How AI Predicts Multifamily Rent Growth

AI is transforming how multifamily rent growth is forecasted. By analyzing billions of data points monthly, it delivers highly precise, hyper-local predictions - down to 100-meter clusters - far beyond what ZIP code-level data offers. Here's what you need to know:

- Accuracy: AI achieves up to 96% accuracy for target markets and 99% accuracy nationwide, reducing errors to within $10–$15 annually over five years.

- Key Data Sources: AI leverages market trends (employment, migration, affordability), property-level metrics (lease terms, trade-out rates), and regional data (construction starts, absorption rates).

- Better Decision-Making: Investors use AI to identify market shifts, optimize underwriting, and plan acquisitions with confidence, even in oversupplied areas.

For example, in 2025, AI tools helped Origin Investments project 5.1% annual rent growth for properties in Charlotte and Nashville, despite local oversupply concerns. These tools also assist in stress-testing investments and tracking portfolio performance in real-time.

Platforms like CoreCast integrate AI forecasts into workflows, enabling faster underwriting, scenario analysis, and portfolio management. With AI, real estate professionals can move from reactive decisions to smarter, data-driven strategies.

A.I. And Rental Housing

Data Sources AI Uses to Predict Rent Growth

Predicting multifamily rent growth with precision relies on three main data sets, which together can achieve accuracy within $10–$15 annually over a five-year period[2][5]. Platforms like Multilytics process an astounding 2.7 billion data points each month, pulling from hundreds of sources. These often include historical data spanning over three decades and multiple economic cycles[5][6][9].

Market and Economic Data

AI models begin by analyzing broad economic factors that influence renter demand and affordability. Key metrics such as national and local employment rates, white-collar job trends, and wage growth help gauge whether renters can handle increasing costs[4][5]. Demographic shifts, including population growth and migration patterns, provide insights into long-term housing demand. Meanwhile, macroeconomic factors like interest rates, inflation, GDP growth, and federal debt levels impact construction and operating costs[4][5].

Supply and demand trends are equally critical. AI tracks new construction starts, apartment absorption rates, and overall supply to determine whether markets are nearing saturation or facing scarcity. For example, by late 2025, new construction starts for rental housing developments had dropped by 70% from their peak, signaling potential rent-growth opportunities in the late 2020s[4]. Another key indicator is the "affordability gap", which compares the cost of renting to homeownership expenses. For niche markets like student housing, AI incorporates specialized data such as university enrollment rates, tuition costs, and high school graduation rates[9].

"In 2026, artificial intelligence won't just amplify human work; increasingly, it will substitute for it... pressuring white-collar employment, capping wage growth, and exerting deflationary pressure on rents." - David Scherer, Co-CEO, Origin Investments[4]

While these broad market indicators provide the foundation, property-specific data adds a finer level of detail.

Property-Level Data

AI models also dive into property-specific metrics to forecast revenue and Net Operating Income (NOI) trends. These include new and renewal trade-out rates, tenant retention percentages, lease terms, and vacant days. Advanced systems analyze unit-level data daily - such as floor plans, square footage, and availability - to generate hyper-local forecasts that surpass traditional ZIP code-level insights[9]. By combining private portfolio data with public market information, platforms deliver clear recommendations for pricing and marketing strategies.

Leasing velocity is another critical factor. It predicts future demand for specific unit types and helps determine how price adjustments might affect occupancy. AI also evaluates the burn-off of market concessions, projecting effective rent growth over several years. This granular analysis enables investors to track unit-level performance trends and absorption rates with remarkable precision[3].

"We highly value RealPage's data because it provides details on rent rolls such as lease renewals and true revenues that simply aren't available anywhere else." - Aimee LaMontagne Baumiller, Vice President, PNC Bank[9]

Competitive and Regional Data

Understanding regional competitiveness adds another layer of accuracy to AI predictions. Traditional ZIP code-level data often fails to capture neighborhood-specific trends. AI models, however, break submarkets into 100-meter clusters, offering a hyper-local perspective that uncovers growth opportunities overlooked by broader reports[1][5].

Regional data on construction starts and absorption rates is equally important. For instance, in November 2025, Origin's Multilytics AI projected that Charlotte, North Carolina, would lead its target markets with a 5.7% rent increase by January 2027. This prediction was based on a 40% decline in new construction starts and strong local absorption rates[4]. Spatial data, such as nearby points of interest and redevelopment activity, also helps identify emerging neighborhoods that traditional metrics might miss.

