Hospitality Diversification Checklist for Real Estate Investors

Hospitality real estate offers a unique way to diversify your investment portfolio with flexible, short-term income streams. Unlike static-lease properties, hospitality assets like hotels and resorts allow for dynamic pricing, acting as a potential inflation hedge. Global hotel investments reached $57.3 billion in 2024, with forecasts predicting 15–25% growth in 2025, and the sector is projected to hit $1.2 trillion in revenue by 2027.

To succeed, focus on operational efficiency, financial metrics, and choosing the right investment strategy. Whether you’re considering stabilized hotels, value-add renovations, or high-risk developments, this guide covers everything you need - from using a real estate deal analysis tool to evaluate metrics like ADR and RevPAR to evaluating location demand and market risks. Here’s a quick summary of the key steps:

- Set clear investment goals: Choose between core (stable), value-add (growth-focused), or opportunistic (high-risk) strategies.

- Understand property types: Options include full-service hotels, boutique properties, and extended-stay apartments.

- Analyze financial metrics: Use real estate analytics tools to track ADR, RevPAR, and occupancy rates to gauge performance.

- Evaluate location demand: Check tourism trends, GDP growth, and local attractions.

- Prepare for management needs: Hospitality requires active oversight, from guest services to revenue strategies.

Hospitality investments demand active management but can offer diverse revenue streams beyond room bookings, such as food, beverage, and wellness services. By following this checklist, you can make informed decisions, reduce risks, and maximize returns.

Why HOTELS are the Most Lucrative Real Estate Asset Class

sbb-itb-99d029f

Assess Your Portfolio and Investment Goals

When thinking about investments in hospitality, it’s crucial to see how this sector fits into your overall strategy. Hospitality operates on a "part-real estate, part-operating business" model, meaning its value stems from daily operations and guest experiences - not just the physical property itself [1][3]. This makes it quite different from traditional office or multifamily investments, requiring a unique approach to evaluation and strategy.

Set Clear Investment Objectives

Start by defining what you want from your hospitality investment. Are you aiming for steady, predictable income? Moderate returns through value-add strategies? Or are you chasing higher returns with more risk through opportunistic investments? Each option has its own demands and potential [1][4].

It’s important to stay objective. Don’t let personal travel preferences cloud your judgment. As Catherine Rey from EHL Advisory Services puts it, "A budget hotel at a great price may be a far more successful investment than paying top dollar for a world-class hotel" [7]. Keep your focus on measurable metrics like Average Daily Rate (ADR) and Revenue Per Available Room (RevPAR) to guide your decisions, rather than relying on subjective impressions.

Review Your Current Portfolio

Take a close look at your existing portfolio and think about how hospitality assets might fit in. Hospitality properties bring unique characteristics, like dynamic pricing and nightly bookings, which contrast sharply with the long-term leases typical of office or residential properties. This dynamic pricing model can act as an inflation hedge, providing a layer of resilience that static-lease properties might lack [1][2].

However, hospitality demands more active management. Revenue depends on nightly bookings, and the sector is highly sensitive to economic cycles, showing a 90% correlation between macroeconomic factors - like GDP and unemployment - and hotel performance metrics [10]. If your portfolio leans heavily on static-lease properties, hospitality can introduce both diversification and flexibility, but it also increases exposure to economic volatility.

Calculate Available Capital and Risk Capacity

Hospitality investments often require significant upfront and ongoing capital, with revenues that can fluctuate based on seasonality and broader economic trends [1][7]. Properties that aren’t regularly updated tend to lose both performance and value over time.

If your available capital is limited, there are still ways to enter the market. Hospitality REITs, for example, offer a lower-cost option and are legally required to distribute 90% of their net income as dividends [9]. For direct property ownership, it’s essential to align your capital with the right investment tier. Core strategies typically need less operational capital, whereas value-add or opportunistic investments may require substantial funds for renovations and operational improvements [1].

