How Real-Time Alerts Improve Portfolio Reporting

Real-time alerts are changing how portfolio managers handle data, risks, and decisions. Unlike outdated monthly or quarterly reports, these alerts provide immediate updates when key metrics - like property values, occupancy rates, or financial thresholds - change. This allows managers to act quickly, avoid missed opportunities, and make better decisions based on live data.

Key Benefits:

- Faster Decisions: Alerts notify managers of issues like lease expirations or expense spikes as they happen.

- Integrated Data: Systems consolidate property, financial, and market data into one dashboard, eliminating manual tracking.

- Customizable Alerts: Managers can set specific triggers for metrics like Net Operating Income (NOI) or occupancy rates.

- Improved Stakeholder Communication: Tailored updates replace static reports, ensuring stakeholders stay informed in real time.

By combining live data with automation, platforms like CoreCast simplify portfolio management and help investors stay ahead of market changes. Real-time alerts aren't just a tool - they're a necessity for efficient, data-driven decision-making.

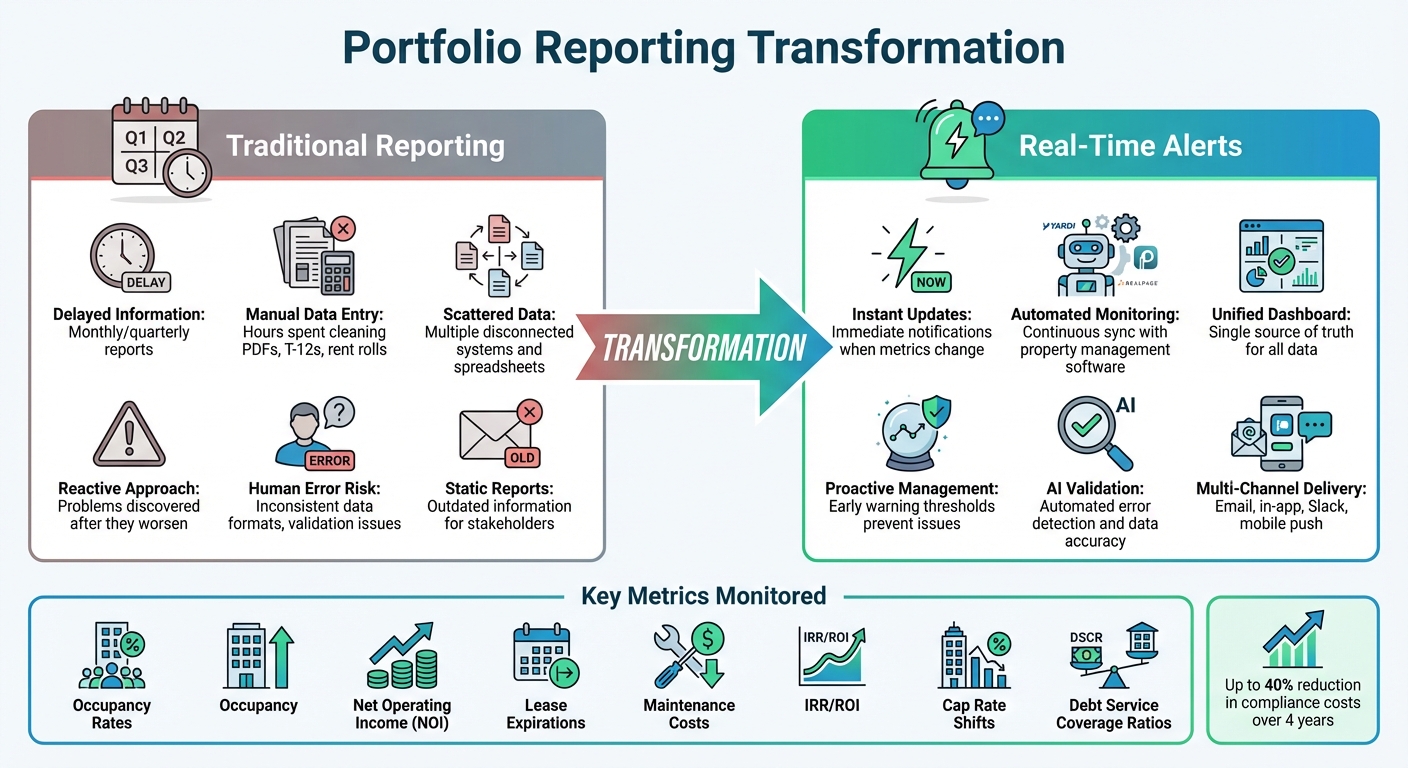

Problems with Traditional Portfolio Reporting

Delayed Information and Slower Decisions

One of the biggest challenges with traditional portfolio reporting is the lack of timely insights. When reports are delivered monthly or quarterly, critical issues - like rising vacancies or unexpected expenses - often go unnoticed until they've already worsened. This puts managers in a constant cycle of reacting to past problems instead of proactively addressing future ones.

