Forecasting Construction Costs Amid Inflation

Construction costs have become harder to predict due to inflation, rising labor expenses, and material price fluctuations. Here's what you need to know:

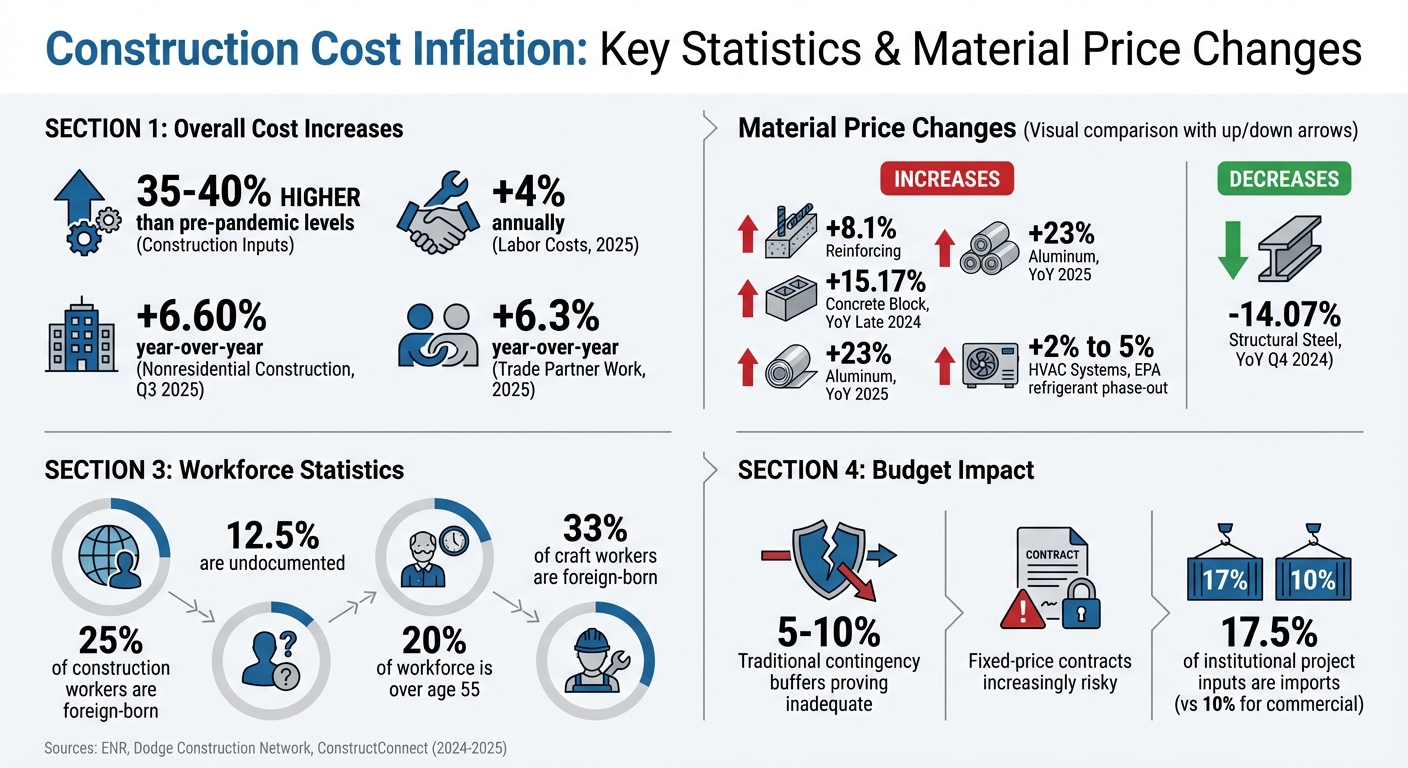

- Costs Are Up: Construction inputs are now 35%-40% higher than pre-pandemic levels. Labor costs are climbing at a steady 4% annually.

- Material Volatility: Prices for key materials like reinforcing steel (+8.1% in Q3 2025) and concrete blocks (+15.17% YoY) are increasing, while others like structural steel dropped by 14.07% in late 2024.

- Budget Pressures: Fixed-price contracts are riskier, and traditional contingency buffers (5%-10%) are proving inadequate.

