Portfolio Risks Under Rent Control Laws

Rent control laws are creating new challenges for property owners in the U.S., especially in cities like New York, Los Angeles, and Seattle. These regulations limit rent increases but often fail to account for rising expenses like taxes, insurance, and utilities. The result? Shrinking profits, higher delinquency rates, and declining property values for rent-stabilized units compared to market-rate properties.

Key takeaways:

- Financial Strain: Delinquency rates for rent-stabilized properties in NYC reached 10.8% in 2025, compared to 0.7% for market-rate units.

- Net Operating Income (NOI) Impact: Rent caps often lag behind rising costs, compressing profit margins.

- Property Value Gap: Since 2019, rent-stabilized units grew in value by just 0.27% annually, trailing market-rate units at 1.75%.

- Operational Complexity: Compliance requires navigating strict rules, from allowable rent increases to tenant protections.

Modern tools like CoreCast simplify managing rent-controlled portfolios. By automating compliance tracking, forecasting costs, and consolidating operations, CoreCast helps property owners mitigate risks and maintain returns in a challenging regulatory environment.

Why Rent Control Might Be A Bad Idea

1. Standard Rent-Controlled Portfolio Management

Managing rent-controlled properties often involves outdated tools like spreadsheets, manual tracking, and occasional reviews. While these methods have been a go-to for years, they’re struggling to keep up with the increasingly complex rent control regulations that vary by location. Relying on these traditional systems can leave portfolios exposed to unnecessary risks.

Risk Mitigation

Traditional management practices focus on tenant screening and legal measures to reduce risks. Property managers typically perform thorough credit checks, background screenings, and rental history evaluations to ensure they’re leasing to reliable tenants. This is especially important in rent-controlled environments, where long-term tenants are common. Many landlords also establish Limited Liability Companies (LLCs) to protect personal assets from legal claims tied to their rental business. On top of that, landlord insurance plays a key role by covering property damage or loss of rent - claims related to these issues make up roughly 50% of cases [5].

Revenue Impact

Rent control policies often restrict how much landlords can increase rents annually, limiting income growth. For instance, Washington D.C. has capped rent increases at 4.3% for 2025 (based on a 2.3% CPI plus 2%) [1]. This makes it challenging for property owners to keep up with rising operating expenses. In 2024, nearly one-third of landlords raised rents by 6–10% to offset costs, but those in rent-controlled markets faced stricter limits. This has widened the gap between revenue and expenses, leading over 70% of housing providers to reduce or cancel development plans in these areas [3][5].

Analytics and Forecasting

Spreadsheet models are commonly used to estimate rent increases based on local rules - like California’s inflation rate plus 5% or Oregon’s inflation rate plus 7% [6]. These tools also help calculate discounted future earnings to assess property value. However, rent-controlled properties typically sell at a 27% discount compared to unregulated ones because of capped income potential [4]. The problem is that these basic models often fail to account for the rapid rise in costs under new rent control laws. They struggle to measure the critical cost-revenue gap, which shows when rising expenses - like insurance, utilities, and property taxes - might outstrip allowable rent increases, potentially leading to negative cash flow.

Operational Efficiency

Staying compliant with rent control regulations requires detailed record-keeping. Property managers need to track lease renewal deadlines, calculate allowable rent increases using local formulas, and document capital improvements that may justify higher rents. In 2025, 17% of landlords said that adapting to new tenant protections and local regulations was a major operational hurdle [5]. Traditional systems often involve juggling multiple tools - one for accounting, another for maintenance, and separate files for regulatory compliance. This fragmented approach increases the risk of errors and makes it harder to get a clear picture of overall portfolio performance. These inefficiencies only add to the challenges of managing revenue and forecasting accurately.

