How Digital Twins Optimize Capital Deployment

Digital twins are transforming how real estate professionals allocate capital by providing a real-time digital replica of physical assets. These systems integrate IoT data, 3D models, and analytics to improve decision-making, reduce costs, and increase efficiency. Key benefits include:

- Cost Savings: Reduce operating costs by up to 35% and extend equipment lifespans by 15–20%.

- Predictive Maintenance: Replace reactive repairs with data-driven strategies, cutting maintenance expenses by 8–30%.

- Scenario Simulations: Test investment plans virtually to avoid costly mistakes.

- Portfolio Insights: Identify underperforming properties and optimize reinvestment.

For example, CapitaLand cut annual capital expenditures by 16.4% using digital twins, while Matterport helped BMO save over 6,000 hours and significant travel costs during property assessments. With the digital twin market projected to grow to $90 billion by 2032, this technology is becoming an essential tool for smarter capital deployment.

What Digital Twins Mean for Real Estate

Digital Twins Explained

A digital twin is a dynamic, virtual replica of a physical building that integrates IoT sensor data, 3D visuals, and historical information [7][8]. Unlike static architectural plans or traditional Building Information Modeling (BIM), digital twins are "living" models, constantly updated with data from HVAC systems, energy meters, occupancy sensors, and other building systems [8][9]. This real-time data flow creates an accurate virtual model that supports smarter and more efficient asset management.

The process of creating a digital twin combines physical and digital data through tools like high-fidelity 3D scanning, Lidar mapping, and real-time CRE analytics. IoT sensors embedded in the building continuously feed data into cloud-based analytical models. This setup provides what industry experts call a "single pane of glass" view - essentially consolidating data from disparate systems like elevators, lighting, and security into one cohesive digital environment [7][9].

"Digital twins are much more about what is 'under the hood,' namely the accurate digital representation of how a building operates, connecting all the data across multiple systems into a living model of the mechanics of a physical building."

- Dean Hopkins, COO, Oxford Properties [9]

By integrating these systems, digital twins tackle common challenges in building management and enable better decision-making around capital investments.

Why Real Estate Professionals Need Digital Twins

Digital twins offer real estate professionals a powerful way to consolidate fragmented data and gain a complete picture of how assets perform. Currently, only 10% of real estate executives report being able to measure the ROI of their digital initiatives [7].

By unifying floor plans, equipment manuals, maintenance logs, and sensor data into one platform, digital twins reduce the need for manual site visits and minimize planning errors [2]. They also allow for simulations - such as testing HVAC upgrades or reconfiguring spaces - before committing resources, ensuring smarter allocation of capital [2][8]. Given that studies reveal 30% to 40% of office space goes unused during a typical workday [8], real-time occupancy tracking through digital twins can identify and address these inefficiencies.

"Commercial real estate isn't a single homogenous entity... To capture these opportunities, asset owners and investors must understand the nuances of each asset, and to do that, they need robust, granular data at asset level."

- Anna Emmison, Partner, Knight Frank Valuation & Advisory [6]

sbb-itb-99d029f

How to Use Digital Twins for Better Capital Deployment

Step 1: Connect Data Sources and IoT Sensors

The foundation of a digital twin lies in combining static design data with live IoT inputs. Static elements include BIM files, architectural layouts, and electrical schematics, while dynamic data is sourced from IoT sensors monitoring systems like HVAC, energy use, occupancy, and security [7][10].

In many cases, building systems like HVAC, lighting, and elevators operate independently, creating data silos [9]. Digital twins eliminate these barriers by centralizing all data streams into integrated real estate platforms that process and analyze information in real time [11]. To ensure compatibility across different systems and vendors, consider using a shared framework like RealEstateCore, which standardizes communication between disparate assets [9].

Technologies like 3D laser scanning and LiDAR mapping can capture highly accurate spatial data, forming the virtual structure that your IoT feeds rely on [8]. For example, in January 2022, the City of Las Vegas partnered with Cityzenith to create a digital twin of its downtown area, covering 4.3 square miles. This system uses IoT sensors to track traffic, air quality, noise, and carbon emissions, improving urban planning efforts [11].

Once data streams are fully integrated, you can use the digital twin to simulate investment scenarios and make informed decisions about capital allocation.