- Data-Driven Tools: Specialized indices (e.g., ENR, Turner Building Cost Index) and platforms like CoreCast help refine cost estimates with localized and real-time data.

- Forecasting Strategies: Combining top-down and bottom-up methods, scenario planning, and risk-adjusted models (e.g., Monte Carlo simulations) improves accuracy.

Takeaway: Inflation is reshaping how construction projects are planned and financed. Accurate forecasting hinges on reliable data, advanced tools, and flexible budgeting strategies to manage rising costs and risks effectively.

Fall 2025 Construction Economic Outlook | Inflation, Tariffs, Labor Costs, Data Centers, Forecasts

How Inflation Affects Construction Costs

Construction Cost Inflation: Key Statistics and Material Price Changes 2024-2025

Inflation Concepts for Construction

Understanding inflation's impact on construction costs requires a deeper dive into specialized data and indices tailored to the industry. General metrics like the Consumer Price Index (CPI) fail to capture the unique cost dynamics of construction. Instead, the industry turns to specialized indices from firms like Mortenson and Gordian, which track construction-specific inputs with greater accuracy. These indices reveal that construction costs often behave differently from headline CPI trends. For instance, construction inputs have stabilized at levels 35% to 40% higher than pre-pandemic rates [4]. Meanwhile, nonresidential construction costs rose 6.60% year-over-year through the third quarter of 2025 [7], highlighting the ongoing divergence.

What Drives Construction Cost Inflation

Material price fluctuations are a major driver of cost inflation. For example, reinforcing steel prices surged 8.1% in the third quarter of 2025, while concrete blocks saw a year-over-year increase of 15.17%. On the other hand, structural steel prices dropped by 14.07% in the fourth quarter of 2024 [7] [8]. These examples underscore how different materials can follow distinct pricing trends.

"After months of wait-and-see due to tariff uncertainty, owners and developers have begun to move forward with projects and assumed higher costs for them." – Sarah Martin, Associate Director of Forecasting, Dodge Construction Network [7]

Labor shortages add another layer of complexity. About 25% of U.S. construction workers are foreign-born, with 12.5% being undocumented. Wages are climbing at an annual rate of over 4% [4] [9] [10] [11], and approximately 20% of the workforce is over the age of 55 [3]. Supply chain disruptions also play a role, particularly when natural disasters, like hurricanes, affect manufacturing hubs concentrated in the Southeastern U.S. [8]. Additionally, tariff uncertainties have led developers to "front-load" projects, accelerating timelines to avoid future cost increases [7]. Together, these challenges significantly strain project budgets, making careful planning more critical than ever.

Budget Impacts from Inflation

Inflation impacts both hard costs (materials and labor) and soft costs (permits, insurance, and professional fees). For instance, trade partner work increased by 6.3% year-over-year in 2025 [7]. Labor costs for self-performed work have also risen, complicating bid evaluations. Contractors have been absorbing some of these increases to remain competitive, but as ConstructConnect's Chief Economist Michael Guckes warns, "that is only a temporary fix" [9].

Fixed-price and Guaranteed Maximum Price (GMP) contracts become particularly risky during inflationary periods. When material costs spike unexpectedly - like the 8.1% quarterly jump in reinforcing steel [7] - contractors locked into fixed agreements often bear the financial burden. Regulatory changes exacerbate these pressures. For example, the EPA's phase-out of R-410 refrigerants has pushed HVAC system costs up by 2% to 5% [8].

Traditional contingency buffers of 5%-10% are proving insufficient as material and regulatory changes drive sharp cost increases. For example, concrete blocks rose 15% and aluminum surged 23% year-over-year [8] [9]. In response, real estate professionals are adjusting by building larger contingency cushions into their budgets and relying on construction-specific indices to monitor localized trends instead of national averages. This shift underscores the importance of precise forecasting tools for navigating inflation's impact on construction projects.

| Material/Input | Recent Change | Timeframe |

|---|---|---|

| Reinforcing Steel | +8.1% | Q3 2025 [7] |

| Concrete Block | +15.17% | Year-over-Year (Late 2024) [8] |

| Structural Steel | –14.07% | Year-over-Year (Q4 2024) [8] |

| Construction Wages | >4% | Annual (2025) [9] |

| Aluminum | +23% | Year-over-Year (2025) [9] |

Data Sources and Tools for Cost Forecasting

Accurate data and advanced tools are crucial for navigating the uncertainties of inflation-driven construction costs.