In 2022, Origin Investments used Multilytics AI to assess "Sawtell", a 40-acre site in Atlanta. By analyzing redevelopment trends and submarket growth clusters, the AI confirmed that this area had the potential for above-average rent growth compared to the broader Atlanta market[5].

"By zeroing in on granular trends rather than focusing more broadly on general ZIP code-level data, Multilytics finds clusters of high-potential submarkets, including areas that are beginning to gentrify." - Phil Schuholz, Origin Investments[5]

How AI Predicts Rent Growth

AI takes vast amounts of data from market trends, property specifics, and regional factors, transforming it into actionable predictions. It doesn’t just track trends - it uses advanced tools like machine learning, statistical models, and scenario simulations to forecast rent growth with precision.

Pattern Recognition with Machine Learning

Machine learning is especially good at spotting hidden patterns in data. By analyzing both historical and real-time information, it reveals connections between rent trends and factors like new construction, demographic changes, or neighborhood improvements. As Rich Hughes from RealPage explains:

"AI models are programs that analyze data to detect patterns, draw conclusions and make predictions. Essentially, they turn raw data into useful intelligence." [6]

One method, called the repeat-pairing approach, compares the same property or floor plan over time. This ensures "apples-to-apples" comparisons by controlling for differences in property condition and unit features. This method provides clearer insights than simply averaging prices across markets [7]. When listing data is incomplete, AI can fill the gaps using logarithmic interpolation to estimate monthly growth rates [7].

The scale of these analyses is massive. For example, the Multilytics platform by Origin Investments processes over 4 billion data points every month from more than 11 million multifamily units [3]. To ensure accuracy, these models are tested against historical economic cycles dating back to 2008 [2][5]. Once patterns are identified, statistical regression models are used to project future rent levels.

Regression and Predictive Modeling

Regression analysis is a key tool for estimating how various factors influence future rent prices. AI platforms build models that connect historical rent data with broader economic, demographic, and spatial variables [2][5]. These models highlight which factors are most influential and weigh them accordingly.

The accuracy of these forecasts is impressive. When tested over five-year periods in the 150 largest U.S. metro areas, AI-driven predictions have shown a margin of error as low as $10 to $15 annually [2][5]. This precision has improved investment decisions by 15% to 25% compared to traditional methods [8]. Additionally, one AI index now tracks rent changes for over 14 million rental units nationwide, focusing on new leases rather than renewals to provide a real-time view of market shifts [7]. With these precise estimates, AI simulations further refine forecasts by testing different scenarios.

Scenario Analysis and Forecasting

AI goes beyond identifying trends by running scenario analyses to simulate market conditions. Instead of predicting a single outcome, it explores multiple possibilities, assessing how factors like interest rate changes or regional downturns could impact rent growth and property values [3][11].

For example, in April 2025, Origin Investments used its Multilytics AI platform to purchase a 323-unit luxury property in Charlotte. While local reports highlighted an oversupply - 2,200 units in lease-up and 3,700 under construction - the AI identified a turning point in supply and demand. It projected a 5.1% annual rent growth rate over five years, giving Origin confidence to make the off-market acquisition [3].

Similarly, in 2025, Origin acquired Nashville Queens, a 221-unit property in the Wedgwood-Houston area. Despite concerns over oversaturation in Nashville's infill markets, AI predicted rent growth exceeding 5% annually, allowing the team to confidently plan for the reduction of market concessions [3]. These scenario-based forecasts help investors spot challenges early and uncover opportunities that might otherwise be missed [8].

