Sales Comparison Approach: Adjustments Explained

The Sales Comparison Approach is a method used to estimate property value by comparing it to recently sold, similar properties. Adjustments are made for differences in factors like location, size, condition, and market trends to align the comparable properties with the subject property.

Key points:

- Adjustments can be dollar-based (e.g., ownership interest, non-real estate items) or percentage-based (e.g., market conditions, property age).

- Reliable market data is crucial for accurate adjustments, typically using at least three recent comparable sales.

- Tools like Potential Gross Income Multiplier (PGIM) and Effective Gross Income Multiplier (EGIM) help validate valuations.

- Modern platforms like CoreCast automate data collection, analysis, and reporting, improving speed and accuracy. CoreCast features real-time updates, historical data integration, and AI-powered tools, with beta pricing at $50/user/month.

While manual methods offer transparency, they can be time-consuming and prone to error. Automated tools like CoreCast streamline the process but depend on accurate market data. Both approaches have strengths and limitations, making them complementary rather than exclusive.

1. Traditional Sales Comparison Adjustments

Adjustment Methodology

The sales comparison approach involves tweaking the sale prices of comparable properties to better reflect the subject property. As PropertyMetrics puts it, "The goal of the adjustment process is to make the comparable property look more like the subject property" [2]. These adjustments are applied exclusively to the sale prices of the comparable properties.

Appraisers typically start with direct dollar adjustments before moving to percentage-based ones. Dollar adjustments address factors like ownership interest, non-market financing terms, or non-real estate items such as furniture or equipment [2]. Percentage adjustments, on the other hand, take into account broader aspects like market conditions, location, and physical attributes [2].

| Adjustment Category | Adjustment Type | Examples |

|---|---|---|

| Transactional | Direct Dollar Adjustments | Ownership interest, seller concessions, furnishings |

| Market/Physical | Percentage | Market trends, location, age, condition |

| Subjective | Qualitative | Design appeal, special equipment, buyer motivation |

These fine-tuned adjustments are essential for aligning comparables with the subject property, ensuring the valuation is as accurate as possible.

For example, in an appreciating market where property values rise by 1% every quarter, older comparable sales would require upward adjustments to match current conditions [2]. Similarly, a newly built commercial property might warrant a 4% premium over properties that are three to five years old [2].

The accuracy of these adjustments hinges on the availability of solid market data.

Market Data Support

Reliable market data plays a crucial role in reducing guesswork during the adjustment process. Appraisers generally rely on at least three recent sales of similar properties to establish dependable value estimates [5]. The more current and comparable the sales data, the fewer adjustments are needed, which leads to more precise valuations.

Beyond basic price-per-square-foot calculations, appraisers also use tools like the Potential Gross Income Multiplier (PGIM) and Effective Gross Income Multiplier (EGIM) to validate their valuations against the income-generating potential of properties [2][3]. These multipliers serve as additional checkpoints, helping to confirm whether the adjustments are on target.

When backed by strong data, the valuation process becomes not only accurate but also more efficient.

Efficiency in Valuation

Speed is a critical factor in commercial real estate valuation. As the CFI Team points out, "Market conditions can shift within a week" [5]. Efficient adjustments enable investors and sellers to react quickly to these changes.

The quickest route to accurate valuations starts with selecting comparables that closely resemble the subject property. Properties located in the same submarket and sharing similar characteristics - such as square footage, age, and condition - require fewer adjustments, reducing the margin for error [5]. Pacific Appraisers cautions that "small inaccuracies can lead to significant valuation errors" [3].

2. CoreCast Real Estate Intelligence Platform

Technology Integration

Modern valuation platforms are reshaping how appraisers handle sales comparisons. By leveraging tools like regression analysis and automated valuation models (AVMs), these systems uncover patterns in market data and provide quantifiable adjustments. This approach minimizes the subjectivity of appraisals, offering data-backed insights that lead to more consistent valuations [4].

CoreCast simplifies the entire valuation process. Users can manage any asset class, monitor their pipeline, and explore properties using an integrated mapping feature - all within a single platform. This eliminates the need for juggling multiple tools, streamlining everything from selecting comparables to finalizing valuations. Additionally, the platform includes a robust system for managing market data, ensuring seamless integration across the workflow.

Market Data Support

CoreCast’s built-in historical data allows appraisers to focus on arm's length transactions, which occur between unrelated parties. This ensures that valuations aren't distorted by forced sales or transactions between related parties [2]. The result? A stronger foundation for accurate adjustments.

The platform also provides real-time insights, keeping appraisers informed about current market conditions. Since property values can change quickly, having immediate access to comparable sales and market trends ensures valuations reflect the latest market realities. CoreCast supports a wide range of commercial real estate asset classes, offering the depth and variety of data needed to handle diverse property types. This extensive data framework enhances both speed and accuracy during the valuation process.

Efficiency in Valuation

CoreCast takes the hassle out of data organization, ensuring that adjustments are made using the most relevant and up-to-date comparables. Features like portfolio analysis and pipeline tracking centralize property and transaction data, allowing appraisers to quickly filter properties by criteria such as location, size, age, or condition. This reduces the time spent on manual data collection and helps identify the best comparables faster.