Choose Your Hospitality Investment Approach

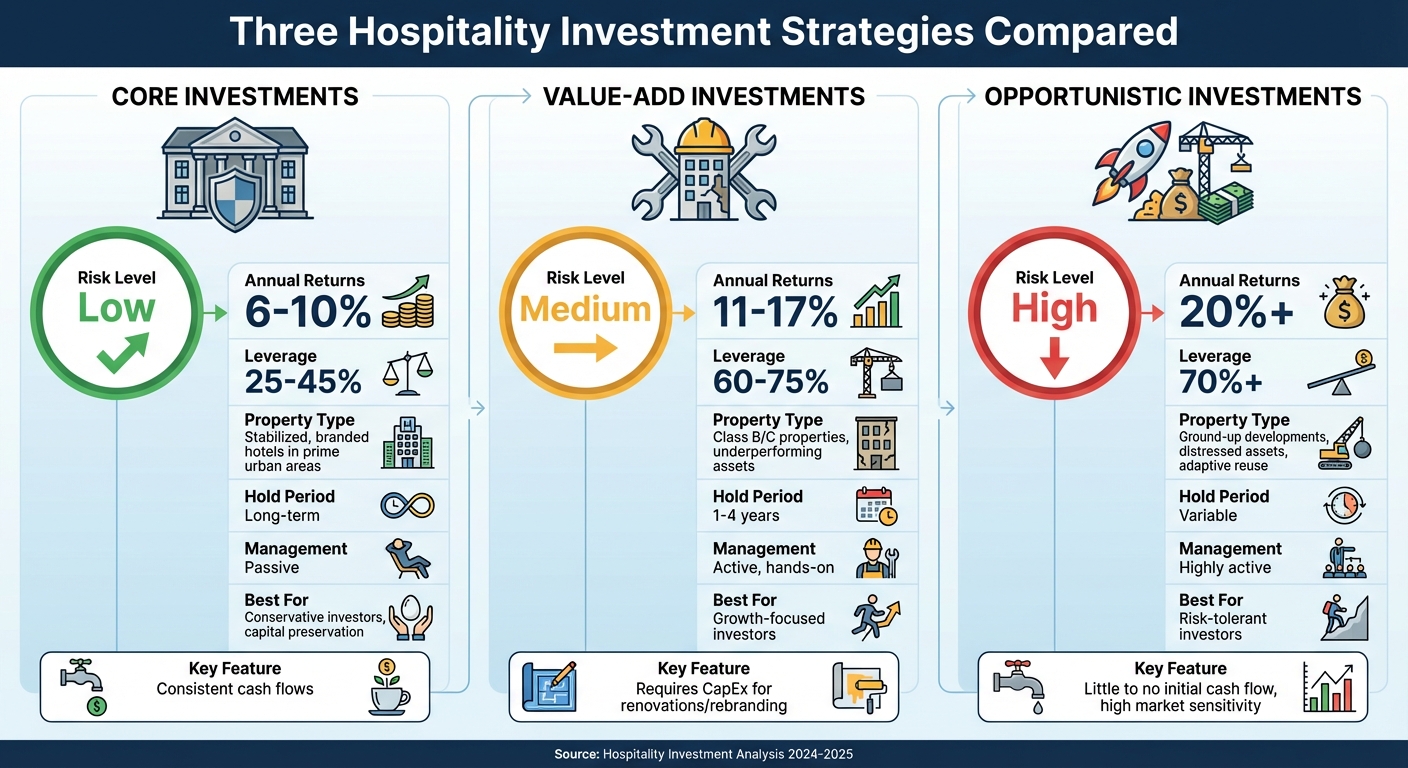

Hospitality Investment Strategies: Core vs Value-Add vs Opportunistic Comparison

Once you've clarified your investment objectives and reviewed your portfolio, the next critical step is picking an investment strategy that aligns with your goals. The hospitality sector offers three main approaches, each with its own risk-return balance and operational requirements. With your capital and risk tolerance in mind, let’s break down these strategies:

Core investments prioritize stabilized, income-generating properties - think branded hotels in prime urban areas or well-established resorts with consistent cash flows. These investments typically yield annual returns of 6% to 10%, with leverage kept low at 25-45% of the purchase price [12][13]. This strategy is ideal for those who value stability and capital preservation, making it a top choice for conservative investors or those new to the hospitality sector. However, the tradeoff is lower returns, and these properties are particularly sensitive to cap rate changes [14].

