5 Steps to Value Distressed Real Estate Using Income

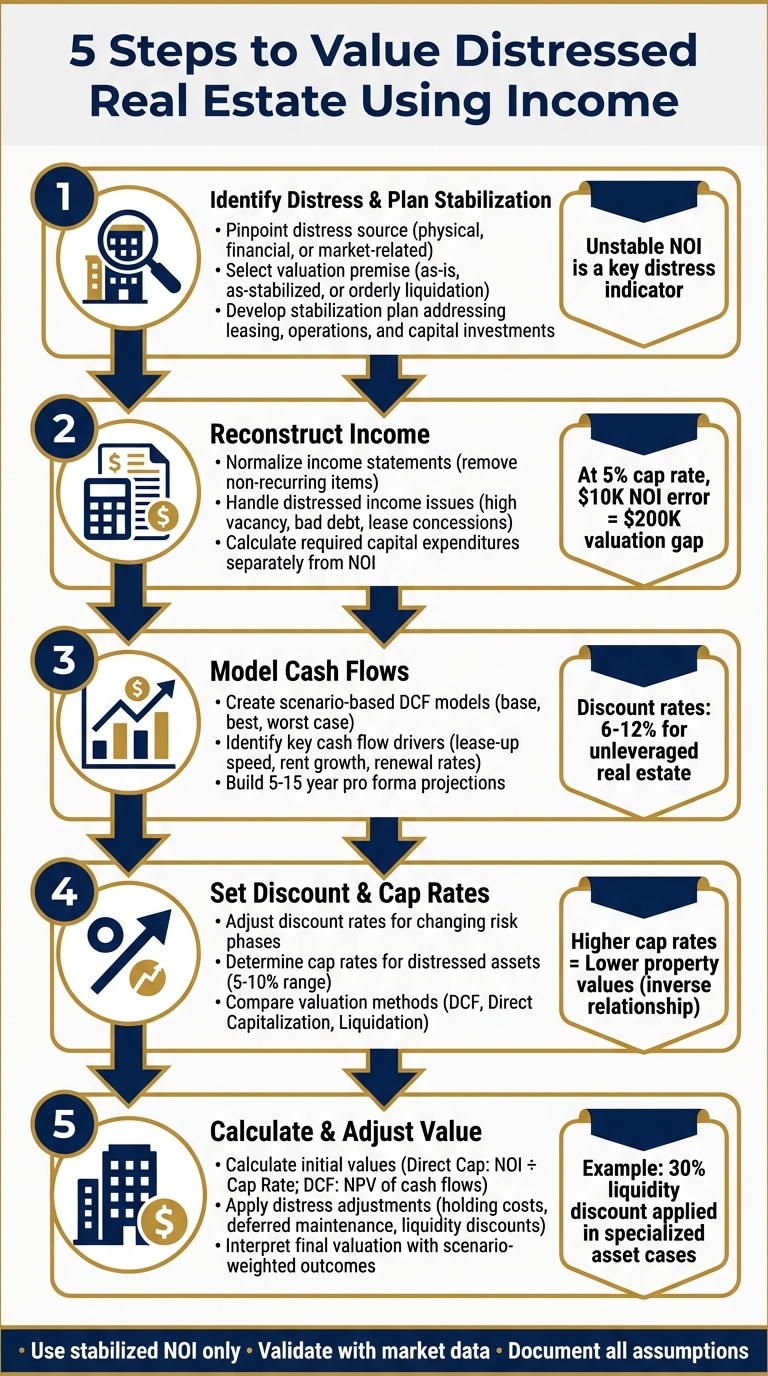

Valuing distressed real estate requires a forward-looking approach, focusing on potential income rather than current conditions. This guide highlights a 5-step process to assess these properties effectively:

- Identify Distress & Plan Stabilization: Determine the cause (physical, financial, or market-related) and create a strategy to restore income potential.

- Reconstruct Income: Adjust financial records to reflect actual performance, removing one-time items and accounting for unstable income streams.

- Model Cash Flows: Develop multi-year projections under different scenarios (base, best, worst) to estimate future performance.

