Biotech Real Estate Needs: Economic and Demographic Factors

Biotech real estate is in flux, shaped by funding trends, construction costs, and workforce dynamics. Here's what you need to know:

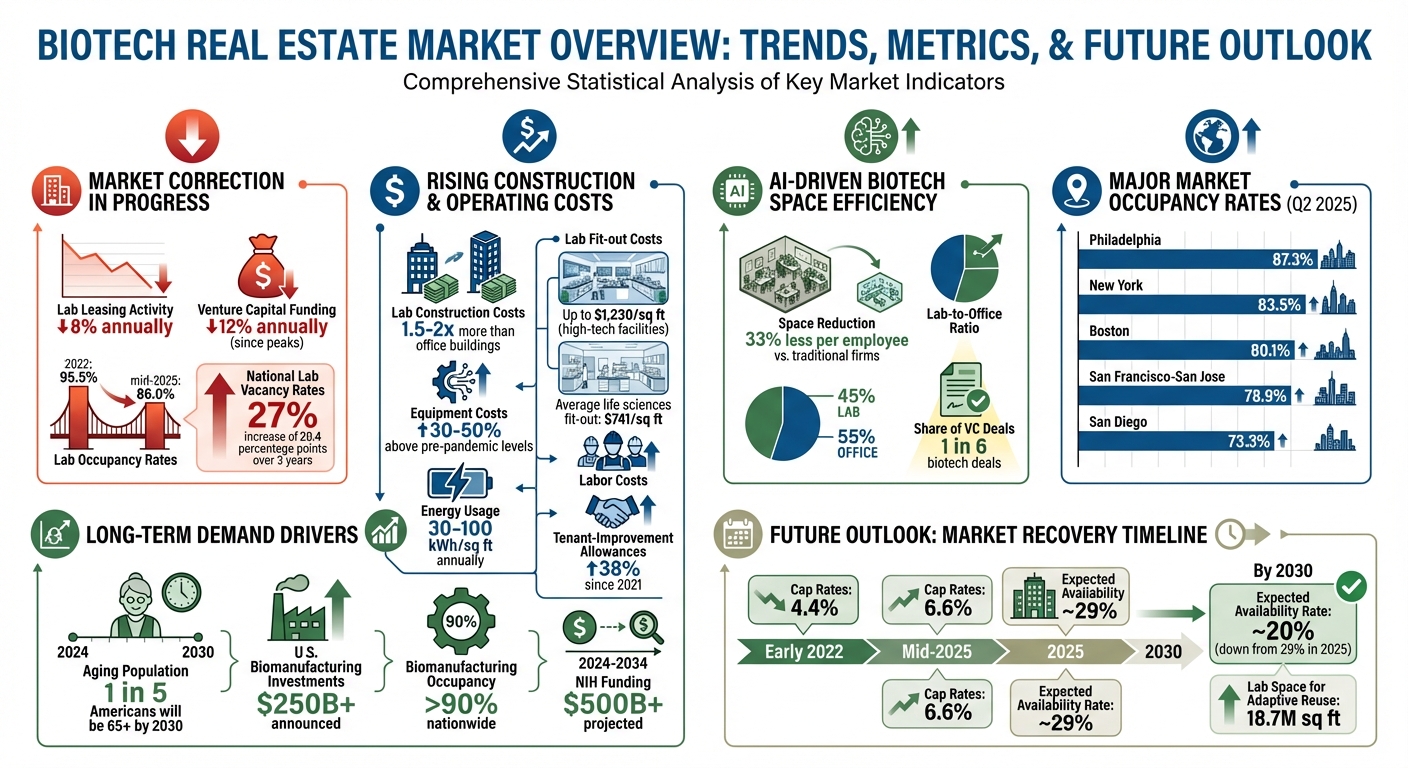

- Lab space demand is falling: Lab leasing activity has dropped 8% annually, while venture capital funding declined 12% yearly since their peaks. Nationwide lab occupancy rates fell from 95.5% in 2022 to 86.0% by mid-2025.

