EV Manufacturing's Impact on Commercial Real Estate

The rise of electric vehicles (EVs) is reshaping commercial real estate in the U.S., driving demand for industrial spaces tailored to EV production. Automakers have invested $197.6 billion in EV and battery plants, sparking a surge in large-scale facilities, or “megasites,” that require over 1,000 acres, high-voltage power, and robust logistics.

Key takeaways:

- Leasing Boom: EV-related industrial leasing grew by 163% in early 2023.

- Battery Plant Growth: U.S. battery factories increased from 2 in 2019 to 34 by 2025.

- Geographic Shift: EV production is clustering in the "Battery Belt" from Michigan to the Southeast.

- Challenges: Limited megasites, high energy needs, and skilled labor shortages.

EV facilities demand billions in investments, specialized infrastructure, and long timelines, while more conventional industrial spaces offer flexibility and lower costs. As EV production grows, real estate developers face both opportunities and hurdles in meeting this evolving demand.

China Built The World's Biggest GigaFactory For Electric Vehicles

1. EV Manufacturing Facilities

Electric vehicle (EV) manufacturing facilities face challenges that set them apart from traditional automotive plants. One of the biggest hurdles is their enormous energy consumption. Producing EV batteries requires hundreds of megawatts of electricity - far more than the energy needed for conventional assembly lines. This demand drives manufacturers to seek locations with access to high-voltage electrical grids and, increasingly, renewable energy. The push for renewable energy aligns with the "green" image EV brands aim to maintain [1][2].

Didi Caldwell, President of Global Location Strategies, highlights the issue:

"Some of these projects require hundreds of megawatts. At the same time, we're shutting a lot of coal plants." [2]

Another major challenge is the availability of land. Large-scale EV projects require megasites - parcels of land spanning over 1,000 acres with existing infrastructure like utilities and transportation links. However, as of 2023, fewer than two dozen such sites remain across the U.S. [2]. For example, Volkswagen's Scout Motors spent months evaluating 74 locations before settling on a 1,600-acre site in South Carolina for a $2 billion assembly plant. Many options were ruled out due to a lack of clean power or the extended timelines - up to six years - needed to build rail connections [2]. Similarly, Rivian passed over Fort Worth, Texas, in favor of Georgia for its $5 billion plant because Fort Worth couldn't meet its tight infrastructure deadlines [2].

Workforce availability adds another layer of complexity. Unlike traditional auto plants, EV facilities rely on highly specialized technical skills. By 2027, the industry will need around 200,000 technicians and engineers trained in areas like battery chemistry, robotics, and precision electronics [1]. This demand has funneled investment into regions with strong technical education programs and automotive expertise, particularly in the Southeast and Midwest. In fact, six Southern states - Alabama, Georgia, Kentucky, North Carolina, South Carolina, and Tennessee - have attracted over $64 billion in EV-related investments [1].

Battery plants, in particular, have clustered in specific regions due to logistical and cost considerations. The "Auto Alley" corridor, which stretches from the Great Lakes to the Gulf of Mexico, has become a hotspot for battery production. This isn't by chance - battery packs are heavy and difficult to transport, so locating plants near final assembly sites helps cut costs [3][4]. For instance, Stellantis and LG Energy Solution invested $3.7 billion (CAD $5 billion) in a battery plant in Windsor, Ontario, in 2022. They chose the location to tap into the area's existing automotive supply chain and access critical raw materials [1][5].

2. Traditional Industrial Real Estate

Traditional industrial real estate operates under a different set of priorities compared to EV facilities. Site selection for these properties typically revolves around factors like labor availability, logistics access, and basic utility needs. For instance, most industrial tenants require around 2,000 to 3,000 amps of power to support standard warehouse operations and light manufacturing tasks [10]. The evaluation criteria for these assets are more straightforward, emphasizing standard operational requirements. This distinction provides a clear contrast when examining trends like nearshoring and the adaptability of properties.

Logistics infrastructure plays a central role in determining location. Access to highways and rail links is crucial for efficient freight movement. This is reflected in the national industrial vacancy rate, which stood at 4.6% as of October 2023 [8]. Standard rail access and visibility from highways are generally sufficient for warehouses and distribution centers. For example, regions like California's Inland Empire (4.3% vacancy) and Orange County (4.6% vacancy) remain highly competitive due to their proximity to major ports [8].

