Tax Policy Changes: Commercial Real Estate Trends 2025

The 2025 tax reforms introduced under the One Big Beautiful Bill Act (P.L. 119-21) have reshaped commercial real estate investment strategies by making key tax benefits permanent and expanding deductions. These changes are driving shifts in financing, property development, and investment priorities.

Key Updates from the 2025 Tax Reforms:

- 100% Bonus Depreciation: Permanently reinstated for qualifying property placed in service starting January 20, 2025. Investors can now deduct the entire cost of assets upfront.

- Section 179 Expensing Limit: Increased to $2.5 million, doubling the previous limit, with a $4 million phase-out threshold.

- Qualified Business Income (QBI) Deduction: The 20% deduction for pass-through entities is now permanent, providing predictability for long-term planning.

- Opportunity Zone Program: Extended indefinitely, with new Qualified Rural Opportunity Funds offering enhanced benefits for investments in rural areas.

Financing and Market Behavior:

- Interest Deductibility: The Section 163(j) limitation now uses EBITDA instead of EBIT, allowing more flexibility for highly leveraged projects.

- Opportunity Zones: Rolling 10-year designations and rural incentives are attracting new investments.

- Property Development Trends: Increased focus on manufacturing, industrial properties, and energy-efficient upgrades due to expanded tax incentives.

These reforms are shifting investor priorities, with tax policy becoming a top concern for industry leaders. Tools like real estate intelligence platforms are now critical for modeling tax impacts, tracking Opportunity Zone investments, and optimizing portfolio strategies under the new rules.

