Remote Work vs. Hybrid Work: Real Estate Impacts

Remote and hybrid work are reshaping commercial real estate. Fully remote setups reduce office demand significantly, while hybrid models maintain some need for physical spaces but at reduced levels. By early 2025, 26% of remote-capable jobs were hybrid, making it the dominant model, while 13% were fully remote. These shifts have caused national office vacancy rates to climb to 19.7%, with older, less desirable properties hit hardest. Meanwhile, suburban markets and flexible office spaces are growing in popularity.

Key takeaways:

- Remote work: Drives higher vacancy rates, reduces office space needs, and increases interest in repurposing offices into residential units.

- Hybrid work: Stabilizes demand but reduces office usage by 30% compared to pre-pandemic levels, prompting redesigns with shared spaces and collaboration zones.

- Geographic trends: Suburban markets and Sun Belt cities outperform urban downtowns.

- Opportunities: Office-to-residential conversions and flexible lease agreements are gaining traction.

Understanding these trends is crucial for landlords, tenants, and investors navigating today’s evolving office market.

Remote Work: Effects on Office Space and Market Trends

Office Demand Challenges in a Remote-First World

The rise of remote work has dramatically shifted the demand for office space across the United States. With more employees working from home, companies are cutting back on square footage, subleasing unused areas, and consolidating their operations. As a result, the national office vacancy rate climbed to 19.7% by March 2025 - an increase of 180 basis points compared to the previous year and approaching record highs[11][12]. This trend is particularly tough on Class B and C buildings in less desirable locations, where falling property values, stricter lending criteria, and refinancing hurdles are squeezing financial returns.

Building owners are feeling the pinch as they continue to pay for utilities, security, and maintenance on spaces that sit largely empty, all while rents stagnate. Tenants, many of whom are still tied to pre-pandemic leases, are opting for smaller spaces when renewing or shifting to shorter, more flexible agreements - typically around five years with renewal clauses - rather than committing to traditional 10-year leases[5][6]. This underutilization leaves companies paying for space they barely use and creates challenges for landlords trying to fill vacancies in a market shaped by remote-friendly roles.

Geographic and Market Segment Effects

Remote work has also triggered a shift away from traditional downtown business districts toward suburban and more affordable markets. With fewer commuters heading into city centers, urban office usage has declined, reducing foot traffic for nearby businesses and weakening the tax revenues of cities heavily reliant on office-based economies[1][3]. Properties in less attractive urban areas - those with high crime rates or limited amenities - have seen sharp drops in value and slower leasing activity.

Meanwhile, suburban markets and mixed-use developments closer to where remote workers live are gaining momentum. Employers are setting up smaller satellite offices in these areas to cut costs and offer employees shorter commutes. Cities in the Sun Belt, supported by population growth and diverse economies, are outperforming older, office-reliant downtowns. Tenants are gravitating toward newer buildings with flexible layouts and modern amenities[4][6]. These shifts are also driving creative approaches to repurposing existing properties.

Office-to-Residential Conversion Opportunities

The ongoing challenges of high office vacancy rates and falling rents in older downtown office buildings have sparked interest in converting these spaces into residential units. Many of these buildings are considered outdated due to their deep floor plans, limited natural light, and aging infrastructure[6][7]. Transforming them into apartments, condos, or mixed-use spaces with ground-floor retail and shared work areas offers a way to revitalize struggling downtowns while addressing housing shortages[3][4].

Successful conversions often focus on Class B and C buildings in downtown areas where demand for housing remains strong. These buildings are better suited for residential use if they allow for good natural light and practical unit layouts[3][7]. However, there are significant hurdles to overcome. Zoning laws, outdated building codes, and high conversion costs make these projects challenging, often requiring collaboration between public and private sectors and the use of tax incentives. For investors, careful planning is essential - this includes assessing construction and regulatory risks, testing rent projections, and taking advantage of incentives in markets most affected by the decline in traditional office demand.

Hybrid Work: Effects on Office Space and Market Trends

Moderated Demand Reduction with Hybrid Models

Hybrid work has solidified its position as the leading workplace model in the United States, with 53% of companies adopting some form of hybrid arrangement as of early 2025[9]. Unlike fully remote setups, hybrid policies maintain the relevance of office spaces but significantly alter the amount of space companies require. Many organizations are cutting back on their total square footage by implementing desk-sharing strategies and increasing space efficiency. However, offices remain active hubs for collaboration and fostering workplace connections.