2. CoreCast SaaS Platform

CoreCast brings rent-controlled portfolio management into a single, streamlined real estate intelligence platform. Instead of juggling outdated manual tools, property owners can now underwrite assets, monitor deals, analyze portfolios, and generate reports all in one place. This integrated system directly addresses the inefficiencies and strategic gaps that often plague traditional portfolio management methods.

Risk Mitigation

CoreCast takes risk identification to the next level by combining advanced analytics with a thorough evaluation of portfolios. Unlike older approaches, the platform uses sophisticated modeling to address the risk of NOI (Net Operating Income) compression. For instance, CoreCast pinpoints "binding constraints" - situations where rent cap regulations limit income growth - by modeling caps like inflation plus 5% against median rent increases [6]. This allows property owners to identify properties where rent control laws might restrict revenue and distinguish them from those with more flexibility. Additionally, CoreCast goes beyond the standard practice of focusing on the top 10 tenants (who often make up less than half of total rental income [8]) by assessing tenant-default risk across the entire portfolio. This comprehensive approach gives property managers a clearer picture of their overall exposure under rent control policies.

Revenue Impact

With real-time cash flow insights and automated financial reporting, CoreCast helps offset the impact of shrinking profit margins under rent caps [5]. The platform simplifies tracking for complex rent formulas, such as Washington, D.C.’s CPI-based increases [1]. It also uses forecasting tools to spread rent hikes strategically over several years, rather than applying the maximum allowable increase each year [6]. This strategy not only helps maintain tenant retention but also optimizes revenue within the boundaries of regulatory requirements.

Analytics and Forecasting

CoreCast moves beyond static rules, like the traditional 2% rule, by leveraging AI and real-time public data to evaluate property performance under specific rent control laws [7]. It adjusts for variables like unit size and type - such as square footage and bedroom counts - to create detailed impact scales. These scales help determine whether rent caps will significantly restrict future income. The platform also forecasts potential cost-revenue gaps, particularly in scenarios where rising expenses could outpace allowable rent increases. This level of detail simplifies daily operations while providing deeper insights for long-term planning.

Operational Efficiency

CoreCast consolidates key tasks like underwriting, deal tracking, portfolio analysis, and stakeholder reporting into one system. Property managers can view their properties and competitors on an integrated map and conduct in-depth portfolio analyses without switching between tools. By eliminating the need for duplicate systems, CoreCast supports strategic decision-making while streamlining day-to-day operations. This unified approach reduces the fragmented workflows that are common in traditional rent-controlled portfolio management.