- Set Discount & Cap Rates: Adjust for the risks of distressed properties, using higher cap rates and risk-weighted discount rates.

- Calculate & Adjust Value: Use direct capitalization or DCF methods, then factor in holding costs, repairs, and liquidity risks.

5-Step Process for Valuing Distressed Real Estate Using Income Approach

Understanding the intricacies of distressed commercial real estate investing

Step 1: Identify the Distress and Plan the Stabilization

Before determining the value of a distressed property, it's crucial to understand what’s causing the distress and to develop a clear stabilization plan. This step lays the groundwork for accurately assessing the property's worth and creating a strategy to restore its value.

Pinpoint the Source of Distress

Distressed properties generally fall into one of three categories: physical, financial, or market-related issues. Physical distress often involves neglected maintenance or significant repair needs, which can reduce future profits and deter potential tenants [6][7]. Financial or operational distress might show up as high vacancy rates, poor management practices, or tenants struggling with their own financial difficulties [6]. Market-related distress arises when a property is misvalued or when appraisal methods fail to reflect current market conditions [7].

A key indicator of distress is an unstable Net Operating Income (NOI). This might include irregular or temporary items such as lease termination fees, short-term tax incentives, or lease-up concessions [1][5]. To get a clear picture, evaluate tenant financial health and review lease agreements - whether full-service, net, or triple-net (NNN) - to compare current rents against market data from platforms like CoStar or REIS [1][5][7].

"A buyer should pay special attention to the condition of the property, operating efficiency, and vacancy when using the income approach." - Investopedia [6]

Once the distress factors are identified, you can move on to selecting the right valuation approach.

Select the Right Valuation Premise

Based on the identified issues, choose a valuation premise that aligns with the property's current situation and its potential. Here are three common approaches:

- "As-is" valuation: Reflects the property's current state, including any immediate cash flow issues and vacancies.

- "As-stabilized" valuation: Projects the property's value after implementing a turnaround plan and achieving market-level occupancy.

- "Orderly liquidation" valuation: Applies when the property needs to be sold quickly, often at a discounted price due to time constraints.

Your choice should align with your investment strategy and timeline. For example, if you're planning a turnaround, an "as-stabilized" valuation may be more appropriate. However, always verify cap rate assumptions against recent comparable sales and ensure they include a reasonable risk premium over the 10-year Treasury rate [5].

Develop a Stabilization Plan

After selecting your valuation premise, create a detailed stabilization plan to guide the property from distress to profitability. This plan should address three key areas: leasing strategy, operational improvements, and capital investments.

Start by outlining how you’ll lease vacant units, including expected rent levels and the use of lease-up concessions, while factoring in tenant turnover patterns [1][9]. Next, identify any physical repairs or upgrades needed to reposition the property. While these capital expenditures don’t appear in NOI calculations, they are essential for achieving the stabilized value [6].

Operational improvements are equally important. Reducing payroll costs, addressing unusual expenses, and optimizing property management can significantly enhance future NOI [9]. Support your projections with data from similar properties in the area to ensure your assumptions are realistic [1]. Keep in mind that unstabilized income should never be used in a direct capitalization formula, as this method assumes income and expenses are already stable and ongoing [1].

"Finding opportunities in the real estate market involves finding properties that have been incorrectly valued by the market. This often means managing a property to a level that surpasses market expectations." - Investopedia [7]

Step 2: Reconstruct Historical and Current Income

Once you've pinpointed the distress and outlined a stabilization plan, the next step is to dig into the property's financials. Distressed owners often present income data that’s more optimistic than reality - whether due to accounting maneuvers or poor recordkeeping. Your job? Strip away those distortions to uncover the actual net operating income (NOI).

Normalize the Income Statements

Start by removing non-recurring income items like lease termination fees or legal settlements. These one-off earnings can make the property’s income seem artificially inflated. Similarly, exclude non-operating costs such as asset management fees, fund-level expenses, or interest income, as they don’t reflect the property’s true operating performance [1].