Construction Cost Indices and Data Providers

Forecasting construction costs starts with reliable data. The Engineering News-Record (ENR) provides two key indices tailored to different project types:

- Construction Cost Index (CCI): Tracks 200 hours of common labor alongside materials like structural steel, cement, and lumber. This index is ideal for heavy construction and infrastructure projects.

- Building Cost Index (BCI): Focuses on 68.38 hours of skilled labor (including bricklayers, carpenters, and ironworkers) combined with a similar material basket, making it more relevant for commercial and industrial buildings.

ENR also offers 20-city individual indexes that reflect regional material prices and union wages, helping refine cost estimates for specific locations [14].

Another valuable resource is the Turner Building Cost Index (TBCI), which provides quarterly updates. It accounts for labor rates, productivity, material prices, and market competition:

"The TBCI is determined by the following factors considered on a nationwide basis: labor rates and productivity, material prices, and the competitive condition of the marketplace." [15]

For residential projects, the U.S. Census Bureau Construction Price Indexes focus on single-family homes, covering both houses sold (including land value) and those under construction. Meanwhile, the Bureau of Labor Statistics' Producer Price Index (PPI) tracks inflation at the producer level, with final demand prices rising 2.7% as of September 2025 [17].

Additionally, ENR's Construction Industry Confidence Index, which reached 52 in Q4 2025, provides a forward-looking snapshot of market sentiment [14]. These indices form a solid foundation for cost forecasting, especially when integrated with modern technology platforms.

Real Estate Intelligence Platforms

Modern digital platforms are transforming how construction cost data is utilized. These tools consolidate various data streams into a unified system, eliminating the inefficiencies of juggling multiple spreadsheets or disconnected tools. One such platform, CoreCast, offers a comprehensive suite of features:

- Underwriting for multiple asset classes

- Project pipeline tracking

- Integrated property mapping

- Detailed portfolio analysis

CoreCast also centralizes historical cost data, helping users validate current assumptions by comparing them to past performance. Its future updates aim to integrate construction management tools, creating a seamless connection between cost forecasting and project execution. Additionally, real-time economic insights, such as those from the Federal Reserve's FRED mobile app, provide access to 13 key Census Bureau economic indicators, further enhancing forecasting accuracy [13].

Validating Data for Accuracy

Ensuring accurate cost forecasts means cross-referencing multiple data sources. Comparing indices from private providers like Turner and ENR with government data from the Census Bureau and Bureau of Labor Statistics is an effective strategy. Geographic specificity is essential, as local union wages and material prices can vary significantly. Since each index uses different labor and material weightings, they respond differently to market shifts, making cross-referencing critical for reliable forecasts.

For example, Census Bureau indexes distinguish between houses sold (which include land value) and those under construction (focused solely on construction costs) [12]. It's also important to note that government data like the PPI may be revised up to four months later, which can impact time-sensitive analyses [17]. Additionally, specific materials can experience price volatility due to geopolitical factors like tariffs and sanctions, even when overall inflation appears stable [3]. By employing robust validation methods, forecasters can build confidence in their predictions, especially amid inflationary pressures.

Techniques for Forecasting Construction Costs

Top-Down and Bottom-Up Forecasting

Top-down forecasting begins with a broad look at economic trends, applying historical escalation rates to your overall project budget. Tools like the Turner Building Cost Index, which considers factors such as labor rates, material costs, productivity, and market competition, are commonly used. This approach is quick and works well for early-stage planning, like feasibility studies or portfolio assessments, when detailed designs aren’t available. For context, commercial construction escalation rates have averaged about 2.8% annually over a seven-year span [2].

Bottom-up forecasting, on the other hand, dives into the details. It breaks down the budget into specific components - labor, materials, equipment rentals, and subcontractor costs. This method relies on detailed quantity takeoffs from 2D or 3D models to produce precise estimates [16]. While this approach takes more time, it’s crucial for final bidding and project execution, especially when material prices are unpredictable due to factors like tariffs or supply chain issues.