sbb-itb-99d029f

Real-World Applications of AI Rent Forecasting

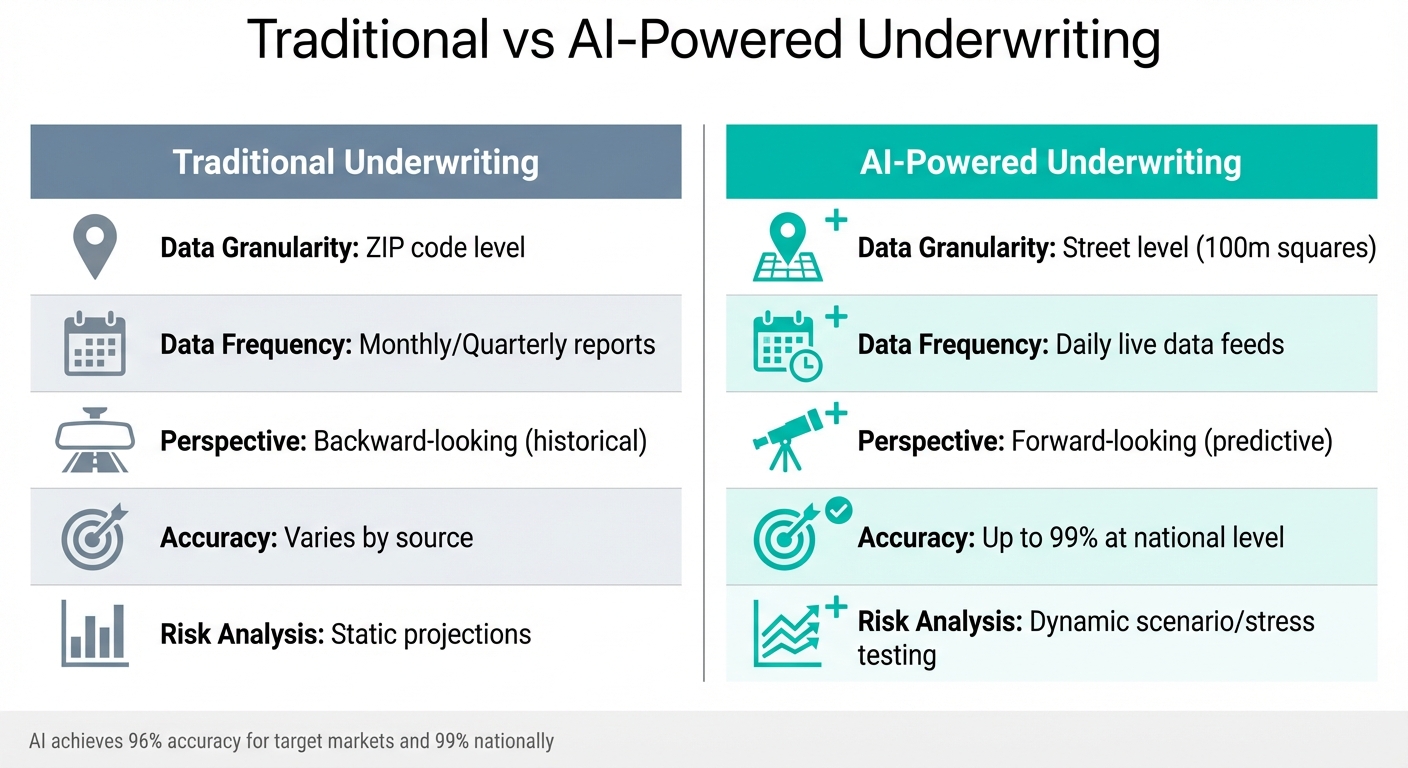

Traditional vs AI-Powered Underwriting in Multifamily Real Estate

AI rent forecasting transforms detailed data analysis into practical strategies, helping real estate professionals make informed decisions in areas like acquisitions, portfolio management, and asset performance.

Improving Underwriting Accuracy

Traditional underwriting often relies on outdated data and broad ZIP code averages, which can hide important differences between properties - even those located just a few blocks apart. AI models, on the other hand, analyze data on a much more granular level, down to 100-meter squares. This precision enables AI systems to achieve annual accuracy within $10–$15 over a five-year period [2][5]. In the first half of 2024, the Multilytics AI model demonstrated 96% accuracy for specific target markets and an impressive 99% accuracy at the national level [3].

This level of detail allows underwriters to simulate various economic scenarios - like shifts in interest rates or regional economic downturns - giving them the tools to stress-test investments [2][11].

"Properties at opposite ends of a ZIP code may appeal to different renter cohorts, operate with diverging dynamics, and face diverging risks. That's why our team of data scientists developed Multilytics - a proprietary, machine-learning rent forecasting platform that carves the country into 100-meter squares." - Dave Welk, Managing Director of Acquisitions, Origin Investments [3]

| Feature | Traditional Underwriting | AI-Powered Underwriting |

|---|---|---|

| Data Granularity | ZIP code level | Street level (100m squares) [3] |

| Data Frequency | Monthly/Quarterly reports | Daily live data feeds [3] |

| Perspective | Backward-looking (historical) | Forward-looking (predictive) [3] |

| Accuracy | Varies by source | Up to 99% at national level [3] |

| Risk Analysis | Static projections | Dynamic scenario/stress testing [2][11] |

This more precise analysis not only improves underwriting but also helps uncover promising investment opportunities.

