End-to-End Real Estate Platforms: Key Features

End-to-end real estate platforms simplify complex workflows by combining underwriting, deal tracking, mapping, portfolio performance tracking, and stakeholder communication into one system. These platforms eliminate the need for juggling multiple tools, reduce inefficiencies, and provide real-time data integration through property management software like Yardi and AppFolio. CoreCast, a new entrant in this space, offers AI-powered tools for underwriting, pipeline tracking, and portfolio management, with features like live stakeholder portals, dynamic mapping, and conversational interfaces. Pricing starts at $50 per user per month, with advanced plans offering more capabilities.

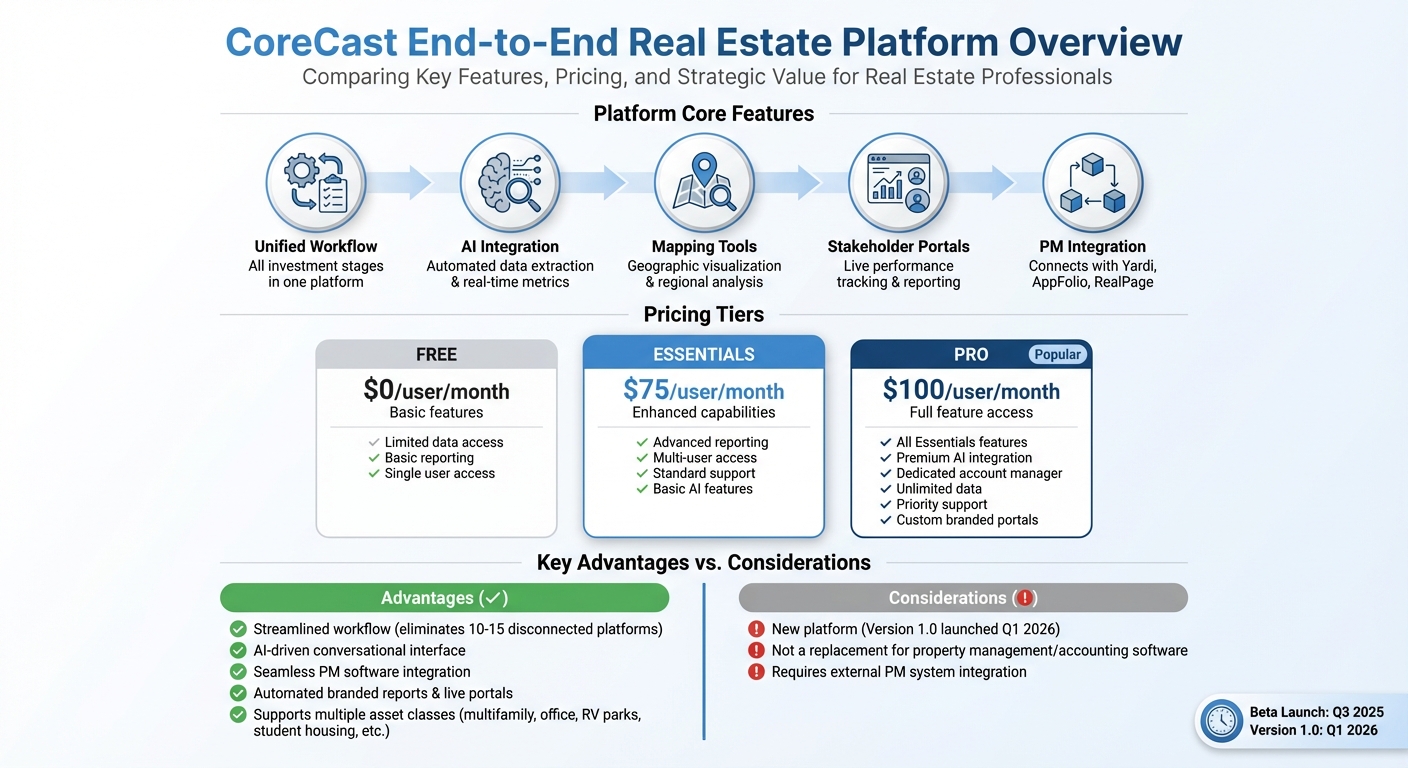

Key highlights:

- Unified Workflow: All stages of real estate investment in one platform.

- AI Integration: Automates data extraction and updates metrics in real-time.

- Mapping Tools: Visualize deals geographically and analyze regional trends.

- Stakeholder Portals: Real-time performance tracking and automated reporting.

- Pricing: Starts at $50/month with tiered plans for different needs.

CoreCast launched its Version 1.0 in early 2026 and focuses on improving efficiency for investment teams while integrating with existing property management systems.

CoreCast Real Estate Platform Features and Pricing Tiers Comparison

1. CoreCast

Underwriting and Asset Class Support

CoreCast handles underwriting for a wide range of asset classes, from multifamily and office properties to niche types like RV parks and student housing. It supports various scenarios, including stabilized, value-add, ground-up developments, and mixed-use projects.