Relying on static spreadsheets makes it even harder to catch early warning signs, such as credit risks, market changes, or operational setbacks. By the time the next report is available, the financial impact may already have grown. These delays not only increase risk but also force teams into time-consuming workflows, as described next.

Manual Tracking and Scattered Data

Traditional methods come with a heavy operational workload. Analysts often spend countless hours manually cleaning and reformatting data from PDFs, T-12s, and rent rolls just to prepare it for modeling [1]. While automated systems can handle this in seconds, manual processes create significant delays and slow down decision-making.

The problem doesn’t stop there - data is often scattered across multiple systems. Property management data might live in one platform, accounting records in another, and market data in yet another. Teams are left trying to bridge these gaps by using separate Excel sheets for each deal, keeping construction updates in isolated tabs, and managing equity waterfalls in disconnected spreadsheets. This disjointed approach not only wastes time but also increases the risk of human error and inconsistent data formats. Without automated validation, mistakes - like inflated rental income figures that don’t align with market benchmarks - can easily slip by, leading to inaccurate analyses and poor investment choices.

How Real-Time Alerts Change Portfolio Reporting

Traditional vs Real-Time Portfolio Reporting Comparison

Automated Monitoring and Alert Creation

Real-time alert systems have transformed the way portfolio metrics are monitored by detecting and flagging issues as soon as thresholds are breached. This eliminates the delays associated with manual tracking. These systems work by syncing continuously with property management software like Yardi, AppFolio, and RealPage, feeding live operational data directly into the alert framework [1].

With these tools, notifications are generated for a variety of operational and financial concerns. For example, they can flag occupancy declines, upcoming lease expirations, or unexpected maintenance cost increases. On the financial side, they monitor key metrics such as IRR, ROI, and cap rate shifts. Some platforms even incorporate conversational AI, enabling users to request instant summaries, such as, "Show me all assets with occupancy above 88%" [1]. A standout feature of these systems is their ability to be customized. Managers can define thresholds based on specific portfolio priorities, ensuring that alerts are meaningful and avoiding the overload of unnecessary notifications.

Integration with Portfolio Management Platforms

The true power of these alert systems is unlocked when they are integrated with portfolio management platforms. Instead of juggling fragmented notifications from various tools, managers gain a single, unified dashboard where alerts, property data, and financial projections all come together. Jared Stoddard, Chief Product Officer at CoreCast, highlights this advantage:

"CoreCast delivers portfolio and property-level management metrics at your frequency of choice... Choose to receive these via email, in-app notifications, or Slack integrations." [1]

This flexibility allows stakeholders to stay informed through their preferred channels. Whether it's mobile push notifications for urgent updates, daily email summaries for ongoing monitoring, or Slack messages for team collaboration, the system ensures the right people get the right information at the right time. Additionally, CoreCast's "Output View" feature simplifies sensitivity analysis by instantly showing how adjustments - like changes in exit cap rates or capital expenditures - impact metrics such as IRR and equity multiples, all without needing to manually rebuild spreadsheets.

Another major benefit of integration is the consolidation of data. By pulling information from property management systems, accounting platforms, and market data sources, these platforms create a single source of truth. For instance, when an alert is triggered - say, for an upcoming lease expiration - managers can immediately access the property's financial history, market comparables, and projected cash flows, all within the same system. This eliminates the hassle of switching between multiple tools and streamlines decision-making.

Benefits of Real-Time Alerts for Portfolio Performance

Better Risk Management

Real-time alerts change the game for risk management by turning a reactive process into a proactive one. Instead of uncovering problems after they've caused harm, managers can set up early warning thresholds. When key metrics approach these thresholds, the system sends an alert, giving teams a chance to act before breaching regulatory or investment policy limits [4].