The growth of nearshoring has reshaped the demand for traditional industrial spaces. By the end of 2023, U.S. imports from Mexico hit a record $480 billion, fueling the need for facilities near border crossings [11]. At the Laredo port of entry in Texas, over 2 million loaded truck crossings occur annually, significantly driving up rental rates in the area [10][11]. While EV facilities rely on specialized infrastructure, traditional industrial spaces thrive due to their adaptability and ability to meet the demands of nearshoring.

One of the key advantages of traditional industrial properties is their flexibility. Unlike the highly specialized nature of EV battery plants, conventional warehouses and manufacturing facilities can adjust to new operations with minimal modifications [9]. This makes them appealing to both investors and tenants who prioritize operational flexibility.

Additionally, traditional industrial spaces benefit from the ripple effect created by manufacturing facilities. Each manufacturing plant can generate a multiplier effect, driving demand for supplier and third-party logistics (3PL) spaces by three to five times [11]. For instance, Samsung's $17 billion semiconductor plant in Taylor, Texas, spurred the development of a 1.7-million-square-foot industrial park by Hines and Galesi Group, designed to accommodate suppliers needing spaces between 30,000 and 150,000 square feet [10]. This trend is common across major manufacturing hubs, sustaining demand for traditional industrial properties that support - but don’t directly house - advanced manufacturing operations.

sbb-itb-99d029f

Pros and Cons

EV Manufacturing Facilities vs Traditional Industrial Real Estate: Key Differences