sbb-itb-99d029f

Advantages and Disadvantages

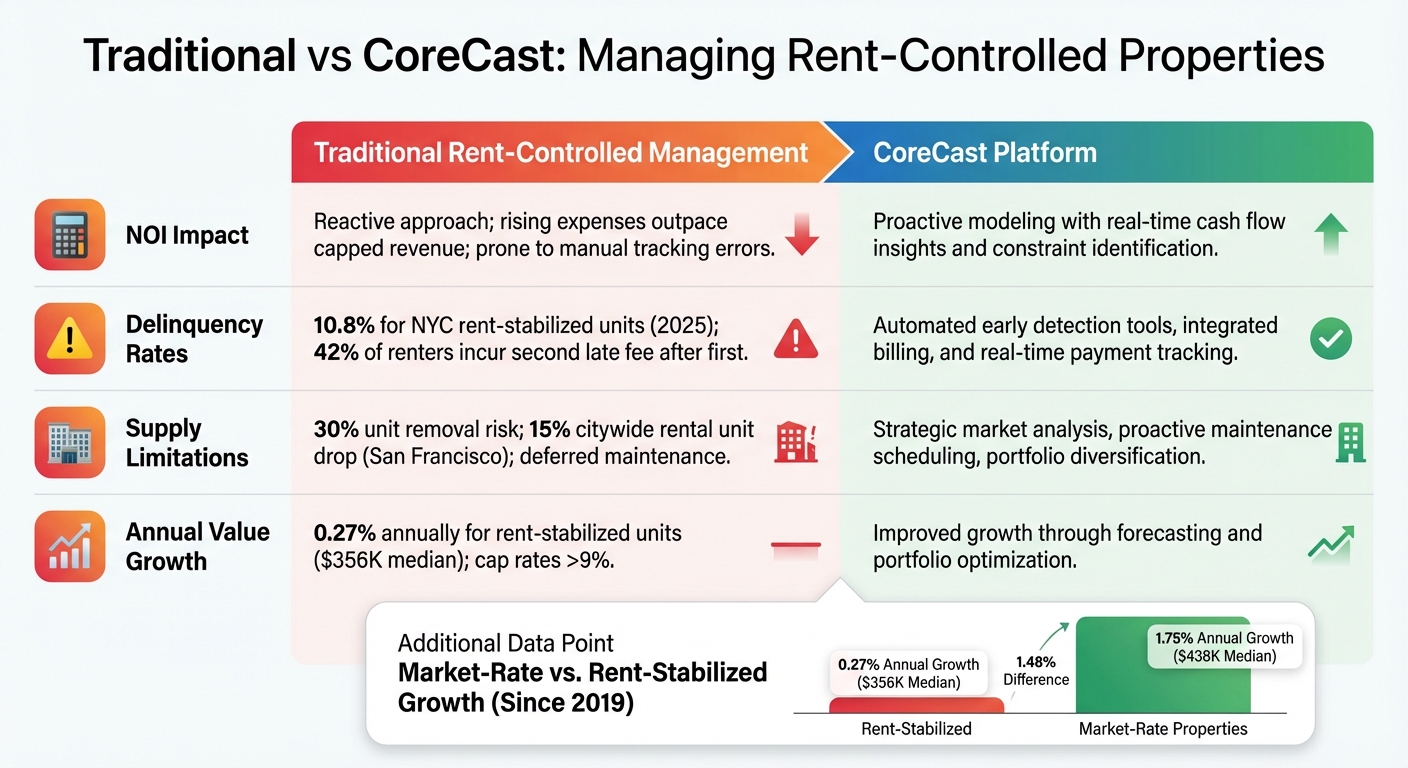

Traditional vs CoreCast Rent-Controlled Property Management Comparison

Managing rent-controlled properties using traditional methods has always been financially challenging. Platforms like CoreCast aim to tackle these issues head-on. One of the biggest hurdles for traditional management is NOI (Net Operating Income) compression, where rising expenses outpace the limited rent increases allowed by regulations [2]. CoreCast addresses this by using proactive modeling to pinpoint constraints and predict cost-revenue gaps before they become major problems. This enables property managers to act early, offering a clear distinction between traditional practices and CoreCast's forward-thinking solutions.

Delinquency rates highlight this gap in performance. For example, in New York City, rent-stabilized properties experienced a delinquency rate of 10.8% year-to-date in 2025, compared to just 0.7% for market-rate properties [2]. Traditional management often relies on manual processes, leaving landlords vulnerable to recurring late payments - 42% of renters incur a second late fee immediately after their first [10]. CoreCast, on the other hand, uses automated tools like integrated billing, real-time payment tracking, and early warnings for economic stress. These features help reduce delinquencies and simplify compliance, which 17% of landlords found particularly challenging in 2025 [5]. Supply constraints further emphasize the differences between the two approaches.

Supply issues are another major factor. A study of San Francisco's rent control expansion revealed a 15% citywide drop in total rental units, with 30% of affected units removed from the market through condo conversions or landlords exiting the rental business altogether [9]. As Blair Jenkins, a researcher, noted:

"The economics profession has reached a rare consensus: Rent control creates many more problems than it solves" [9].