The financial advantages are clear. Financial services firms can cut the total cost of ownership for compliance and risk programs by up to 40% over four years using integrated technology and managed services [5]. These systems automatically detect issues like trading during blackout periods, front-running, or insider trading across portfolios [3][5]. Brett Scheller, Director of Compliance at RA Capital Management, highlights the importance:

"The connectivity offered by ACA's platform... allows us to contextualize data across different areas of our Compliance program, providing a more comprehensive view and enhancing our ability to monitor and manage compliance risks effectively" [3].

But the benefits don’t stop at compliance. Alerts also provide instant updates on market volatility - think earnings surprises, guidance changes, or material disclosures - helping investors avoid losses that come with delayed reactions [6][7]. Advanced systems even leverage AI to analyze management commentary for subtle tone shifts or unusual language patterns that might reveal hidden risks [6]. By late 2024, over 70% of financial services firms had adopted AI for validation and oversight [5].

Better Decisions with Live Data

Real-time data doesn’t just improve risk management - it empowers faster, smarter decision-making. With live data, managers can immediately identify underperforming assets by comparing current metrics like ROI or occupancy rates to their targets.

Dynamic modeling tools take this a step further, allowing managers to quickly see how adjustments - like changes to exit cap rates or capital expenditures - affect levered IRR or debt service coverage ratios [1]. This brings clarity to financial modeling. Managers can also use conversational queries to get instant answers, such as a Monday morning summary of assets with a breakeven occupancy above 88% [1].

Having access to up-to-date operational data means underwriting and analysis are always grounded in the latest trailing-12 performance and rent rolls, rather than outdated static reports [1]. This ensures every decision is backed by real-time insights.

Better Stakeholder Communication

Real-time alerts also transform how managers communicate with stakeholders, replacing static reports with timely, relevant updates. Different stakeholders need different types of information - Limited Partners often focus on distributions and performance metrics, while lenders are more concerned with compliance and debt service coverage ratios [1]. Alert systems can deliver these tailored updates via email, mobile notifications, or even Slack.

Jaclyn Poniros, Analyst at Corporate Insight, underscores the communication benefits:

"Real-time alerts play a critical role in risk mitigation, providing investors with early warnings of market changes and allowing them to adjust portfolios accordingly" [7].

This shift to real-time communication builds trust by ensuring stakeholders are promptly informed when critical metrics hit thresholds or major events occur. The move from periodic reporting to continuous updates fosters stronger relationships, enabling managers to focus on forward-looking discussions about opportunities and risks. Branded stakeholder portals add another layer of convenience, giving investors and lenders direct access to live performance data, distributions, and compliance metrics - cutting out the back-and-forth of traditional updates [1].

sbb-itb-99d029f

Personalized Alerts and Insights with CoreCast

Customizable Alert Settings

CoreCast’s real estate intelligence platform gives you the power to focus on what truly matters. By setting precise thresholds that match your investment strategy and risk tolerance, you can define triggers for key metrics like Net Operating Income (NOI), occupancy rates, or maintenance costs. When these metrics deviate from your set parameters, the system flags them - keeping you informed about the changes that count. This tailored approach ensures detailed monitoring across various property types.

The platform supports a wide range of asset categories, including Multifamily, Office, Retail, and Industrial properties, making it ideal for diverse portfolios. For instance, if occupancy dips below your target or payroll expenses climb 5% higher than historical averages, CoreCast sends you an automated alert [1]. From there, you can use its drill-down feature to move from a portfolio-wide perspective to detailed property or tenant-level data, pinpointing the root cause of any issue.

James Gueits, Principal at MHP Operator, highlights the platform’s value:

"Our family office needed a solution to manage legacy real estate assets. They streamlined our valuation and underwriting processes" [2].

By eliminating the need for manual updates, CoreCast ensures that alerts always reflect the latest performance data [1].

Actionable Recommendations and Analysis

CoreCast doesn’t stop at sending notifications - it delivers insights that directly tie to your portfolio’s performance. Through its conversational interface, you can ask specific questions like, “CoreCast, give me a Monday morning summary of every asset with breakeven occupancy above 88%” [1], and receive instant, actionable answers. If the system detects anomalies, such as expenses exceeding budget, you can quickly run scenario modeling to evaluate the impact on metrics like levered IRR or debt service coverage ratios [1].