Currently, 80% of office occupiers have adopted hybrid policies, reducing overall space needs while keeping physical offices functional[6]. Office attendance has stabilized at 30% below pre-pandemic levels, leaving companies paying for spaces that are often underutilized[1]. Even in cases where employers mandate three or more in-office days per week, actual attendance frequently falls short of expectations[11]. While hybrid work has softened the impact compared to fully remote setups, vacancy rates remain high, hovering around 19.7%[11]. These trends are prompting a significant rethinking of office design to better accommodate hybrid work dynamics.

Changing Office Layout and Design Priorities

In response to these changes, companies are reimagining their office layouts to prioritize collaboration and flexibility. The traditional setup of assigned desks is giving way to collaboration zones, project rooms, and multi-functional spaces designed to support teamwork and engagement[11][13]. Hot-desking and hoteling systems are becoming standard, with employees using booking apps and occupancy sensors to reserve workstations on the days they come into the office[9][11].

Meeting rooms are undergoing significant upgrades, including advanced video conferencing tools, smart screens, and improved acoustics to accommodate hybrid scenarios where some team members are remote while others are in the office[11]. According to McKinsey, 91% of office occupiers are willing to pay extra for tech-enabled spaces that support flexible work, underscoring the growing importance of integrated technology[4]. Additionally, offices are incorporating wellness-focused features such as natural lighting, biophilic design elements, quiet zones, and focus rooms. These enhancements aim to make the office experience more appealing than working from home, giving employees a reason to commute[13][4].

Growth in Suburban and Flex Office Demand

Hybrid work is also driving a shift toward distributed office models that reflect where employees live. Many companies are moving away from the traditional large downtown headquarters in favor of smaller, distributed offices or satellite locations closer to residential areas[11][4]. Suburban markets are benefiting from this trend, as workers prefer shorter commutes and convenient access to offices. This has led to the rise of strategically located smaller offices that focus on collaboration and flexibility[2][6].

Coworking and flexible office spaces are seeing roughly 25% annual growth in demand, as companies seek occasional collaboration spaces without committing to long-term leases[11]. These flexible arrangements often feature shorter lease terms, such as five years with renewal options, allowing businesses to adjust as hybrid work policies continue to evolve[6]. Suburban mixed-use developments - offering a combination of office space, retail, and amenities - are particularly appealing, providing hybrid workers with nearby services and reduced commute times[6]. Landlords are adapting by incorporating coworking options, offering flexible lease terms with exit clauses, and investing in tech upgrades funded through adjusted rents. These changes are fostering more collaborative relationships between landlords and tenants as they navigate this evolving landscape[5][6].

