Urban Growth Boundaries: Impact on Commercial Real Estate

Urban Growth Boundaries (UGBs) are legal tools used to control urban sprawl by separating urban areas from rural or agricultural land. They directly affect commercial real estate (CRE) by limiting land supply for development, which increases property prices and encourages higher-density projects. Cities like Portland, Oregon, and many in California use UGBs to manage growth, creating challenges like higher costs, complex regulations, and longer approval timelines for CRE developers. However, these constraints also present opportunities for infill development, mixed-use projects, and investments in areas near UGBs or transit hubs.

Key Points:

- Land Supply Limits: UGBs restrict urban expansion, driving up land and property costs within boundaries.

- Infill Development: Developers focus on redeveloping underutilized urban sites, often facing higher costs and logistical challenges.

- Regulatory Hurdles: UGB-related planning and permitting processes can be lengthy and costly, adding risks to projects.

- Investment Opportunities: High-demand areas within UGBs and edge markets outside them offer potential for long-term growth.

- Data Tools: Platforms like CoreCast help CRE professionals navigate UGB regulations, zoning, and market trends.

Developers can succeed in UGB-constrained markets by collaborating with urban planners, modernizing zoning strategies, and focusing on transit-oriented and high-density projects. Balancing infill investments with speculative edge market projects can help manage risks and optimize returns.

Urban Growth Boundaries: Effective or Worthless?

Problems Urban Growth Boundaries Create for CRE Development

Urban Growth Boundaries Impact on Commercial Real Estate: Key Statistics and Costs