Step 2: Run Investment Scenario Simulations

With a functioning digital twin, you can explore "what-if" scenarios before committing capital. Start by creating a baseline model of your current asset, then test variables like HVAC upgrades, space redesigns, or lighting improvements [6]. Using AI analytics, these simulations can predict outcomes such as energy savings, CapEx requirements, and environmental impacts [8][7].

In 2022, CapitaLand Integrated Commercial Trust in Singapore implemented digital twins in three major malls. By focusing on mechanical systems and shared spaces, they reduced annual CapEx by 16.4% and emergency repair costs by 22% within 18 months, achieving payback in just 14 months [4]. Similarly, Scentre Group in Australia used digital twins across its Westfield properties, cutting overall CapEx by 13.7% in the first year [4].

To streamline stakeholder approval, use 3D photorealistic walk-throughs to showcase proposed changes and their costs [1]. By linking your digital twin with property management and financial systems, you can ensure that simulation results directly inform your capital planning process [4].

Step 3: Use Predictive Maintenance

Digital twins enable a shift from reactive maintenance to condition-based strategies, replacing parts only when performance data signals a need [4][8]. IoT sensors track metrics like vibration, power usage, and temperature, identifying performance issues early to prevent costly failures [8][3]. This approach can extend asset lifespans by 15% to 20% and cut maintenance expenses by 8% to 30% [4][8].

Since maintenance and utilities typically account for 27% of real estate operating costs [2], keeping equipment in peak condition reduces emergency repairs, which are often more expensive due to unplanned downtime and rush labor [4].

Focus on high-impact systems - such as HVAC, elevators, and electrical grids - for your initial predictive maintenance efforts, as these tend to deliver the quickest returns [4]. Start small with a pilot project in one building to demonstrate value, then scale the approach across your portfolio [2].

In addition to maintaining assets, real-time monitoring across properties provides insights that further refine your capital strategies.

Step 4: Track Portfolio Performance

Digital twins consolidate data across your portfolio, offering real-time insights that help optimize reinvestment and capital distribution. By benchmarking and analyzing performance, you can identify underperforming properties and prioritize investments where they’ll have the most impact [11][7]. This visibility also helps measure the ROI of digital initiatives - something only about 10% of real estate executives currently achieve [7].

For example, a commercial real estate firm in London used JLL's digital twin services to monitor workspace utilization. Real-time data revealed that 30% to 40% of office space was underused, leading to layout changes that maximized efficiency without increasing costs [8]. Similarly, SoFi Stadium in Los Angeles employed the WillowTwin platform to integrate 30 to 40 technology systems into a single interface. This allowed management to oversee operations in real time, improving both project coordination and visitor experiences [11].

"Willow provides a centralized home for your building data, so users can compare and benchmark their assets, in real time."

- Joshua Ridley, CEO, Willow [11]

CoreCast: Supporting Digital Twin Implementation

Features That Support Digital Twins

CoreCast is a real estate intelligence platform designed to unify IoT sensor data, building management system (BMS) inputs, and historical records into a single interface. This creates a "golden thread" of information that ensures transparency throughout a building's lifecycle, from design to daily operations [12].

The platform excels at real-time data integration, pulling live feeds from IoT sensors that track factors like temperature, occupancy, and equipment runtimes. This keeps digital twin models aligned with the physical assets they represent [2][3]. CoreCast also facilitates detailed portfolio analysis and real-time tracking of project pipelines, providing the insights needed to make informed investment decisions. For example, users can benchmark performance metrics across multiple properties, identify underperforming assets, and prioritize capital allocations to maximize returns [3].

Its pipeline tracking feature is particularly valuable for monitoring construction or renovation projects. By comparing real-time progress to original plans, CoreCast helps detect delays or specification mismatches early, allowing for adjustments that can prevent budget overruns [2]. Additionally, the platform integrates simulations into capital planning, enabling users to predict energy consumption and financial outcomes before committing resources [1][7].

All these tools work together to seamlessly align with broader capital deployment strategies, offering a comprehensive approach to real estate management.

