Predicting Tenant Churn With Analytics Tools

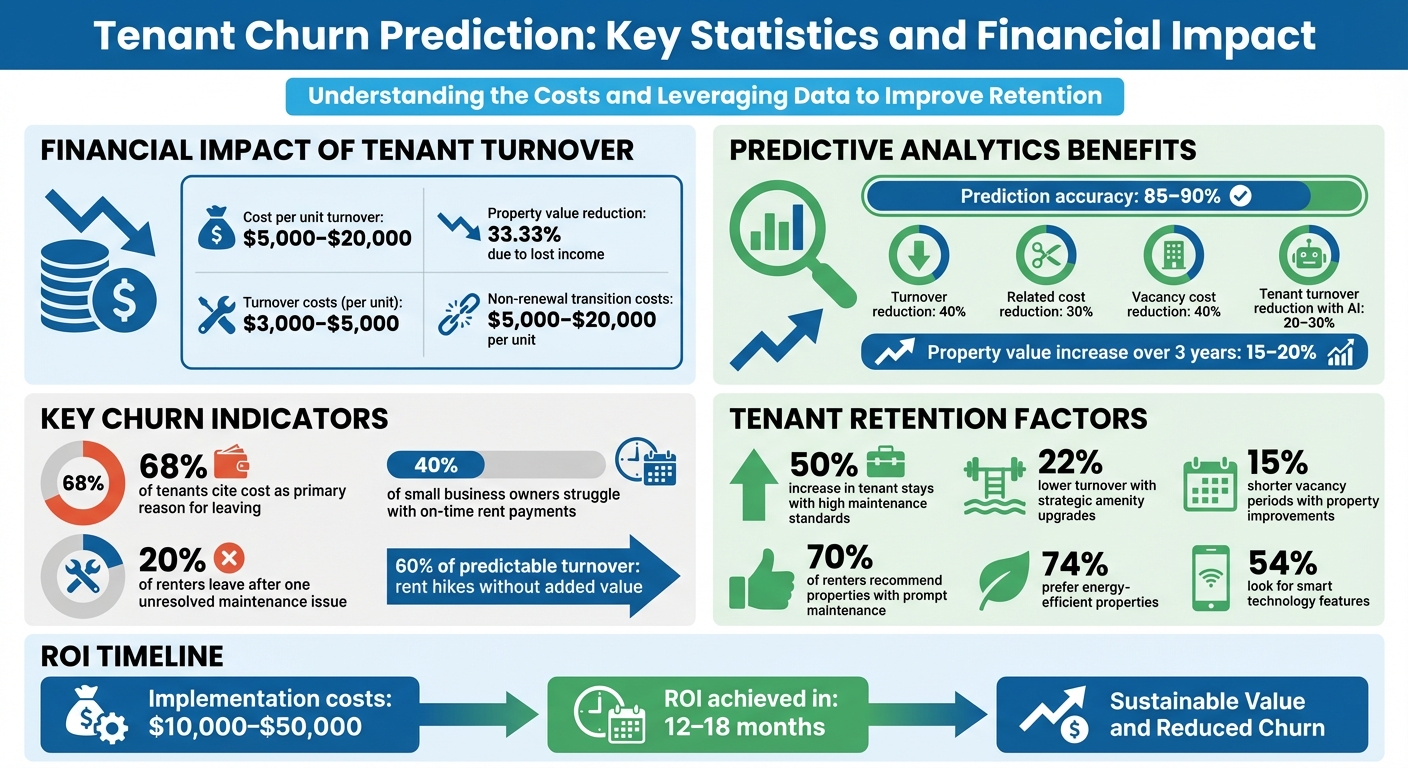

Tenant churn is expensive. When tenants leave, landlords face lost rental income, costly renovations, and marketing expenses - amounting to $5,000–$20,000 per unit. Predictive analytics offers a solution, identifying at-risk tenants with up to 85% accuracy. By analyzing payment patterns, maintenance requests, and amenity usage, property managers can act early to retain tenants and save costs.

Key Takeaways:

- Tenant turnover can reduce property value by 33.33% due to lost income.