Watch for related-party transactions that skew the numbers. For example, above-market management fees or below-market rents can distort the property’s financial picture. Compare current rents with market data to identify irregularities. Delays in financial reporting can also signal recordkeeping issues [10].

"When business owners try to hide deteriorating performance, they often devise creative accounting strategies to increase sales and profits." - Axley & Rode [10]

Why does this matter? At a 5% cap rate, even a $10,000 error in normalized NOI can lead to a $200,000 valuation gap [1]. Carefully verify all adjustments using market benchmarks to ensure accuracy.

Handle Distressed Income Issues

Distressed properties often face unstable income streams. You’ll need to account for high vacancy rates, lease-up concessions, and bad debt from tenants struggling to pay. When rent payments are questionable, switch to cash-received accounting instead of accrual-based methods [11].

Dive into tenant aging reports and assess their credit health to estimate potential collection losses. For lease modifications, determine if the changes are immediate or future-dated. If a tenant remains in part of the space after a lease termination, reallocate termination income across the remaining lease term [11]. Replace the property's current distressed vacancy rate with a market-standard vacancy assumption that reflects what a stabilized property would typically experience [5].

Calculate Required Capital Expenditures

Separate capital expenditures - like replacing a roof or upgrading HVAC systems - from NOI, as these costs directly impact net cash flow [6][1]. For distressed properties, deferred maintenance often leads to hefty repair bills.

Prepare a detailed list of required repairs and improvements, including tenant improvement (TI) allowances for commercial spaces. Align these expenses with your lease-up schedule to project when the property will stabilize [9]. Compare your capital expenditure estimates with historical spending at similar properties to ensure they’re reasonable. Running sensitivity analyses can help you understand how changes in capital spending impact overall returns.

| Item | Normalization Action | Reason |

|---|---|---|

| Lease-up Concessions | Remove from income | Temporary; doesn't reflect stabilized potential [1] |

| Asset Management Fees | Exclude from expenses | Owner-level costs, not property-specific [1] |

| Capital Expenditures | Track separately from NOI | Affects cash flow but isn’t part of NOI [6] |

| Market Vacancy | Use market average | Reflects expectations for a stabilized property [5] |

With income normalized and capital expenditures clearly defined, you’re ready to model the property’s future cash flows.

Step 3: Build Cash Flow Scenarios

With normalized income calculated, the next step is to map out how cash flows are likely to evolve as the property transitions from distress to stabilization. For distressed properties, this involves creating detailed multi-year cash flow models that account for factors like repair schedules, lease-up periods, and the shifting levels of risk. Unlike stabilized assets, where a simple cap rate calculation might suffice, distressed assets require a more nuanced approach to project future performance [12].

Create Scenario-Based DCF Models

Develop three distinct scenarios - base case, best case, and worst case - to reflect varying recovery assumptions. For instance:

- The base case might assume a moderate recovery with steady rent growth.

- The worst case could anticipate a prolonged stabilization period, with stagnant or even declining rents.

- The best case might envision a quick recovery coupled with strong rental increases.

"For scenarios involving fluctuating cash flows, such as renovations, lease-ups, or repositioning, DCF analysis isn't just helpful, it's essential." – Robert Schmidt, CCIM, PropertyMetrics [12]

Distressed properties typically go through different risk phases. Initially, during renovations, the risk is high. This transitions to moderate risk during early lease-up and finally to lower risk once the property stabilizes. Your discount rate should reflect these changing risk levels, often ranging from 6% to 12% for unleveraged real estate [13]. Adjust your purchase price until you achieve your target equity IRR [12].

Once you've outlined these scenarios, focus on the critical factors that will shape your cash flow projections.

Identify Key Cash Flow Drivers

Several variables play a significant role in projecting cash flows. Here are the most impactful ones to consider:

- Lease-up Speed: This determines how quickly revenue recovers. Slow absorption increases carrying costs [2].

- Market Rent Growth: Declining rents can reduce future lease revenue, especially if new supply enters the market with better amenities [2].

- Renewal Rates: Higher renewal rates can stabilize income faster.

- Timing of Capital Expenditures: Large upfront costs can create negative initial cash flows and must be deducted from NOI [2].