Value-add investments focus on underperforming or poorly managed properties where improvements can unlock higher returns - usually in the range of 11-17% annually [12][13]. This strategy often involves Class B or C properties that require significant capital expenditure (CapEx) for renovations, rebranding, or operational upgrades. Leverage for these investments can range from 60-75%, and the typical hold period is 1-4 years [12][14]. While this approach offers stronger growth potential, it also demands active management and a hands-on approach to operations.

Opportunistic investments cater to risk-tolerant investors seeking high returns, often exceeding 20% annually [12]. These deals typically involve ground-up developments, distressed asset turnarounds, or adaptive reuse projects like converting office spaces into hotels [4]. While the potential rewards are substantial, these investments often provide little to no initial cash flow, are highly sensitive to market conditions, and involve leverage exceeding 70% [12]. Elisa Stucki from Colliers MENA highlights this dynamic:

What makes hospitality real estate so remarkably unique is how closely operations and experience tie into asset value. It's not just about location or build quality - brand selection and positioning... can materially impact performance [4].

A good example of this strategy is Spark GHC’s $120 million+ redevelopment of Cleveland's historic Rose Building, launched in February 2025. This hybrid value-add/opportunistic project combines a branded boutique hotel with luxury apartments, creating revenue streams from both short-term and long-term bookings. This dual-use approach not only enhances asset appreciation but also reduces the risk tied to single-use properties [2].

Your choice of strategy should align with your financial resources and operational expertise. Core investments are more passive, while value-add and opportunistic strategies require hands-on management and a deep understanding of guest services and revenue strategies [12][8]. Balancing your financial capacity with your ability to manage these operational demands is key to a successful hospitality investment.

Select the Right Hospitality Property Type

Choosing the right hospitality property type is all about aligning your investment strategy with your operational capabilities and revenue goals. The key is to find a property type that strikes a balance - minimizing operational challenges while maximizing income potential. Let’s break down the main options and how they fit into various strategies.

Hotels and Resorts

Hotels and resorts are often categorized by their service levels and brand affiliations, such as Marriott or Hilton [15][11]. Full-service hotels, including lifestyle properties, typically generate a diverse income stream, relying heavily on non-room revenue from areas like food and beverage (F&B) or wellness offerings [3]. However, the success of these properties depends significantly on the quality of these additional amenities. On the other hand, limited-service hotels simplify operations by skipping extras like on-site restaurants or room service, making their operations more predictable [15]. Comparing commercial real estate markets also plays a critical role - proximity to airports, business hubs, or tourist attractions can directly impact both occupancy rates and pricing power [16].

Lifestyle and Boutique Properties

These properties cater to travelers seeking unique experiences, emphasizing personalized service and distinctive designs [3]. They often feature smaller rooms, cutting-edge technology, and lively communal spaces, attracting younger, experience-driven guests [11]. While they can command premium rates and foster strong brand loyalty, they require hands-on management and a deep understanding of guest expectations. Branded residences within this category can be especially lucrative, often selling at 20–35% higher prices than non-branded equivalents, with investment yields reaching 6–8% in established markets like Dubai and Miami [3].

Extended-Stay and Serviced Apartments

Designed for guests staying five days or longer - such as corporate travelers or relocating families - these properties focus on home-like amenities. Features like full kitchens, laundry facilities, and separate living spaces make them appealing to long-term guests seeking comfort and convenience [15][11]. With fewer operational complexities, extended-stay properties often deliver steady occupancy rates [3]. During economic downturns, they’ve shown resilience, thanks to demand from corporate relocations and project-based work [3].

Each property type comes with its own set of challenges and opportunities. For instance, full-service resorts demand higher staffing levels and regular reinvestment, while extended-stay properties offer leaner operations and predictable cash flows. Experts highlight that hospitality assets function as hybrid businesses, where the value of the asset is closely tied to guest satisfaction and effective daily management [3][4]. Whether you plan to manage the property yourself or hire skilled operators, your ability to oversee these operations is a critical factor in choosing the right property type. Utilizing a central source of truth for asset management can help streamline this oversight.