Making Better Investment Decisions

With more accurate underwriting as a foundation, AI-driven forecasts empower investors to identify market shifts that might go unnoticed in traditional reports. By analyzing real-time data - such as leasing velocity, construction trends, and demographic changes - AI pinpoints areas where demand is set to outpace supply [3].

For example, in 2025, Origin Investments used machine learning models to assess the Sawtell tract in Atlanta, a 40-acre site planned for 2,000 units. AI analysis confirmed that redevelopment in the area was accelerating, leading to a successful investment for their QOZ Fund II [5]. These tools can simultaneously evaluate thousands of properties or markets, enabling investors to act on off-market opportunities faster than competitors [1][11].

Predictive analytics also improve the accuracy of investment decisions by 15% to 25% compared to traditional methods [8]. Additionally, AI serves as an early warning system, monitoring signals like website visits, tour volumes, and application rates to alert investors to potential leasing slowdowns before they impact revenue or occupancy [8].

Portfolio Management and Performance Tracking

For asset managers juggling multiple properties, AI forecasts offer real-time insights to optimize portfolio performance. These platforms process billions of data points monthly, helping managers project growth and cash flows. This allows for strategic capital deployment, even in uncertain markets [3].

In June 2025, Origin Investments used its Multilytics AI platform to project growth and cash flows for its $1 billion IncomePlus Fund. The data supported acquisitions in Charlotte and Nashville, despite concerns about oversupply, by forecasting a 5.1% compound annual rent growth rate over five years [3].

"Our use of Multilytics is critical not only for acquisitions but also for projecting portfolio-level growth and cash flows within our all-weather IncomePlus Fund." - Dave Welk, Managing Director of Acquisitions, Origin Investments [3]

AI also enables adaptive investing by sending real-time alerts when specific conditions are met, such as rent growth exceeding a target in a particular submarket [11]. This helps teams make timely disposition decisions based on short-term rent predictions, ensuring they maximize an asset's value. Moreover, real-time indices focused on new leases provide asset managers with up-to-date insights into current market rates, offering greater transparency for managing existing properties [7].

Using AI Forecasts with CoreCast

CoreCast transforms AI-driven forecasts into practical tools for every stage of the investment process. By utilizing the detailed AI rent predictions mentioned earlier, the platform integrates underwriting, pipeline tracking, and portfolio management into one streamlined system. This approach simplifies workflows and helps investors make smarter decisions. Here's how CoreCast's real-time insights and AI capabilities can enhance your investment strategy.

Centralized Data and Real-Time Insights

CoreCast integrates seamlessly with property management software like AppFolio, Yardi, RealPage, Entrata, and Buildium. This connection allows the platform to automatically pull in historical T‑12 performance data and rent rolls. By starting with actual trailing data instead of static projections, underwriting models become more accurate. Users can also upload financial documents, and the AI instantly maps the data into underwriting models.

"What once took an analyst an afternoon now takes seconds." - Jared Stoddard, Co-Founder, CoreCast

The platform's Output View lets users adjust assumptions - like exit cap rates or CapEx budgets - and immediately see updated metrics such as IRR, equity multiple, and cash-on-cash returns. Additionally, it offers a geospatial map to visualize deal pipelines, with filters for risk profiles, project stages, or market density. This feature helps identify potential over-concentrations in specific submarkets.

Smarter Decision-Making with AI

With centralized data in place, CoreCast equips investors with actionable insights in real time. Its conversational AI allows users to ask questions in plain language. For instance, an investor could request stabilized market data for a mixed-use development or run sensitivity analyses for different economic scenarios. This eliminates the need for complex Excel models, making stress-testing investments much simpler.

CoreCast also provides automated alerts through email, Slack, or in-app notifications, ensuring key parties stay informed. These alerts can highlight issues like occupancy nearing breakeven levels, giving asset managers time to act before revenue is impacted. Meanwhile, live stakeholder portals offer tailored transparency for limited partners, lenders, and joint venture partners, eliminating the need for manual reporting. These portals provide easy access to performance metrics, distributions, and debt coverage details.