NEW 100% Write-Offs Under Trump's Big Beautiful Bill

Major Tax Changes Affecting Commercial Real Estate in 2025

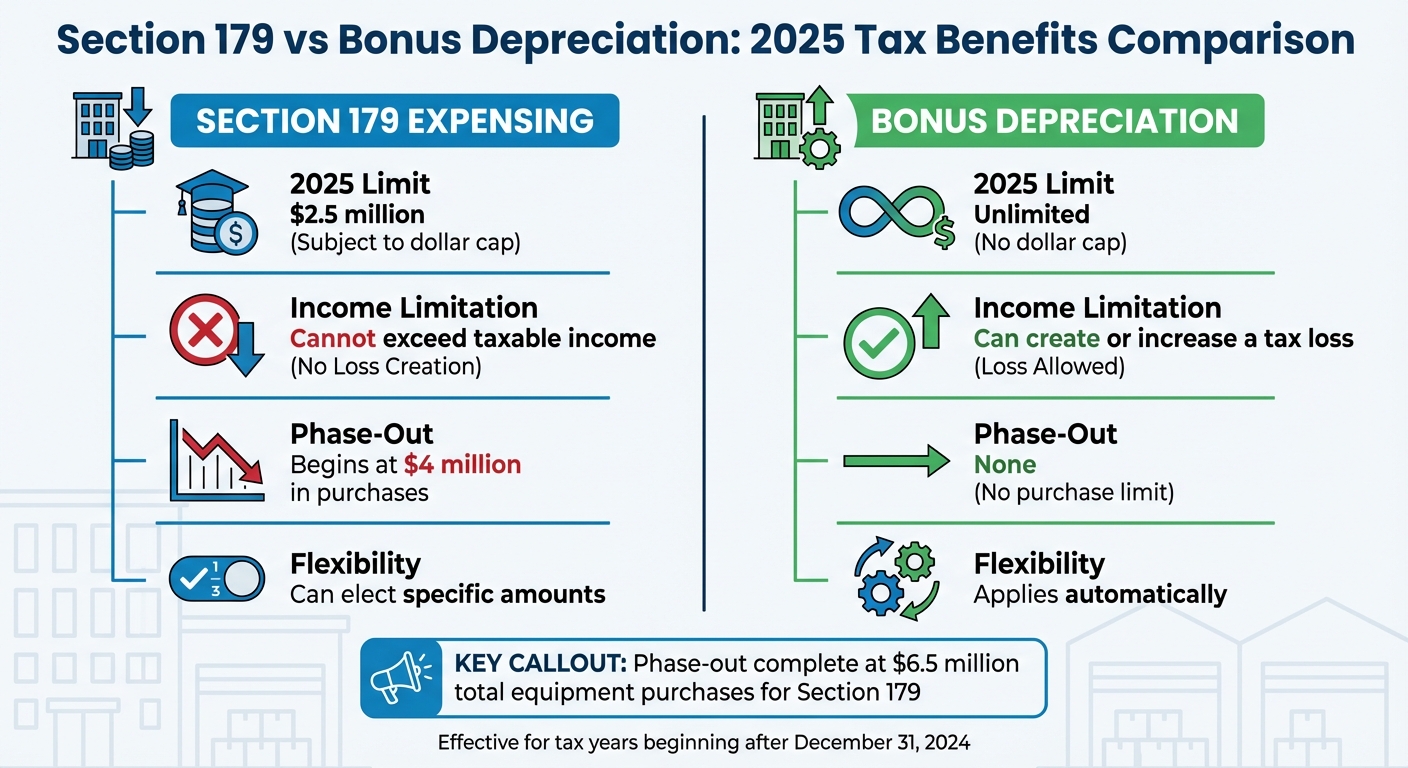

2025 Commercial Real Estate Tax Benefits Comparison: Section 179 vs Bonus Depreciation

The Act introduces three pivotal provisions - 100% bonus depreciation, increased Section 179 limits, and a permanent 20% QBI deduction - designed to improve cash flow and simplify long-term planning for investors.

100% Bonus Depreciation Returns

This provision offers an immediate boost to cash flow by allowing full asset deductions upfront. Starting January 20, 2025, 100% bonus depreciation is permanently restored for qualifying properties placed in service on or after this date [1]. Investors can now deduct the entire cost of assets with a useful life of 20 years or less in the year they’re placed in service, rather than spreading the deduction over several years.

To maximize this benefit, many investors are turning to cost segregation studies. These studies reclassify specific building components - like HVAC systems, fixtures, and land improvements - into shorter-lived asset categories, making them eligible for the full deduction.

Higher Section 179 Expensing Limits

The Section 179 expensing limits have more than doubled, increasing to $2.5 million for tax years beginning after December 31, 2024. Additionally, the phase-out threshold has been raised to $4 million [4]. This change is particularly beneficial for investors focusing on building enhancements, such as roofs, HVAC systems, fire protection, and security systems in nonresidential properties.

However, unlike bonus depreciation, Section 179 deductions are capped by the business's taxable income. This means it cannot create a taxable loss, and the deduction phases out entirely once total equipment purchases hit $6.5 million [5].

| Feature | Section 179 Expensing | Bonus Depreciation |

|---|---|---|

| 2025 Limit | $2.5 million | Unlimited |

| Income Limitation | Cannot exceed taxable income | Can create or increase a tax loss |

| Phase-Out | Begins at $4 million in purchases | None |

| Flexibility | Can elect specific amounts | Applies automatically |

Qualified Business Income Deduction Made Permanent

The 20% Qualified Business Income (QBI) deduction under Section 199A is now permanent, eliminating the uncertainty about its prior expiration date at the end of 2025 [3]. This deduction applies to income from partnerships, S corporations, and qualified REIT dividends, giving pass-through entities a reliable way to lower their effective tax rates.

"The Act is generally positive for the real estate industry and investors, offering taxpayers numerous opportunities to reduce their tax burdens." - Jones Day [3]

With this permanence, pass-through entities can continue deducting 20% of their qualified business income. This consistency allows investors to better predict after-tax returns and refine their long-term strategies. These changes provide a solid foundation for evolving investment and financing approaches in the real estate market.

How 2025 Tax Reforms Are Changing Market Behavior

The latest tax reforms are shaking up how the market operates, especially in areas like financing, incentive usage, and asset development. These new provisions are reshaping how investors approach deals, allocate capital, and choose property types. It's no surprise that tax considerations have jumped from 14th to 3rd place among industry leaders' priorities, highlighting how these changes are rewriting the rules of investment economics [2].

Changes to Interest Deductibility and Financing Strategies

One of the key updates comes from the shift in Section 163(j) calculations, which now use EBITDA instead of EBIT. This adjustment allows investors to include depreciation, amortization, and depletion when determining adjusted taxable income. The result? Better after-tax returns on highly leveraged projects and more flexible debt options. However, there’s a catch: opting out as a Real Property Trade or Business means switching to the longer Alternative Depreciation System (ADS) and losing access to 100% bonus depreciation [1][4].

Investors are now faced with a choice: immediate expensing or unlimited interest deductions. The right decision depends on factors like leverage levels and the type of assets involved, making detailed financial modeling essential. For smaller businesses, the exemption threshold will rise to $31 million in 2025 [4].

These changes are forcing a reevaluation of capital allocation strategies, especially in Opportunity Zones, where incentives are evolving to meet new demands.