- Predictive tools cut turnover by 40% and reduce related costs by 30%.

- Early warning signs include late payments, unresolved maintenance, and low amenity use.

- Platforms like CoreCast integrate data to provide real-time insights, lease renewal probabilities, and market comparisons.

With data-driven strategies, landlords can minimize vacancies, stabilize cash flow, and improve tenant satisfaction.

Tenant Churn Prediction: Key Statistics and Financial Impact

Why Tenants Leave: Main Causes of Churn

Understanding why tenants choose to leave is crucial for creating effective strategies to predict and reduce churn. The reasons typically fall into three categories: financial pressures, property-related issues, and tenant behavior. By analyzing these areas, property managers can identify warning signs and take action before it's too late.

Economic and Market Conditions

Financial factors play a significant role in tenant decisions. In fact, around 68% of tenants cite cost as their primary reason for renewing or leaving a lease [1]. When rental rates rise above local market averages, tenants often start exploring other options. This sensitivity to pricing becomes even more pronounced during economic downturns, when businesses face shrinking budgets or closures.

The structure of rent payments can also cause strain. Many small businesses operate on seasonal or irregular cash flows, but traditional rent models require full payment at the start of each month. This mismatch often leads to what experts call a "payment delays spiral", where one missed payment snowballs into mounting debt and, eventually, lease termination [5]. Over 40% of small business owners struggle to pay rent on time every month [5].

On top of rent, rising operating costs put additional pressure on tenants. Inflation drives up the price of labor, goods, and supplies, cutting into profit margins [5]. High interest rates make refinancing difficult, while stricter lending standards limit access to much-needed capital [4]. In retail settings, the departure of an anchor tenant can create a domino effect, reducing foot traffic for neighboring businesses and increasing their likelihood of leaving [7].

But financial challenges aren’t the only factor driving tenant churn - property-specific issues also play a major role.

Property-Specific Factors

The quality of property management can make or break tenant satisfaction. For example, properties with high maintenance standards see tenant stays increase by 50%, while 20% of renters leave after just one unresolved maintenance issue [8]. Speed matters, too - emergency repairs should be addressed within 2 hours, urgent issues within 24 hours, and routine maintenance within 3–7 days [8]. Properties with responsive management are more likely to earn tenant loyalty, with 70% of renters recommending properties where maintenance is handled promptly [8].

Investing in amenities can also reduce tenant turnover. Strategic upgrades lower turnover by 22% and shorten vacancy periods by 15% [8]. However, poorly designed or underused amenities may signal deeper problems. For instance, low usage of facilities like gyms or pools could indicate tenant disengagement, which often precedes non-renewal [6]. Today’s tenants value energy-efficient features and smart technology - 74% prefer energy-efficient properties, and 54% look for features like smart locks and thermostats [8].

Rent increases without added value are another common reason tenants leave. When tenants feel they’re paying more but getting less, they’re more likely to seek alternatives. In fact, rent hikes combined with a lack of appealing amenities account for 60% of predictable turnover cases [1].

Beyond property-related concerns, tenant behavior and preferences provide additional insights into churn risks.

Tenant Behavior and Preferences

Changes in tenant behavior often signal churn risk long before a lease ends. For example, reduced communication, an increase in maintenance requests, or declining use of amenities can all serve as early warning signs [1][9]. With the help of analytics tools, property managers can track these patterns and act proactively. These tools can predict tenant behavior with 85–90% accuracy by analyzing behavioral shifts alongside historical data [1].

This level of understanding allows property managers to move from reactive problem-solving to proactive solutions. For instance, a tenant flagged as "medium-risk" might be offered a small rent concession or more flexible lease terms, while a different strategy might be used for those less likely to renew [9]. Direct tenant feedback also plays a big role - 75% of cases show improved service adaptations when feedback is used, which increases the chances of lease renewal [1].

Using Data to Predict Churn

Predicting tenant churn begins with gathering the right data and transforming it into actionable insights. Effective churn prediction models rely on five key data categories: lease and financial records, operational metrics, behavioral signals, demographic information, and external market data. Together, these create a well-rounded view of tenant satisfaction and potential risks [6]. Automating the collection of this data is essential for generating real-time insights.