What’s Next for AI in CoreCast?

CoreCast has several exciting features in development. These include AI-generated investor reports that compile performance summaries automatically, predictive sourcing tools that recommend deals based on historical preferences and market trends, and automated workflows for construction draw approvals. Another upcoming feature, an AI deal review assistant, will instantly evaluate opportunities to determine if they meet investment criteria.

For early adopters, CoreCast offers a special deal: the first 50 users receive 50% off their first year after the beta release. Additionally, a $50 pre-order fee grants access to the platform's first four months for free.

Conclusion

AI is reshaping the way real estate professionals predict multifamily rent growth. Gone are the days of relying on outdated ZIP code data and gut instincts. Now, investors can tap into street-level precision, powered by systems that process billions of data points every month. This shift means professionals can move from reactive decision-making to proactive strategies, identifying market changes before they show up in traditional reports. Whether it’s spotting early recovery signs in oversupplied areas or detecting creeping vacancies before they affect revenue, these insights lead to tangible performance improvements.

Predictive models boast an impressive 96% accuracy for target markets and 99% accuracy nationally [3]. These tools provide estimates that stay within $10–$15 annually over a five-year period [2]. Take Rentana, for instance: in July 2025, their AI platform delivered a $4.6 million valuation boost across pilot properties in just 90 days, driving a 3.5% increase in Net Rental Income [8]. These kinds of results highlight the clear advantages for investors embracing AI over those who stick with outdated methods.

CoreCast takes these precise forecasts a step further by integrating real-time intelligence into every part of a professional’s workflow. From underwriting and pipeline tracking to portfolio management and real-time forecasting, the platform replaces manual spreadsheet tasks with a unified system. This ensures that professionals always have the most up-to-date data at their fingertips - whether they’re evaluating a new acquisition or benchmarking an existing portfolio against market trends. By streamlining operations, CoreCast makes it easier to translate AI insights into actionable investment strategies.

The industry is moving quickly. A staggering 87% of brokerage leaders report their agents are already using AI tools [10]. The real question isn’t whether AI will change multifamily investing - it’s whether you’ll stay ahead of the curve or find yourself scrambling to catch up.

FAQs

How does AI accurately predict rent growth in multifamily housing?

AI delivers precise rent growth predictions by sifting through extensive data and using advanced machine learning models. These models dive deep into detailed market insights, even down to specific neighborhoods, while factoring in broader economic elements like employment trends, population changes, and borrowing costs. By constantly updating predictions based on actual market outcomes, AI adapts to shifting conditions to keep forecasts accurate and relevant.

CoreCast applies this AI-powered method to offer real-time rent growth forecasts tailored to individual properties. By blending detailed property data with broader market trends, CoreCast equips real estate professionals with the insights they need for smarter decision-making - whether it’s evaluating deals, monitoring project pipelines, or preparing reports for stakeholders - all through a single, easy-to-use platform.

What data does AI analyze to predict multifamily rent growth?

AI forecasts multifamily rent growth by diving deep into decades of data. It analyzes over 30 years of market trends alongside property-specific details like unit-level rents, occupancy rates, concessions, and floor plans. On top of that, it keeps tabs on daily updates from sales transactions, loan records, millions of rental listings, and new lease agreements - spanning more than 14 million housing units.

By crunching all this information, AI uncovers patterns and trends that help predict rent shifts. These insights empower real estate professionals to make more informed decisions.

How does AI help predict rent growth in multifamily real estate?

AI-powered tools are transforming the way real estate investors make decisions by processing massive amounts of data and breaking down complex trends into clear, actionable insights. By analyzing factors like economic indicators, employment rates, and local supply-demand dynamics, these tools can predict rent growth with impressive precision - even pinpointing forecasts for specific ZIP codes or individual properties.

These forecasts empower investors to spot high-growth areas, avoid overpaying for properties, and test how different scenarios - like rising interest rates or shifting demographics - might impact their investments. For example, platforms like CoreCast take these predictions a step further by integrating them into a seamless system. Users can underwrite assets, monitor pipelines, and generate professional reports, all enhanced by AI-driven analytics. This data-focused approach not only sharpens decision-making but also helps reduce risks and boost portfolio performance.