How CoreCast Helps Real Estate Professionals

CoreCast goes beyond its technical features to simplify decision-making for real estate professionals. It combines underwriting, pipeline management, portfolio analysis, and stakeholder communication into one cohesive system. Users can underwrite various asset classes, track deals through every stage, view properties and competitive landscapes on an integrated map, and generate tailored reports for stakeholders - all without leaving the platform.

The platform’s customized reporting capabilities stand out, offering 3D visualizations paired with budget data. This allows stakeholders to virtually "walk through" proposed upgrades while reviewing associated costs, making it easier to gain approval for projects [1]. By integrating with property management systems and third-party tools, CoreCast ensures that insights from digital twin simulations directly inform capital planning and resource allocation [4].

In short, CoreCast equips real estate professionals with the tools to make smarter, faster decisions while keeping all relevant data at their fingertips.

How JLL & CRB use Digital Twins

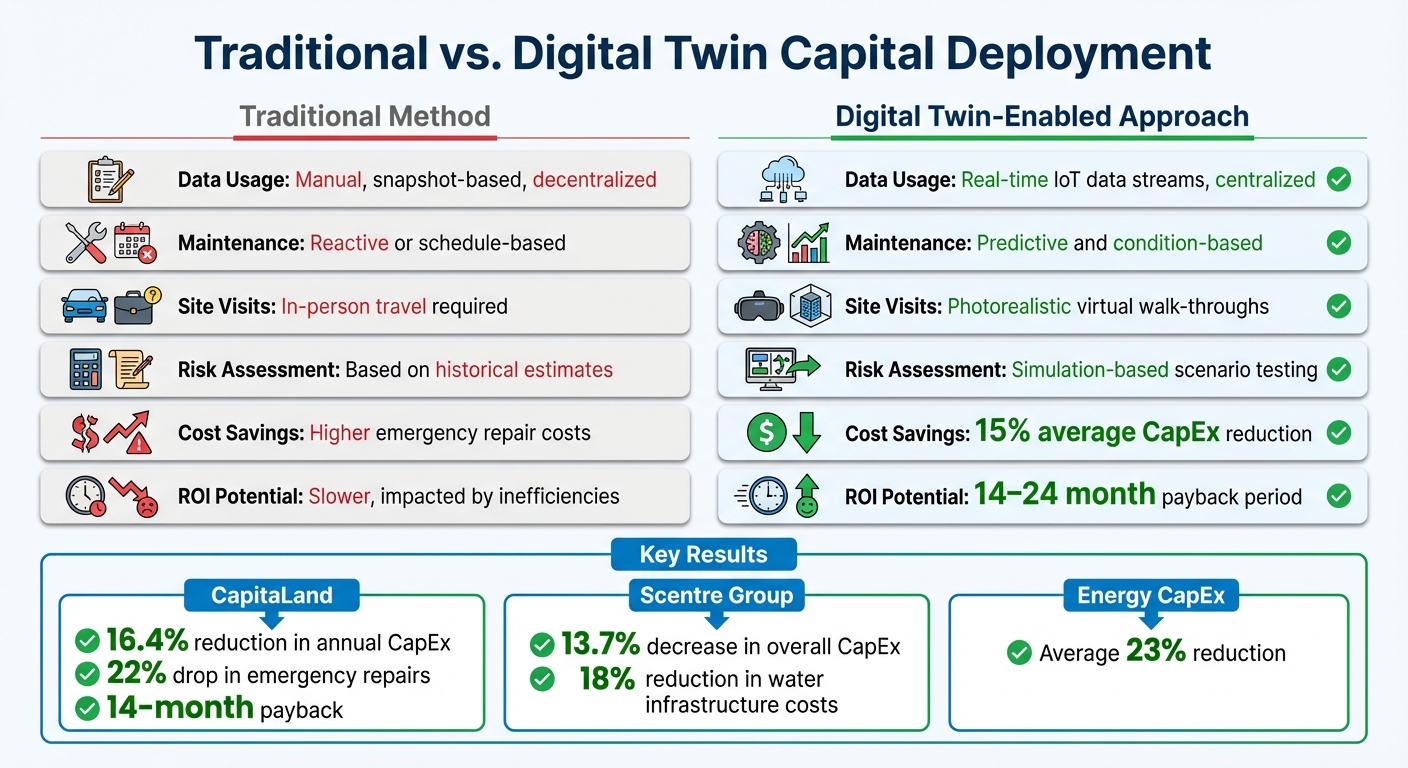

Traditional vs. Digital Twin Capital Deployment Methods

Traditional vs Digital Twin Capital Deployment Methods in Real Estate

When it comes to managing capital deployment, the shift from traditional methods to digital twins is a game-changer. Traditional approaches rely heavily on manual processes, outdated snapshots, and scattered data. This means decision-making often depends on static spreadsheets, manual site visits, and historical data stored in disconnected systems. The result? Planning errors, delays, and inefficiencies. Maintenance under this model is reactive - fixing things only when they fail - or rigidly scheduled, replacing equipment based on age rather than its actual performance [1][4].

Digital twins, on the other hand, eliminate these inefficiencies. By creating a real-time virtual replica of properties, they integrate IoT sensors that continuously feed data into a centralized platform. This allows for constant monitoring of equipment health, virtual testing of renovation scenarios, and even predicting failures before they happen [4][8]. In-person site visits can also be replaced with photorealistic virtual walk-throughs, cutting down on travel time and costs [1].

The results speak for themselves. For example, CapitaLand Integrated Commercial Trust in Singapore adopted digital twins in 2022 across three flagship malls. The outcome? A 16.4% reduction in annual capital expenditures and a 22% drop in emergency repair costs. The project paid for itself within 14 months, thanks to operational savings [4]. Similarly, Scentre Group applied digital twins to its Westfield properties in Australia, achieving a 13.7% decrease in overall capital expenditures and an 18% reduction in water infrastructure costs through better leak detection [4].