Additionally, CoreCast enables users to create customized, branded reports that can be shared directly with stakeholders. By combining streamlined analysis with professional presentation tools, the platform makes the entire valuation process - from research to reporting - more efficient and effective.

Sales Comparison Adjustments Paired Sales

sbb-itb-99d029f

Advantages and Limitations

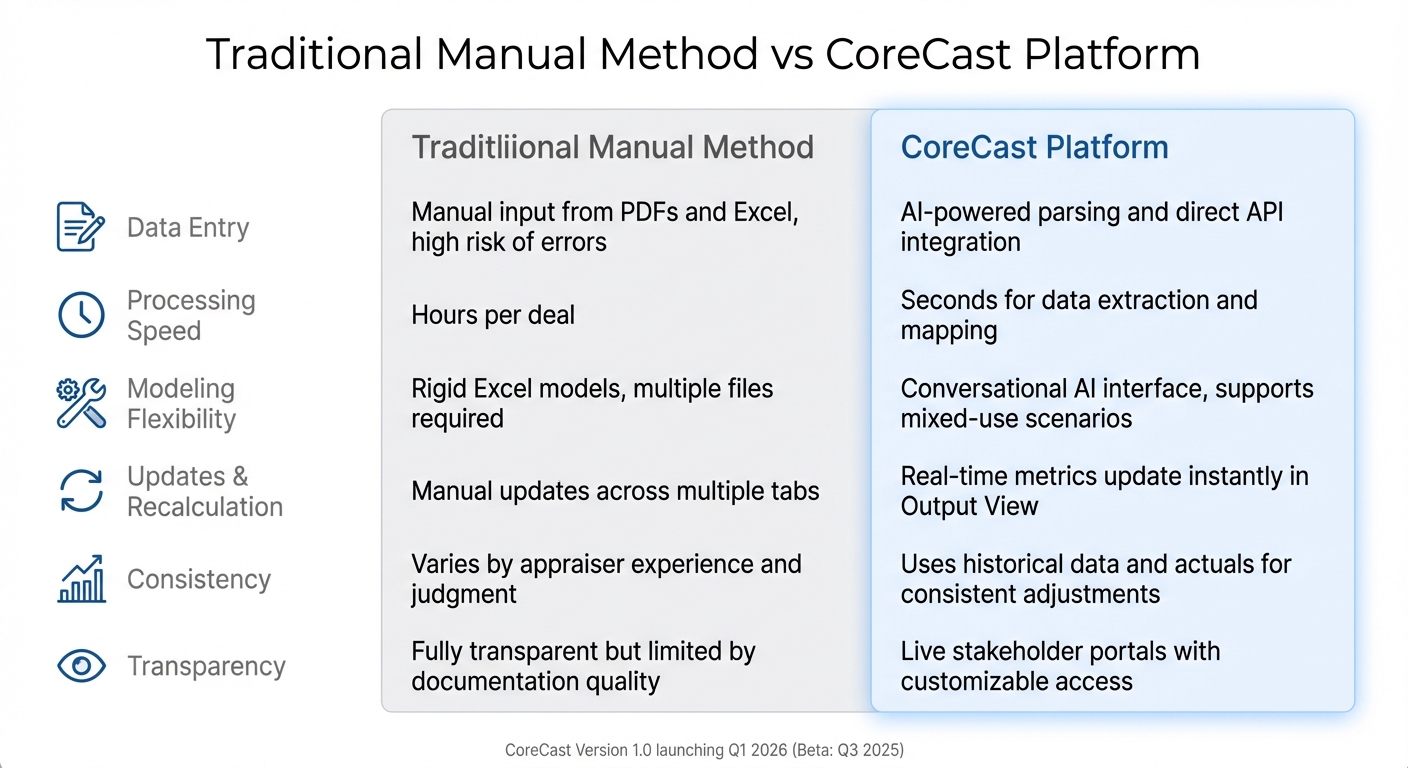

Traditional vs CoreCast Property Valuation Methods Comparison

After exploring traditional valuation adjustments and CoreCast's data integration, let's dive into the strengths and weaknesses of each approach. While manual methods offer unmatched transparency, they come with significant challenges, especially in terms of efficiency and consistency.

Manual methods shine when it comes to transparency. Every adjustment is fully visible, allowing appraisers to clearly explain their reasoning to clients or regulatory bodies. This level of clarity is invaluable in maintaining trust. However, the downside is that these methods are time-intensive and prone to human error. As Investopedia points out:

Making adjustments for differences between the subject property and comparables can be subjective and challenging [6].

Moreover, relying on individual judgment often leads to inconsistencies between appraisers, which can undermine confidence in the valuation process.

These challenges highlight the need for more streamlined, automated solutions.

