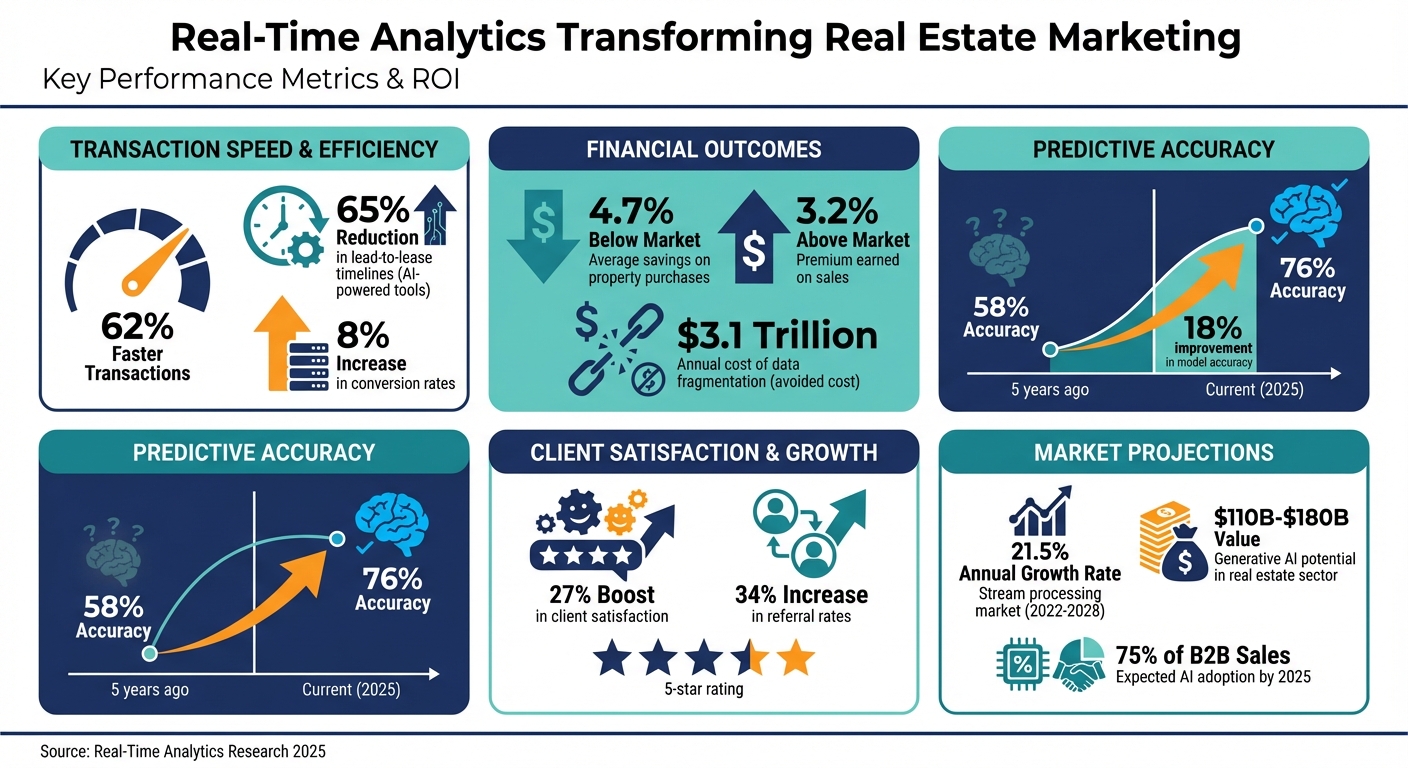

Real-Time Analytics Trends in Real Estate Marketing

Real-time analytics is transforming real estate marketing by replacing outdated reports with actionable, live data. This shift allows professionals to make faster, smarter decisions, improving deal timelines, pricing strategies, and client satisfaction. Key highlights include:

- 62% Faster Transactions: Real-time tools speed up decision-making compared to older methods.

- Better Financial Outcomes: Investors save 4.7% on purchases and earn 3.2% higher premiums on sales.

- Improved Accuracy: Predictive models now forecast trends with 76% accuracy, up from 58% five years ago.

- AI-Powered Efficiency: Tools reduce lead-to-lease timelines by 65% and increase conversion rates by 8%.

- Hyperlocal Insights: Data-driven strategies focus on block-level trends, boosting client satisfaction by 27%.

Platforms like CoreCast simplify data management, helping professionals track, forecast, and optimize portfolios in real time. These advancements are reshaping how real estate teams operate, emphasizing speed, precision, and data-driven decisions.

