Future of Risk Assessment in Real Estate Analytics

The real estate industry is shifting toward smarter, data-driven risk management methods. Traditional tools like spreadsheets and linear models are no longer enough to handle today’s complex challenges. Here’s what’s changing:

- AI and Predictive Analytics: Machine learning models are now uncovering patterns that older methods missed. For example, a new risk model combines factors like location and legal risks into a single score to help investors make better decisions.

- Real-Time Monitoring: Tools like CoreCast centralize data, enabling companies to track risks as they emerge and simulate scenarios to prepare for potential disruptions.

- Digital Twins: These virtual replicas of buildings help monitor construction risks, detect structural issues, and improve efficiency using IoT sensors and AI.

- Supply Chain and Climate Risks: Real estate firms are mapping supplier vulnerabilities and adjusting property valuations to account for risks like hurricanes, floods, and wildfires.

- Regulations and Reporting: New rules are pushing for standardized risk assessments, such as quality controls for automated valuation models and climate risk disclosures.

This transformation is empowering real estate professionals with tools to predict risks, protect investments, and comply with evolving regulations. By integrating AI, real-time data, and centralized platforms, the industry is moving toward smarter, more precise risk management.

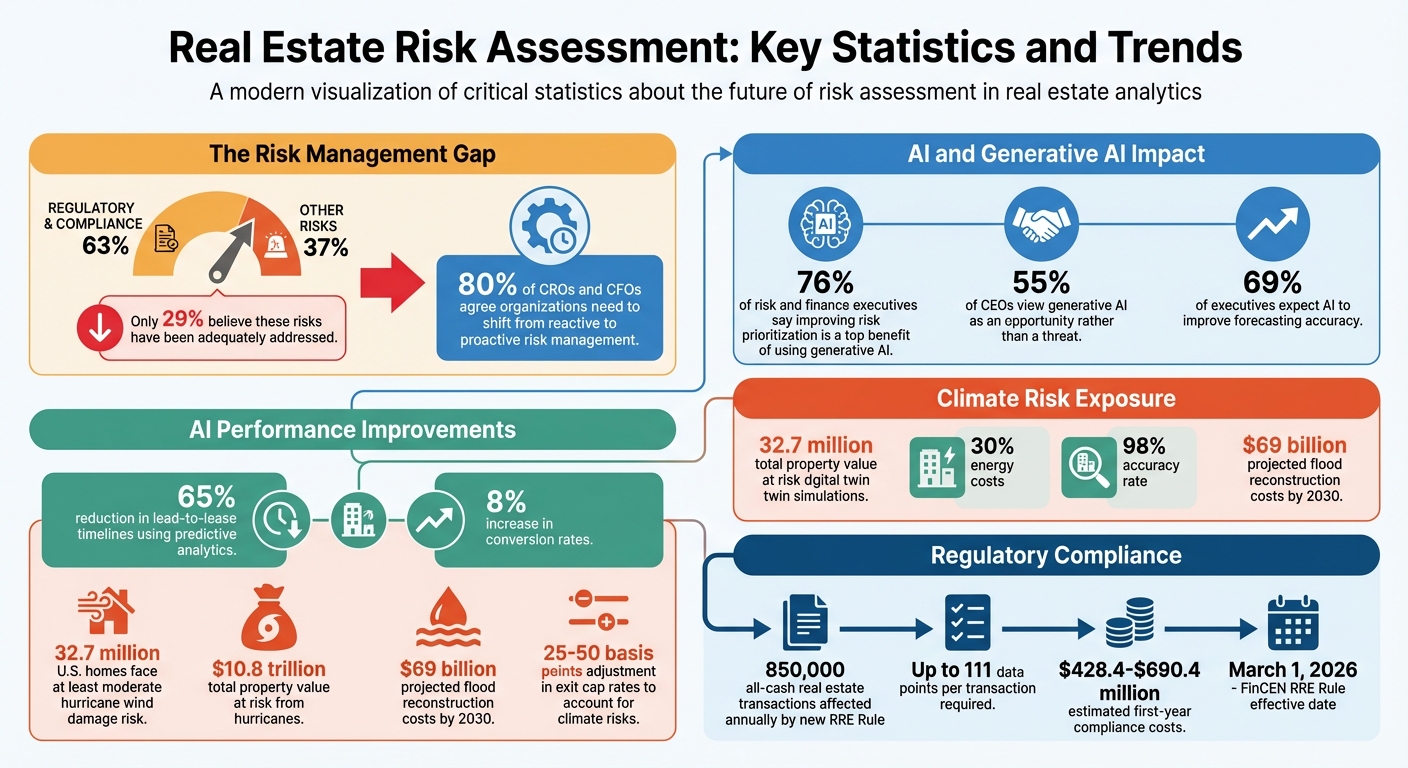

Real Estate Risk Management Statistics: AI Adoption and Climate Impact

Moving to Dynamic, Data-Driven Risk Frameworks

Why Traditional Risk Assessment Falls Short

Static, outdated checklists just don’t cut it anymore when it comes to managing risks in modern real estate. Traditional methods tend to compartmentalize risk analysis, isolating departments and missing the bigger picture. For example, a permitting delay might disrupt construction timelines, inflate financing costs, and throw contractor schedules into chaos - all at once. But siloed systems often fail to connect these dots, leaving critical interdependencies unnoticed [3].

The numbers tell the story. While 63% of Chief Risk Officers (CROs) and Chief Financial Officers (CFOs) are focused on regulatory and compliance risks, only 29% believe these risks have been adequately addressed [1]. Why the gap? Conventional methods rely on linear models that don’t account for the complex web of interactions needed for forward-thinking decisions [2]. And when market conditions shift quickly, yesterday's risk assessment becomes irrelevant.

This is where real-time risk monitoring steps in, shifting the focus from reacting to problems to anticipating them.

Real-Time Risk Monitoring

Dynamic risk frameworks take a proactive approach, replacing reactive guesswork with data-driven planning. Real-time monitoring can spot subtle patterns that hint at emerging risks and allow for preemptive "what-if" simulations [1]. The impact is undeniable: 76% of risk and finance executives say that improving risk prioritization is a top benefit of using generative AI in risk management [1].

But the benefits go beyond early warnings. Real-time monitoring offers hyper-local insights. In real estate, this means analyzing parcel-level data to predict potential financial losses for nearly all U.S. properties. This is crucial when 32.7 million homes in the U.S. face at least moderate risk of hurricane wind damage - a total property value of $10.8 trillion [5].

