Predictive Analytics for Real Estate: 5 Use Cases

Predictive analytics is transforming real estate by turning raw data into actionable insights. It helps professionals forecast market trends, optimize property pricing, identify high-value leads, assess investment risks, and predict vacancies with unprecedented precision. By leveraging machine learning and economic indicators, these tools are driving smarter decisions and improving ROI across asset classes.

Key Highlights:

- Market Forecasting: Predicts neighborhood growth, rental demand, and supply trends using real-time data like migration patterns and employment rates.

- Property Valuation: Combines traditional data with real-time signals like listing activity and economic factors to refine pricing accuracy.

- Lead Prioritization: Scores leads based on conversion likelihood, helping brokers focus on high-potential buyers and sellers.

- Investment Analysis: Merges internal and external data to evaluate risks and streamline underwriting processes.

- Vacancy Forecasting: Anticipates tenant turnover and demand shifts using hyperlocal demographics and lease data.

Predictive tools are no longer a luxury but a necessity for staying competitive in real estate. Platforms like CoreCast integrate all these capabilities, providing professionals with a single system to manage deals, analyze portfolios, and generate forecasts efficiently. With predictive analytics, the industry is moving from reactive to proactive decision-making.

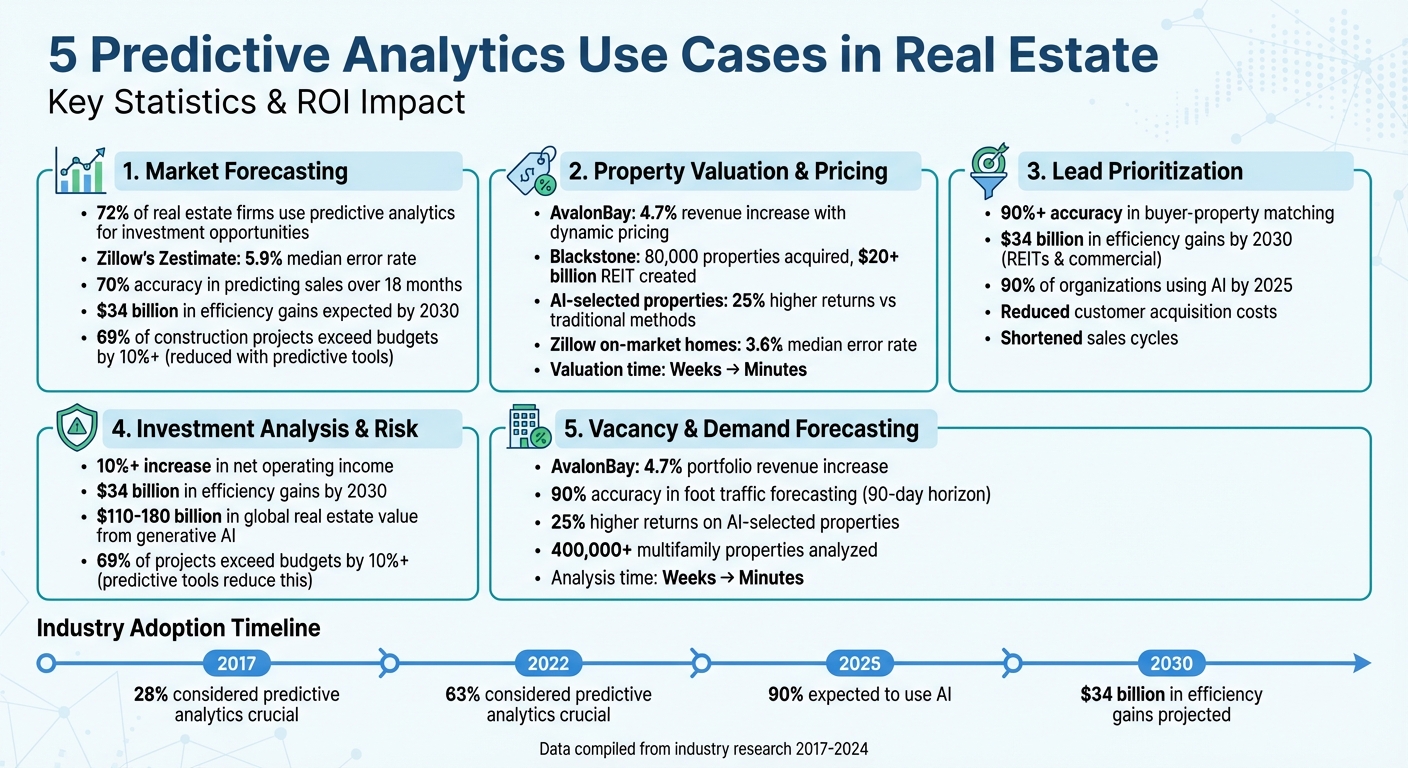

5 Predictive Analytics Use Cases in Real Estate: Key Statistics and ROI Impact

1. Market Forecasting

Data Integration and Analysis Capabilities

Market forecasting in real estate has evolved into a powerful tool by merging historical property data with real-time inputs like migration patterns, employment trends, and interest rate changes [1]. Advanced AI models now go a step further, analyzing urban growth trajectories, zoning updates, and infrastructure projects to uncover emerging trends [5].

Unlike traditional methods that relied on static, past-quarter data, today’s dynamic forecasting models incorporate live economic indicators and consumer behaviors. For example, data such as how often a property is viewed or added to saved lists feeds into hyperlocal demand models. These models deliver highly localized insights, offering a clear picture of market dynamics at the neighborhood level. This real-time approach makes forecasting more actionable and relevant.

Practical Applications in Real Estate Decision-Making

Predictive analytics has become a cornerstone for real estate firms, with over 72% now leveraging this technology to identify investment opportunities and manage risks [1]. These tools help pinpoint neighborhoods poised for value growth, predict shifts in rental demand, and clarify supply trends.