A smart approach combines both methods. Start with top-down forecasting to set initial budgets, then refine those estimates using bottom-up analysis as the project design becomes more detailed. Incorporating modern decision science - blending data from indices with insights from industry experts - can further enhance the accuracy of your forecasts [2]. Once you’ve established a baseline, it’s critical to assess potential variations to prepare for uncertainties.

Scenario and Sensitivity Analysis

Single-point cost estimates often fail to capture the range of possible outcomes, particularly during times of inflation. Instead, consider developing three scenarios: optimistic (best-case), pessimistic (worst-case), and most likely. For instance, a worst-case scenario might project cost reductions of up to 13% over two years, while stable conditions could result in annual cost increases of 2%-4% [2][3].

Sensitivity analysis is another valuable tool, helping you pinpoint which factors have the biggest impact on your forecast. Key variables include Federal Reserve monetary policies, interest rate trends (with the 10-year Treasury often used as a financing cost benchmark), and labor market dynamics [5]. For example, construction labor costs have been rising steadily at about 4% annually, even as commodity prices have leveled off [4]. By testing how sensitive your forecast is to these key inputs, you can identify areas where risk mitigation is most needed.

Expressing your estimates as ranges (e.g., "$40 million to $45 million") not only reflects the inherent uncertainty but also helps build trust with stakeholders. This approach lays the groundwork for more advanced forecasting techniques that account for risks and variability.

Risk-Adjusted Forecasting Models

In volatile environments, risk-adjusted models can help refine your forecasts by quantifying uncertainty. This method goes beyond simple escalation rates, accounting for both the likelihood of cost-related events and their financial impact. Globally, only 31% of construction projects finish within 10% of their initial budget [18], often because traditional estimates overlook uncertainty. For example, a risk-adjusted model might add $150,000 to cover extra onsite supervision when working with an inexperienced subcontractor or include administrative costs for managing lien waivers on complex projects.

Monte Carlo simulations are a powerful tool in this approach. By running thousands of scenarios, these simulations create confidence intervals for your estimates. Pairing Monte Carlo simulations with a live risk register - tracking risks, their likelihood, and mitigation plans - allows for real-time adjustments to forecasts as conditions change [6][19].

"Risk-adjusted costs quantify uncertainty and lead to more accurate bids because they account for both the probability of an event occurring and the potential cost impacts of those events." - Justin Levine, Head of Risk Management Strategy, Autodesk Construction Solutions [18]

To strengthen financial planning even further, incorporate risk assessments throughout the project lifecycle. Regularly update forecasts with actual cost data and resource-loaded schedules to stay on top of evolving conditions [19].

sbb-itb-99d029f

Using Cost Forecasts in Real Estate Strategy

Adding Forecasts to Project Budgets

Incorporating construction cost forecasts into project budgets is essential to shield your development from inflation. A common approach is to allocate escalation allowances using indices like the Turner Building Cost Index or CBRE Construction Cost Index, typically reserving 2% to 4% annually during stable economic conditions [3][2]. However, in more unpredictable times, this method alone may not suffice. A modern budgeting strategy involves scenario-based planning, which includes three cases: best-case (2.8% annual escalation over seven years), average, and worst-case (a potential 13% cost drop within two years after a severe recession) [2].

Budgets should focus on three key cost drivers: materials, labor, and margins. Each of these reacts differently to inflation, meaning contingency plans must address their unique risks instead of applying uniform escalation rates. For example, material costs may spike while labor costs hold steady, requiring more nuanced adjustments.

For larger developments, adopting a phased execution strategy can provide flexibility. This allows for periodic budget recalibrations as market conditions evolve [2]. This approach proved invaluable in 2022 when construction costs surged by 14.1% year-over-year - far exceeding the typical 2% to 4% range [3][20]. Breaking projects into smaller phases enables developers to update budgets using real-time market data, which directly informs underwriting and deal structuring.

Effects on Underwriting and Deal Structuring

Cost forecasts have a direct impact on whether deals proceed or stall. Shifts in credit conditions, coupled with 10-year Treasury yields climbing to 4.25%–4.5% from just 0.5% in 2020, have significantly increased financing costs, making some deals no longer feasible [4][5].

"Tighter credit conditions often are the reason for not moving ahead with a project, or for changing plans during the design phase of a project." - AIA Consensus Construction Forecast [4]

The rising "Project Stress Index" reflects this trend, with more developers halting or redesigning projects during the planning stage due to cost concerns [4]. Savvy developers are using these forecasts to shift strategies. When new construction costs appear too high, many are opting for reconstructions or facility additions instead. This shift now accounts for about 50% of architecture firm billings [5].