- Costs are rising: Lab construction costs are 1.5–2x more than office buildings, with fit-outs costing up to $1,230 per square foot. Energy and labor costs are also climbing.

- AI is reshaping space needs: AI-driven biotech firms lease 33% less space per employee, favoring office-heavy setups (45% lab, 55% office).

- Key markets are adjusting: Established hubs like Boston and San Francisco face higher vacancy rates, while emerging markets like Philadelphia maintain stronger occupancy.

- Aging population fuels demand: By 2030, 1 in 5 Americans will be 65+, driving healthcare and biotech infrastructure needs.

What’s next? With oversupply and rising costs, biotech real estate is undergoing a correction. However, reshoring initiatives and AI-focused operations offer new opportunities. For landlords and developers, leveraging data-driven tools is critical to navigating this evolving market.

Biotech Real Estate Market Trends: Key Statistics and Metrics 2022-2025

Life Science REITs Are Crashing - Here’s Why It Might Be a 50% Return Opportunity

How Economic Factors Drive Biotech Real Estate Demand

The interplay of venture capital availability, construction and operating costs, and regional economic incentives heavily influences where biotech companies choose to set up shop and how much space they require. These factors shape the broader landscape of real estate decisions in the biotech sector, from funding trends to regional policies and construction challenges.

How Venture Capital and Investor Funding Affects Facility Development

Venture capital (VC) funding and lab space demand are closely tied. For example, when VC funding dropped by 12% annually, lab leasing activity followed with an average yearly decline of 8% [1]. However, funding bounced back in Q3 2024, climbing 10% above its 2019 pre-pandemic levels. This recovery spurred a 41% year-over-year increase in lab and R&D leasing activity [6].

"Venture financing and secondary offerings created greater financial flexibility for select companies... The year ahead likely will see further growth in investment and headcount" [6].

The funding environment also shapes trends within biotech. For instance, AI-driven biotech startups now represent one-sixth of all biotech VC deals. These companies typically lease about one-third less space per employee compared to traditional firms, favoring a lab-to-office ratio of 45% lab and 55% office [1]. Meanwhile, institutional investors play a pivotal role, funding 80% of active lab construction projects in key markets like Boston, San Francisco, and San Diego as of Q4 2023 [5]. However, these investors have adopted a more cautious approach, often relying on joint ventures - accounting for 30% of sales in 2022–2023 - to mitigate the high risks and costs of developing specialized facilities [7].

Construction Costs and Operating Expenses

The rising costs of construction are forcing developers to explore more economical building solutions. As of late 2025, the average cost for life sciences fit-outs in the U.S. stands at $741 per square foot, while high-tech facilities like gene therapy labs can exceed $1,230 per square foot [10,14].

One cost-saving trend involves repurposing older industrial buildings - often referred to as structures with "industrial bones." These buildings, such as former newspaper facilities, already feature the necessary floor load capacity and ceiling heights for heavy lab equipment, making them more cost-efficient to convert than standard office buildings [8].

Operating expenses are also climbing. Energy usage in life sciences facilities ranges from 30 to 100 kWh per square foot annually, while equipment costs have surged 30% to 50% above pre-pandemic levels. Labor costs have also risen by 4% to 5% [10,12,14]. These factors push companies toward locations with robust utility infrastructures. To stay competitive in an oversupplied market, landlords have increased tenant-improvement allowances by an average of 38% since 2021 [9]. For early-stage startups, leasing remains the preferred option, even when it requires credit enhancements like letters of credit, as it allows them to conserve cash for R&D [8].

Regional Economic Incentives for Biotech Clusters

Regional incentives play a critical role in shaping the biotech real estate landscape. Federal funding, particularly through the National Institutes of Health (NIH), underpins many biotech clusters. Between 2024 and 2034, NIH outlays are projected to exceed $500 billion [7], with much of this funding directed to universities and hospitals, which often serve as incubators for new biotech startups [4].