Take Zillow’s Zestimate algorithm, for instance - it estimates home values with a median error rate of just 5.9% [1]. Additionally, some forecasting programs boast up to 70% accuracy in predicting sales over an 18-month horizon [6]. Such precision is invaluable, guiding strategies across a range of real estate decisions, from acquisitions to development planning.

Impact on ROI and Operational Efficiency

AI-driven forecasting isn’t just about better insights - it’s also delivering measurable financial benefits. By 2030, these tools are expected to generate $34 billion in efficiency gains for real estate investment trusts (REITs) and commercial firms [5]. Early identification of market shifts gives investors a first-mover advantage, enabling them to lock in properties or adjust portfolios before prices respond [8].

Forecasting also reduces costly missteps. For instance, in construction, where 69% of projects typically miss their budgets by more than 10%, predictive tools can anticipate cost fluctuations before breaking ground [5]. What used to take hours of manual data collection can now be accomplished in minutes [8].

Support for Commercial Real Estate Asset Classes

One of the standout features of predictive models is their adaptability across various asset classes, including multifamily housing, industrial properties, office spaces, and retail [8][9]. Each class has unique variables that these models analyze with precision.

For multifamily investments, factors like crime rates, school quality, and demographic trends come into play. Industrial site selection benefits from insights into local labor markets and logistics, while retail forecasting focuses on foot traffic and customer spending patterns [8][9]. This flexibility ensures that firms maintain a consistent level of analytical rigor across their portfolios, regardless of geography or property type [5][8].

CoreCast is a prime example of how advanced forecasting tools are reshaping the industry. It offers an end-to-end solution, enabling professionals to underwrite diverse asset classes, track deals through various stages, and produce detailed, branded reports. This comprehensive approach empowers smarter, data-driven decisions across the board.

2. Property Valuation and Pricing Optimization

Data Integration and Analysis Capabilities

Predictive models are reshaping how property values are assessed by incorporating a mix of traditional and non-traditional factors. While square footage and recent sales remain important, these systems dive deeper, analyzing elements like local amenities, socioeconomic trends, and even real-time signals such as listing saves, virtual tour activity, and social sentiment. Economic factors - such as mortgage rates, employment growth, and inflation - add another layer of precision, while data on environmental risks like flood zones and wildfire potential help predict long-term value. Dynamic pricing tools take it a step further, adjusting property values daily by tracking market trends like listing activity, nearby sales, and sale-to-list price ratios. This level of analysis provides a foundation for smarter pricing strategies.