To navigate these challenges, incorporate decision science analysis into your underwriting. This means blending quantitative data from indices with insights from contractors, suppliers, and market experts [2]. Tools like the Architecture Billings Index (ABI) offer a 9-to-12-month outlook on construction trends, helping developers make informed go/no-go decisions [5].

Portfolio-Level Implications

At the portfolio level, refined cost forecasts guide capital allocation strategies across sectors and regions. For instance, projections for 2025–2026 show institutional facilities like healthcare and education growing by 6.0% and 3.4%, respectively, while manufacturing construction is expected to decline by 2.6% in 2026 [1][11]. These varying growth rates highlight the need for active portfolio adjustments based on forecast data.

Certain niche sectors demand extra attention. Data centers, for example, are projected to grow 33% in 2025 and an additional 20% in 2026, while traditional commercial sectors like office and retail continue to lag [1]. Balancing high-growth niches against more stable institutional investments can help create a diversified portfolio that withstands inflationary pressures. Additionally, labor policy risks should be factored in, as changes in immigration policy could impact the construction workforce, where 25% of workers and 33% of craft workers are foreign-born [1][11].

Real estate intelligence platforms like CoreCast are invaluable for monitoring forecast alignment across multiple projects in real time. These tools consolidate underwriting, pipeline tracking, and portfolio analysis, helping you identify projects that are on track or those requiring adjustments. This real-time visibility is critical when managing portfolios with varying inflation sensitivities. For example, institutional projects often rely on imports for 17.5% of inputs, compared to just 10% for commercial projects [1].

Use these platforms to establish regional and sector-specific benchmarks that refine assumptions for your portfolio. Trends indicate higher optimism for revenue growth in the Southern U.S. by 2025, pointing to regional differences in cost pressures and opportunities [11]. Tracking these patterns can guide decisions on where to allocate capital and whether to prioritize new developments or value-add opportunities within existing assets.

Best Practices for Cost Forecasting and Governance

Setting Up Governance and Approval Processes

With construction input costs remaining 35%-40% higher than pre-pandemic levels [4], it's crucial to establish clear governance and approval processes. Define who is responsible for each forecast, who validates it, and when leadership needs to step in for budget revisions. This is particularly important as around 60% of lenders tightened credit standards for commercial real estate loans in late 2023 [4].

Incorporating real-time data into your governance framework can improve forecast reliability. For example, using the Project Stress Index - a tool that monitors delayed, stalled, or abandoned projects - can serve as an early warning system for potential risks. For large-scale developments, set up approval checkpoints at each project phase. This approach allows you to adjust budgets in response to changing market conditions, rather than sticking to outdated assumptions. When paired with robust internal benchmarks, these processes can significantly improve budget accuracy.

Building Internal Benchmarks

An internal cost database can turn historical project data into a strategic advantage. By tracking realized inflation and forecast variances, you can develop highly accurate benchmarks tailored to specific sectors and regions. Tools like CoreCast simplify this process by centralizing data across your portfolio and normalizing it for easy comparisons. Analyzing historical cost patterns across various project types can also help refine contingencies for future forecasts. This capability is especially critical as labor costs continue to climb at an annual rate of 4% [4].

Working with Supply Chain and Market Experts

Collaborating with contractors, suppliers, and cost consultants can provide deeper insights into pricing trends and market shifts - often before these changes are reflected in published indices. This approach, sometimes called "decision science analysis", combines hard data with expert knowledge to go beyond traditional forecasting models [2].

"This method allows estimators to incorporate a comprehensive view of the current economic landscape, transcending conventional academic models."

- Roger Myrvang and Chin-Yen Alice Liu, Journal of Construction Engineering and Management [2]

For complex or high-value projects, consider hiring external cost advisory services. These experts can identify procurement savings and manage risks throughout the construction process [3]. Many also have access to proprietary supply chain technology that leverages global buying power, often securing better deals than individual negotiations [3]. With reconstruction work now making up about 50% of billings at architecture firms [5], it's essential that your team understands the unique cost dynamics of renovation projects compared to new builds. By combining expert collaboration, internal benchmarks, and a strong governance structure, you can create a reliable framework for accurate cost forecasting.