Real-Time Analytics Impact on Real Estate: Key Statistics and ROI Metrics

AI-Powered Real Estate: The Next Big Shift in Marketing & Lead Gen Ep 2

Current Trends in Real-Time Analytics for Real Estate Marketing

The real estate industry is undergoing a major transformation in how marketing decisions are made. One game-changer is Generative AI, which processes unstructured data from sources like leasing documents and market reports. This technology enables professionals to quickly spot investment opportunities and market trends. According to McKinsey, it could bring between $110 billion and $180 billion in value to the sector [2].

A key shift is the move away from traditional daily batch processing to real-time data streaming. Tools like Apache Pulsar now allow marketing campaigns to adapt instantly based on current pricing and availability, eliminating the delays caused by overnight updates [8][5]. The market for stream processing is projected to grow at a 21.5% annual rate from 2022 to 2028 [8].

Another innovation is the rise of AI agents, which are systems capable of learning and acting independently. These agents are automating tasks across the board, from generating leads to signing leases. Greg Lindsay from PwC/ULI envisions a future where "self-driving buildings" can manage resources, optimize operations, and respond to changes with minimal human input [5]. These advancements are setting the stage for marketing strategies that are more precise and data-driven than ever before.

AI-Powered Personalization and Predictive Analytics

Artificial intelligence is reshaping how real estate professionals connect with potential clients. Smart Targeting systems analyze historical data to identify homeowners most likely to sell, allowing agents to launch automated campaigns - such as postcards, emails, and ads - directly at these high-probability prospects [7]. By 2025, 75% of B2B sales organizations are expected to adopt AI-driven guided selling tools [9].

Personalization doesn’t stop at targeting. Generative AI tools let prospective tenants virtually customize properties during digital tours, enabling them to see finishes like cherrywood or walnut in real time [2]. This level of customization not only boosts conversion rates but also provides insights into which features resonate with different customer groups. One developer reported a 10%+ increase in net operating income after adopting these tools [2].

Predictive analytics are also reaching impressive levels of accuracy. Today’s models can predict neighborhood price trends with about 76% accuracy six months in advance, a leap from 58% five years ago [1]. This allows marketing teams to adjust strategies ahead of market shifts. For instance, when real-time analytics showed waning interest in luxury properties in Seattle - despite traditional reports indicating rising prices - investors pivoted to selling strategies three months earlier than the broader market, avoiding average losses of 8.7% [1].

Hyperlocal Marketing Insights

Real estate marketing is becoming more precise, moving from broad neighborhood analyses to block-by-block insights. Modern buyers think and act based on hyperlocal factors, such as specific streets or landmarks, rather than entire cities or zip codes [11]. With location and price consistently ranking as top priorities for buyers, this granular approach is critical [11].

Advanced location analytics now provide detailed insights into consumer behavior at specific points of interest. These tools track metrics like visit volumes, dwell times, and cross-shopping patterns, helping marketers craft campaigns tailored to real-time neighborhood data [4]. Amy Broghamer, Founder and Lead Agent at Amy B Sells, emphasizes the importance of staying informed:

"You truly have to have your ear to the ground in this market on a daily basis to get opportunities early and often for your clients" [10].

This hyperlocal focus is delivering tangible results. Agents using real-time analytics report a 27% boost in client satisfaction and a 34% increase in referral rates compared to those relying on traditional data [1]. Peter Chabris, Owner of The Chabris Group, highlights the predictive power of these tools:

"Our lender will have an even better feel for the front end of the pipeline with new loan applications. It's a foreshadowing of what local buyer activity will look like 30 to 60 days from now" [10].

How Real Estate Professionals Use Real-Time Analytics

Real estate professionals are moving away from relying solely on quarterly reports and static spreadsheets. Instead, they're embracing live data streams that speed up transactions and improve decision-making. For example, investors using real-time analytics have been able to close deals at prices averaging 4.7% below market value while selling properties at premiums of 3.2% above comparable listings [1]. This shift not only shortens the time it takes to finalize deals but also revolutionizes the way transactions are managed.

Pipeline Tracking for Deal Management

From sourcing to closing, managing real estate deals requires careful monitoring of key metrics at every stage. Real-time pipeline tracking offers instant insights into the status of each deal, highlighting which properties are moving forward and where delays are happening. Metrics like lead-to-lease timelines, conversion rates, and buyer intent signals - such as how often mortgage pre-approvals are completed or where prospects drop off after eligibility checks - are closely monitored [12].