Hybrid Working Explained - How to Create a Hybrid Office

sbb-itb-99d029f

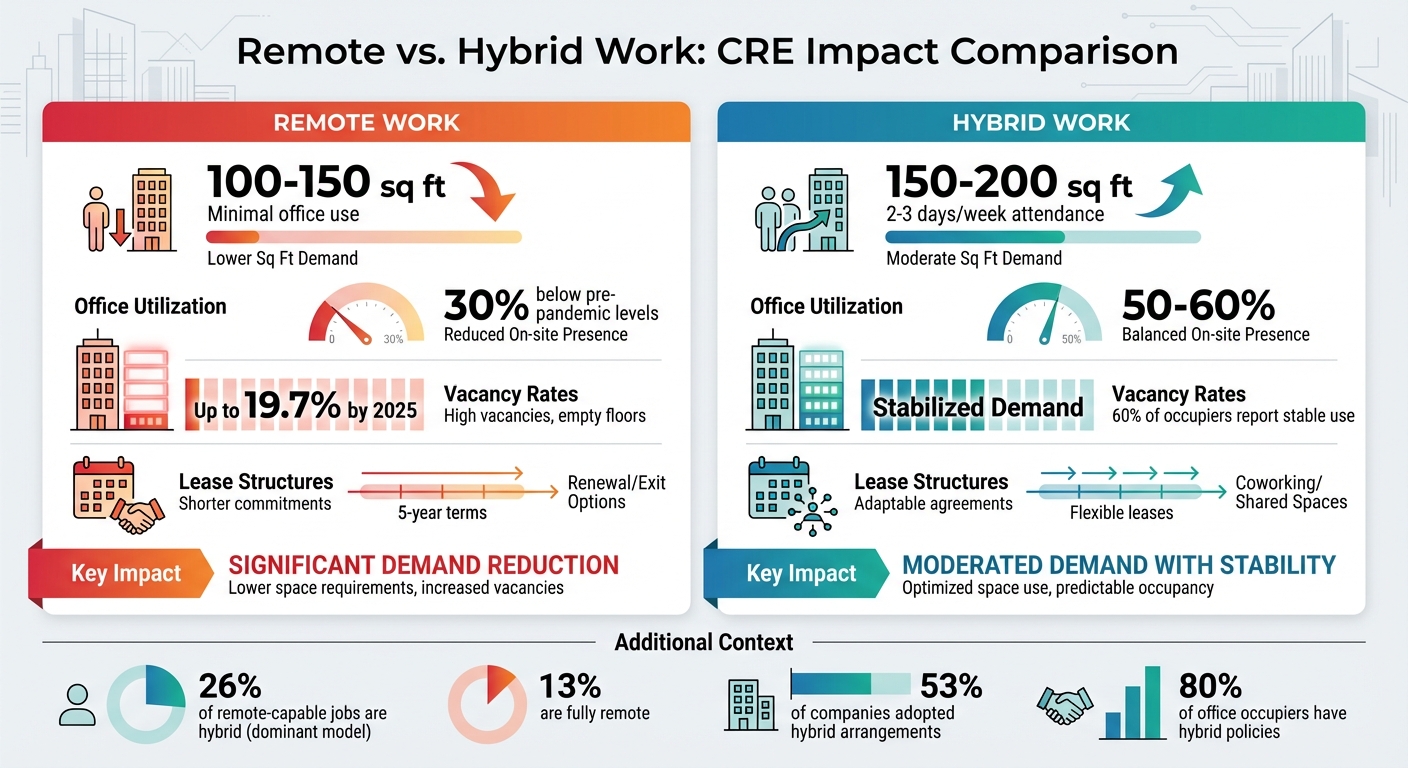

Remote Work vs. Hybrid Work: Key Differences in CRE

Remote vs Hybrid Work Impact on Commercial Real Estate: Key Metrics Comparison

Office Demand Metrics Comparison

The remote and hybrid work models have reshaped how office spaces are utilized. Remote work has significantly reduced the office space needed per employee, dropping from pre-pandemic levels of 200-250 sq ft to a leaner 100-150 sq ft, as offices now see limited use. Hybrid models, where employees come in 2-3 days a week, fall somewhere in the middle, requiring 150-200 sq ft per employee[1][6][8].

Office attendance metrics tell a similar story. Remote work has driven office utilization 30% below pre-pandemic levels[1][6][8]. In contrast, hybrid arrangements achieve 50-60% utilization, with 60% of occupiers reporting stabilized office use[8]. Lease structures have also evolved to match these trends. Remote work often leads to short-term leases, typically 5-year agreements with renewal options and exit clauses. Hybrid work, on the other hand, leans on flexible leases designed for coworking and shared spaces[1][6][8].

| Metric | Remote Work | Hybrid Work |

|---|---|---|

| Square Footage per Employee | 100-150 sq ft (minimal office use) | 150-200 sq ft (2-3 days/week attendance) |

| Office Utilization | 30% below pre-pandemic levels | 50-60% |

| Vacancy Rates | Up to 19% projected by 2025 | Stabilized demand (60% of occupiers report stable use) |

| Lease Structures | Short-term 5-year terms with renewal/exit options | Adaptable leases for coworking and shared spaces |

These metrics highlight the contrasting effects of remote and hybrid work on commercial real estate and set the stage for their varied impacts on stakeholders.

Pros and Cons for Stakeholders

The shift to remote and hybrid work models presents distinct advantages and challenges for investors, landlords, and tenants.

For investors, remote work opens opportunities to repurpose underutilized office spaces into residential or mixed-use developments. However, it also brings challenges like declining property valuations and refinancing difficulties due to reduced demand[1][6]. Hybrid work offers steadier demand and revenue streams, particularly from flexible office spaces, though it often requires costly renovations to accommodate new layouts[1][6][8].

Landlords face unique pressures too. Remote work can lead to tenant churn as companies downsize their space needs, but it also allows landlords to explore mixed-use redevelopment options[1][5][6]. Hybrid work provides better tenant retention through adaptable spaces and consistent utility revenues. Yet, it comes with the need for infrastructure upgrades - 54-63% of hybrid workers now expect high-speed internet and advanced tech capabilities in their office spaces[1][4][5].