Practical Applications in Real Estate Decision-Making

Real-world examples highlight how these technologies are driving results. AvalonBay Communities, for instance, implemented a dynamic pricing system that adjusts rental rates daily based on market conditions and competitor pricing. The result? A 4.7% boost in revenue without significantly affecting occupancy rates [10]. After the 2008 financial crisis, Blackstone turned to predictive analytics to evaluate thousands of properties, focusing on undervalued homes with strong appreciation potential. This strategy led to the acquisition of roughly 80,000 properties and the creation of a REIT now valued at over $20 billion [10]. Similarly, in March 2020, Skyline AI worked with AION Partners to acquire two residential complexes in Philadelphia, using an AI-driven model that integrated unconventional data like Airbnb listings and credit card trends. Properties identified as "high potential" through these algorithms have delivered, on average, 25% higher returns compared to traditional selection methods [10].

Impact on ROI and Operational Efficiency

Predictive analytics is speeding up property valuation processes dramatically. What once took weeks of manual effort can now be completed in minutes, thanks to advanced tools [8]. Zillow’s Zestimate algorithm, for example, has achieved a median error rate of just 3.6% for on-market homes, giving sellers more confidence in setting competitive prices [10].

Support for Commercial Real Estate Asset Classes

These predictive techniques extend their benefits across various types of real estate. For multifamily properties, models incorporate factors like school quality and demographic trends to refine valuations. Industrial site selection gains from analyzing labor market data and logistics needs, while retail property assessments leverage insights on foot traffic and consumer spending patterns [8]. Platforms like CoreCast bring all of this together, allowing real estate professionals to evaluate any asset class or risk profile within a single system. CoreCast users can monitor deal progress, run detailed portfolio analyses, and produce tailored reports, ensuring that every asset class benefits from these predictive insights. This integrated approach turns raw data into accurate, actionable valuations ready for the market.

3. Lead Prioritization and Buyer/Seller Identification

Data Integration and Analysis Capabilities

Predictive analytics has become a game-changer for real estate professionals, transforming how leads are identified and prioritized. By analyzing data from CRMs, website activity, and even social media, these advanced systems can score leads based on their likelihood to convert [1][11]. For instance, financial red flags like missed loan payments or tenant losses often signal property owners who may be ready to sell [4]. These models also consider factors like demographic trends, regional migration, and hyperlocal details such as nearby amenities to predict buyer intent. With machine learning driving these predictions, accuracy rates for matching buyers with suitable properties can exceed 90% [11].

This data-driven approach equips real estate professionals to proactively engage with potential clients, rather than waiting for opportunities to surface.

Practical Applications in Real Estate Decision-Making

The move from reactive to proactive lead generation is reshaping the industry. Predictive tools can pinpoint off-market properties that are likely to be listed within the next year, giving brokers a head start in building relationships with property owners [4]. Automated systems also help sales teams quickly rank and qualify leads, so they can focus on prospects that are most likely to move forward [11]. These tools streamline the process, ensuring high-intent buyers are identified early and efficiently guided through the transaction pipeline.

Impact on ROI and Operational Efficiency

Focusing on high-probability leads not only shortens sales cycles but also lowers customer acquisition costs [4][11]. According to Morgan Stanley Research, AI could deliver $34 billion in efficiency gains for real estate investment trusts and commercial firms by 2030 [5]. By 2025, nearly 90% of organizations are expected to leverage AI as a key strategy for staying competitive [5]. Real-time dashboards further enhance operational efficiency, enabling teams to respond instantly to market changes.

Support for Commercial Real Estate Asset Classes

Modern predictive platforms are versatile, accommodating a wide range of property types. Whether it’s multifamily housing, industrial sites, or retail spaces, these systems adapt their analysis to include asset-specific factors. For residential properties, this might mean evaluating school quality and demographic trends, while industrial properties might require insights into labor markets and logistics [8]. Tools like CoreCast bring all these capabilities into a single workflow, allowing users to manage deal pipelines, perform portfolio analyses, and track progress across various asset classes. This integrated approach ensures that lead prioritization seamlessly connects to deal tracking, competitive analysis, and stakeholder reporting, all within one comprehensive system.

4. Investment Analysis and Risk Assessment

Data Integration and Analysis Capabilities

Predictive analytics is reshaping how investment decisions are made by bringing together data from various sources. By merging internal records like lease agreements and sales histories with external factors such as interest rates, demographic trends, and migration patterns, these tools offer a detailed view of portfolio performance [1][3]. AI-powered platforms can also process unstructured data from leases and market reports, automatically highlighting key variables such as projected rent and market dynamics, which helps streamline manual review processes [13]. This kind of integration speeds up underwriting significantly.