To streamline this process, property managers integrate property management systems to automatically track lease and payment data. IoT sensors and digital access logs monitor building activity, flagging potential maintenance issues [6][11]. Real-time pulse surveys gauge tenant sentiment, while natural language processing tools analyze the tone of written complaints. Public APIs, on the other hand, provide macroeconomic data to help explain broader churn trends [6].

Before feeding this information into predictive models, data must be cleaned and standardized. AI-powered tools can parse unstructured data, ensuring that property records include at least 500 data points per record [3][1]. Live data sources should be connected through direct integrations so models always work with the most up-to-date information [3].

Once the data is prepared, machine learning algorithms take over. These algorithms assign statistical probabilities to tenant behaviors - like renewal or departure - rather than offering fixed outcomes [2]. Advanced tools have achieved accuracy rates of 85–90% in predicting tenant behavior [1]. For example, in 2024, JLL implemented AI-powered lease abstraction, digitizing tens of thousands of contracts. This reduced manual labor by 60%, allowed staff to handle triple the workload, and uncovered over $1 million in missed escalation clauses [11].

Certain data points, like payment history and maintenance resolution times, are especially valuable as early indicators of churn [6]. To keep models relevant, they should be updated regularly - every three to six months - to reflect changes in tenant behavior and market conditions [6][10]. The benefits of this approach are clear: 81% of commercial real estate firms have identified data and technology as a top spending priority for 2025, and AI is expected to deliver $34 billion in efficiency gains for the industry by 2030 [11].

How CoreCast Supports Tenant Churn Prediction

Real-Time Portfolio Insights

CoreCast connects seamlessly with top property management systems to automatically pull in historical lease data, T-12 reports, and current rent rolls [3]. By automating data imports, it eliminates the need for manual entry, ensuring churn models always rely on the most current information. The platform meticulously tracks tenant-level lease details, occupancy rates, turnover trends, and renewal histories, helping property managers pinpoint risks across their portfolio [3].

With its probability-based renewal modeling, CoreCast calculates the likelihood of full, partial, or no lease renewals. These predictions are then used to update key financial metrics like projected returns (IRR, cash-on-cash, and valuations) in real time [2][3]. Spencer Vickers, CEO of CoreCast, highlights the platform's strength:

"The key difference between a decent model and an exceptional one often lies in how well it captures the subtleties of tenant behavior and market trends within renewal assumptions" [2].

The system also provides alerts whenever occupancy targets aren’t met or critical thresholds are breached. This allows property managers to focus on properties most at risk of financial losses due to tenant turnover. These real-time insights pave the way for a more efficient and proactive lease renewal process.

Pipeline Tracking for Lease Renewals

CoreCast’s pipeline tracker simplifies lease renewal management by offering clear insights into upcoming expirations, customizable deal stages, and geospatial mapping to prioritize renewals [3].

The platform further tracks tenant satisfaction metrics, such as service request volumes and resolution times, acting as an early indicator of potential dissatisfaction that could lead to non-renewals. Additionally, its AI-powered document parsing enables users to upload rent rolls or income statements in PDF or Excel formats, automatically extracting and mapping the data to underwriting models - no manual input required. Jared Stoddard describes the platform’s value succinctly:

"CoreCast delivers portfolio and property-level management metrics at preferred intervals... This isn't reporting. This is executive insight" [3].

Integrated Property and Market Analysis

CoreCast goes beyond internal performance metrics by incorporating external market data, creating a full picture of tenant churn risks. It consolidates assets, projects, and market data into a unified environment, aligning internal forecasts with market rent benchmarks to assess competitive positioning more efficiently [12]. With its mapping tool, property managers can identify whether nearby competitors are offering better rates or amenities, shedding light on external pressures that could sway tenant decisions. This is essential, given that terminal value can represent 60%–80% of a property's total DCF valuation, making accurate lease renewal assumptions crucial [2].