Run sensitivity analyses on your exit cap rate, as small adjustments here can have a significant impact on terminal value and overall returns [12][1]. To ensure your assumptions are realistic, cross-check them against third-party data sources like CoStar, particularly for vacancy and absorption rates [1][5].

With these drivers in mind, you can now construct detailed, multi-year projections.

Build Multi-Year Pro Forma Projections

A 5- to 15-year time horizon is typically used to capture the full stabilization process and eventual exit [4]. Your pro forma should include:

- The timing of capital expenditures and tenant improvements.

- Lease rollovers and their impact on cash flow.

- Annual stabilization assumptions layered over the trailing 12-month actuals [9].

To calculate terminal value, divide the projected NOI for the year following your hold period by the exit cap rate [13]. Model both levered and unlevered cash flows to understand returns before and after accounting for debt service [12]. The holding period should align with the time required for stabilization and favorable market conditions for a sale.

| Variable | Impact on Cash Flow Projections |

|---|---|

| Lease-up Speed | Determines revenue recovery timing; slower absorption increases carrying costs [2]. |

| CapEx Timing | Early large outlays create negative initial cash flows and must be deducted from NOI [2]. |

| Market Rent Growth | Declining trends reduce future lease revenue; verify assumptions with market data [2]. |

| Exit Cap Rate | Small changes can significantly affect terminal value and IRR [12][1]. |

sbb-itb-99d029f

Step 4: Select Discount and Cap Rates for Distressed Properties

Once you’ve developed your cash flow scenarios, the next step is to fine-tune your discount and cap rates to reflect the added risks associated with distressed properties. This builds on the cash flow analysis from Step 3, ensuring your valuation accurately mirrors the asset's risk profile.

Adjust Discount Rates for Risk

When performing a discounted cash flow (DCF) analysis, your discount rate needs to account for the unique uncertainties tied to distressed assets. A common approach is the risk-premium method - adding a premium to the risk-free rate, often represented by the 10-year U.S. Treasury bond, to capture property-specific risks [12].

The risk profile of a distressed property shifts over time. Initially, during major renovations, the property carries high risk. As it enters early lease-up, the risk moderates, eventually decreasing further once stabilized [12]. Adjust your discount rate to reflect these phases. Use your DCF model to tweak the purchase price iteratively until it aligns with your target equity internal rate of return (IRR) [12].

"Distressed valuation is where the science of valuation truly meets the art of the specialty." – Mike Fussman, Incoming Partner, CohnReznick [14]

Determine Cap Rates for Distressed Assets

Cap rates for distressed properties are inherently higher than those for stabilized assets due to the increased risk. However, they should only be applied to the stabilized, long-term net operating income (NOI) [1]. Using current "as-is" income for a distressed property can lead to inaccurate valuations.

Since cap rates have an inverse relationship with property value, increasing the cap rate to account for distress risk will lower the estimated value [6]. For distressed properties, cap rates typically range between 5% and 10%, with those on the higher end reflecting the elevated risk [16].

Once your discount rate reflects the asset's risk, set a cap rate that uses only stabilized NOI to avoid misleading results. Compare your chosen cap rate with the prevailing risk-free rate to ensure the spread adequately compensates for the asset's specific risks [1]. Support your assumptions by analyzing recent sales of comparable distressed properties in the same market, while excluding any outliers that might distort the data [1][6]. Additionally, assess factors like tenant stability, property condition, and anticipated capital expenditures, as these can increase the risk profile and justify a higher cap rate [1][6].

Compare Valuation Methods

Different valuation methods serve different purposes, offering complementary perspectives on distressed asset valuation. Here are the key approaches:

- Discounted Cash Flow (DCF) Analysis is ideal for properties with fluctuating cash flows, such as those undergoing renovations or lease-up phases. It’s particularly useful for long-term hold periods, typically between 5 and 15 years, where stabilization efforts are significant [12][4].

