Why Data Sync Matters for Real Estate Workflows

Data synchronization is the key to fixing inefficiencies caused by disconnected systems in real estate. Without it, professionals waste time on manual data entry, deal with inconsistent information, and risk costly errors. By syncing data across CRMs, transaction platforms, marketing tools, and financial systems, you can ensure accuracy, save time, and improve decision-making.

Key Benefits of Data Synchronization:

- Time Savings: Automates updates across platforms, reducing manual work.

- Error Reduction: Minimizes mistakes caused by duplicate or outdated data.

- Better Decisions: Real-time updates provide accurate insights for faster actions.

- Streamlined Workflows: Aligns systems to reduce delays and improve collaboration.

Challenges and Solutions:

- Inconsistent Data Fields: Standardizing terms like "Listing Price" avoids mismatched records.

- Data Accuracy: Testing and cleaning data before syncing ensures reliability.

- Tool Integration: Platforms like CoreCast simplify syncing and provide portfolio-wide insights.

Data synchronization isn’t just about efficiency - it’s about staying ahead in a competitive market. Tools that integrate and align data can help real estate professionals focus on growth rather than fixing errors.

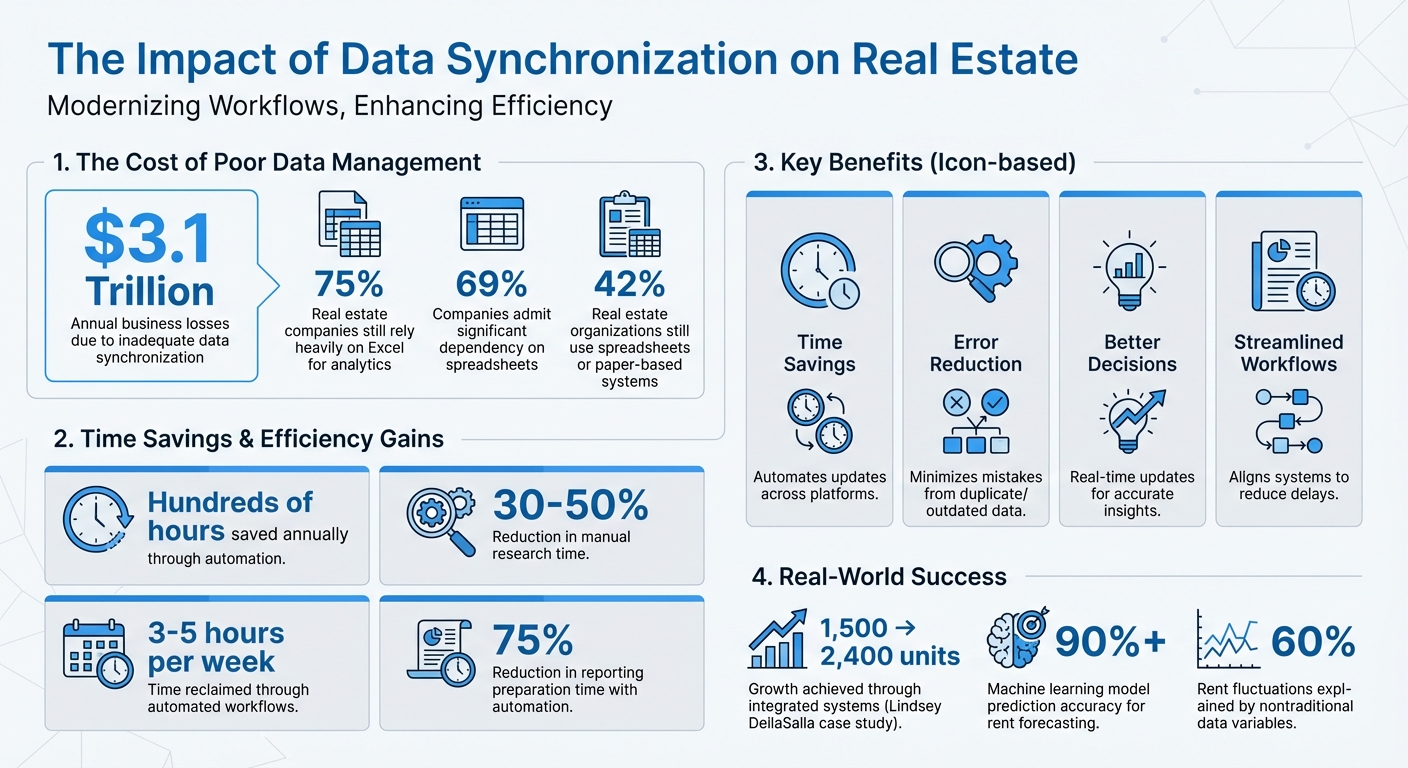

Data Synchronization Impact on Real Estate: Key Statistics and Benefits

How Data Sync Improves Workflow Efficiency

Research on Time Savings and Error Reduction

Automating data entry can save businesses hundreds of hours each year [5]. Instead of manually updating multiple platforms, synchronized systems take care of these updates automatically. This means your team can spend more time closing deals and less time buried in repetitive tasks.