Comparison Table

Here’s a quick look at how the two approaches stack up:

| Feature | Traditional Method | Digital Twin–Enabled Approach |

|---|---|---|

| Data Usage | Manual, snapshot-based, decentralized [1] | Real-time IoT data streams, centralized [4][8] |

| Maintenance | Reactive or schedule-based [4] | Predictive and condition-based [4][8] |

| Site Visits | In-person travel required [1] | Photorealistic virtual walk-throughs [1] |

| Risk Assessment | Based on historical estimates [4] | Simulation-based scenario testing [4][2] |

| Cost Savings | Higher emergency repair costs [4] | 15% average CapEx reduction [4] |

| ROI Potential | Slower, impacted by inefficiencies [1] | 14–24 month payback period [4] |

The advantages go even further. Energy-related capital expenditures drop by an average of 23%, as systems optimize HVAC and lighting based on real occupancy patterns rather than assumptions [4]. These improvements are already transforming operations across commercial, retail, and mixed-use properties.

Common Challenges and How to Overcome Them

Adopting digital twins comes with its share of challenges. A common misstep is treating the technology as a flashy visual tool rather than a data-driven system for informed decision-making. When teams view it solely as a marketing asset, the full potential of digital twins is never realized. The fix? Start with a clear focus on outcomes instead of visuals. Identify specific business goals - like cutting down on site visit costs or reducing emergency repair expenses - before diving into development[13]. This outcome-first approach lays the groundwork to tackle hurdles related to integration, cost, and adoption.

One major obstacle is connecting diverse and fragmented data sources. Without a unified system, the data remains siloed and ineffective. A unified, API-driven approach is key here. Interestingly, only 33% of commercial real estate companies feel equipped with the skills to operate in a digitally transformed environment[7]. The solution lies in multimodal data integration from the outset. Use APIs to link your digital twin with existing tech stacks and invest in platforms that consolidate fragmented data into a single source of truth[5].

Another challenge is the high upfront cost, which can be daunting, especially for smaller firms. Implementing digital twins demands specialized expertise and significant computing power[3]. However, the financial returns can be compelling. For instance, CapitaLand Integrated Commercial Trust invested around $3.2 million (SGD 4.2 million) to implement digital twins across three malls in 2022, and the investment paid off within just 14 months[4]. Starting small - like piloting the technology on high-impact systems such as HVAC or elevators - can deliver quick wins. Predictive maintenance in these areas has been shown to extend equipment lifespan by 15–20%[4].