Opportunity Zones: Extended Incentives and Investment Strategies

The Opportunity Zone program’s permanence is transforming how investors plan. With rolling 10-year designations starting July 1, 2026, the program remains focused on uplifting economically distressed areas [1][4]. This stability is a game-changer for long-term investment strategies.

"This kind of stability offers predictability for investors and developers, a critical factor in long-term planning." - Aquiles Suarez, Senior Vice President for Government Affairs, NAIOP [6]

Rural markets are seeing a surge in interest. Qualified Rural Opportunity Funds now offer a 30% basis step-up after five years - three times the 10% available in standard zones. Plus, the substantial improvement requirement has been reduced to 50% of the adjusted basis for existing properties [1][4]. Another incentive? After 30 years, property basis can be stepped up to fair market value without a sale, making generational holding strategies more appealing [1].

Developers are also getting creative by combining Opportunity Zone equity with expanded Low-Income Housing Tax Credits (LIHTC) and New Markets Tax Credits (NMTC). This approach helps fill financing gaps in complex projects, particularly those involving mixed-use or affordable housing [1].

But the ripple effects of these tax reforms don’t stop there. They’re also redefining which property types are gaining traction.

Property Development and Asset Class Trends

Tax reforms are driving renewed interest in specific asset classes. For example, manufacturing and industrial properties are booming thanks to the new Qualified Production Property (QPP) deduction. This allows 100% first-year depreciation for real property used in manufacturing, production, or refining, provided construction kicks off after January 19, 2025 [1][4]. Designed to boost domestic manufacturing, this deduction is sparking a wave of production-related real estate projects.

Meanwhile, energy-efficient commercial buildings are on a tighter timeline. Section 179D benefits will expire for projects starting after June 30, 2026, prompting property owners to fast-track upgrades to HVAC systems, lighting, and building envelopes to secure these tax advantages [1].

REITs are also seeing new opportunities. Starting in 2026, the ownership limit for Taxable REIT Subsidiaries will increase from 20% to 25% of total asset value, giving REITs more flexibility in their operations [1][4].

sbb-itb-99d029f

Using Real Estate Intelligence Platforms to Navigate Tax Changes

With tax policies taking center stage for investors, the use of advanced real estate intelligence platforms has become more critical than ever. These platforms provide a comprehensive way to analyze investments under evolving tax rules, identify incentive-driven opportunities, and streamline communication with stakeholders. The growing need for accuracy has made tools that clearly model tax changes an essential part of the investment process.

Analyzing Investments Under New Tax Rules

CoreCast's underwriting tools are designed to handle the complexities of new tax regulations. They allow real-time modeling of factors like the permanent 100% bonus depreciation and the 20% QBI deduction, instantly updating key metrics such as IRR, equity multiples, and DSCR. This functionality is a major time-saver, especially when assessing how the 30% EBITDA limitation impacts highly leveraged deals.

Another standout feature is CoreCast's AI-powered document parsing. It automatically extracts data from seller T-12s, rent rolls, and operating summaries - whether in PDF or Excel formats - and maps this information directly into underwriting models [7]. This is particularly useful for quickly spotting tax-saving opportunities and ensuring compliance with requirements for properties placed in service after January 19, 2025 [7].

Tracking Opportunity Zone Investments

With the Opportunity Zone program now made permanent and new designations set to roll out every decade starting July 1, 2026, CoreCast provides tools to simplify the process. The platform’s Pipeline Tracker and geospatial mapping features help investors locate properties within designated zones and manage critical timelines, like the five-year deferral and ten-year gain elimination periods [3][7]. These mapping tools allow users to quickly identify properties in both standard and rural Opportunity Zones.

The platform also enables users to monitor deals through every stage and conduct sensitivity analyses to evaluate how Opportunity Zone tax benefits impact projected returns. It supports modeling across a range of asset classes, including multifamily, industrial, retail, cold storage, student housing, and affordable housing. This makes it easier to incorporate stabilized assumptions and test exit strategies against the 10-year gain elimination threshold [7][3].

Portfolio Analysis and Stakeholder Reporting

CoreCast goes beyond mapping and modeling by integrating tax-related strategies into overall portfolio performance insights. The platform consolidates financial and operational data into a single dashboard, simplifying the creation of branded investment memos and asset management reports that reflect tax-driven strategy adjustments [7].

Jared Stoddard, CoreCast’s Chief Product Officer, highlighted the platform’s capabilities: "CoreCast, generate a quarterly update for our equity partner on the Tampa deal: IRR tracking at 14.2%, occupancy stable at 95%, latest draws accounted for" [7].