- Direct Capitalization works best for stabilized properties with consistent income streams. While it’s quicker to apply, it doesn’t account for the timing of capital expenditures or shifts in risk levels. For distressed assets, it should only be used once you’ve projected a stabilized NOI [1][5].

- Liquidation Analysis is relevant when the property might be worth more sold piecemeal than as an ongoing operation. This method establishes a valuation floor, helping you determine if your assumptions or deal viability need reevaluation [14][15].

| Valuation Method | Best Use Case | Key Limitation |

|---|---|---|

| Discounted Cash Flow (DCF) | Properties with fluctuating cash flows, renovations, or lease-up phases [12] | Requires complex estimations of future costs and rental growth [4] |

| Direct Capitalization | Stabilized income-producing properties with consistent cash flows [1][5] | Doesn’t account for timing of capital outlays or changing risk levels [12] |

| Liquidation Analysis | Assets where piecemeal sale might yield higher value [14][15] | Assumes a "forced" or "orderly" sale rather than continued operation [14] |

"There is no 'right' value that results from using the income capitalization approach. Instead, there is either a value that can be defended using market data, or there is a value that cannot be defended at all." – FNRP Editor [5]

Cross-check your assumptions across all three methods. If your DCF value significantly deviates from your cap rate valuation or falls below the liquidation value, revisit your inputs. Compare them against market data from sources like CoStar or REIS to ensure accuracy [1][5].

Step 5: Calculate Value and Apply Distress Adjustments

Calculate Initial Values

Start by determining the property's initial value using two common methods: direct capitalization and the discounted cash flow (DCF) method.

For direct capitalization, divide the stabilized net operating income (NOI) by the market capitalization rate (Cap Rate). The formula is straightforward: Value = NOI / Cap Rate. For instance, if your stabilized NOI is $500,000 and the cap rate is 7%, the property's value would come out to approximately $7,142,857.

The DCF method, on the other hand, involves calculating the net present value (NPV) of future cash flows. This means discounting each year’s projected cash flow back to the present using your required rate of return. Don’t forget to include the terminal value, which represents the expected sale price at the end of your holding period. Since the terminal value often makes up a large part of the total valuation, it’s critical to base it on realistic, stabilized assumptions.

Keep in mind that valuation results can vary significantly depending on the inputs. Ensure your stabilized NOI excludes any one-time or non-recurring items to maintain accuracy.

Once you've calculated these initial values, you’ll need to adjust them to reflect the specific challenges of distressed assets.

Apply Distress Adjustments

While the initial values represent the property's stabilized potential, distressed assets come with unique challenges that must be factored into your valuation. Start by accounting for annual holding costs, such as maintenance, repairs, taxes, and insurance. These expenses directly reduce your net cash flow and, in turn, your overall return.

Next, consider deferred maintenance and the capital expenditures required to bring the property into a stabilized condition. For example, if the property needs $250,000 in immediate repairs, this will either reduce your effective purchase price or increase your total investment basis. Additionally, for specialized assets, liquidity discounts may apply. In one bankruptcy case involving Low-Income Housing Tax Credits, a 30% discount was applied to address risks related to incomplete deals and the absence of investment-grade guarantees.

You should also adjust cash flow projections to strip out any overly optimistic growth assumptions, as these may not be realistic for distressed properties. Using a risk-weighted discount rate tailored to the property’s specific ability to generate future cash flows can further refine your valuation.

Interpret the Final Valuation

Your final valuation should reflect a range of possible outcomes, especially if you’ve conducted scenario analyses. For instance, you might model worst-case, base-case, and best-case scenarios, then assign probabilities to each to calculate a scenario-weighted value. This approach acknowledges the inherent uncertainty in distressed property investments.

Compare your DCF valuation to the direct capitalization value and the liquidation analysis floor. If the DCF value is significantly lower than the liquidation value, it might indicate that the property could be worth more if sold off in parts rather than as a functioning operation. Revisit your assumptions if necessary.