The costs of poor data management are staggering. Businesses lose a jaw-dropping $3.1 trillion annually due to inadequate data synchronization [2]. Outdated property information alone can slow down transactions, creating unnecessary delays [7].

"Spreadsheets require excessive manual updates, wasting valuable time." – Alexander Fish, 4Degrees [5]

Despite these advantages, 42% of real estate organizations still lean on spreadsheets or even paper-based systems for critical functions [8]. Relying on such outdated methods not only slows operations but also increases the risk of errors and delays in decision-making.

These improvements in efficiency pave the way for real-world success stories, as illustrated in the case studies below.

Case Study: Real-Time Updates in Action

The impact of data synchronization becomes crystal clear through real-world examples.

In August 2024, Doorify MLS adopted RESO standards across its data infrastructure. This move allowed seamless integration across various software platforms, significantly boosting both vendor and customer engagement [4].

Similarly, in August 2022, the Brick Consortium and RealEstateCore joined forces to align metadata standards. This effort enabled HVAC sensors to communicate directly with lease data. The result? Lower energy consumption and automated facility management [2].

"Alignment Reports save organizations significant time in constructing comparative data frameworks, allowing technical staff, data analysts and business management to focus on the critical details." – RESO [4]

Benefits of Real-Time Data Synchronization

Improved Data Accuracy and Consistency

Real-time synchronization ensures a "single version of truth" across your entire business [1][2]. When property listings, pricing, and client data are updated instantly across systems, everyone works off the same accurate, up-to-date information. For example, fields like "Ask Price" and "Offer Price" can be standardized into a unified "List Price", reducing discrepancies and confusion.

Despite growing interest in coordinated data strategies, a staggering 75% of real estate companies still rely heavily on Excel for analytics, with 69% admitting significant dependency [6]. While spreadsheets often lead to fragmented and error-prone data, real-time synchronization connects tools like CRMs, accounting software (e.g., QuickBooks), and MLS systems, enabling seamless data sharing [2][9]. This creates a unified data foundation that supports automation and minimizes the need for manual adjustments.

Streamlined Workflows and Less Manual Work

By automating tasks, synchronized data significantly cuts down on manual effort. For instance, when a bank transaction is recorded, it can automatically match to the correct renter balance. Similarly, when a lead converts, the system can instantly update agent performance leaderboards [9][11]. This eliminates time-consuming tasks like manual data entry and report generation.

"The team at Real Synch helped us streamline our technology and integrate all of our systems, which allowed us to grow from 1,500 to 2,400 units sold because we had the entire infrastructure in place to support such growth." – Lindsey DellaSalla [9]

Smarter Decision-Making with Real-Time Insights

Accurate and automated data doesn’t just save time - it also enables faster, more informed decision-making. With real-time updates, you can monitor revenue, gross commission income (GCI), and profit trends as they happen, rather than waiting for end-of-month reports [9]. This allows you to make timely, fact-based adjustments to your strategy.

Take the example of a machine learning model developed by McKinsey researchers in October 2018 for multifamily buildings in Seattle. By combining traditional vacancy rate data with nontraditional factors like proximity to top-rated restaurants and stores, the model predicted three-year rent per square foot with over 90% accuracy. Interestingly, nontraditional variables accounted for 60% of rent fluctuations [10].

For portfolio analysis and pipeline tracking, synchronized data ensures that all teams - from agents to architects - are aligned with the same reliable information. This unified approach not only accelerates collaboration but also provides hyperlocal insights, such as city-block-level trends, that traditional retrospective data often misses. Monitoring agent KPIs and lead conversions in real time means you can adjust strategies immediately instead of discovering problems weeks later.

"Advanced analytics can rapidly yield powerful input that informs new hypotheses, challenges conventional intuition, and sifts through the noise to identify what matters most." – Gabriel Morgan Asaftei, Senior Expert, McKinsey [10]

Why Your MLS Listings Aren’t Updating | Fixing IDX Sync Delays and Data Lag

sbb-itb-99d029f

CoreCast: End-to-End Real Estate Intelligence with Data Sync

Real-time synchronization has the power to revolutionize real estate workflows, yet many firms still struggle with fragmented systems and outdated, guesswork-driven tracking. CoreCast steps in to solve this by bringing all commercial real estate intelligence under one roof.