AI-powered tools are playing a big role here. Automated systems handle routine communications via text, email, and voice, cutting lead-to-lease timelines by 65% and boosting conversion rates by 8% [5]. These tools also analyze CRM activity, property viewing behaviors, and email engagement to score leads, helping sales teams focus on the most promising prospects [6, 19].

Portfolio Optimization Through Real-Time Monitoring

Real-time analytics go beyond individual deals - they help optimize entire property portfolios. Instead of waiting for quarterly reviews, live dashboards now provide continuous updates on metrics like ROI, capitalization rates, occupancy levels, and overall asset performance. This real-time visibility allows managers to quickly spot underperforming properties and adjust marketing strategies as needed. Additionally, tracking lease expirations in real time enables teams to launch targeted campaigns before spaces become vacant.

Take Westridge Development Group, for example. In Portland, Oregon, they used real-time analytics to study building permits and social media sentiment, spotting an early revitalization trend. Acting quickly, they purchased three commercial properties six months before values surged by 22%, gaining $4.3 million in additional equity compared to competitors who entered later [1]. Similarly, BlackRock Capital Real Estate leveraged real-time search interest data during the pandemic recovery to identify growing demand for suburban office parks. Their $78 million investment yielded a 31% ROI within just 18 months [1].

sbb-itb-99d029f

CoreCast: An End-to-End Real Estate Intelligence Platform

In a world where commercial real estate professionals juggle fragmented data from various sources, CoreCast steps in as a game-changer. This platform brings everything together - tracking, forecasting, and investment management - into one seamless hub. Co-founder Spencer Vickers sums it up perfectly:

"Data is scattered across applications, underwriting models don't connect to real performance, and pipeline tracking is more guesswork than strategy. That's why CoreCast was developed - to deliver smarter tracking, forecasting, and management for CRE investments." [3]

What Makes CoreCast Stand Out?

CoreCast simplifies complex processes with tools like the Revenue Manager and Portfolio Rollup. These features let users upload, visualize, and aggregate asset-level data, providing a clear picture of fund economics and portfolio performance [3]. The platform doesn’t stop there - it bridges the gap between theoretical underwriting models and real-world performance, covering diverse asset types and risk profiles [3].

One standout feature is the integrated map, which shows properties in real-time and highlights competitive market opportunities. And for teams looking to impress investors, the stakeholder center allows for custom-branded reports that can be shared directly within the platform. It’s a one-stop shop for smarter, faster decision-making.

Transforming Marketing Strategies with CoreCast

CoreCast takes the guesswork out of marketing by automating data visualization. This not only speeds up decision-making but also ensures that marketing strategies are backed by hard data [3]. Instead of relying on assumptions, professionals can confidently tell investors, “The data shows...” This shift not only builds credibility but also helps teams zero in on the deals that deserve immediate attention.

By addressing gaps in traditional pipeline tracking and portfolio analysis, CoreCast doesn’t just improve marketing - it redefines it. It’s a tool designed for the fast-paced demands of modern real estate.

Beta Launch and Pricing

CoreCast began its beta rollout in Q2 2025 with 50 early users, who received a 50% discount on their first year following the platform’s official launch in Q3 2025 [3]. Beta pricing is set at $50 per user per month, with plans to expand into three tiers: Free, Essentials at $75 per user per month, and Pro at $100 per user per month [3].

Challenges and Future Opportunities in Real-Time Analytics

Solving Data Integration Problems

In real estate, data often exists in silos - spread across various models, management systems, and spreadsheets. This fragmentation hampers the ability to gain unified insights and costs businesses a staggering $3.1 trillion annually due to lost productivity and errors [14].

Modern platforms are stepping up by using APIs to unify legacy data systems into a single, cohesive view [5]. Mindy Ferguson, Vice President of Messaging and Streaming at Amazon Web Services, highlights the power of this approach:

"The advantage is being able to bring it in once, use it across your organization, and put it to use before the value of that data diminishes" [6].

Streamlined data integration not only improves operational efficiency but also sets the stage for advanced AI applications in real estate. For example, CoreCast simplifies this process by directly linking underwriting models with real-time performance data. This eliminates the need for error-prone manual spreadsheet tasks, speeding up decision-making and reducing mistakes [3]. Once integration is achieved, the focus shifts to leveraging AI for automation.

The Future of AI-Driven Automation

The real estate sector is evolving from basic automation to "Agentic AI" - systems capable of independently perceiving, learning, and acting [13][5]. One platform demonstrated this potential by cutting lead-to-lease timelines by 65% while boosting conversion rates by 8% through the use of autonomous agents [5].