Recent policy efforts to reshore pharmaceutical manufacturing have spurred significant investment. Over $250 billion in U.S. biomanufacturing projects have been announced, driven by federal initiatives to strengthen domestic supply chains [2]. This shift has fueled demand for biotech spaces with manufacturing capabilities, which maintain occupancy rates above 90% nationwide [4].

Environmental considerations also influence real estate trends. From 2020 to 2023, LEED-certified R&D buildings in key markets sold for nearly double the price per square foot of non-LEED buildings, while their cap rates traded 110 basis points lower [5]. Additionally, the clustering of research institutions continues to drive demand in core markets. Despite the rise of secondary markets, 80% of institutional investor–funded lab construction remains concentrated in hubs like Boston, San Francisco, and San Diego, where thriving ecosystems attract biotech firms [5].

How Demographic Trends Shape Biotech Real Estate Needs

The location and size of biotech facilities are heavily influenced by workforce availability and population trends. These factors guide decisions on where to establish facilities and how to design them, creating distinct patterns across regions and subsectors within the industry.

Talent Pool Availability and Location

The availability of skilled professionals is a key factor in determining where biotech companies set up shop. Between 2011 and 2022, the U.S. saw a 54% increase in biological and biomedical sciences degrees, with 173,825 degrees awarded annually [10]. Despite this growth, unemployment in life sciences remains exceptionally low, making it crucial for companies to position themselves near universities and research institutions to ensure a steady talent pipeline [10].

"With historically low unemployment in the U.S. and stalling working-age population growth, unemployment in life, physical and social sciences occupations is particularly low." [10]

Leading biotech hubs such as Boston-Cambridge, the San Francisco Bay Area, and San Diego dominate due to their dense talent pools. In these areas, 78% of life sciences properties are owned by REITs or private investors, highlighting the fierce competition for space [4]. However, the specific workforce needs vary by subsector. For example, R&D operations are typically located near academic centers, while manufacturing facilities often thrive in regions like Houston, Philadelphia, and Albany, NY, where the labor force aligns with production needs [10].

The rise of AI-focused biotech companies is also reshaping space requirements. These firms often need less lab space and more office setups, particularly in markets where AI and biotech expertise intersect [1][11]. These shifts in workforce and technology trends are closely tied to broader urban migration patterns that influence real estate decisions.

Urbanization and Migration Patterns

Urban migration plays a significant role in shaping biotech real estate demand. Established urban hubs remain the most sought-after locations for biotech facilities. As of Q2 2025, Boston reported an 80.1% occupancy rate across 67.7 million square feet of space, while San Francisco-San Jose held a 78.9% occupancy rate with 51.1 million square feet [4]. These core markets have shown greater resilience compared to "urban edge" areas, even as secondary cities expand their biotech presence.

Here’s a snapshot of key biotech clusters and their real estate metrics:

| Cluster Market | 2Q25 Square Feet | 2Q25 Occupancy (%) | 3-Year Inventory Growth |

|---|---|---|---|

| Boston | 67.7M | 80.1% | 29% |

| San Francisco-San Jose | 51.1M | 78.9% | 15% |

| San Diego | 30.8M | 73.3% | 25% |

| Philadelphia | 20.0M | 87.3% | 21% |

| New York | 30.3M | 83.5% | 6% |

The trend of reshoring is also shifting demand toward regions with strong manufacturing capabilities. Over $250 billion in U.S. biomanufacturing investments have been announced, driving interest in properties that integrate research and production [2]. Manufacturing-focused facilities are in high demand, boasting occupancy rates above 90% nationwide, far outpacing pure R&D spaces [4]. This has created opportunities in markets like Philadelphia, which expanded its biotech inventory by 21% between 2022 and 2025 while maintaining an 87.3% occupancy rate [4].