Team engagement is another critical factor. Without early buy-in from sales, leasing, and operations teams, adoption can falter. If the tool doesn’t address their daily needs, teams may revert to familiar methods like PDFs and PowerPoints. A practical way to counter this is by involving end-users in early prototypes and providing straightforward, one-page playbooks. Designating internal champions to demonstrate the tool’s benefits can also help win over skeptics[13]. As Radek Zdunek from Chameleon Interactive points out:

"The real problem is how projects are scoped, implemented and adopted"[13].

Lastly, many organizations fail to define clear ROI metrics before launching a digital twin. To avoid this pitfall, establish key performance indicators - such as reductions in site visit costs or fewer emergency repairs - from the start. A phased rollout plan can also help manage budgets effectively. Begin with core buildings and essential features, saving additional functionalities for later phases[13]. This approach not only justifies the investment but also ensures the strategy aligns with smarter capital allocation.

Conclusion

Digital twins are reshaping how capital is deployed by combining real-time data with actionable insights. For real estate professionals, this means smarter, more precise capital allocation. By creating a centralized digital replica of a portfolio, you can virtually test renovation plans, forecast equipment failures, and monitor energy usage - all before committing funds. Case studies back this up, showing an average 15% reduction in CapEx and payback periods as short as 14 months[4].

This approach transitions capital deployment from reactive to proactive. For example, CapitaLand Integrated Commercial Trust lowered emergency repair costs by 22% and cut energy use by 9.8% within 18 months of adopting digital twins[4]. Similarly, Scentre Group reduced water-related infrastructure costs by 18% through better leak detection[4]. These results highlight the financial benefits of implementing digital twins with clear goals in mind.

CoreCast supports this transformation with its end-to-end intelligence platform. It consolidates portfolio data, tracks deal pipelines, and enables advanced analysis. While not a property management system, CoreCast integrates seamlessly with existing tools, providing that essential "single source of truth" for capital planning. Its ability to underwrite diverse asset classes, perform portfolio analyses, and generate polished reports for stakeholders makes it a valuable addition to digital twin strategies. With CoreCast, you can turn raw data into profitable investment decisions.

Starting small is key. Focus on a pilot project targeting high-impact systems to see early returns. Set measurable goals, like cutting site visit costs or extending equipment lifespan by 15–20%[4], to guide your efforts. With the global digital twin market expected to exceed $90 billion by 2032[3], early adopters are already gaining an edge by optimizing capital deployment.

The real challenge isn’t whether to adopt digital twins - it’s how quickly you can integrate them. With a solid platform and a clear plan, you can transform scattered data into insights that drive smarter, more profitable capital decisions across your portfolio.

FAQs

What data do I need to build a digital twin for a building?

To build a digital twin for a building, you’ll need precise data that captures its structure, systems, and performance. This typically involves collecting information from sensors monitoring areas like electrical systems, mechanical components, and environmental conditions. Additionally, operational metrics and real-time telemetry play a crucial role.

The process includes several key steps:

- Identifying relevant data sources: Pinpoint where the data is coming from, such as IoT devices, building management systems, or external databases.

- Ensuring data quality: Accurate and reliable data is essential for the virtual model to function effectively.

- Integrating the data: Combine and process the information to create a virtual model that mirrors the building’s behavior. This allows for better analysis and system improvements.

When done right, the digital twin becomes a powerful tool for understanding and improving building performance.

How do I prove the ROI of a digital twin before spending capital?

To justify the investment in a digital twin, it's crucial to show how it can directly impact key business metrics. Highlight its potential to cut operating costs, improve decision-making, and boost asset performance. Use tools like real-time data, simulations, and scenario analyses to illustrate these benefits clearly.

Back your case with real-world examples. Case studies from similar projects that showcase cost savings and operational efficiency can make a strong impact. For instance, share specific numbers or outcomes - like a percentage reduction in maintenance costs or increased uptime - that demonstrate measurable results. Focusing on tangible benefits will help build a persuasive argument for adopting the technology.

What’s the best first digital twin pilot for a small portfolio?

For a smaller portfolio, begin with one property or a small cluster of properties. Starting small keeps things manageable and allows you to clearly see the benefits, such as better facility management, predictive maintenance, and valuable operational insights. This straightforward approach reduces complexity and showcases real, measurable advantages - making it a smart way to get started.