What makes CoreCast stand out is its conversational AI interface. You can adjust assumptions on the fly - just ask it to "layer in stabilized assumptions" or "run a downside case with 10% lower rents." As Jared Stoddard, CoreCast's founder, explains:

"With the Output View, you're no longer modeling in the dark. You're seeing the consequences of every decision as you make it." [1]

The platform eliminates tedious manual data entry by integrating with leading property management software. Whether you upload a PDF of trailing-12 financials or a photo of a rent roll, CoreCast's AI extracts the data directly into your underwriting model. This ensures you're working with real performance data, not rough estimates.

Beyond underwriting, CoreCast simplifies deal tracking, keeping your workflow organized at every stage.

Pipeline Tracking and Deal Stages

CoreCast offers a unified pipeline tracker that lets you monitor deals from sourcing to closing. Its AI-powered document parsing extracts data from uploaded files, so you don’t have to manually retype numbers from broker packages. Considering that real estate professionals often juggle 10 to 15 different platforms to manage operations [3], CoreCast consolidates these tasks into one streamlined pipeline tracking system.

The platform’s Output View dynamically updates key metrics like IRR, equity multiples, cash-on-cash returns, and DSCR as you tweak assumptions. For example, adjust the exit cap rate or CapEx, and you'll instantly see how it impacts levered IRR - no need to update multiple spreadsheets.

Once your deals are tracked, CoreCast’s Map View adds a layer of spatial intelligence to guide your strategy.

Mapping and Competitive Analysis

CoreCast’s Map View visualizes deals on a geographic scale, allowing you to filter by product type, risk profile, sponsor, or stage. This helps you manage regional exposure more effectively. You can even use conversational queries for spatial analysis - ask to see all deals in a specific region with an IRR over 15% and certain leverage constraints, and the platform will surface the relevant opportunities.

Future updates aim to integrate data from third-party sources like CoStar and RealPage, enabling live benchmarking against your portfolio. CoreCast is also working on AI deal review assistants that can analyze Offering Memorandums and flag opportunities with a red/yellow/green signal based on market trends and your firm’s preferences.

Portfolio Analysis and Stakeholder Management

After closing deals, CoreCast transitions into portfolio mode. It offers live stakeholder portals where LPs, lenders, and JV partners can view real-time performance metrics and distributions. This eliminates the hassle of manual quarterly updates. Each stakeholder gets a customized view - LPs can track distributions and overall performance, while lenders monitor compliance and debt coverage ratios.

CoreCast also generates branded reports tailored to stakeholders. These reports are ready to send out directly, saving time and ensuring clear communication.

Integrations and Future Scalability

CoreCast integrates seamlessly with property management systems to pull live financial data. It’s not a property management tool itself but instead acts as an intelligence platform that consolidates data for underwriting, pipeline tracking, and portfolio analysis. Future plans include automated construction draws, AI-generated investor reports, and predictive sourcing tools that identify opportunities based on market trends.

Launched in beta in Q3 2025, CoreCast’s Version 1.0 is set for release in Q1 2026. Pricing starts at $50 per user per month, with tiered plans to suit different needs: Free, Essentials at $75 per user per month, and Pro at $100 per user per month.

sbb-itb-99d029f

The 14 Best Real Estate Investing Tools for 2024: What You Really Need to Succeed

2. Other Real Estate Platforms

CoreCast may offer a robust end-to-end solution, but it's not alone in the game. Many modern real estate platforms have adopted similar approaches to simplify underwriting, tracking, mapping, and stakeholder management - leaving behind the patchwork of tools once common in the industry.

Underwriting and Asset Class Support

Today's platforms come equipped with underwriting tools tailored to different asset classes. For example, they can handle specifics like unit mixes for multifamily properties, bay configurations for industrial spaces, or anchor tenant tracking for retail properties [5]. Many also allow side-by-side comparisons of financial models, enabling teams to upload multiple scenarios and evaluate how deals perform under different financial assumptions [4][2]. Some platforms even include extensive databases of comparable properties, giving users quick access to benchmark data for deal analysis [6].

Pipeline Tracking and Deal Stages

Centralized pipeline management is now a staple feature, providing real-time visibility into deals across regions, property types, and risk profiles [4]. Automated dashboards track everything from capital deployment to deals sourced and time-to-close, all without the need for manual updates [4][2]. This unified approach eliminates the inefficiency of using multiple disconnected tools, offering a clear view of deal flow and progress.

Mapping and Competitive Analysis

Modern platforms integrate geographic and demographic data - like school districts, zoning boundaries, transit access, and income levels - into their mapping tools [9][8]. This allows users to conduct precise benchmarking and gain deeper market insights. By combining mapping capabilities with comparable property databases, teams can easily identify regional trends and uncover new opportunities [6].