Advanced systems go a step further by incorporating nontraditional data like FEMA flood maps, real-time sensor inputs, and mobile phone traffic. These additional layers of data help refine risk models and make risk management more proactive [7][8].

Practical Applications in Real Estate Decision-Making

Predictive tools are enabling a shift from reactive to proactive risk management in real estate. For instance, they can flag early warning signs such as declining tenant credit scores, oversupply in certain regions, or worsening neighborhood conditions. With these insights, firms can reallocate capital before losses occur [1]. Additionally, real-time analysis of buyer profiles and transaction histories can detect issues like inflated valuations or mismatched identities, preventing potential financial setbacks [1].

These advanced capabilities allow firms to make informed portfolio adjustments and identify risks that traditional methods might overlook.

Impact on ROI and Operational Efficiency

The financial benefits of predictive analytics in real estate are hard to ignore. Companies using AI have reported over 10% increases in net operating income, thanks to better asset selection and stronger tenant retention [14]. By 2030, AI is projected to contribute $34 billion in efficiency gains to real estate investment trusts and commercial firms [5]. On a larger scale, generative AI could add between $110 billion and $180 billion in global real estate value [13][14].

These tools also help reduce budget overruns - a common issue, as nearly 69% of real estate projects exceed their initial budgets by more than 10% [5]. Predictive analytics can flag long-term budget risks in real time and automate data entry for budgets, invoices, and reports, allowing teams to address issues before they escalate [5].

Support for Commercial Real Estate Asset Classes

Predictive platforms are designed to cater to various property types by tailoring their analysis to the unique characteristics of each asset class. For example, multifamily models focus on tenant behavior and local employment trends, while industrial site selection prioritizes proximity to ports, airports, and labor markets. Meanwhile, office and retail evaluations often examine foot traffic patterns and space utilization rates [8][14]. This asset-specific approach enhances the precision of investment decisions.

Platforms like CoreCast consolidate these capabilities into a single workflow. CoreCast offers an integrated system for underwriting different asset classes, tracking deal progress, and generating analysis-ready reports. This streamlined approach ties investment analysis directly to competitive mapping, fund performance, and internal rate of return (IRR) projections across an entire portfolio [3][1].

sbb-itb-99d029f

5. Vacancy and Demand Forecasting

Data Integration and Analysis Capabilities

Forecasting tenant turnover and demand has become more precise with the integration of internal operations data and external economic indicators. Predictive models now blend information like lease renewal dates, payment histories, and tenant credit scores with broader metrics such as employment rates, GDP growth, and mortgage interest rates. This combination provides a clearer picture of future occupancy trends.

To refine these forecasts, analysts also consider hyperlocal demographics, including population, income, and education levels, alongside less traditional factors like proximity to restaurants, crime statistics, and business ratings. Some platforms even incorporate real-time data, such as online property search trends and sensor-detected foot traffic, offering actionable insights for proactive property management.

Practical Applications in Real Estate Decision-Making

Property managers can now anticipate vacancies well in advance. By analyzing tenant behavior and payment patterns, predictive tools help identify tenants who may be at risk of leaving. This foresight allows managers to take early action, such as offering lease renewal incentives or starting marketing efforts for upcoming vacancies ahead of time.

A notable example comes from May 2019, when Skyline AI launched software capable of analyzing data from over 400,000 multifamily properties across the U.S. The platform used data points like nearby restaurant locations, crime rates, and education levels to predict property values and occupancy rates in just minutes - a task that previously required weeks of manual effort [8].

"Efficient property management is predictive, not reactive." - Colliers Insights Team [8]

Impact on ROI and Operational Efficiency

Accurate vacancy forecasting has proven to be a financial game-changer. Take AvalonBay Communities, for example - a leading multifamily REIT. By implementing a dynamic pricing model that factored in market conditions, property features, and competitor pricing in real time, they increased portfolio revenue by 4.7% without sacrificing occupancy rates [10].

Predictive tools also extend to foot traffic analysis, offering up to 90% accuracy in estimating visitor numbers for the next 90 days. This data helps property managers fine-tune maintenance schedules and justify rental premiums based on actual usage patterns [12]. Properties identified as "high potential" through predictive algorithms have delivered, on average, 25% higher returns compared to those selected through traditional methods [10]. These gains in efficiency and profitability span across various property types.