The platform also supports rent roll-plus analysis, which examines individual units with tailored assumptions about future performance. This helps identify key value drivers and churn risks [2]. Users can perform sensitivity analyses to explore how changes in renewal probabilities might impact returns and valuations. By syncing with tools like RealPage, Buildium, and QuickBooks, CoreCast integrates economic data to refine churn predictions based on broader market trends [12]. This holistic approach doesn’t just reveal which tenants might leave but also helps uncover why - and what steps could encourage them to stay.

sbb-itb-99d029f

Applying Churn Predictions to Property Management

Taking Action on Churn Risks

Identifying tenants at risk of leaving and responding strategically can make a huge difference in property management. AI models assign renewal probability scores, helping property managers group tenants into high, medium, and low-risk categories [9]. The medium-risk group - those who might leave but could be persuaded to stay - should be a priority. Offering tailored incentives, such as rent discounts or added amenities, can encourage them to renew [9].

For high-risk tenants, it's smart to prepare for their potential departure well in advance. This might involve scheduling property renovations, refreshing marketing materials, and lining up new tenants [9]. By planning ahead, you can reduce downtime and avoid the financial strain that often comes with unexpected vacancies. These proactive measures also set the stage for smoother lease renewal discussions.

Improving Lease Renewal Rates

Lease renewal negotiations are a great opportunity to lock in long-term commitments by offering meaningful upgrades. Instead of simply matching market rates, consider adding value through property improvements. Upgrades like energy-efficient lighting, enhanced security systems, or modern HVAC units can be rolled into lease agreements, with costs spread over the lease term through adjusted net rents [2].

Timing is critical. Since pricing is often the biggest factor influencing renewals [1], addressing cost concerns early - ideally 90 to 120 days before the lease ends - gives you a better chance to negotiate effectively. Real-time feedback tools can help reduce tenant turnover by up to 40% [1]. Digital platforms that track tenant sentiment throughout the lease period can alert you to potential issues, giving you time to address them before they escalate into deal-breakers.

Increasing Tenant Satisfaction

Tenant satisfaction plays a crucial role in securing lease renewals. One of the best ways to keep tenants happy is through proactive maintenance. Predictive analytics can pinpoint recurring maintenance problems that might frustrate tenants [1]. Tackling these issues early shows tenants that you're attentive, which helps build trust. In fact, optimizing maintenance processes through analytics can cut turnover costs by 30% [1].

Personalization is another key factor in retention. Leverage insights from your analytics tools to customize communication and incentives based on tenant preferences. For example, tenants who enjoy community events might value amenity upgrades, while those focused on saving money may appreciate energy-efficient improvements that lower utility bills. A positive tenant experience can boost the likelihood of lease renewal by 20% [1]. These personalized touches not only enhance satisfaction but also contribute to long-term occupancy.

Measuring Results from Predictive Analytics

Once you've implemented proactive tenant retention strategies, the next step is measuring the results to ensure your predictive analytics efforts are delivering the desired outcomes.

Key Performance Indicators (KPIs)

To assess the return on investment (ROI) of predictive analytics, tracking key performance indicators (KPIs) is essential. One of the most important KPIs is renewal probability accuracy, which evaluates how well your models predict tenant behavior. Accurate predictions lead to better discounted cash flow forecasts, helping you refine financial planning [2].

Another critical metric is cost savings. The financial impact of tenant turnover is significant, with each unit turnover costing between $3,000 and $5,000 [14]. In cases of non-renewal, transition costs can range from $5,000 to $20,000 per unit [2]. By monitoring reductions in these costs, you can quantify the value your analytics tools bring. Properties leveraging tenant behavior analytics often experience a 15% to 20% boost in property value over three years [1].

Additionally, occupancy metrics highlight the effectiveness of predictive tools. Metrics like vacancy periods and retention rates are key indicators. Predictive retention tools can lower vacancy costs by 40% [14], while AI-driven analysis often reduces tenant turnover by 20% to 30% [14]. Performing regular sensitivity analyses ensures your models remain responsive to market changes by quantifying shifts in renewal probabilities and portfolio returns [2].

Before and After Implementation Metrics

To measure the impact of predictive analytics, start by establishing a baseline using historical data from property management, accounting, and maintenance records. This baseline serves as a benchmark for evaluating improvements after implementing predictive strategies.