CoreCast's Integration Features

CoreCast simplifies operations by consolidating data from various sources into a single, reliable platform. You can upload information for managed properties and potential deals while seamlessly integrating with third-party tools. This eliminates the hassle of manual data entry and ensures updates flow smoothly across your workflow, reducing errors and version control issues.

One standout feature is the platform's Revenue Manager, which provides clear visualizations of both asset and portfolio performance. Whether you're assessing properties already under management or exploring new opportunities, the integration of underwriting models with real-world performance data turns static spreadsheets into dynamic, up-to-date tracking tools that reflect current market trends.

By combining strong integration capabilities with synchronized portfolio insights, CoreCast helps streamline decision-making and improve operational efficiency.

How CoreCast Improves Real Estate Workflows

CoreCast uses real-time synchronization to convert asset-level data into actionable insights for your entire portfolio. Its Portfolio Rollup tool aggregates data from individual assets into a comprehensive portfolio view, enabling you to analyze fund economics across your investments. With this unified approach, your team - whether in acquisitions or asset management - works from the same dependable data foundation, promoting faster collaboration and more informed decisions.

"Data often remains scattered and disconnected. CoreCast offers a smarter way to track, forecast, and manage CRE investments." - Spencer Vickers, CoreCast

The platform supports a variety of asset types and risk profiles, making it equally effective for multifamily, retail, office, or industrial properties. It allows you to monitor deals through pipeline stages, conduct portfolio analyses, and create custom-branded reports for stakeholders - all within one system.

CoreCast vs. Property Management Systems

CoreCast isn't a property management or bookkeeping tool. Instead, it integrates with property management systems to provide advanced intelligence, analysis, and forecasting. Think of it as a strategic layer that sits above your operational tools, delivering the clarity and speed necessary for effective portfolio management. By complementing your existing systems, CoreCast ensures you gain both operational efficiency and strategic insights.

Common Challenges in Data Synchronization

Real estate companies often struggle with synchronizing data across a variety of platforms. The industry relies heavily on standalone systems - CRMs, transaction platforms, marketing tools, and accounting software - each speaking its own "language." This fragmentation makes it difficult to keep data aligned and accurate, creating barriers to smooth operations and informed decision-making.

Aligning Data Fields Across Systems

One of the biggest headaches in managing data is the inconsistent terminology used by different systems. For instance, your CRM might refer to a field as "Listing Price", while your property management software calls it "Ask Price." Multiply this by dozens of fields, and you quickly end up with a mess that requires manual intervention.

To address this, field mapping creates a "translation layer" between systems, ensuring that terms like "Listing Price" and "Ask Price" are standardized into a single field, such as "List Price." Without this step, you risk duplicate records, conflicting data, and reports that don't add up. The Real Estate Standards Organization (RESO) has tackled this issue by developing a Data Dictionary, a universal framework designed to standardize data sharing across the industry [12].

The problem gets even trickier with custom integrations. As more systems are added, the effort to map and align data grows exponentially. What works for two systems can become unmanageable when you're dealing with five, ten, or more.

Keeping Data Accurate During Sync

Ensuring data accuracy during synchronization is another major challenge. Manual data entry is not only expensive and slow but also prone to errors like typos, outdated information, or missing fields [5].

A thorough testing process is essential before launching any synchronization. Start by identifying all data sources and cleaning up duplicates or inconsistencies. Then, run checks to confirm that the synchronized data matches the original. For example, one MLS provider revamped its data infrastructure using RESO standards, making it easier to integrate with other tools and adopt new technologies faster.

Another key tactic is identity resolution - linking different records that refer to the same person. For instance, a contact in your CRM, an email subscriber, and a website registrant might all be the same individual. Without this capability, fragmented profiles can lead to poor decision-making [3].

To tackle these challenges, advanced technologies offer practical solutions.

Using Advanced Technologies for Better Sync

Master Data Management (MDM) systems simplify synchronization by consolidating data into a single, reliable source. Instead of connecting every tool directly, MDM acts as a central hub that standardizes and enriches data before distributing it across various platforms [3].

"MDM uses technology to consolidate data from different systems into a single source of truth and ensures that data is accurate and consistent across the enterprise."

- Jeffrey A Hickey, Founder and CEO, Real Estate 3.0, llc [3]

Modern cloud-based platforms like Snowflake and Databricks provide the infrastructure needed for MDM. These solutions typically include layers for data ingestion, processing, and access, ensuring clean, standardized data is ready for use in business intelligence tools. Automating this process can cut reporting preparation time by as much as 75% [3].