Aging Population and Healthcare Demand

The aging population in the U.S. is a major driver of long-term demand for biotech facilities. By 2030, one in five Americans will be of retirement age, and by 2060, nearly one in four will fall into this category. This demographic shift is fueling a sustained need for medical research and advanced biotech infrastructure [13].

In Q1 2025, venture capital investment in life sciences reached $12.3 billion - a 23% increase from the previous year - partly due to the growing demand for solutions to aging-related health challenges [12]. Welltower Inc., a leading healthcare REIT, reported a 9.1% year-over-year increase in net operating income for its senior housing portfolio in Q4 2023, further underscoring the strength of age-focused real estate sectors [13].

Chronic conditions associated with aging require specialized labs and manufacturing facilities that go beyond the capabilities of standard office spaces [12]. This has made biotech real estate a stable and recession-resistant investment sector, as healthcare needs remain steady regardless of broader economic conditions [12][14]. These demographic trends highlight the evolving demands and long-term stability of the biotech real estate market.

sbb-itb-99d029f

Major Biotech Hubs and Their Real Estate Challenges

The U.S. biotech industry is heavily concentrated in three key areas: Boston-Cambridge, the San Francisco Bay Area, and San Diego. These regions have risen to prominence thanks to their deep pools of specialized talent, close ties to top-tier research universities, and robust venture capital investments [1][3]. However, these well-established markets are now grappling with mounting real estate pressures, prompting shifts in the industry's geographic focus. This evolving landscape highlights the contrasts between established biotech hubs and emerging clusters.

Emerging vs. Established Biotech Clusters

As economic conditions shift, established biotech hubs are undergoing significant market adjustments, while emerging clusters demonstrate greater resilience. By Q2 2025, occupancy rates in Boston, San Francisco, and San Diego dropped dramatically from their mid-90% levels in 2022 to 80.1%, 78.9%, and 73.3%, respectively [4]. This decline has created a tenant's market, with national lab vacancy rates climbing to 27% - a sharp increase of 20.4 percentage points over three years [1].

"We're witnessing a historic market correction that, while painful in the short term, is setting the stage for a more sustainable and innovative future." - Travis McCready, Head of Industries, Leasing Advisory, JLL [3]

Emerging markets, on the other hand, are holding steady. For instance, Philadelphia achieved an 87.3% occupancy rate despite a 21% growth in inventory between 2022 and 2025. Its occupancy decline of just 470 basis points starkly contrasts with San Diego's 1,950 basis point drop [4]. Other rising clusters, such as Raleigh-Durham (83.4% occupancy) and Los Angeles (94.5% occupancy), also show stronger stability, especially in areas with a higher percentage of user-owned or biomanufacturing facilities [4].

This divergence stems from differing ownership structures. In the major hubs, 78% of life sciences properties are owned by REITs or private investors, leaving these markets more exposed to speculative oversupply [4]. Meanwhile, emerging markets often rely on university-owned or user-owned facilities, which offer more stability during economic downturns.

Competition for Lab and Office Space

The competition for specialized real estate adds another layer to the story. Even with an overall oversupply, certain types of lab space are still in high demand. Facilities focused on biomanufacturing maintain nationwide occupancy rates above 90%, far outstripping traditional R&D spaces [4]. This trend is driven by over $250 billion in announced investments aimed at reshoring pharmaceutical manufacturing in the U.S. [2].

AI-native biotech companies are also reshaping space requirements. These firms prioritize office-heavy configurations that accommodate computational needs, automation, and flexible lab setups, particularly in markets where biotech and AI expertise overlap.

"AI-native companies are pioneering new models of space utilization that emphasize computational power, automation and flexible laboratory configurations." - Mark Bruso, Director, Boston and National Life Sciences Research, JLL [3]

For landlords in established hubs, high barriers to entry offer some protection. Building lab facilities costs 1.5 to 2 times more than traditional office spaces, and outfitting labs is typically twice as expensive as office fit-outs [5]. By 2030, around 18.7 million square feet of lab space is expected to transition to alternative uses through distress sales or adaptive reuse [1][3]. Meanwhile, cap rates for life sciences properties have risen from 4.4% in early 2022 to 6.6% by mid-2025, creating opportunities for investors who can navigate the complexities of biotech real estate [4].