Analyze Financial Performance Metrics

Once you've chosen the type of property to invest in, the next step is to dive into its financial performance metrics. These numbers help you understand the property's potential for generating revenue and give you a better sense of its pricing strategy, operational efficiency, and how it stacks up against competitors. Essentially, these metrics help you see what you're really getting into.

Calculate ADR and RevPAR

The Average Daily Rate (ADR) tells you the average revenue generated per occupied room. You calculate it by dividing total room revenue by the number of rooms sold. For example, in October 2024, the U.S. hotel industry reported an ADR of $164.86, which was a 1.8% increase from the previous year [17]. While ADR highlights how strong a property's pricing is, it doesn’t account for unoccupied rooms. For instance, a hotel charging $300 per night at 40% occupancy might generate less revenue than one charging $150 per night at 80% occupancy.

To get a better sense of revenue efficiency, you can look at Revenue per Available Room (RevPAR). This metric is calculated by multiplying ADR by the occupancy rate. In October 2024, U.S. hotels hit a record-high RevPAR of $110.94 [17]. For full-service hotels that earn income from other areas like restaurants or event spaces, Total Revenue per Available Room (TRevPAR) gives a broader picture. If you want to focus on profitability, Gross Operating Profit per Available Room (GOPPAR) is key - it factors in operating expenses and is closely tied to a hotel’s actual value, with an 85% to 90% correlation compared to RevPAR’s 70% to 75% [19].

Determine Occupancy Rates and Break-Even Points

The occupancy rate measures demand by dividing the number of rooms sold by the total number of rooms available. For example, in November 2024, the U.S. hotel occupancy rate was 59.4% [17]. But filling rooms isn’t enough - you also need to ensure that revenues cover costs. That’s where the break-even occupancy rate comes in. You can calculate it using this formula:

(Total Fixed Costs ÷ ((ADR – Variable Cost per Room) × Total Rooms)) × 100 [22].

Here’s how it works: fixed costs include things like property taxes, insurance, and marketing, while variable costs cover items like room supplies and management fees. During the 2020 pandemic, when U.S. hotel occupancy dropped to roughly 44% [21], properties with lower break-even thresholds were better equipped to handle tough times. To prepare for potential downturns, conduct scenario analysis for real estate portfolios by simulating a 20% drop in RevPAR and check if the Debt Service Coverage Ratio remains sustainable [21]. Finally, compare these metrics with local competitors to see how your property measures up.

Compare Against Local Competitors

To understand how your property performs in the market, compare it to similar competitors using indices like MPI, ARI, and RGI. These three benchmarks are critical:

- Market Penetration Index (MPI): Compares your occupancy rate to the market average. A value above 1 means you’re capturing more than your fair share of the market.

- Average Rate Index (ARI): Compares your ADR to the market average. A value below 1 could indicate underpricing.

- Revenue Generation Index (RGI): Compares your RevPAR to the market average [18][20].

Many investors rely on STR Reports, which cover about 67,000 hotels worldwide, for this kind of benchmarking data [18]. By tracking these indices over the past 12 months, you can spot trends and adjust your strategy. For properties with large non-room spaces, like meeting rooms or lobbies, calculating Gross Operating Profit per Available Square Meter (GOPPAM) can help identify areas that could be turned into revenue-generating opportunities [19].

Here’s a quick reference table to summarize these metrics:

| Metric | Formula | What It Tells You |

|---|---|---|

| ADR | Total Room Revenue / Rooms Sold | Pricing strength per occupied room |

| RevPAR | ADR × Occupancy Rate | Revenue efficiency across all rooms |

| GOPPAR | Gross Operating Profit / Total Rooms | Profitability and asset value |

| MPI | (Hotel Occupancy / Market Occupancy) × 100 | Market share compared to competitors |

| ARI | Hotel ADR / Market ADR | Pricing competitiveness |

| RGI | Hotel RevPAR / Market RevPAR | Revenue competitiveness |

Evaluate Location and Market Demand

Once you've analyzed your financial metrics, the next step is to assess whether the location can sustain demand and support your investment goals. A strong location is essential for aligning your hospitality diversification strategy with growth opportunities. Even if a property has a solid performance history, it won't thrive without consistent local demand. A detailed location analysis helps you pinpoint the factors driving current demand and evaluate their longevity.