For tenants, remote work offers significant cost savings on office space and access to a broader talent pool. However, it comes with risks like reduced collaboration and potential team isolation[9]. Hybrid setups strike a balance by providing flexible lease terms and lower costs per employee while maintaining some level of in-person interaction. Still, tenants must navigate challenges like scheduling and commuting logistics[5][6][9].

Market Segment and Geographic Effects

The impact of remote and hybrid work varies widely depending on property types and geographic locations.

In terms of property classes, Class A urban office buildings have felt the brunt of remote work, with rising vacancies and declining values in central business districts. Meanwhile, Class B and C properties are finding new life as candidates for residential or mixed-use conversions[6][8]. Hybrid work, however, helps sustain demand for Class A offices by emphasizing premium amenities and flexible designs. It also boosts the appeal of suburban Class B and C properties, which offer lower costs and room for growth[6][8].

Geographically, remote work has accelerated the exodus from central business districts (CBDs), as workers migrate to cities like Boise and Austin. This trend has spiked demand for suburban and rural properties[2][3][6]. Hybrid work moderates the decline in CBD office use by maintaining some level of in-office presence while supporting growth in suburban flex spaces and mixed-use developments. In Sun Belt cities like Atlanta, remote work has driven suburban population booms, even as urban office markets experience 2-4% revenue declines. Hybrid work, on the other hand, strengthens demand for flexible office spaces in these high-growth areas[2][6]. In more traditional markets, remote work exacerbates urban office market challenges, while hybrid setups offer some stabilization through tech-enhanced properties[2][6].

Forecasting and Underwriting in a Remote and Hybrid Future

As market trends evolve, forecasting and underwriting in commercial real estate demand more adaptable strategies to meet the challenges of remote and hybrid work.

Changes in Lease Structures and Valuations

The rise of remote and hybrid work has fundamentally altered how commercial real estate leases are structured. Long-standing 10-year lease agreements are being replaced by shorter 5-year terms, often including renewal options and flexible exit clauses that give tenants more room to adapt their space needs[6]. Landlords are also taking on more upfront costs, such as renovations, which they recover through higher monthly rents. Emergency clauses addressing unforeseen disruptions have become the norm in lease agreements[6].

These shifts have a direct impact on property valuations. Higher cap rates now reflect increased risk premiums, particularly for urban office properties. For instance, cities like Austin have seen revenue dip by 2–4% as remote work continues to gain traction[2][6]. However, properties with premium amenities have shown greater resilience, and suburban assets are starting to outperform urban ones. Meanwhile, coworking spaces are growing in popularity - up 25% annually through March 2025 - introducing new per-use and lease-provision models that complicate traditional valuation approaches[11].

Scenario Planning for Remote and Hybrid Adoption

To navigate the changing commercial real estate landscape, accurate forecasting and effective underwriting have become essential. This requires modeling a range of scenarios based on regional and industry-specific trends. With 80% of office tenants adopting hybrid work policies, stakeholders must consider varying levels of in-office attendance across different markets[8]. Additionally, remote job postings have stabilized at about 7% of total job listings as of 2025, creating a benchmark for permanent remote work adoption[10].

Regional differences also play a critical role. In high return-to-office markets like New York and Miami, investments in centralized office spaces with premium amenities are key. Conversely, remote-leaning areas like Denver require funding for collaboration tools and occasional team travel[10]. Cities such as San Francisco offer opportunities for re-pricing as leases are renegotiated. Interestingly, while 38% of office tenants expect utilization to grow, 60% report stable usage levels - data points that are vital for shaping demand forecasts[8]. These scenarios provide a foundation for making informed decisions.

Using CoreCast for Data-Driven Decisions

CoreCast, a comprehensive real estate intelligence platform, equips stakeholders with the tools to navigate the complexities of remote and hybrid work. It integrates data analysis with scenario modeling, allowing users to underwrite various asset classes and risk profiles by incorporating real-time information on vacancy rates, cap rate changes, and regional adoption trends directly into valuation models.