Support for Commercial Real Estate Asset Classes

Predictive tools adapt their focus based on property type. For multifamily properties, the emphasis is on tenant turnover and local employment trends. Industrial properties benefit from insights into labor market access and infrastructure development, while retail and office spaces rely on foot traffic and space utilization data to forecast demand effectively.

Platforms like CoreCast consolidate these capabilities, offering a unified workflow to track pipeline deals, analyze competitive landscapes through integrated maps, and generate portfolio-wide occupancy forecasts across diverse asset classes. This integrated approach streamlines decision-making and enhances operational efficiency for real estate professionals.

The Future of Real Estate: Predictive Analysis

Conclusion

Predictive analytics is reshaping how decisions are made in real estate. The days of relying solely on intuition or static historical data are fading, replaced by strategies powered by massive data processing and real-time insights. Companies leveraging these tools are seeing noticeable gains in both portfolio performance and operational efficiency.

The shift toward predictive analytics has been rapid. By 2022, 63% of real estate professionals considered these tools crucial for competitive market analysis - a dramatic rise from just 28% in 2017 [2]. Machine learning models now outperform traditional methods in forecasting property value changes, while AI-powered tools are streamlining workflows across the industry [2][5]. These advancements are driving the adoption of platforms that consolidate and simplify complex data into actionable insights.

One standout example is CoreCast, an all-in-one intelligence platform designed for real estate professionals. With CoreCast, users can underwrite assets across various classes, monitor deal pipelines, explore properties and competitive landscapes through integrated maps, and conduct detailed portfolio analyses - all within a single platform. Its Portfolio Rollup feature simplifies decision-making by aggregating asset-level data into a clear, fund-level view [3].

Professionals incorporating predictive analytics into their processes today gain a significant edge. These tools allow for earlier opportunity identification, better risk management, and optimized portfolio returns. And the best part? These capabilities are no longer limited to large institutions - they’re now accessible to anyone ready to embrace a data-driven approach and leave manual processes behind.

FAQs

How can predictive analytics enhance real estate investment decisions?

Predictive analytics takes massive amounts of historical and real-time data and turns it into actionable insights, making real estate investment decisions smarter and more data-driven. With the help of machine learning, it can predict property prices, rental income, and market demand. This helps investors pinpoint high-growth areas, set competitive rental rates, and confidently time their transactions.

It’s also a powerful tool for assessing risks, such as shifts in interest rates or rising construction costs, which can help avoid mispricing or extended vacancies. Platforms like CoreCast bring these features together in one place, enabling users to evaluate asset performance, monitor deal pipelines, and create professional-grade reports. By combining real-time insights with AI-powered forecasting, predictive analytics equips investors to boost returns, reduce risks, and navigate the ever-changing real estate market with confidence.

What data is used in predictive analytics to determine property value?

Predictive analytics for property valuation draws from a mix of essential data sources to paint a clearer picture of property values. Among these are historical transaction records, which include sale prices, tax assessments, and ownership details. Additionally, market trends - such as price indices, rental yields, and local economic or demographic data - play a crucial role in understanding broader patterns.

Equally important are property-specific details, like size, age, and unit composition, as well as location-based factors, such as proximity to schools, public transit, and local amenities. Even digital signals - like social media activity or online search trends - add valuable insights. By combining these data points, real estate professionals can make smarter, data-driven decisions when assessing property values.

How does predictive analytics help reduce vacancy rates in real estate?

Predictive analytics plays a key role in helping landlords minimize vacancy rates. By analyzing both historical and real-time data, it can forecast demand trends and predict tenant behavior. For example, advanced models can anticipate tenant turnover, pinpoint areas where rental demand is increasing, and evaluate the potential impact of rent changes before they’re implemented. These insights enable landlords to take proactive steps, like adjusting rent prices, offering special incentives, or rolling out targeted marketing campaigns to keep units filled.

CoreCast brings all these capabilities into one easy-to-use platform. It analyzes lease data, market trends, and property performance to highlight units at risk of becoming vacant, recommend optimal rent pricing, and display portfolio-wide occupancy trends on an integrated map. This allows real estate professionals to act swiftly based on data-driven insights, helping maintain high occupancy rates and steady cash flow.