Review Tourism and Economic Factors

Take a close look at the broader economic indicators that influence hotel performance. Metrics like GDP growth, the Consumer Price Index (CPI), and unemployment rates are closely tied to how hotels perform [10]. Pay particular attention to local employment trends that fuel business travel. For instance, markets with growth in professional and technical jobs, alongside high occupancy rates in office and industrial spaces, often see increased demand [23].

It's also crucial to understand whether demand is driven by proximity to business hubs or leisure attractions, as these factors create distinct occupancy patterns. Convention centers, universities, hospitals, and other key attractions can generate steady traffic, but the timing varies. For example, large convention centers or universities may boost mid-week occupancy, while resort destinations often see stronger demand on weekends. This knowledge helps you forecast cash flow throughout the year.

By understanding these dynamics, you can better assess the risks and opportunities in both emerging and established markets.

Compare Emerging vs. Established Markets

Choosing between emerging and established markets involves weighing potential rewards against risks. Established markets - like top-tier urban centers or well-known resort destinations - often provide stable cash flows and lower risk. However, these markets typically come with lower cap rates and fewer opportunities for significant returns, making them more suited for core investments [1].

Emerging markets, on the other hand, carry higher risks but may offer greater upside. Look for areas with limited hotel room supply relative to strong GDP growth. For instance, India has one of the lowest hotel room supplies per capita globally, despite its robust economic growth, making it an attractive option [1].

Saudi Arabia is another emerging market worth noting. The country's Vision 2030 initiative aims to attract 150 million tourists annually by 2030, signaling strong government support for the hospitality sector [1]. While these markets promise substantial returns, they often require active management and a willingness to navigate volatility. In contrast, established U.S. markets offer more predictability, even if their growth potential is modest. For example, the U.S. hospitality market saw a 0.3% decline in RevPAR in 2025, with forecasts for 2026 predicting growth between 0.5% and 1.0% [24].

Regulatory considerations also play a significant role in shaping your investment strategy.

Understand Regulatory and Market Risks

Local regulations can have a major impact on the profitability of hospitality investments. Labor laws, for example, are a critical factor. In Los Angeles, a new mandate will raise hotel worker wages to $30 per hour by July 2028, significantly affecting operating margins. Between 2019 and 2025, Gross Operating Profit (GOP) margins in Los Angeles hotels dropped from 29% to 20% due to rising labor costs [27]. It's essential to research minimum wage laws, union activity, and pending legislation that could influence your expenses.

Zoning laws and development restrictions also shape market dynamics. For instance, New York's restrictions on new hotel construction create artificial scarcity, driving up room rates. While this benefits owners of existing properties, it can also lead to higher acquisition costs [24]. Additionally, trade and tariff policies can affect border cities or regions reliant on international tourism. New tariffs may increase material costs or alter demand due to stricter security measures [26][27].

Financing risks are another critical consideration. Rising debt costs and tighter lending conditions make new developments more challenging, requiring higher equity and more cautious underwriting [25][26]. For example, in early 2025, San Francisco's hotel market faced distress when the Parc 55 and Hilton Union Square hotels became tied to a $725 million delinquent CMBS loan. This contributed to a nearly 50% delinquency rate for securitized hotel loans in the region [27]. Markets with high delinquency rates or upcoming loan maturities at elevated interest rates face heightened risks of foreclosures or forced sales, which can signal market instability but also create potential buying opportunities.

Review Operations and Management Requirements

Hospitality assets demand a level of operational oversight that goes far beyond what’s required for traditional real estate investments. Unlike multifamily properties with long-term leases, hotels require daily attention to guest services, staff coordination, and revenue strategies. This complexity makes it essential to evaluate both the quality of your management team and the value of your brand partnerships.

Assess Management Expertise and Brand Value

A capable management team should excel at handling the full guest experience - from pre-arrival to post-departure - while ensuring owner-friendly terms in their contracts. These agreements should give you control over budgets, key staffing decisions, and vendor relationships [29]. Partnering with the right brand can also make a big difference. Strong brand affiliations help cut distribution costs by securing lower commissions with Online Travel Agencies (OTAs) and bring in demand through loyalty programs [1].