For firms dealing with complex systems, semantic web technologies offer additional help. In August 2022, the Brick Consortium and RealEstateCore introduced a harmonized metadata solution. This allows building owners to manage HVAC systems with one standard while tracking lease details with another, all within a shared framework that ensures compatibility [2].

Finally, clear data governance is vital. Defining who owns the data, setting consistent naming conventions, and creating firm policies can prevent the reemergence of data silos. Without strong governance, even the most advanced technology can fail to maintain order [3].

Conclusion: Data Sync and the Future of Real Estate Workflows

In today’s real estate landscape, data synchronization has become more than a convenience - it’s a must-have for staying competitive. When property details, financial records, and client interactions flow effortlessly between systems, professionals can make quicker, more informed decisions. Take Lindsey DellaSalla, for example. By leveraging integrated data systems, she managed to scale operations from 1,500 units to 2,400 units - a clear testament to the power of synchronized workflows [9]. The result? Consistent operations and significant time savings.

Real estate professionals who implement data synchronization often report cutting manual research time by 30–50% and reclaiming 3–5 hours per week thanks to automated workflows [13][3]. These gains make scaling operations possible without the need for a proportional increase in staff.

Tools like CoreCast address the challenge of fragmented data by consolidating various streams into actionable insights. Features such as its Revenue Manager and Portfolio Rollup transform scattered data into meaningful intelligence, helping professionals connect their analysis directly to asset performance.

Looking ahead, the industry is shifting focus from simply managing raw data to orchestrating actions at the right time. As Jeffrey A Hickey explains:

"Master Data Management creates consistent records for each person, place, or thing in a business... ensuring that data is accurate and consistent across the enterprise" [3].

The real winners in real estate won’t be those who collect the most data but those who synchronize it effectively. Clean, connected data doesn’t just boost efficiency - it builds trust, speeds up decision-making, and enables action while competitors are still stuck reconciling spreadsheets.

FAQs

Why is data synchronization important for real estate workflows?

Data synchronization ensures that all your tools and systems - like spreadsheets, MLS feeds, zoning maps, and tenancy logs - work together seamlessly and stay up-to-date. By cutting out the need for manual data entry, it minimizes errors, saves time, and establishes a single source of truth your entire team can depend on.

With real-time updates, tasks such as site selection, market analysis, and investor reporting become quicker and more efficient. This not only speeds up decision-making and shortens deal cycles but also improves forecasting accuracy. When your data is in sync, you can tap into advanced tools like AI and analytics to refine investment strategies and reporting.

Synchronized data simplifies every step of the real estate process, helping your business achieve smarter, faster, and more precise results.

What are the key challenges in synchronizing data for real estate systems?

Synchronizing data in real estate systems comes with its fair share of challenges. A primary hurdle is data fragmentation, where essential information is scattered across multiple systems - think title registries, zoning databases, and property listings. This fragmentation often results in inconsistent formats, duplicate entries, and missing details, making it tough to establish a reliable single source of truth. On top of that, the temporal nature of data - such as outdated records or overwritten changes - can lead to inaccuracies or conflicting information.

From a technical perspective, integrating diverse data types adds another layer of complexity. Tasks like address matching, geospatial linking, or real-time synchronization require precise execution, and older legacy systems combined with manual processes can amplify error rates and slow down operations. Ensuring data governance is equally crucial; without it, maintaining consistency, security, and scalability becomes a daunting task, especially when dealing with high transaction volumes.

Organizational challenges also come into play. Gaining alignment among stakeholders, defining data ownership, and encouraging the adoption of new tools often demand extensive change management efforts. Platforms like CoreCast tackle these issues by bringing data sources together, standardizing identifiers, and offering real-time insights - all within a streamlined and user-friendly interface.

How does real-time data synchronization enhance decision-making in real estate?

Real-time data synchronization keeps property details, market updates, and performance metrics current across all tools used by real estate teams. This eliminates the hassle of outdated information, reduces the need for manual updates, and lowers the risk of costly mistakes. By relying on a single source of truth, workflows become smoother, and accuracy improves.

Having the latest data at their fingertips allows decision-makers to act on emerging market trends, run predictive models, and leverage AI-driven insights. This means quicker, well-informed decisions on pricing and investments. Real-time data also fuels dashboards with live metrics, cash flow projections, and risk assessments, transforming raw information into actionable insights almost instantly. The outcome? A streamlined workflow that moves in step with the ever-changing market.