Traditional management often treats supply as a fixed limitation, leading to deferred maintenance and fewer incentives for property improvements. In contrast, CoreCast provides tools like strategic market analysis and proactive maintenance scheduling, which help preserve asset value even under strict regulatory caps [5].

| Metric | Traditional Rent-Controlled Management | CoreCast Platform |

|---|---|---|

| NOI Impact | Reactive; rising expenses outpace capped revenue; prone to errors with manual tracking [2][5] | Proactive modeling with real-time insights into cash flow and constraints [5] |

| Delinquency Rates | High (10.8% for NYC stabilized units) [2][10] | Automated tools for early detection of financial stress and streamlined billing [5][10] |

| Supply Limitations | Risk of unit removal (up to 30%); deferred maintenance; fewer property improvements [9][11] | Strategic market analysis, proactive maintenance, and portfolio diversification [5] |

| Annual Value Growth | Minimal (~0.27% annually) with higher cap rates (>9%) [2] | Improved growth through forecasting and portfolio optimization |

The financial impact is just as stark. Since 2019, market-rate property values have grown by 1.75% annually, reaching a median of $438,000 per unit, while rent-stabilized units saw only a 0.27% increase, ending at $356,000 per unit [2]. Additionally, cap rates for stabilized buildings have soared from around 3% pre-2019 to over 9% in 2025, driven by rising expenses and regulatory risks [2]. CoreCast's platform simplifies these challenges by combining underwriting, deal tracking, portfolio analysis, and stakeholder reporting into one system. This eliminates fragmented workflows and reduces manual errors, helping property owners manage financial pressures more effectively.

Conclusion

Rent control laws can shrink net operating income (NOI), increase delinquency rates, and limit housing supply, ultimately impacting portfolio values.

To tackle these hurdles, modern analytics platforms like CoreCast provide a powerful assist. CoreCast automates compliance tracking, calculates rent formulas, and offers real-time portfolio insights to help investors navigate complex regulations effectively [1][9]. Its capability to pinpoint exemptions gives landlords an edge in maximizing returns while staying within the rules [1][9]. Considering that 17% of landlords identified compliance as a major challenge in 2025, tools like automated documentation and legislative monitoring are becoming indispensable [5].

FAQs

What are the risks rent control laws pose to property investments?

Rent control laws can have a noticeable effect on the profitability of property investments. These regulations, which cap rent increases - often at rates below inflation or rising operating expenses - can directly reduce a property’s net operating income (NOI). As a result, property values may drop, making investments less appealing. For many investors, the added risk means requiring higher cap rates to justify their involvement, which further narrows the pool of interested buyers.

Beyond financial returns, rent control can also restrict landlords from reinvesting in their properties. This could lead to delayed maintenance or fewer upgrades, which might cause the overall quality of the property to decline over time. For investors managing a range of assets, these laws add another layer of complexity, making it harder to forecast returns and maintain steady performance across their portfolios.

How can property owners reduce the risks posed by rent control laws?

Property owners can navigate the challenges posed by rent control laws with a few smart strategies. One approach is to make permitted rent adjustments when upgrading units, changing services, or addressing shifts in occupancy. Exploring exemptions or specific clauses within rent control regulations can also provide some relief from restrictions.

Another key tactic is to invest consistently in property maintenance and upgrades. This not only keeps properties in good shape but also helps maintain their value over time. Lastly, diversifying investments into properties or asset types not affected by rent control can spread out risk and create a more balanced portfolio.

By staying proactive and strategic, property owners can better protect their investments while adapting to the complexities of rent control.

Why do rent-stabilized properties often have higher delinquency rates than market-rate units?

Rent-stabilized properties often come with rent caps that don’t keep pace with rising market rates. Meanwhile, operating costs - like maintenance, taxes, and utilities - continue climbing. This creates a financial squeeze for property owners. On top of that, many tenants in these units are still grappling with financial hardships from the pandemic, leading to more frequent missed or late rent payments compared to tenants in market-rate properties.

These challenges make rent-stabilized properties more prone to payment issues, which can disrupt cash flow and hurt overall portfolio performance.