For full-service hotels, it’s wise to negotiate performance benchmarks and include termination clauses for underperformance. When it comes to branded residences, these properties can command 20–35% higher prices compared to non-branded equivalents, with yields reaching 6–8% in established markets like Dubai and Miami [1].

Identify Operational Improvements

Look for properties where operational adjustments, rather than just physical renovations, can unlock more value. Lifestyle hotels, for example, often generate up to 40% of their revenue from non-room offerings like wellness services, co-working spaces, or unique food and beverage concepts. These kinds of properties can be excellent candidates for repositioning [1]. Before jumping into renovations, consult hospitality experts to confirm market demand and streamline operational processes. This approach can save up to 15% on renovation costs [10].

Proactive management of your Capital Expenditure (CapEx) plan is equally important. Neglecting maintenance can quickly hurt your property’s competitive edge, while thoughtful upgrades to amenities or services can boost both your Average Daily Rate (ADR) and occupancy rates [28].

Use Technology for Deal and Portfolio Management

Managing the intricate operations of hospitality assets becomes much more efficient with the right technology. Tools like CoreCast offer an all-in-one platform to underwrite hospitality investments, track deals, and analyze portfolio performance. Its integrated mapping feature allows you to visualize your properties alongside competitors, and it generates branded reports to keep stakeholders updated without juggling multiple tools.

Unlike property management systems designed for daily operations and bookkeeping, CoreCast focuses on deal intelligence and portfolio strategy. You can track key metrics like RevPAR and occupancy across your portfolio, benchmark properties against local competitors, and forecast returns based on market trends. This centralized solution is particularly useful when managing diverse hospitality property types or assets spread across multiple markets.

Integrate Assets and Manage Portfolio Risk

Bringing hospitality assets into your portfolio requires a thoughtful approach to managing their unique risks. Unlike properties with long-term leases, such as office spaces or multifamily units, hospitality investments demand active oversight and strategic planning. By aligning these assets with proactive risk management, you can enhance your portfolio's resilience.

Balance Your Portfolio Across Asset Classes

Hospitality assets offer a distinct way to diversify your portfolio. Their performance is closely tied to factors like mobility and consumer sentiment, which often follow different economic cycles than other types of commercial real estate.

"Hospitality assets properties often serve diversification purposes in investment portfolios... because hospitality asset performance is largely driven by mobility and consumer sentiment, it often follows different cycles from office or industrial real estate." – Emma Näpänkangas, M.Sc. Student in Hospitality Management, EHL [1]

To manage risk effectively, spread your investments across various property types and service levels. Mixed-use developments, such as branded residences, can be particularly appealing. These properties often command 20–35% higher prices than their non-branded counterparts [1][3]. Diversify further by tiering your investments into Core (stable with lower returns), Value-Add (repositioning opportunities), and Opportunistic (higher-risk development) strategies [1][3]. Geographic diversity matters too - investing in both established urban centers and emerging markets can help mitigate risks from local economic downturns or regulatory changes [9][4].

Once your portfolio is well-balanced, stay vigilant by tracking performance and adapting to market shifts.

Track and Forecast Performance

Hospitality investments require monitoring both their physical condition and operational revenue. Key performance indicators (KPIs) like RevPAR (Revenue Per Available Room) and occupancy rates are essential metrics to track. Hospitality performance often mirrors macroeconomic indicators such as GDP, unemployment rates, and CPI, with almost no lag time [6]. Reviewing these metrics quarterly can help you refine your strategy.

Tools like CoreCast can make this process more efficient. CoreCast provides real-time insights into hospitality metrics, allowing you to benchmark properties against competitors, map local market trends, and forecast returns - all from a single platform. Unlike property management systems that focus on daily operations, CoreCast centers on deal intelligence and portfolio strategy, making it particularly useful for investors managing diverse property types.

Regularly updating your metrics and conducting stress tests can prepare you for market changes. For example, calculate how delayed exits or liquidity issues might impact your internal rate of return (IRR) [30]. Use tools like STR or local market data to ensure your properties remain competitive [1][6]. Additionally, keep a close eye on capital expenditures - underfunded reinvestments are a leading cause of hotel delinquency [5].