Speed is another game-changer. With flood risks projected to result in $69 billion in reconstruction costs by 2030 [5], faster responses can directly protect capital and reduce losses.

These real-time insights set the stage for integrated solutions like CoreCast, which turns data into actionable strategies.

CoreCast for Integrated Risk Management

CoreCast bridges the gaps left by traditional methods and meets the demand for real-time monitoring with a centralized approach. Instead of scattering risk data across spreadsheets and email threads, CoreCast consolidates everything into a single, structured database - your one source of truth. By directly linking underwriting models to real-time asset performance, it eliminates the manual processes that often lead to blind spots in risk visibility [6].

Think about it: When managing deals at various stages, tracking competitors with integrated maps, and analyzing portfolios, having all your tools in one place isn’t just convenient - it’s critical. CoreCast’s end-to-end system lets you underwrite any asset class, monitor your pipeline, evaluate your portfolio, and generate branded reports for stakeholders, all without jumping between disconnected platforms.

This approach is especially important as 80% of CROs and CFOs agree that organizations need to shift from defensive, reactive risk management to a forward-looking, proactive strategy [1]. CoreCast makes that shift possible, transforming advanced risk assessment theories into practical, everyday tools for decision-making.

AI, Predictive Analytics, and Digital Twins in Risk Assessment

AI and Predictive Analytics for Risk Forecasting

Machine learning is reshaping risk assessment by uncovering complex patterns that traditional linear models often miss. A notable example is the Real Estate Construction Investment Risk (RECIR) model, developed in October 2025 by researchers from the University of Córdoba and the University of Seville. This model uses machine learning to combine seven weighted indices into a single Total Risk Score (TRS). The model’s reliability was confirmed through structured consultations with 11 senior real estate investors and 125 practitioners. Among the indices, Location Score (22.5% weight) and Legal and Regulatory Factors (25.2% weight) emerged as the most influential contributors to investment risk [2].

Predictive analytics have also revolutionized real estate processes, cutting lead-to-lease timelines by 65% and increasing conversion rates by 8% [8]. These systems integrate macroeconomic trends into unit-specific risk assessments, bridging the gap between broad economic indicators and individual underwriting decisions [2].

"GenAI actually shows as much if not more potential as a force-multiplier in managing risks than as a source of them." – Alex Laurie, Principal, Risk Modeling Services, PwC US [3]

The industry is increasingly adopting autonomous AI systems to automate workflows like deal sourcing, underwriting, and procurement [8]. At the same time, modern risk models are prioritizing explainable AI (XAI) to meet regulations such as GDPR and the EU AI Act. Techniques like permutation importance ensure that AI-driven decisions are transparent and auditable [2].