These dynamics highlight the importance of developing real estate strategies that balance market corrections with the evolving needs of biotech users.

Using Technology for Biotech Real Estate Planning

Real estate intelligence platforms are becoming essential tools for biotech facility planning, especially as lab vacancy rates soar to 27% [3][1]. These platforms bring together market data, competitive analysis, and portfolio tracking, offering professionals a clearer view of the shifting dynamics in biotech real estate. By providing real-time insights, they help bridge economic challenges with changing demographic trends, enabling well-informed and strategic decisions.

Improving Decision-Making with Real Estate Intelligence

One of the key advantages of intelligence platforms is their ability to track the relationship between venture capital (VC) trends and lab leasing activity. For example, lab leases have historically declined by 8% for every 12% drop in venture funding [11]. With biotech's share of VC dollars shrinking - from 15% to roughly 7% in recent quarters [3][1] - understanding these patterns allows professionals to time their market moves and negotiate better lease terms.

Platforms like CoreCast offer a comprehensive suite of tools tailored for biotech real estate. Users can evaluate specialized lab facilities, monitor deal pipelines, visualize competitive clusters using integrated maps, and generate branded reports for stakeholders - all within a single system. These features are particularly useful for assessing regional strengths, such as AI integration, biomanufacturing capabilities, and workforce density [1][15].

Another crucial function of these platforms is monitoring supply dynamics. This helps distinguish between projects that meet actual demand and those contributing to speculative oversupply. For instance, JLL estimates that 18.7 million square feet of available lab space will be repurposed for alternative uses by 2030 [3][1]. Keeping tabs on such trends is vital for identifying properties with potential for adaptive reuse.

Forecasting Future Demand for Biotech Real Estate

Predictive analytics, powered by real-time insights, are helping forecast the shifting demands of the biotech industry. AI-focused biotech companies, which now account for one-sixth of all biotech VC deals, typically require 33% less space per employee and maintain a 45:55 lab-to-office space ratio [11][3]. Intelligence platforms that model these changing needs enable landlords and developers to create flexible spaces that cater to both traditional and AI-driven tenants.

Another critical factor in demand forecasting is the trend of pharmaceutical reshoring. With over $475 billion committed to U.S. manufacturing and R&D investments [3], platforms can identify regions poised for growth, such as New Jersey, a key hub for biomanufacturing. Lab availability rates are expected to drop from 29% in 2025 to around 20% by 2030 [3], making accurate supply and demand modeling more important than ever.

Managing Portfolio Performance Across Asset Classes

Portfolio analysis tools are invaluable for optimizing returns across diverse biotech real estate holdings. Managing life sciences properties involves tracking complex factors like joint venture structures - responsible for 30% of life sciences sales in 2022–2023 - and ESG certifications [7][5].

CoreCast’s portfolio analysis features allow professionals to assess performance across multiple properties, monitor key metrics, and identify opportunities for improvement. The platform’s stakeholder center and branded reporting tools are particularly helpful for engaging with institutional investors, who increasingly value ESG metrics. For instance, LEED-certified R&D buildings have historically sold for nearly double the price per square foot of non-certified properties and trade at cap rates 110 basis points lower [5]. This makes sustainability tracking a critical component of maximizing asset value.

CoreCast also integrates with third-party data sources, enhancing its market analysis capabilities while maintaining its core functions of underwriting and tracking. This integrated approach helps professionals evaluate investments in both established hubs and emerging clusters - like Philadelphia, which boasts an occupancy rate of 87.3% - and make informed decisions in a rapidly changing market.