Frequent performance reviews should guide contingency planning and exit strategies.

Prepare Contingency and Exit Plans

Hospitality assets are especially vulnerable during market downturns due to their short lease periods - often nightly or weekly rather than multi-year terms [1]. This makes having a solid contingency plan crucial. Take advantage of the operational flexibility of hospitality properties by implementing dynamic pricing strategies and operational improvements to adapt quickly to market shifts [7].

To reduce risk, consider hybrid leases that combine fixed and variable components, and diversify revenue streams beyond room rates. For instance, food and beverage services, spas, retail spaces, and event hosting can significantly boost income. Lifestyle hotels demonstrate this potential, with up to 40% of their revenue coming from non-room sources [1].

Your exit strategy should be in place from the moment of acquisition. Options include traditional sales, refinancing to recover initial capital (e.g., the BRRRR strategy), or adaptive reuse conversions [1][8]. Partnering with established brands or skilled operators can provide added security, leveraging demand and loyalty programs [1][2]. Additionally, take advantage of tax benefits like accelerated depreciation on furniture and fixtures to improve cash flow during your holding period [7]. When planning your exit, consider capital market cycles rather than focusing solely on the property's individual performance [30].

Final Checklist for Hospitality Diversification

Before investing in hospitality real estate, use this checklist to ensure your decisions are backed by solid data. Start by aligning your investment choices with your objectives and assembling an advisory team with expertise in hospitality.

Perform a detailed market analysis to confirm that the market positioning and lease structures align with your strategic goals. Make sure the selected brand and operator have a proven ability to turn revenue into strong net operating income. This step builds on earlier evaluations of operational and financial performance.

Account for ongoing capital expenditures to maintain competitiveness, and reduce localized risks by diversifying across different property types and markets.

Leverage technology to simplify your process. Tools like CoreCast bring together underwriting, pipeline tracking, competitive mapping, and portfolio analysis in one platform. This kind of integration allows you to benchmark performance in real time, predict returns, and generate branded reports for stakeholders - all within a single system. Using such data-driven tools is a critical part of the process.

Finally, establish contingency and exit plans before making any acquisitions. Hospitality assets are particularly vulnerable during economic downturns due to their shorter lease periods, so it's important to prepare multiple exit strategies. These could include traditional sales, refinancing, or even adaptive reuse conversions. By following this checklist and utilizing the right tools, you'll be better equipped to make informed decisions that strengthen both returns and portfolio stability.

FAQs

How do I choose between core, value-add, and opportunistic hotel deals?

When deciding among core, value-add, and opportunistic hotel deals, your choice should align with your investment goals, risk appetite, and how hands-on you want to be.

- Core deals: These are the safer bets - properties that already generate steady income with little need for active management. They’re ideal if you’re looking for consistent cash flow without much hassle.

- Value-add deals: These require some effort, like renovations or operational tweaks, but they come with the promise of higher returns. The trade-off? A bit more risk and involvement.

- Opportunistic deals: These are high-risk, high-reward options. Think distressed or underperforming properties that need major overhauls or strategic shifts. While they carry the most uncertainty, they also offer the chance for big payoffs if executed well.

Each type caters to different investor profiles, so it’s all about finding the right balance for your strategy.

Which hotel metrics matter most when underwriting a property?

When assessing a hotel property, two key metrics stand out: occupancy and Average Daily Rate (ADR).

- Occupancy measures the percentage of rooms filled at any given time. It's a critical indicator of demand and helps gauge the revenue potential of the property.

- ADR, on the other hand, reveals the average price guests pay per room. This figure directly influences the hotel's profitability.

By analyzing these metrics together, you can get a clear picture of the property's financial health and its potential as an investment.

What market and regulatory risks can hurt hotel returns the fastest?

Market and regulatory risks can significantly affect hotel profitability. These risks often stem from revenue fluctuations caused by seasonal and cyclical changes in occupancy and room rates. Additionally, economic uncertainty and evolving travel preferences play a major role. Such shifts can result in steep drops in ADR (Average Daily Rate) and RevPAR (Revenue Per Available Room), particularly during challenging periods like economic recessions or global crises, such as the COVID-19 pandemic.