Limited Land Supply and Higher Costs

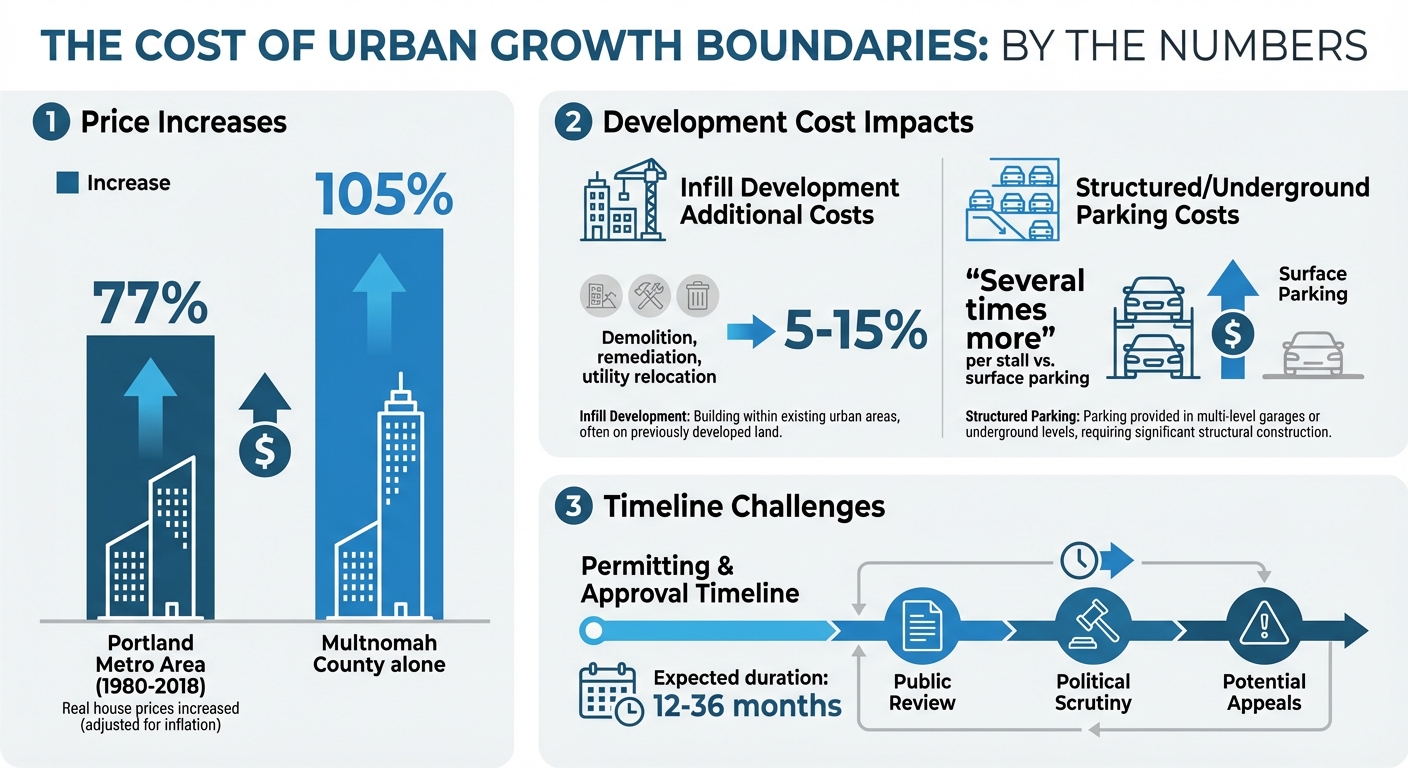

Urban Growth Boundaries (UGBs) restrict the amount of land available for development, which drives up prices for properties within the boundary. For example, in Portland’s three-county metro area, real house prices increased by 77% from 1980 to 2018, adjusted for inflation. In Multnomah County alone, prices surged 105% during the same period [5][8]. For commercial real estate, this translates into significantly higher costs for land acquisition. Properties inside the UGB often command higher prices than similar sites outside it because they already have entitlements, infrastructure, and utilities in place. Additionally, limited competition and rising impact fees further inflate costs as cities work to upgrade existing infrastructure within the boundary [2][4]. These cost pressures force developers to pursue projects like mixed-use developments, higher-density builds, or value-add opportunities to make the economics work. As a result, infill development has become a primary focus.

Infill Development and Density Requirements

With undeveloped land increasingly scarce, UGBs push most new commercial projects onto infill or redevelopment sites. These sites often require costly steps like demolition, remediation, or relocating utilities, which can add 5–15% to project costs depending on the site’s history [2]. Additionally, outdated zoning codes frequently clash with modern development goals, forcing developers to go through lengthy processes like rezonings, variances, or planned unit developments [2][4]. Tight urban sites introduce logistical challenges for staging and construction, while mid- to high-rise projects require more complex structural systems compared to suburban low-rise buildings.

Parking is another hurdle. Structured or underground parking - which is often the only option on infill sites - can cost several times more per stall than surface parking. Yet many parcels lack the space for surface lots [2][6]. Even when cities encourage higher density, restrictions like height limits aimed at preserving views or neighborhood character can make it difficult to build enough to offset the high cost of land [8][4]. These challenges add layers of complexity, increasing planning risks and timelines.

Regulatory Uncertainty and Planning Risk

UGBs are subject to periodic reviews, during which boundaries may expand, contract, or shift to redirect growth [5]. These changes, along with major rezonings, often lead to legal disputes, creating extended periods of uncertainty for developers working on large projects. Updates to comprehensive plans can also bring unexpected changes, such as new restrictions on building heights, allowable uses, or density, or the addition of conservation overlays that limit future development potential [2][6].

Permitting and approvals often take longer in UGB-regulated areas due to extensive public review and political scrutiny [2][7]. Developers may face opposition from communities concerned about traffic, building heights, or changes to neighborhood character, which can lead to added studies, redesigns, or appeals. These delays pile up legal and consulting fees, stretching timelines and driving up costs. Carrying costs - including interest on land and predevelopment loans, property taxes, and overhead - can erode a project’s profitability, even if its final value is appealing. Developers should anticipate 12–36 months for permitting and plan for higher predevelopment contingencies to account for these risks.

Opportunities for CRE Professionals in UGB-Constrained Markets

Developing Infill Projects

Urban Growth Boundaries (UGBs) may pose challenges, but they also create opportunities by concentrating demand. This often leads to higher rent growth, lower vacancy rates, and increased land values for properties within the boundary, especially those located near transit hubs and employment centers[1][8]. Success in these markets lies in maximizing transit access, building vertically, incorporating mixed-use designs, and repurposing existing structures[1][2].

Proximity to transit not only boosts rental income but also reduces the need for extensive parking, making projects more feasible even when land costs are high[1]. Mixed-use developments - like combining retail on the ground floor with residential or office spaces above - can diversify income streams and, in some cases, speed up city approvals or unlock density bonuses. Cities often favor these projects to encourage walkable, vibrant neighborhoods[2][4]. Meanwhile, repurposing outdated office or industrial spaces can lower construction costs and reduce risks tied to zoning approvals, all while contributing to urban renewal efforts[2][3].

The best opportunities are often found in areas where demand meets limited supply. Think locations within half a mile of transit stations, walkable corridors with urban amenities, employment hubs, or neighborhoods earmarked for upzoning or redevelopment[1][2]. Investors should keep an eye out for underutilized sites, such as parcels with low floor-area ratios, excessive surface parking, or vacant buildings. Areas near planned infrastructure upgrades - like new transit hubs or streetscape improvements - should also be on the radar[2][6].