The platform also provides refinance alerts based on current market rates and offers valuation summaries broken down by asset, region, or partner [1]. Soon, AI-driven automation will analyze portfolio trends and recommend optimization strategies tailored to your holdings. Mitchell Rice, Principal at Elkstone Capital, shares his perspective:

"As a capital raiser, having reliable financial analysis is crucial to building trust with investors. They provided the expert financial analysis support I needed to strengthen my efforts" [2].

Insights are delivered through your preferred channels - email, in-app notifications, or Slack integrations - on a schedule that works for you, whether that’s weekly, monthly, or quarterly [1]. This system doesn’t just inform you about what’s happening; it helps you decide what to do next. With these insights, you can take a proactive approach to management, ensuring your portfolio stays aligned with your strategy for real-time performance excellence.

Conclusion

The move from slow, manual portfolio reporting to real-time alerts marks a game-changer for real estate professionals managing their investments. The traditional approach - characterized by scattered data and sluggish cycles - struggles to keep pace with today's fast-moving market. Automated monitoring eliminates these inefficiencies, offering timely insights that enable quicker decisions and more effective risk management.

But real-time alerts go beyond just keeping you informed - they drive action. Whether it's flagging occupancy drops, identifying unexpected expense spikes, or uncovering refinancing opportunities, these alerts ensure you're always equipped with up-to-date information. This constant flow of insights not only sharpens decision-making but also enhances communication with stakeholders, fostering trust through transparency and tailored updates.

CoreCast combines these capabilities into one streamlined real estate intelligence platform. It centralizes key functions like underwriting, portfolio analysis, pipeline tracking, and stakeholder reporting, removing the need for manual, error-prone processes. With customizable alerts based on your specific thresholds and insights delivered through your preferred channels, you can shift your focus from chasing data to crafting strategy.

By reducing reporting timelines from weeks to real time, automation allows for earlier interventions that protect and enhance portfolio value [8][9]. For professionals managing diverse portfolios - whether in Multifamily, Office, Retail, or Industrial sectors - real-time alerts are no longer a luxury. They’re essential for staying competitive in a market that rewards speed and precision.

Incorporating real-time alerts into your operations positions your firm as agile and forward-thinking. With AI-driven automation on the rise and the ability to provide branded, personalized reports for stakeholders, CoreCast ensures you're not just adapting to industry trends - you’re setting the standard for smarter, faster, and more informed investment strategies.

FAQs

How do real-time alerts improve portfolio management and decision-making?

Real-time alerts deliver instant updates on crucial changes, like increasing vacancies, unexpected costs, or fluctuations in portfolio performance. These alerts empower managers to act swiftly, address potential risks, and base their decisions on solid data.

By keeping stakeholders informed without delay, these alerts promote openness and build trust, paving the way for smoother portfolio management and improved investment results.

How does real-time portfolio reporting differ from traditional methods?

Traditional portfolio reporting often relies on static, manually prepared reports that are generated on fixed schedules, like monthly or quarterly. The problem? These reports can quickly become outdated, leaving stakeholders stuck with incomplete or stale data. As a result, shifts in occupancy, cash flow, or risk metrics might go unnoticed until the next reporting cycle, potentially leading to missed opportunities or escalating challenges.

Real-time portfolio reporting flips this model on its head by delivering live updates through dashboards that reflect changes as they occur. This means stakeholders always have access to the most current data, enabling quicker decisions, proactive risk management, and efficient communication. By automating data collection and integration, this approach not only minimizes manual errors but also saves time while ensuring reports are accurate and formatted to U.S. standards (like $ currency and comma-separated thousands). Platforms like CoreCast make this possible, offering real estate professionals a centralized solution for monitoring portfolio performance and overall health in real time.

How can real-time alerts be customized to align with portfolio goals?

Real-time alerts can be customized to meet the unique demands of your portfolio by zeroing in on key metrics, setting precise thresholds, and assigning roles to stakeholders. Start by pinpointing the most important KPIs - think occupancy rates, Net Operating Income (NOI), or Internal Rate of Return (IRR). Define specific numeric thresholds for these metrics to trigger alerts, such as an occupancy rate dropping below 85% or an NOI surpassing $150,000.

Then, determine who should receive these alerts. For example, property managers might need updates on maintenance concerns, while investors could benefit from insights into overall performance trends. Select delivery methods that work best for your team, whether that’s in-app notifications, emails, or SMS messages. Lastly, make it a habit to review and adjust your alert system regularly. This ensures it stays in sync with your portfolio’s changing priorities, helping stakeholders make quicker, data-informed decisions.