The platform’s pipeline tracking feature enables investors to follow suburban flex space opportunities and urban office conversion projects through every stage of the deal. Its mapping tools provide visual insights into properties and their competitive landscapes. CoreCast also offers advanced portfolio analysis, helping users model different remote and hybrid adoption scenarios - from the baseline 7% remote work adoption to higher levels - so they can evaluate how workforce policies influence property values and lease structures[10]. Additionally, users can create branded reports that highlight the impact of shorter lease terms on investment strategies[6]. By consolidating underwriting, pipeline management, and portfolio insights into one platform, CoreCast simplifies decision-making for real estate professionals navigating an ever-changing office market.

Conclusion: Planning for the Future of CRE with Remote and Hybrid Work

The rise of remote and hybrid work models has reshaped U.S. commercial real estate (CRE) in distinct ways. Remote-first strategies are driving a noticeable drop in overall office demand, leading to higher vacancy rates and an increase in office-to-residential conversions in weaker markets[3][4]. On the other hand, hybrid work has softened the impact on demand. While tenants downsize, they still retain central offices for collaboration, often opting for spaces with better amenities and a focus on employee experience. Interestingly, just 10% of U.S. office buildings have accounted for 80% of the vacancy increase since 2020[8], highlighting a significant shift in market dynamics. These trends demand customized approaches for different market conditions.

For investors and property owners, strategies must align with the prevailing work model and regional dynamics. In markets dominated by remote work, longer lease-up times, higher tenant improvement costs, and repurposing of properties may become the norm. Meanwhile, hybrid-focused markets can benefit from reimagined office layouts, shorter and more flexible lease agreements, and enhanced services. Geographically, remote work often boosts suburban and Sun Belt markets, while hybrid models help stabilize major coastal and gateway cities that are investing in modern, next-generation office spaces. Staying competitive will require leveraging data insights and quickly adapting to evolving scenarios.

Tools like CoreCast can provide the real-time analysis needed to navigate these changes. By integrating underwriting, pipeline tracking, mapping, and portfolio analytics into a single platform, CoreCast enables users to model various remote and hybrid work scenarios. This helps assess impacts on returns, debt coverage, and portfolio diversification. Its stakeholder center and personalized reporting features also allow asset managers to communicate clear, data-driven insights with partners, lenders, and investors, improving both transparency and decision-making speed.

Adopting a data-driven approach equips stakeholders to safeguard value, seize emerging opportunities, and shape the future of the office market. Whether converting distressed office spaces into residential units in remote-heavy areas or investing in high-quality, experience-focused offices for hybrid tenants, success will depend on incorporating scenario-based strategies into every major leasing, investment, and property management decision.

FAQs

How do remote and hybrid work models influence suburban real estate markets?

Remote and hybrid work models are reshaping suburban real estate markets. With many companies moving away from centralized office spaces, suburban areas are experiencing a surge in both office developments and residential expansion. This shift caters to employees who prefer working closer to home and avoiding the congestion of urban centers.

The impact is clear: suburban areas are witnessing higher occupancy rates and increasing property values. This evolution in workplace flexibility is driving new trends in real estate and opening up fresh investment opportunities in these regions.

What challenges do landlords face with rising office vacancies?

Landlords are facing mounting difficulties as office vacancies rise. With fewer tenants, rental income drops, making it tougher to manage operating costs and sustain profits. On top of that, maintaining and securing empty spaces can become a costly burden, especially when new tenants aren't on the horizon.

Empty offices also tend to lose their appeal to potential renters, often resulting in longer wait times to fill vacancies. This can push landlords to offer discounts or other incentives, further squeezing their bottom line. Over time, these challenges can negatively affect property values, adding another layer of financial unpredictability in an already shifting commercial real estate market.

What are the key steps to converting office spaces into residential units?

Transforming office spaces into residential units is a detailed process requiring careful planning and execution. Start by examining local zoning laws and obtaining any necessary permits to ensure the project aligns with legal requirements. Once that’s squared away, the interior must be reimagined to include essential living areas like kitchens, bathrooms, and bedrooms. This often involves addressing structural changes, such as adding insulation, windows, and soundproofing to create a comfortable living environment.

Upgrading utilities is another critical step. Plumbing, electrical systems, and HVAC need to be brought up to residential standards to ensure the space is safe and functional. Compliance with residential building codes - especially those related to safety and accessibility - should also be a top priority.

Beyond the basics, features like parking and shared amenities can greatly enhance the property’s appeal to potential residents. To determine whether the project is financially viable and aligns with market demand, tools like CoreCast can offer valuable insights, helping you forecast potential returns and make informed decisions.