamily and office properties to mixed-use and LIHTC - and integrates smoothly with third-party tools, there are occasional scenarios where the hands-on expertise of manual analysis proves beneficial [3][4]. These trade-offs highlight how the choice between the two approaches depends on the complexity of the asset being evaluated and the specific needs of the project.

Here's a quick comparison of the two methods:

| Aspect | CoreCast | Manual Sales Comp Analysis |

|---|---|---|

| Data Accuracy | Real-time updates and centralized data management help reduce errors [1] | More prone to discrepancies due to reliance on individual judgment |

| Time Requirements | Instant portfolio summaries and real-time updates [1] | Requires more time for data collection and processing |

| Model Compatibility | Supports major asset classes and integrates with third-party tools [1] | Flexible for niche adjustments but may face challenges with integration gaps |

| Customization | Standardized processes with planned AI-driven automation [1] | Allows for subjective, case-specific adjustments in rare scenarios [3][4] |

Conclusion

When it comes to choosing the right sales comparison methodology, the decision ultimately depends on your operational scale, speed requirements, and the level of precision you need. If you're managing multiple assets or need fast, data-driven insights, CoreCast is a strong contender. With features like real-time data updates, centralized portfolio management, and instant valuation outputs, it’s designed to simplify the workflow for professionals handling complex or high-volume portfolios.

For those working with single assets - especially in niche markets or situations where local expertise is essential - manual analysis can still be a practical option. However, it demands more time and carries a higher risk of errors, making it less efficient for larger-scale operations.

For real estate professionals managing diverse portfolios - whether multifamily, office, retail, or mixed-use - CoreCast offers tools that can significantly streamline the valuation process. Integrated mapping, pipeline tracking, and portfolio analytics help reduce the time spent on analysis while ensuring valuations align with lender and investor expectations.

As Mitchell Rice, Principal at Elkstone Capital, puts it: "Having reliable financial analysis is crucial to building trust with investors" [1].

CoreCast’s ability to generate custom portfolio summaries and track properties through various deal stages gives professionals a competitive edge, particularly for those juggling multiple deals, raising capital, or presenting to stakeholders.

Whether you opt for CoreCast or stick with manual methods, combining the sales comparison approach with income and cost methodologies is key to producing valuations that stand up to scrutiny.

For those ready to take advantage of a more efficient approach, CoreCast is currently available in beta for $50 per user per month. With no credit card required for sign-up, it’s an opportunity to explore how an integrated real estate intelligence platform can transform your valuation workflows before committing to future pricing tiers.

FAQs

How does CoreCast enhance property valuation accuracy compared to manual methods?

CoreCast improves property valuation precision by utilizing real-time data and sophisticated tools to evaluate sales comparables and predict property performance. This approach reduces the likelihood of human error common in manual processes, delivering valuations that are both consistent and grounded in data.

By incorporating essential metrics and offering a detailed perspective on the competitive market, CoreCast equips real estate professionals with the insights they need to make well-informed, confident decisions.

How does CoreCast save time when analyzing sales comps?

CoreCast takes the hassle out of sales comp analysis by automating data updates, pulling in real-time market information, and simplifying your workflows. No more tedious manual data entry or lengthy comparisons - everything moves faster and smoother.

The platform’s user-friendly design lets you dive straight into valuable insights, prioritize smarter decision-making, and handle your portfolio with ease - all from a single, centralized hub.

How does CoreCast work with existing property valuation models?

CoreCast brings together real estate data into one centralized platform, making it easier to work with existing property valuation models. With this integration, users can delve into historical trends, monitor property performance, and apply valuation methods with improved precision and speed.

By consolidating assets, projects, and data, CoreCast creates a more efficient workflow and helps users make informed decisions across different asset types. Its real-time insights and advanced analytics simplify the valuation process, enabling smarter, data-driven strategies.