Conclusion

Predicting construction costs in an inflationary environment hinges on three key components: dependable data, advanced forecasting methods, and seamless integration into decision-making. Construction inputs are still 35%-40% higher than pre-pandemic levels, with labor costs rising at an annual rate of 4% [4]. To account for regional differences in labor and material costs, combine national benchmarks like the HCI with localized data from the CCI [8].

Using decision science analysis - a blend of quantitative data and qualitative insights from contractors, suppliers, and market experts - can help create best-case, average, and worst-case scenarios. This strategy equips teams to adapt to economic changes, making flexible forecasting models essential for managing uncertainty. Accurate, data-based estimates are the backbone of this process.

"Accuracy is the foundation of every successful bid. With data-driven estimating, teams can eliminate guesswork and ensure every project begins with a reliable cost baseline." - Procore [16]

Incorporating forecasting into your workflow offers measurable advantages. Aligning scope and cost from the outset through cloud-based platforms minimizes rework and ensures estimates remain reliable throughout the project lifecycle [16]. Companies utilizing integrated estimating software report 52% fewer non-recoverable change orders and a 16% drop in rework [16]. Tools like CoreCast simplify real-time data integration, enabling detailed analysis at every project stage - from underwriting to construction management - within a single platform.

Accurate forecasting also strengthens your broader investment strategy. With nonresidential construction spending projected to grow modestly - 2.2% in 2025 and 2.6% in 2026 [10] - precision in cost estimation becomes a competitive advantage. By combining strong governance, internal benchmarks validated by historical data, and real-time tracking tools, you can protect profit margins and secure long-term investment value, even as market conditions evolve.

FAQs

How can construction companies manage budget risks effectively during high inflation?

To handle budget risks during inflation, construction companies should prioritize precise forecasting, proactive planning, and adaptable strategies. Start by creating a thorough cost breakdown, incorporating current market escalation rates into each project component. This approach ensures your budget accounts for up-to-date price fluctuations in materials and labor. Leveraging real-time data tools can also make a big difference by tracking commodity trends and regional cost indices, allowing for quick updates to your forecasts as market conditions shift.

On top of that, consider risk-reduction measures like securing contracts with escalation clauses for flexibility, procuring essential materials early, and setting aside a contingency reserve of 5–10% of the total budget. Tools like CoreCast can streamline cost tracking, scenario planning, and stakeholder communication, helping you manage inflation pressures effectively while keeping projects on schedule and investors in the loop.

How can data-driven tools and indices improve the accuracy of construction cost forecasting?

Data-driven tools and construction cost indices are essential for crafting precise cost forecasts. They transform raw market data into meaningful insights, helping professionals navigate complex economic factors. Trusted sources like the U.S. Census Bureau’s Construction Price Indexes and ENR’s Construction Cost Index provide valuable benchmarks for tracking trends in materials, labor, and regional costs. These indices enable adjustments for inflation, supply chain issues, and labor shortages, ensuring cost estimates remain accurate and relevant.

Tools like CoreCast take this a step further by integrating public and proprietary data into a single, user-friendly platform. With CoreCast, users can dive into city-specific cost trends, account for inflation, and create real-time, project-specific forecasts. By leveraging advanced analytics and current market data, this platform empowers professionals to make informed budgeting decisions, even in today’s unpredictable economic climate.

Why are traditional contingency budgets no longer enough in today’s construction market?

Traditional contingency budgets, typically calculated as a fixed percentage of a project's total cost, were built on the idea that costs would remain relatively steady over time. But the construction landscape today tells a very different story. With post-pandemic economic shifts, fluctuating material prices, supply chain issues, labor shortages, and geopolitical tensions, costs have become far less predictable. For instance, U.S. construction costs have experienced double-digit increases in recent years - well beyond historical norms.

Relying on static contingency buffers in such a volatile market leaves projects exposed to unforeseen expenses. Tools like the CoreCast real estate intelligence platform offer a smarter alternative. By tapping into real-time data - covering everything from commodity prices and labor trends to project-specific risks - firms can continuously refine their budgets. This flexible approach leads to more precise cost predictions and better safeguards against sudden price hikes in today’s inflation-driven market.