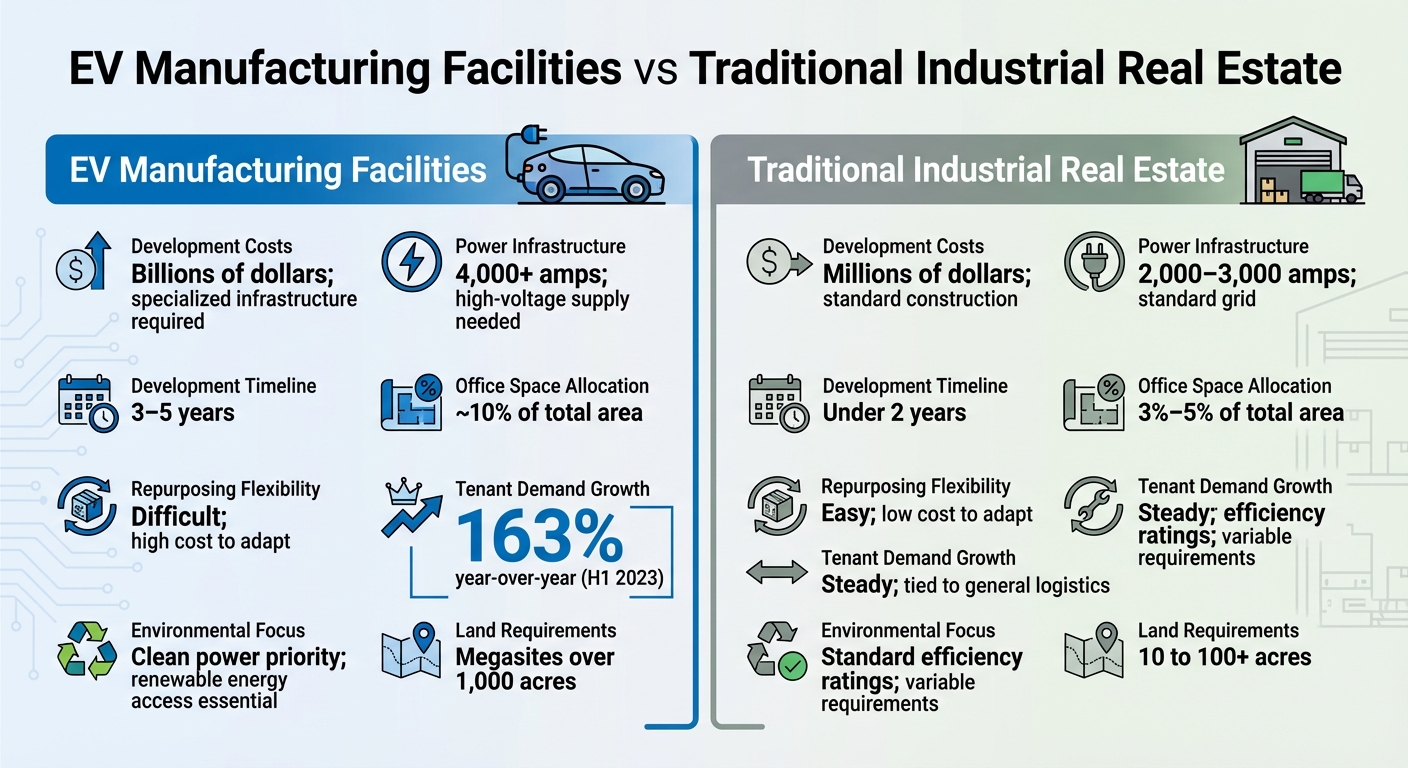

When assessing the advantages and challenges of investing in EV-specific facilities versus traditional industrial properties, a closer look at their differences reveals some important trade-offs. These comparisons help clarify the factors that influence investment decisions.

Development costs are one of the most striking differences. Building EV manufacturing plants is a massive financial undertaking, often requiring billions of dollars to cover specialized needs like battery assembly lines and advanced robotics [9][12]. In contrast, traditional warehouses are far less expensive, typically costing millions, with construction focused on standard shells and basic loading features.

Power infrastructure marks another key distinction. EV facilities demand at least 4,000 amps of electricity and rely on high-voltage supplies, whereas traditional logistics operations operate on 2,000 to 3,000 amps [10]. This higher power requirement not only increases costs but also extends development timelines - EV plants can take 3–5 years to complete, compared to under 2 years for conventional facilities [1][7].

Tenant demand and flexibility also vary significantly. EV-related bulk leases saw a 163% year-over-year increase in the first half of 2023 [7], and manufacturing rents reached $8.39 per square foot by late 2022, reflecting a 22.7% annual rise [10]. However, traditional industrial properties offer a level of adaptability that EV plants cannot match. As Patrich Jett, Senior Vice President at Colliers, explained:

"EV manufacturing facilities, such as battery plants, require significant investment and are hard to repurpose compared to traditional distribution warehouses" [9].

This lack of flexibility makes EV facilities riskier for long-term investment, especially if market demand shifts.

Environmental considerations add another layer of complexity. EV plants are designed to align with corporate decarbonization goals by prioritizing clean energy sources [7][2]. However, their enormous energy needs strain local power grids and require "megasites" of over 1,000 acres [2]. On the other hand, traditional industrial properties operate on smaller plots, typically ranging from 10 to 100+ acres, and follow standard efficiency guidelines. While EV facilities aim to be environmentally friendly, their resource-heavy nature presents challenges.

| Feature | EV Manufacturing Facilities | Traditional Industrial Real Estate |

|---|---|---|

| Development Costs | Extremely high (billions); specialized infrastructure required [9][12] | Moderate (millions); standard construction [9] |

| Power Infrastructure | 4,000+ amps; high-voltage supply [10] | 2,000–3,000 amps; standard grid [10] |

| Development Timeline | 3–5 years [1][7] | Under 2 years |

| Office Space Allocation | Approximately 10% of total area [10] | 3%–5% of total area [10] |

| Repurposing Flexibility | Difficult; high cost [9] | Easy; low cost [9] |

| Tenant Demand Growth | 163% YoY (H1 2023) [7] | Steady; tied to general logistics |

| Environmental Focus | Clean power priority; renewable energy access [7][2] | Standard efficiency ratings; variable requirements |

These comparisons highlight the complex trade-offs between these two types of commercial real estate, setting the stage for deeper strategic evaluations in future discussions.

Conclusion

The rise of EV manufacturing is reshaping commercial real estate across the U.S., creating a new category of industrial assets with unique requirements that go far beyond what traditional warehouses and distribution centers can accommodate.

This transformation is fueled by substantial investments and a rapid expansion in production capacity. Since 2020, over 60 million square feet of new production space has been added to support this growing industry[6].