Portfolio Analysis and Stakeholder Management

Once a deal closes, these platforms seamlessly shift into portfolio management. They automate report generation and performance tracking, reducing the need for manual updates [7]. Features like automated document creation can produce investment memos, letters of intent, and branded reports for stakeholders, saving time and ensuring consistency [2][7]. This approach keeps everyone - team members and investors - on the same page while cutting down on administrative work.

Integrations and Future Scalability

Integration options differ across platforms. Some allow users to continue working with their existing Excel models, integrating them into the system while benefiting from cloud-based storage [6]. Others focus on API connectivity, linking internal systems with external market data sources [8]. These features minimize manual data transfers, making it easier for firms to manage large volumes of deals efficiently.

Pros and Cons

The choice of platform hinges on what your firm values most in its real estate operations. CoreCast offers a comprehensive solution that simplifies underwriting, pipeline tracking, mapping, portfolio analysis and risk assessment, and stakeholder communication - all within a single system. This design tackles the industry's growing issue of "tech fatigue", which stems from juggling multiple disconnected systems [10][11]. By integrating these functions, CoreCast provides a seamless experience tailored to real estate professionals. Its conversational interface allows you to tweak underwriting assumptions on the go, while real-time updates to metrics like IRR, equity multiples, and DSCR eliminate the need for manual recalculations. For those focusing on specific deals, using a commercial property ROI estimator can provide additional granular insights.

Here’s a look at CoreCast’s standout features and some considerations about its current stage.

CoreCast's Key Advantages

- Streamlined Workflow: Combines various processes into one platform, removing the hassle of managing fragmented systems connected by Single Sign-On [10].

- AI-Driven Tools: The conversational interface makes it easy to adjust assumptions dynamically, with instant updates to critical metrics.

- Seamless Integration: Works directly with property management tools like Yardi, AppFolio, and RealPage to access live financial data.

- Enhanced Communication: Produces branded reports and offers live portals for LPs, lenders, and JV partners, simplifying stakeholder updates.

- Versatile Asset Support: Accommodates a range of property types, from multifamily units to specialized assets like RV parks and cold storage facilities.

Considerations

- New to the Market: CoreCast launched its Version 1.0 in early 2026, meaning it’s still establishing itself in the industry.

- Functionality Gaps: It’s not designed to replace property management or accounting software, so firms will still need separate tools for bookkeeping.

- Integration Needs: The platform relies on connections with external property management systems to deliver its full potential.

For teams looking for an all-in-one platform that covers underwriting through to stakeholder communication, CoreCast offers a compelling option. Its unified system directly addresses the need for streamlined operations, reducing administrative burdens and serving as a single source of truth for investment teams.

Conclusion

CoreCast addresses the challenges of fragmented workflows by bringing together underwriting, deal tracking, portfolio analysis, mapping, and stakeholder reporting into a single cohesive platform. By eliminating the need for multiple disconnected tools, it tackles inefficiencies that have long hindered traditional processes. Its seamless integration with property management systems like Yardi and AppFolio ensures a smooth flow of data from acquisition to asset management.

For professionals juggling disparate workflows, CoreCast simplifies tasks such as underwriting, portfolio analysis, and stakeholder communication. It supports a wide range of asset classes - from multifamily properties to more specialized investments like RV parks and cold storage. Features like AI-powered document parsing and automated stakeholder portals not only save time but also enhance operational transparency. As Mitchell Rice, Principal at Elkstone Capital, noted, CoreCast provided "the expert financial analysis support I needed to strengthen my efforts" during capital raising. This unified approach is paving the way for further advancements.

Since its Version 1.0 launch in early 2026, CoreCast has outlined a roadmap that includes AI-driven automation, construction management tools, and advanced reporting capabilities. By positioning itself as a single source of truth for investment teams, CoreCast aligns with the industry's growing preference for integrated SaaS solutions that minimize administrative burdens and boost efficiency.

FAQs

What data sources can an end-to-end real estate platform integrate with?

An end-to-end real estate platform like CoreCast connects seamlessly with multiple data sources to streamline operations and improve decision-making. These sources include CRM systems, property management software, analytics tools, APIs, market data providers, lease and sales databases, and financial metrics such as NOI (Net Operating Income), cap rates, DSCR (Debt Service Coverage Ratio), and LTV (Loan-to-Value) ratios. By integrating these elements, the platform ensures data is standardized in real time, minimizes errors, and empowers more informed investment strategies.

How does AI reduce manual work in underwriting and deal tracking?

AI simplifies underwriting and deal tracking by automating repetitive tasks such as data collection, validation, and reporting. This not only saves time but also minimizes errors while improving precision. Additionally, it delivers real-time insights into deal progress and property details, helping teams make decisions more efficiently.

Can CoreCast replace property management or accounting software?

CoreCast is an all-in-one real estate intelligence platform built for data analysis, forecasting, and portfolio management. While it offers tools to simplify real estate workflows and deliver actionable insights, it’s important to note that CoreCast is not designed to replace property management or accounting software. Tasks like property oversight or bookkeeping fall outside its intended use. Instead, CoreCast focuses on helping users make informed decisions and optimize their real estate strategies.