For example, predictive retention strategies have been shown to increase tenant retention rates from 72% to 87%, while reducing unexpected turnover from 28% to 13% [11]. A case study from 2022 highlights the Acadian Group, a New York-based real estate firm, which adopted a machine learning pipeline to predict commercial tenant churn. The system outperformed their previous manual analysis, enabling targeted promotions and discounts for at-risk tenants [13].

Most predictive analytics systems deliver ROI within 12 to 18 months, thanks to operational efficiencies and reduced vacancy rates [1]. Implementation costs typically range between $10,000 and $50,000, depending on the size of the portfolio [1].

Conclusion

Predictive analytics is transforming how property managers approach tenant retention. Instead of waiting for vacancy notices to react, these tools allow managers to identify at-risk tenants months ahead of time and take strategic steps to keep them. By leveraging analytics, property managers can significantly reduce turnover while improving the accuracy of their forecasts.

The benefits go far beyond simply filling empty units. These tools provide clear financial advantages, with many platforms offering a return on investment within 12 to 18 months[1]. That’s not just cost savings - it’s a strategic edge.

Take CoreCast, for example. This platform consolidates predictive insights into a single, user-friendly system. By integrating directly with property management software, CoreCast creates renewal models based on actual tenant behavior. Features like real-time portfolio insights, scenario modeling, and market analysis allow managers to move away from static assumptions and embrace forecasts that reflect real-world dynamics and market conditions.

Predictive analytics doesn’t just reduce tenant churn - it lays the foundation for a smarter, data-driven approach to property management. It enhances tenant satisfaction, stabilizes cash flow, and boosts asset value. By unifying data sources, applying probability-based models, and monitoring key behavioral trends, properties can position themselves for stronger retention rates and greater profitability in the future. Those who adopt these tools today will lead the way in tomorrow’s competitive landscape.

FAQs

How can predictive analytics tools help identify tenants who might leave?

Predictive analytics tools dig into a mix of data points, including payment history, lease terms, maintenance requests, and tenant feedback. By leveraging machine learning models, these tools uncover patterns and red flags - like late payments, dropping satisfaction levels, or unusual behavior - that often signal a higher risk of tenant turnover.

Spotting these trends early allows real estate professionals to step in, address tenant concerns, and boost satisfaction. This proactive approach helps keep tenants happy and reduces the chances of them leaving.

How can predictive analytics improve tenant retention?

Predictive analytics equips property managers with the ability to anticipate tenant churn by examining critical data points such as payment patterns, maintenance requests, and tenant feedback. By identifying early signs of dissatisfaction, managers can address concerns promptly - whether by resolving issues faster or improving communication - ultimately boosting tenant satisfaction and minimizing turnover.

These tools also help estimate the likelihood of lease renewals, enabling managers to prepare for various outcomes and refine their cash flow forecasts. Platforms like CoreCast bring these predictive functions together in one streamlined interface. They allow users to monitor churn risks, schedule preventive maintenance, and deliver tailored tenant experiences. This data-driven strategy not only improves occupancy rates but also reduces vacancy costs and strengthens overall portfolio performance.

How can property managers use predictive analytics to reduce tenant churn?

Property managers can use predictive analytics to spot critical risks, such as tenants who might move out or unexpected jumps in maintenance expenses. With real-time dashboards offering these insights, managers can take proactive steps - like reaching out to at-risk tenants with personalized messages or offering incentives. This shifts their focus from reacting to problems to actively working on tenant retention.

Predictive models also help fine-tune budgets by incorporating lease-renewal probabilities into cash-flow planning. This allows managers to make smarter decisions, like targeting marketing efforts more effectively, adjusting rents strategically, or offering tailored lease incentives. Tools like CoreCast make this process easier by blending predictive insights with automated alerts and dashboards, helping teams respond quickly and measure the outcomes.

When analytics are integrated with task management systems, follow-ups become more organized and actionable. This closed-loop approach not only boosts retention rates but also generates valuable data to continuously improve predictions over time.