"The valuation that your analysis spits out is only as good as the assumptions that went into the analysis; hence the reason CRE professionals are paid the big bucks!" – Spencer Burton, Co-Founder and CEO of CRE Agents [1]

Document all your assumptions, data sources, and adjustments thoroughly. A solid, defensible valuation relies on market data rather than overly optimistic forecasts. Including sensitivity analyses to show how changes in key variables - like NOI, cap rates, and discount rates - impact the final valuation can help stakeholders better understand the risks and make more informed decisions.

Conclusion: Applying Income-Based Valuation to Distressed Assets

Valuing distressed real estate goes beyond standard calculations; it’s about blending technical analysis with a nuanced understanding of the asset's potential. As Michael Fussman, Incoming Partner – Dispute Resolution Leader at CohnReznick, aptly put it, "distressed valuation is where the science of valuation truly meets the art of the specialty" [14]. The key is moving from simply identifying a troubled property to envisioning its stabilized future. This distinction between "as-is" value and "as-stabilized" value is where opportunities for profitable investments emerge [3][1]. It’s this shift - from recognizing distress to estimating future income - that enables precise valuation adjustments.

At the heart of this process lies the principle of adjustment. Even small changes in Net Operating Income (NOI) can lead to significant shifts in property values [1]. This is why yield capitalization, particularly through Discounted Cash Flow analysis, is often the preferred method for valuing distressed assets. Unlike direct capitalization, it accounts for the time and resources required to stabilize the property over several years [3][2].

To uncover undervalued distressed assets, it’s essential to rely on realistic assumptions and solid market benchmarks. Successful investments often come down to finding properties that the market has mispriced or where operational improvements can surpass expectations [7]. The difference between a lucrative deal and a costly mistake often hinges on the accuracy of your assumptions. Projections should be rooted in reliable market data and recent comparable sales, steering clear of overly optimistic forecasts [14][17]. Validating these assumptions with concrete market data ensures that your valuation reflects the asset's genuine income-generating potential [8].

FAQs

How can I determine the appropriate discount rate for valuing a distressed property?

To determine the appropriate discount rate for a distressed property, begin with a market-based rate like the current cap rate or the cost of capital. From there, make adjustments by incorporating risk premiums for factors such as elevated vacancy rates, necessary repairs, financing difficulties, and liquidity risks. To refine these adjustments, rely on data from comparable distressed property sales, market research, or use a band-of-investment model.

The resulting discount rate reflects the return an investor would expect based on the property’s specific risk profile. This rate is then applied to assess the property's projected cash flows, ensuring the valuation accounts for both prevailing market conditions and the unique challenges tied to the asset.

What should you consider when creating a stabilization plan for distressed real estate?

When creating a stabilization plan for a distressed property, the main focus should be on identifying the factors that will shape its cash flow once it reaches full occupancy. Pay close attention to the cost, scope, and timeline of renovations or repositioning efforts. These elements directly influence the net operating income (NOI) and determine how quickly the property can achieve stabilization. It's also important to evaluate current and projected occupancy levels, lease-up timelines, and any potential rent changes - whether due to expiring leases or shifts in market rents.

The quality of property management plays a critical role as well. Their ability to retain tenants, control expenses, and implement the stabilization plan effectively can make or break the process. Local market conditions, such as unemployment rates, competition from nearby properties, and broader economic trends, should guide your assumptions about rent growth and the capitalization rate, which is used to translate projected NOI into property value. Don’t overlook the property’s financial position. Assess its debt structure and liquidity to understand how much capital is available for stabilization and what financing options are realistic.

A practical stabilization plan should include a calculation of the stabilized NOI. This means projecting future revenue, deducting realistic expenses - like taxes, repairs, and reserves - and applying a market-driven cap rate. Be sure to document any assumptions, such as temporary rent concessions or reduced expenses, so your valuation aligns with both investor expectations and the realities of the market.

Why is normalizing income statements crucial when valuing distressed properties?

Normalizing income statements helps reveal the real, ongoing performance of a property’s cash flow by eliminating one-time, irregular, or situation-specific items. This adjustment offers a clearer view of the property’s actual operating potential, which is critical for accurate income-based valuations.

By concentrating on the normalized income, you gain a stronger understanding of the property’s long-term value, enabling smarter and more confident investment decisions.