Conclusion

The biotech real estate market is evolving, shaped by economic trends and demographic shifts. Demand for lab space remains closely tied to venture capital activity, while the aging U.S. population - expected to surpass 73 million people aged 65 and older by 2030 - continues to drive healthcare needs [16]. At the same time, AI-focused biotech companies are changing the game, leasing roughly 33% less space per employee compared to traditional firms [1].

However, the market is currently grappling with oversupply and rising vacancy rates. As Travis McCready, Head of Industries, Leasing Advisory at JLL, puts it:

"We're witnessing a historic market correction that, while painful in the short term, is setting the stage for a more sustainable and innovative future" [3].

For tenants, these conditions create opportunities to secure flexible leases at competitive rates. But navigating this environment requires sophisticated, data-driven tools. Technology is becoming a key ally, allowing companies to make informed decisions in a complex market.

Real estate intelligence platforms are playing a critical role in this transformation. With a significant amount of lab space expected to shift toward adaptive reuse by 2030 [1], these tools are essential for identifying viable properties and avoiding distressed assets. Platforms like CoreCast offer integrated solutions, combining underwriting, pipeline tracking, mapping, and portfolio analysis to deliver actionable, real-time insights.

Looking ahead, achieving success in biotech real estate will require a careful balance of short-term opportunities and long-term trends. Investments in reshoring pharmaceutical production are expected to fuel future demand, while AI-driven operations are redefining the need for flexible lab-to-office spaces [3]. Data-powered planning tools will help professionals anticipate demand patterns and strategically position their portfolios for a gradual recovery.

Ultimately, the interplay of economic forces and demographic trends is reshaping the biotech real estate landscape. Professionals who embrace intelligence platforms to analyze regional strengths, manage supply challenges, and adapt to shifting space needs will be well-equipped to seize the opportunities that lie ahead in this dynamic sector.

FAQs

How are AI-driven biotech companies changing their real estate needs?

AI-powered biotech companies are reshaping the real estate market by increasing the demand for cutting-edge lab spaces. With artificial intelligence (AI) and machine learning (ML) driving advancements in research and development, biotech firms are focusing on securing high-tech facilities in key innovation hubs like Boston, San Francisco, and San Diego. These spaces need to accommodate AI-driven research and biomanufacturing, creating a growing need for modern, adaptable environments.

AI’s ability to streamline operations is also changing how biotech companies use space. Instead of relying on large, traditional labs, many are opting for smaller, integrated, or shared facilities that are more efficient. This trend has led to the repurposing of underused lab spaces, offering cost-effective and flexible solutions that meet the demands of the fast-evolving biotech sector. The influence of AI is driving a shift in real estate priorities, emphasizing flexibility, operational efficiency, and strategic locations.

What is driving the increase in construction and operating costs for biotech real estate?

The increasing costs in biotech real estate largely stem from the rising need for specialized facilities and progress in technology. As the biotech and life sciences industries grow, businesses demand high-tech infrastructure like advanced HVAC systems and cleanrooms. These features, while essential, add significantly to both construction and operational budgets.

On top of that, demographic shifts, including an aging population and a spike in biotech investment, are pushing the need for innovative research spaces. When paired with the intricate nature of today’s biotech projects, these factors are collectively driving costs higher throughout the sector.

How does an aging population impact the real estate needs of biotech companies?

The aging population in the United States is reshaping the real estate demands of biotech and life sciences companies. By 2040, about 1 in 5 Americans will be over the age of 65, driving a surge in demand for healthcare services, research, and innovation. To address this, there’s a growing need for specialized real estate, including medical office buildings, senior housing, and flexible healthcare facilities.

With healthcare spending projected to hit $7.7 trillion by 2032, the demand for state-of-the-art biotech infrastructure is only set to increase. This includes spaces dedicated to life sciences research, medical advancements, and senior care - critical components for adapting to the needs of an aging population. These types of properties are expected to remain stable and reliable, even during economic fluctuations, making them a central focus for real estate development within the biotech industry.