Stakeholder portals further enhance communication by offering tailored views. Limited partners can track distributions and performance metrics, while lenders monitor compliance and debt coverage ratios under the new EBITDA-based rules [7]. The platform also includes refinance feasibility tools, which analyze debt restructuring options based on current market rates and the updated 30% EBITDA interest expense limitation [7][1].

Conclusion: Adapting to the New Tax Environment

The 2025 tax reforms have reshaped the landscape for commercial real estate investment, offering a more stable foundation for long-term planning. Key changes like the permanent reinstatement of 100% bonus depreciation, expanded interest deductibility using EBITDA-based calculations, and the continuation of the Opportunity Zone program are reshaping how investors approach their strategies.

But the real challenge lies in execution. Tax policy has surged in importance, climbing from the 14th to the 3rd biggest macro concern for global commercial real estate leaders in 2025 [2]. Investors can no longer rely on outdated, disjointed systems. As Jared Stoddard, CoreCast's Chief Product Officer, put it: "The status quo is broken... Excel models for every deal. Separate Excel sheets for your pipeline. It's not just inefficient. It's insane" [7].

To navigate this new environment, modern tools are essential. Integrated real estate intelligence platforms are stepping up, enabling faster tax impact modeling and more efficient reporting. The ability to model tax scenarios in real time - whether it’s factoring in the 20% QBI deduction or changes in interest deductibility - fundamentally changes how teams evaluate deals and communicate with partners and lenders.

Time-sensitive incentives add urgency to this shift. For example, the Section 179D deduction ends for projects starting after June 30, 2026 [1], and new Opportunity Zone designations begin rolling out on July 1, 2026 [3]. Those who can quickly assess opportunities and stay ahead of deadlines will gain a clear edge.

Firms that pair tax expertise with operational efficiency - and leverage integrated platforms - are better positioned to seize the benefits of these structural tax changes. The ability to adapt quickly is what will set successful investors apart.

FAQs

What is the impact of the 100% bonus depreciation on commercial real estate investments?

The 100% bonus depreciation rule lets investors deduct the full cost of eligible commercial real estate assets in the year they’re put into use. This upfront tax benefit can lower overall tax bills, improve cash flow, and make real estate projects more financially attractive.

By offering this immediate deduction, the policy supports new developments and gives investors more control and confidence when planning their projects. This, in turn, can help spur growth within the commercial real estate market.

What are the benefits of investing in Opportunity Zones under the updated 2025 tax reforms?

Investing in Qualified Opportunity Zones (QOZs) under the 2025 tax reforms offers a combination of tax perks and a chance to contribute to community development. These reforms extend critical deadlines, allowing investors to defer capital gains taxes until 2027, while also introducing ways to invest in underserved rural areas through Qualified Rural Opportunity Funds.

Here’s how investors can benefit:

- Capital gains deferral: Taxes on capital gains that are reinvested into a QOZ can be postponed until either the investment is sold or 2027 - whichever comes first.

- Tax exclusions: Holding the investment for 10 years means a 15% exclusion on the original gain. Stretch that to 15 years, and the gain could be completely excluded, making the profit tax-free.

- Expanded investment options: The reform widens the scope of eligible properties, creating new opportunities in both urban hubs and rural regions.

For commercial real estate professionals, staying on top of these deadlines and benefits is critical. Tools like CoreCast make this easier by offering a streamlined dashboard to underwrite QOZ projects, track investment timelines, and model potential returns - all in one place.

How can real estate intelligence platforms help commercial real estate teams navigate 2025 tax changes?

Real estate intelligence platforms are becoming indispensable for commercial real estate (CRE) teams as they navigate the upcoming 2025 tax reforms. These changes are set to impact key areas such as depreciation schedules, interest-deduction limits, and REIT qualification rules across the United States. By bringing together critical property metrics like NOI (Net Operating Income), IRR (Internal Rate of Return), and cap rates into one streamlined dashboard, these platforms let users analyze how new tax policies might influence cash flow and explore alternative financing strategies in real time.

With advanced forecasting tools, these platforms automatically adjust calculations for depreciation timelines and interest caps, ensuring that performance projections remain precise and up to date. They also simplify reporting processes, cutting down on manual tasks and helping teams create tax packages that meet U.S. filing requirements. On top of that, features like pipeline tracking and real-time alerts empower teams to spot underperforming assets, refine their strategies, and uncover new tax-saving opportunities - all while staying compliant and maintaining profitability under the revised regulations.