These advancements in AI are paving the way for digital twin technology, which is taking risk assessment in construction to the next level.

Digital Twins for Construction Risk Assessment

Digital twins are transforming how construction risks are managed by creating virtual replicas of buildings, allowing real-time monitoring of structural integrity. Using computer vision and deep learning, these models can detect risks that might otherwise go unnoticed, such as structural fatigue, micro-cracks in foundations, and moisture damage [7]. When paired with IoT sensors, digital twins shift risk monitoring from static snapshots to dynamic, continuous updates, tracking everything from building conditions to energy efficiency and infrastructure stress [7].

The financial benefits are hard to ignore. Physics-based simulations enabled by digital twins can cut energy costs by up to 30% and extend the lifespan of hardware by over a year [8]. Additionally, 3D reconstruction and AI-driven digitization of property portfolios can shorten renovation timelines by six months and reduce project costs by 8% [8]. Remote property assessments using AI-powered 3D technologies now achieve an impressive 98% accuracy rate [8].

Digital twins also play a crucial role in safety and compliance. By analyzing drone footage and satellite images, computer vision can identify code violations, facade erosion, and other safety risks on construction sites [7]. This capability is vital, especially when 32.7 million U.S. homes face moderate or higher hurricane risk - representing $10.8 trillion in exposed value - and when flood-related reconstruction costs are expected to hit $69 billion by 2030 [5].

"The question isn't whether buildings will drive themselves, but how quickly the industry will learn how to steer them." – Greg Lindsay, Author/Consultant, PwC [8]

To fully leverage these tools, a unified data foundation is critical.

CoreCast as a Data Foundation for AI-Driven Risk Analysis

For AI and digital twins to deliver precise insights, they need clean, centralized data, which is where CoreCast’s platform becomes indispensable. CoreCast consolidates historical data, performance metrics, and market intelligence into a single, unified system, providing a solid foundation for training AI models and reducing errors in generative AI outputs [3].

By integrating data through APIs across operations, finance, and asset management, CoreCast shifts the focus from tedious data collection to meaningful analysis [3][8]. This centralized approach supports multi-dimensional risk scoring frameworks like RECIR, enabling more accurate underwriting, pipeline tracking, and portfolio analysis [2].

CoreCast’s real-time streaming analytics offer predictive capabilities that traditional batch processing simply can’t match. These include identifying maintenance issues before they escalate, adjusting marketing strategies based on current vacancy rates, and generating synthetic data to simulate extreme "100-year" risk scenarios [1][8]. With this approach, CoreCast turns advanced AI theories into practical tools for daily risk management across real estate portfolios.

Adding Supply Chain and Climate Resilience to Risk Frameworks

Supply Chain Risk Management in Real Estate

Risk assessment in real estate is no longer confined to property-level metrics. Today, it must also account for global supply chain vulnerabilities, which can significantly impact construction timelines and costs. Often, the exposure to international disruptions in supplier networks is greater than traditional indicators suggest [10]. Even when sourcing appears domestic, ties to global supply chains can introduce hidden risks related to geopolitics and trade [10].

"Exposure [to foreign shocks] is higher than direct indicators imply." – Richard Baldwin & Rebecca Freeman [10]

As deglobalization trends and evolving trade policies reshape the investment landscape, mapping supplier networks has become a necessity. Looking ahead to 2026, the Fifth National Climate Assessment (NCA5) emphasizes "Risks to Supply Chains" (Focus Area F4), highlighting how climate-driven events like unusual floods or hurricanes can disrupt construction and operational supply chains [9]. Real estate firms must dig deeper into their vendor relationships to uncover vulnerabilities to international disruptions [10]. With supply chain dynamics increasingly intertwined with financial risks, climate uncertainties have become a critical piece of modern risk management.

Climate Resilience in Risk Models

Climate risks are now directly shaping property valuations. Many leading firms are adjusting their exit cap rates by 25–50 basis points to account for physical climate risks [4]. This reflects the growing awareness that properties in high-risk areas - prone to flooding, wildfires, or hurricanes - face long-term value depreciation.

The industry is shifting from relying on broad risk scores to focusing on specific hazard data. While aggregate physical risk scores are useful for initial portfolio screening, underwriting decisions require more detailed insights, such as flood risks in desert regions or coastal storm surge patterns [4]. To address these challenges, firms are now integrating individual hazard data and resilience CapEx forecasts into their underwriting processes, targeting risks like flooding, wildfires, and hurricanes [4]. For climate risk benchmarks, 2030 and 2050 have become key time horizons [4].