These strategies open the door to further exploration of nearby market opportunities.

Investing in Edge Markets Outside UGBs

Edge markets, located just beyond UGBs, offer a different kind of investment potential. With lower entry costs and the possibility of future boundary expansions, these areas can be attractive for long-term growth[8][5]. Key opportunities arise in regions where future UGB expansions are part of regional plans, where new infrastructure projects like highways or transit lines are underway, or where local governments are preparing for growth by planning employment centers or logistics hubs[1][2].

Investors should approach these markets with caution, modeling longer holding periods and conservative rent expectations until infrastructure is fully developed[1]. Tracking past UGB adjustments and understanding local political dynamics can help pinpoint the right timing for investments. Additionally, it’s wise to test different scenarios for cap rate changes, as some properties may remain low-density or agricultural for longer than anticipated[8][5]. A balanced investment approach might include stable, income-generating infill properties within UGBs alongside more speculative land or early-stage projects on the edge, treating the latter as a long-term bet on regional growth[1][2].

Using Real Estate Intelligence Platforms

In UGB-constrained markets, having access to diverse and integrated data is essential. To navigate these complexities, professionals need tools that consolidate zoning codes, UGB boundaries, proposed changes, transit and infrastructure maps, rent trends, vacancy rates, construction pipelines, and sales comps - both inside and outside UGBs[1][2][6]. Platforms like CoreCast bring all this information into one place, allowing users to analyze any property type or risk profile near UGBs. These tools also offer features like interactive maps that overlay UGB lines, zoning data, and transit routes, making it easier to evaluate competitive supply and track entitlement progress[6].

CRE teams can use geofenced alerts to stay updated on new listings, zoning changes, or infrastructure developments in key areas like transit-oriented districts or planned UGB expansions[2][6]. During the underwriting process, they can pull standardized data on rents, expenses, and cap rates, while also assessing supply risks by overlaying construction pipeline information. Sensitivity analyses can help teams evaluate factors like density, entitlement timelines, and exit strategies[1][6]. For asset management, these platforms enable tracking of leasing performance, monitoring submarket trends, and generating detailed reports for equity partners. These insights highlight how UGB constraints can enhance pricing power and long-term value.

sbb-itb-99d029f

Solutions for Aligning CRE Goals with Growth Management Policies

These strategies address the challenges of limited land availability and the planning risks discussed earlier.

Collaborating with Urban Planners

One of the best ways to navigate the constraints of Urban Growth Boundaries (UGBs) is to engage early in the planning process. By participating in planning meetings, developers can share valuable market data - such as demand, rent trends, and vacancy rates - which helps shape comprehensive plans and UGB updates. This proactive approach ensures that plans account for sufficient commercial acreage and employment hubs near transit, rather than discovering too late that new policies have made projects unfeasible[2][10].

Early discussions with planning staff allow developers to align their site plans with local growth-management goals. This might include compact designs, mixed-use developments, or transit-oriented layouts. Engaging in this way before formal submissions can reduce risks and speed up approval timelines[2][6]. In UGB-constrained areas, developers often bring market studies, financial projections, and infrastructure cost-sharing proposals to demonstrate how additional commercial capacity or targeted upzoning can drive job growth and expand the tax base - all while preserving farmland and curbing sprawl[9][11]. Leveraging real estate intelligence tools can further bridge the gap between market realities and planning objectives.

In addition to active participation in planning, innovative zoning approaches provide another way to address UGB limitations.

Modernizing Land Use and Zoning

Updated zoning practices can unlock more commercial opportunities within UGBs. Upzoning near transit hubs and major intersections - by increasing allowable building height, floor-area ratios (FAR), or lot coverage - enables developers to maximize leasable space on limited urban land, helping offset high acquisition costs[4][6]. Mixed-use zoning not only diversifies revenue streams but also fosters vibrant urban environments[2][10].

Form-based codes are another tool that prioritize building design and form over strict use categories. This approach allows for a mix of uses - like light industrial, creative office spaces, and service retail - without the need for repeated rezoning, which reduces entitlement risks[2][10].

Revisiting parking requirements, especially near high-capacity transit, can also free up valuable land for revenue-generating spaces. This aligns with climate and mobility goals while improving project feasibility[2][6]. Developers who can present financial models and data showing how these zoning changes sustain or boost tax revenues and job density are more likely to secure political backing in UGB-constrained regions[1][2]. Higher-density, mixed-use projects can yield strong financial returns while advancing regional growth-management priorities.