The geographic shift is just as striking. The emergence of the "Battery Belt" along the I-75 Corridor - from Michigan through Tennessee, Kentucky, and down to Georgia - marks a major realignment in industrial activity[9]. This area is becoming a hub for integrated manufacturing ecosystems, where battery production, vehicle assembly, R&D, and supplier networks operate side by side. Ford’s BlueOval City in Tennessee is a prime example, with its $11.4 billion investment projected to attract an additional $5.2 billion in regional supplier investments[10]. This mirrors earlier trends in the clustering of advanced manufacturing facilities, reinforcing the importance of proximity and collaboration.

However, the industry faces significant infrastructure challenges. One key issue is the limited availability of "megasites" - large, contiguous plots of 1,000 acres or more equipped with high-voltage power and strong transportation links[2]. With battery electric vehicle production expected to jump from 1.1 million units in 2023 to 7.3 million by 2029, developers who can provide shovel-ready sites with at least 4,000 amps of power will be in high demand[4][10].

The impact of EV growth extends beyond industrial properties. By 2030, an estimated 26 million EVs will be on U.S. roads[1], driving changes across retail, multifamily, and office spaces. Properties in these sectors will need to incorporate charging infrastructure to stay competitive. Platforms like CoreCast (https://corecastre.com) are helping real estate professionals stay ahead of these trends, offering tools to analyze EV-driven opportunities, track developments in the Battery Belt, and conduct in-depth portfolio analyses.

The EV revolution isn’t just transforming vehicle manufacturing - it’s redefining the role of commercial real estate in the U.S. economy.

FAQs

What unique challenges do EV manufacturing facilities face compared to traditional industrial spaces?

EV manufacturing facilities come with their own set of challenges that set them apart from traditional industrial spaces.

Power demands are a major hurdle. These facilities need a much more robust and reliable power supply to handle energy-intensive processes like battery assembly and vehicle testing. This often means installing high-capacity grid connections, on-site substations, or even tapping into renewable energy sources. However, if the local infrastructure isn’t up to the task, it can cause significant delays.

Another challenge is the specialized workforce. Operating high-voltage equipment, managing battery systems, and maintaining clean-room environments require highly trained professionals. Unfortunately, there’s often a shortage of workers with these specific skills, which can slow production schedules.

Site selection is also a tricky process. Ideal locations need access to clean energy, reliable transportation for heavy shipments, and plenty of water for cooling and battery production. On top of that, developers must ensure compliance with strict safety and environmental regulations. Adding to the complexity, shifting tax incentives and policy changes can make financial planning unpredictable.

How is the rise of EV manufacturing in the 'Battery Belt' shaping commercial real estate?

The growth of electric vehicle (EV) manufacturing in the 'Battery Belt' - a stretch of the Southeast and Midwest - is reshaping the commercial real estate landscape. States such as Georgia, Tennessee, and South Carolina are experiencing a boom in demand for industrial spaces like manufacturing plants, logistics centers, and sites near suppliers. This surge ties back to over $80 billion in EV projects launched since the Inflation Reduction Act, with nearly half of the planned factories concentrated in this region.

As a result, property values are climbing, and rents for prime locations are at a premium. Sites with key features - like access to renewable energy, rail connections, and a skilled workforce - are especially sought after. Meanwhile, local communities are scrambling to upgrade infrastructure, including roads, utilities, and housing, to keep pace with this rapid expansion. Real estate professionals can use tools like CoreCast to monitor these trends, assess site potential, and make informed decisions in this fast-changing market.

What infrastructure is essential for EV megasites to succeed?

The success of EV megasites hinges on several essential infrastructure components. At the top of the list is a dependable and high-capacity clean energy supply to meet the immense power demands of assembling vehicles and producing batteries. This often means upgrading the existing grid connection or incorporating on-site renewable energy options. Next, efficient transportation links, such as rail spurs for transporting raw materials and shipping finished vehicles, play a crucial role in keeping logistics smooth and avoiding unnecessary delays. Additionally, being near a skilled labor force and having access to vocational training programs can make hiring easier and help projects stay on track.

Other important considerations include sufficient water supplies, waste management systems, and broadband infrastructure, all of which support both manufacturing processes and digital monitoring tools. Lastly, policy incentives and streamlined permitting processes can significantly speed up development timelines and make these projects more attractive to investors.

To manage these interconnected elements effectively, platforms like CoreCast offer real-time analytics. These tools allow users to evaluate factors such as power grid capacity, rail accessibility, labor availability, and policy incentives in one centralized system. This helps investors gauge project feasibility and minimize risks before construction begins.