New Frameworks for Integrated Risk Management

Traditional underwriting often overlooked the long-term implications of environmental and supply chain risks. Today’s frameworks are taking a top-down approach, integrating climate and supply chain challenges into acquisition, underwriting, and disposition practices from the outset [4]. This shift represents a new way of evaluating risk concentration, where climate and supply chain risks are analyzed with the same level of detail as financial risks [4].

| Traditional Framework | Integrated Framework |

|---|---|

| Aggregate risk scores for screening | Individual hazard data for underwriting |

| Climate risk as secondary factor | Climate-adjusted exit cap rates (25-50 bps) |

| Limited supply chain visibility | Detailed supplier network mapping |

| Static environmental assessments | Resilience CapEx in long-term forecasts |

Investment managers are now focusing on fund-level risks, while capital providers are broadening their view to include portfolio-wide risk concentrations [4]. These integrated frameworks allow firms to assess how climate events and supply chain disruptions intersect. For instance, a hurricane in a manufacturing region could not only delay the delivery of construction materials but also damage existing properties in a portfolio. By combining operational, environmental, and supply chain insights, this unified approach creates a more comprehensive risk strategy. As the industry moves toward 2026 and beyond, such multi-dimensional assessments will be essential for navigating an increasingly complex risk landscape.

sbb-itb-99d029f

Standardization and Regulation in Risk Assessment

ESG and Climate Risk Disclosure Requirements

The rules around risk assessment in real estate are moving from optional guidelines to strict compliance mandates. Federal agencies are now requiring standardized quality control measures across the industry, reshaping how risks are evaluated and reported. This shift is a major step toward creating consistent practices across the board.

In July 2024, agencies like the FDIC and the Federal Reserve introduced a Final Rule requiring mortgage originators to implement mandatory quality controls for Automated Valuation Models (AVMs). These controls focus on five key aspects: producing reliable estimates, safeguarding against data manipulation, avoiding conflicts of interest, conducting random sample testing, and complying with nondiscrimination laws [11][12]. The rule will take effect one year after its publication in the Federal Register, signaling a move from voluntary guidelines to enforceable standards [12].

A notable addition to these regulations is the emphasis on nondiscrimination, which integrates social risk metrics into automated analytics. This requires institutions to adopt systems that align with fair housing laws [12]. As the FDIC explained:

"AVMs have the potential to reduce human bias. Yet without adequate attention to ensuring compliance with Federal nondiscrimination laws, AVMs also have the potential to introduce associated discrimination risks" [12].

Beyond valuation models, transparency requirements are extending to transaction-level reporting. Starting March 1, 2026, FinCEN's Residential Real Estate (RRE) Rule will standardize beneficial ownership reporting for all-cash transactions involving legal entities or trusts [13]. This framework applies to approximately 850,000 transactions each year, with up to 111 data points per transaction, and is expected to cost $428.4–$690.4 million in compliance during the first year [13]. Title companies, settlement agents, and attorneys will play a critical role in federal risk monitoring, acting as key regulatory gatekeepers [13]. These measures underscore the shift toward integrated, data-driven risk management that is becoming central to modern real estate analytics.

Standardized Risk Frameworks

In addition to disclosure requirements, the industry is working to create consistent standards for risk assessments. The demand for standardization now extends to setting industry-wide benchmarks, particularly for AVMs. There is increasing support for Standard Setting Organizations (SSOs) focused on AVMs to ensure the quality and comparability of risk evaluations [12]. This reflects a growing understanding that automated tools need to meet "credibility and integrity" standards similar to those applied to human appraisals [12].

Organizations are encouraged to align their AVM policies with Model Risk Management guidance to meet the new five-factor quality control requirements [12]. Under the RRE Rule, firms should use written agreements to clarify reporting responsibilities [13]. Additionally, they should establish systems for collecting written certifications from buyers concerning beneficial ownership, as regulators allow reliance on such certifications unless red flags arise [13].

These evolving standards, combined with real-time monitoring and AI-driven tools, are elevating the way risks are managed to address today's complex challenges. While these standards are mandatory, regulators are allowing firms to adapt their policies based on transaction size and complexity [12]. This flexibility ensures that businesses can design risk frameworks that align with their scale while adhering to regulatory expectations. As climate risk assessments become mandatory alongside financial reporting, the integration of environmental, social, and governance metrics into these frameworks will shape the future of real estate risk management [14].