CoreCast's platform tackles these inefficiencies head-on through automation and advanced data integration. Tasks that once took hours are now completed in seconds. For example, CoreCast's AI-powered document parsing extracts data from T-12s, rent rolls, and seller financials almost instantly [7]. Its real-time Output View ensures that metrics like IRR, equity multiples, and valuations update immediately as assumptions change [7]. The system also integrates directly with tools like Yardi, AppFolio, and RealPage, pulling historical data automatically [7].

While automation reduces subjectivity by grounding adjustments in historical comparables and actual performance data, it isn't foolproof. CoreCast's effectiveness depends on the availability of accurate market data and proper configuration. For properties in unique or volatile markets where recent sales data is sparse, even advanced technology faces limitations [6][3]. CoreCast is currently refining some features, with Version 1.0 expected to launch in Q1 2026 after a beta release in Q3 2025 [7].

Here's a side-by-side look at how the two approaches compare:

| Aspect | Traditional Manual Method | CoreCast Platform |

|---|---|---|

| Data Entry | Manual input from PDFs and Excel, with a high risk of errors [6][7] | AI-powered parsing and direct API integration [7] |

| Processing Speed | Can take hours per deal [7] | Completes data extraction and mapping in seconds [7] |

| Modeling Flexibility | Relies on rigid Excel models, often requiring multiple files [7] | Features a conversational AI interface and supports mixed-use scenarios [7] |

| Updates & Recalculation | Requires manual updates across multiple tabs [7] | Real-time metrics update instantly in the Output View [7] |

| Consistency | Varies depending on appraiser experience and judgment [6][1] | Uses historical data and actuals for more consistent adjustments [7] |

| Transparency | Fully transparent but limited by the quality of documentation [6] | Offers live stakeholder portals with customizable access [7] |

This comparison highlights the trade-offs between traditional methods and automated tools, giving appraisers a clearer perspective on which approach best meets their needs.

Conclusion

Making precise adjustments is essential for dependable commercial property valuations. Since no two properties are exactly alike, adjustments help align comparable sales with the specific characteristics of the property being assessed [2][5]. As Thomas McCoy of McCoy Valuation explains:

The Sales Comparison Approach, when executed diligently, not only enhances the accuracy of property valuations but also contributes to the overall transparency and reliability of the real estate market [1].

Even minor errors during the adjustment process can lead to substantial valuation inaccuracies, potentially resulting in overpayment or undervaluation [3].

To tackle these issues, CoreCast simplifies the valuation process by automating many labor-intensive steps. It provides real-time updates and integrates seamlessly with property management systems, ensuring that adjustments are based on up-to-date performance metrics [7].

CoreCast’s comprehensive approach enables professionals managing multiple transactions to handle tasks like underwriting properties, tracking deal pipelines, analyzing portfolios, and creating branded reports - all from one platform. As the system continues to develop, it’s set to become an indispensable tool for those who prioritize both efficiency and precision in property valuations.

FAQs

What’s the difference between dollar-based and percentage-based adjustments in the Sales Comparison Approach?

When comparing properties, dollar-based adjustments and percentage-based adjustments are two common approaches to account for differences.

- Dollar-based adjustments involve adding or subtracting a fixed monetary amount to address specific differences between the subject property and a comparable one. For example, if a comparable property has a feature worth $10,000 more than the subject property, that amount would be subtracted from the comparable's value.

- Percentage-based adjustments, on the other hand, modify the comparable property’s value by a set percentage to reflect proportional differences. This method is often used when differences are better expressed as a percentage of the property’s value, such as location or market conditions.

Both approaches aim to align property values to make comparisons more accurate. The choice between them typically depends on the nature of the differences being evaluated and standard practices in the market.

How does market data ensure accurate property valuations in the sales comparison approach?

Market data plays a key role in delivering accurate property valuations. It offers up-to-date information on recent sale prices, contract terms, and listing details that appraisers use to compare properties. With this information, appraisers can apply the principle of substitution - the idea that buyers won’t pay more for a property if a similar one is available for less. By focusing on recent, location-specific transactions, appraisals reflect the current market rather than relying on outdated or irrelevant data.

Valuation adjustments hinge on how the market responds to differences in factors like property size, condition, location, amenities, and timing. By analyzing these trends with reliable data - ideally drawn from three to six comparable sales - appraisers can provide valuations that capture both local market dynamics and broader trends.

Tools like CoreCast simplify this process by aggregating and standardizing real-time market data. This gives appraisers the ability to make precise, data-informed adjustments, leading to property valuations that are both transparent and well-supported.

How does CoreCast simplify and speed up the sales comparison valuation process?

CoreCast takes the old-school, labor-intensive sales comparison method and turns it into a fast, efficient, and data-driven process. Forget juggling spreadsheets and making subjective tweaks - CoreCast pulls in real-time market data, pinpoints the best comparable sales, and automatically adjusts for factors like location, size, and amenities, all within a single platform.

With CoreCast, appraisers can handle any asset type, dive into detailed portfolio analyses, and create polished, stakeholder-ready reports with just a few clicks. By automating complex calculations and cutting down on manual work, the platform not only saves valuable time but also boosts accuracy and consistency. This means users can spend less time on repetitive tasks and more time focusing on meaningful, strategic insights.