AI's potential in real estate is widely recognized, with 89% of C-suite leaders believing it can address key industry challenges [13]. A case in point is Royal London Asset Management, which deployed JLL’s AI-driven "Hank" technology in a 125,000-square-foot commercial office space. The results were impressive: a 708% ROI, 59% energy savings, and a reduction of 500 metric tons of carbon emissions annually [13]. Yao Morin, Chief Technology Officer at JLLT, underscores the role of AI in the industry:

"JLL is embracing the AI-enabled future. We see AI as a valuable human enhancement, not a replacement" [13].

Looking ahead, researchers are envisioning "self-driving buildings" - properties capable of managing resources and adapting to changes with minimal human input [5]. Digital twins, powered by real-time data, are already showing promise, delivering up to 30% energy cost savings and extending hardware lifespans by at least a year [5]. Greg Lindsay, author and lead researcher at PwC/ULI, captures the essence of this shift:

"The question isn't whether buildings will drive themselves, but how quickly the industry will learn how to steer them" [5].

This movement toward autonomous, data-driven operations marks a transformative phase for the real estate industry.

Conclusion

The real estate industry is at a critical juncture where success hinges on how quickly insights are turned into action. Teams leveraging real-time analytics are closing deals 62% faster, securing better pricing on acquisitions and sales, and seeing higher client satisfaction and referral rates [1].

These results highlight the importance of unified analytics. Tools like CoreCast bring scattered data together into a single platform - streamlining everything from underwriting across asset classes to tracking pipeline stages, conducting portfolio analysis, and creating branded reports. By cutting out the manual processes that slow decisions and introduce errors, this approach allows for faster, more accurate market strategies [3].

Moving forward, combining AI-driven insights with human expertise will be key. While technology can now predict trends with 76% accuracy up to six months in advance [1], local market nuances and regulatory know-how remain crucial. Balancing these elements will define who stays ahead in this competitive landscape, with the speed of adoption playing a decisive role.

FAQs

How can real-time analytics speed up real estate deal timelines?

Real-time analytics speed up deal timelines by delivering instant insights into the factors that influence transactions. As market conditions evolve - whether it’s shifting prices, changes in buyer behavior, or new financing trends - data is captured, analyzed, and shared with the deal team in real time. This eliminates the lag caused by outdated reports or manual processes, allowing agents and investors to make quick decisions, tweak strategies, and act on opportunities without delay.

By keeping data continuously updated, real-time analytics also shine a light on potential roadblocks, like stalled underwriting or delayed approvals. Automated alerts ensure teams can tackle these issues early, keeping deals on schedule. Tools like CoreCast make this process even smoother by combining market data, pipeline tracking, and forecasting into a single platform. This helps professionals manage every stage of a deal more effectively, cutting down the time it takes to move from prospecting to closing.

How does AI enhance real estate marketing strategies?

AI is reshaping real estate marketing by introducing highly personalized, data-driven strategies. By sifting through massive datasets - like search patterns, demographics, transaction histories, and even social media activity - AI builds detailed profiles of potential buyers and renters. This allows agents to offer property recommendations, ads, and email campaigns that align perfectly with individual preferences, all in real time.

Tools powered by AI, such as dynamic content generators, intelligent chatbots, and advanced CRMs, simplify this process by automatically presenting relevant property details, pricing, and neighborhood information. Platforms like CoreCast push this even further by using AI-driven automation to deliver real-time market insights and portfolio forecasts. This empowers agents to create marketing materials that feel tailored to each client, ensuring every interaction adds value, increases engagement, and supports smarter investment choices.

How do hyperlocal insights improve client experiences in real estate marketing?

Hyperlocal insights drill down into the nitty-gritty details of a neighborhood - think individual streets, blocks, or even specific buildings. Instead of sticking to broad citywide or regional trends, this approach zeroes in on specifics like nearby amenities, school ratings, foot traffic, and local price trends. The result? Agents can paint a crystal-clear picture of a property’s surroundings and even offer insights into its potential future value.

When this data is provided in real time, it takes client satisfaction to a whole new level. Buyers and sellers get instant access to current price trends, comparable sales, and alerts about new listings or zoning updates. This empowers them to make decisions quickly and with more confidence. For agents, real-time analytics open the door to creating personalized marketing messages that spotlight the most relevant local features, making every interaction feel custom-tailored. Tools like CoreCast bring all these capabilities together, giving real estate professionals the power to deliver services that are not just timely but also highly precise and client-focused.