Top 3 AI Risks in Commercial Real Estate (And How to Avoid Them)

Conclusion

The landscape of risk assessment in real estate is evolving from traditional, reactive methods to forward-thinking, integrated approaches powered by AI, real-time data, and sophisticated modeling techniques. In fact, 80% of Chief Risk Officers and CFOs recognize the importance of shifting from defensive strategies to more predictive, proactive risk management [1]. The industry is increasingly turning to tools that can merge diverse data sources - ranging from macroeconomic trends to individual property details - into comprehensive risk scores. This transformation is setting the stage for advanced technologies to take forecasting to the next level.

With 55% of CEOs viewing generative AI as an opportunity rather than a threat [1] and 69% of executives expecting AI to improve forecasting accuracy [1], the focus is on transparent and auditable systems. These systems aim to provide clear decision-making support, avoiding the pitfalls of opaque, "black-box" predictions. The ability to regularly simulate "what-if" scenarios and update risk assessments with fresh data marks a significant departure from outdated, static annual reviews.

At the heart of this shift lies data centralization. By integrating underwriting, pipeline tracking, portfolio analysis, and stakeholder reporting into a unified platform, tools like CoreCast enable seamless data synthesis. This centralized approach supports the detailed and broad data analysis required by modern risk frameworks, ensuring more cohesive and actionable insights.

Regulatory pressures are also driving change, pushing firms toward transparent, audit-ready systems. As ESG metrics, climate resilience, and supply chain factors become essential components of compliance, robust centralized platforms are no longer optional - they are indispensable.

Looking ahead, real estate professionals who embrace an AI-first strategy while maintaining human oversight will be best equipped to navigate this evolving environment. Success lies in blending cutting-edge technology with human expertise. AI can handle data integration and pattern recognition, but it’s up to professionals to bring judgment, strategic thinking, and relationship-building to the table. As the IBM Institute for Business Value aptly puts it:

"Risk is the currency of innovation - but uncontrolled risks pose an existential threat to the enterprise" [1].

FAQs

How is AI transforming risk assessment in real estate analytics?

AI is transforming how real estate professionals approach risk assessment, turning layers of complicated data into clear, actionable insights. With advanced AI models, it's now possible to evaluate multiple factors - such as market trends, credit risks, supply chain disruptions, and regulatory shifts - simultaneously. The result? A concise risk score that simplifies decision-making. These tools also deliver real-time forecasts, predicting everything from cash flow and property values to potential risks under varying economic scenarios. This shift allows firms to replace outdated spreadsheets with dynamic, automated dashboards that keep pace with the market.

Take platforms like CoreCast, for example. They harness AI-driven automation to simplify underwriting, track market trends, and flag potential risks as they arise. With real-time updates, users can monitor performance, tweak strategies, and produce polished reports - all from one integrated system. As AI continues to advance, these risk assessment tools will become even more proactive, offering earlier warnings and sharper insights to help protect investments from both broad economic swings and localized challenges.

What are digital twins, and how do they improve construction risk management?

Digital twins are incredibly detailed virtual representations of physical assets, processes, or locations that stay in sync with real-world data. They mirror every aspect of a building - its design, materials, schedule, and operations - allowing teams to test scenarios, identify risks, and track performance without interfering with the actual construction process.

When it comes to managing risks in construction, digital twins bring some serious advantages. By combining sensor data, AI-driven analytics, and building information models (BIM), they can spot safety or structural issues early on. They’re also great for forecasting, as they simulate how challenges like material shortages or weather disruptions might play out, helping teams plan better for the unexpected. Integrated with tools like CoreCast, digital twins offer a centralized hub for monitoring risks, coordinating mitigation strategies, and creating professional reports. This makes them a powerful resource for developers and investors aiming to reduce uncertainties in their projects.

Why is real-time monitoring essential for modern risk assessment in real estate?

Real-time monitoring has become a cornerstone for modern risk assessment, especially in industries like real estate and supply chain management, where risks can change in the blink of an eye. Market fluctuations, climate events, and regulatory updates can surface unexpectedly, rendering outdated data practically useless. By tapping into live data, businesses can keep their risk models sharp and aligned with current realities.

The advantage? Professionals can move from simply reacting to risks after they occur to anticipating them before they escalate. This shift allows for quicker identification of potential threats, smarter adjustments to underwriting assumptions, and more effective portfolio management. Tools like CoreCast make this possible by pulling together real-time data from various asset classes, tracking dynamic risks, and producing actionable reports. The result? Decisions grounded in the most up-to-date information available.