Aligning with Long-Term Regional Development

Beyond zoning reforms, aligning commercial real estate (CRE) strategies with broader regional objectives can further ease UGB constraints. This involves focusing on infrastructure, mobility, and climate resilience. Prioritizing properties near high-capacity transit ensures stable long-term demand, as urban plans and UGB policies increasingly direct growth and public investment to these areas[2][11]. Transit-oriented developments - such as offices, medical facilities, and retail near transit stations - not only help reduce congestion and emissions but also tend to command higher rents and lower vacancy rates[1][11].

Incorporating climate-resilient design features - like elevated mechanical systems, flood-resistant materials, and heat-mitigating landscaping - protects property values while aligning with citywide climate-adaptation initiatives. These measures often attract zoning incentives and infrastructure funding[11]. By adopting transit-oriented and climate-conscious strategies, developers can address early planning challenges while safeguarding asset value.

Using portfolio analytics, investors can gradually shift their focus from car-dependent, fringe locations to compact, infrastructure-rich corridors identified in metropolitan plans as long-term growth hubs. This approach not only improves returns but also aligns with public policy goals[1][2]. Long-term collaboration and structured data sharing - through platforms like CoreCast - enable both CRE firms and public agencies to monitor trends in vacancy, rent growth, and construction. These shared insights make it easier to coordinate on infrastructure investments and future UGB adjustments.

Conclusion

Key Points for CRE Professionals

Urban growth boundaries (UGBs) create a mix of challenges and opportunities for commercial real estate (CRE) professionals. Within these boundaries, limited land supply increases acquisition costs and pushes for higher-density developments. However, these areas often offer prime locations, better infrastructure, and stronger long-term asset values. On the flip side, areas outside the boundary provide cheaper land and more flexibility for large-scale projects like logistics and industrial developments. That said, these "edge markets" come with infrastructure gaps and greater uncertainty in policies. The key to success lies in carefully analyzing both scenarios and building a balanced portfolio - combining stable, infill assets with high-yield edge developments to navigate market cycles effectively.

Thriving in UGB-affected markets requires a deep understanding of local regulations, early collaboration with planners, and leveraging data to evaluate submarket performance. Knowing the nuances of growth management laws, reserve areas, and zoning overlays can help uncover off-market opportunities before others. Engaging with urban planners and policymakers early in the process can align projects with community goals, reduce entitlement risks, and speed up approvals.

CoreCast enhances these efforts by streamlining underwriting, deal tracking, and scenario analysis. Its interactive mapping tools visualize UGB lines, competitive assets, and market data, enabling sharper underwriting, quicker submarket comparisons, and better communication of UGB-related risks to investors and lenders. In markets where high-density projects are required and planning timelines are lengthy, data-driven strategies and strong collaboration with public agencies become essential for developing a sustainable CRE approach.

FAQs

How do Urban Growth Boundaries influence commercial real estate values?

Urban Growth Boundaries (UGBs) tend to push up commercial real estate values within their limits by curbing urban sprawl and focusing development in targeted areas. With a restricted supply of land, demand for properties and development opportunities often rises, leading to higher prices and rental rates - especially in sought-after locations.

That said, UGBs can also bring hurdles for investors and developers. Higher land costs and fewer expansion options can make projects more challenging. To navigate these limitations, strategies like building upward or making the most of existing spaces become essential for maximizing returns within these boundaries.

What challenges do developers face when working within urban growth boundaries?

Developers working within urban growth boundaries (UGBs) face a unique set of hurdles. These include navigating stricter land use regulations that can slow down planning and approvals, dealing with a limited supply of land for new projects, and addressing pushback from communities that want to maintain their area's character and identity.

To tackle these challenges, developers need to think outside the box. This means employing creative approaches like smart site planning, building strong relationships with local stakeholders from the outset, and using advanced tools that offer real-time insights into market trends and property data. These strategies help ensure that growth aligns with the needs of the community while staying practical and forward-thinking.

What are the investment opportunities around Urban Growth Boundaries?

Urban Growth Boundaries can open up intriguing possibilities for commercial real estate investors. These zones often experience rising demand for multifamily housing, office spaces, retail hubs, and industrial developments as cities expand and populations grow.

For investors, this can translate to strong growth prospects and the chance for higher returns. That said, success hinges on thorough research - understanding zoning laws, assessing available infrastructure, and keeping a close eye on market trends are key to spotting the best opportunities.