AI Early Warning Systems for CRE Risks

AI is transforming risk management in commercial real estate (CRE) by offering early warning systems that detect potential issues months in advance. These systems analyze real-time data - like tenant activity, economic trends, and satellite imagery - to flag risks well before they escalate. Unlike outdated methods relying on quarterly reports or annual inspections, AI tools provide instant insights, helping CRE professionals make faster, data-driven decisions.

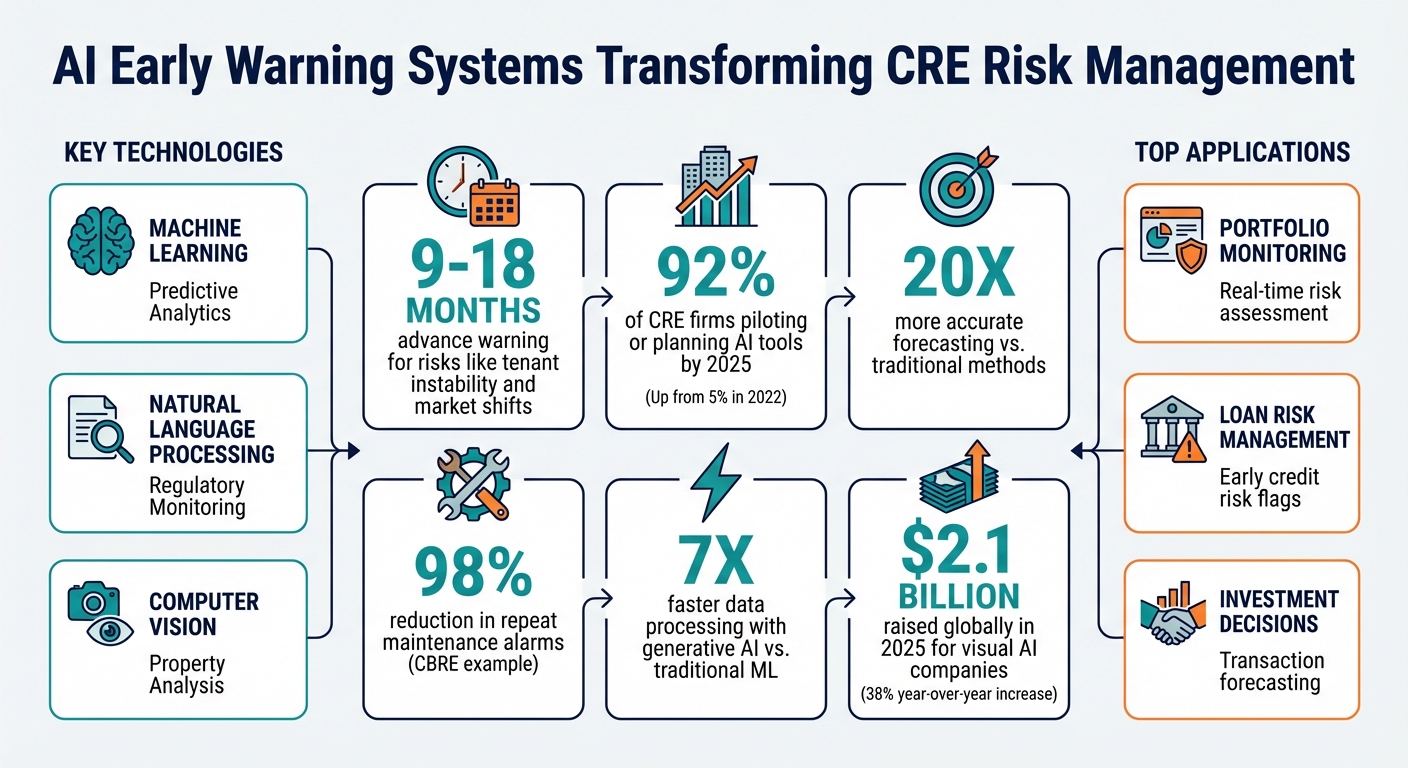

Key Takeaways:

- AI identifies risks (e.g., tenant instability, market shifts) 9–18 months ahead of time.

- Tools like Moody's Early Warning System monitor tenant health, market changes, and property conditions in real time.

- AI processes vast datasets, predicting tenant defaults, property devaluation, and market downturns with high accuracy.

- Technologies include machine learning, natural language processing (NLP) for regulatory updates, and computer vision for property analysis.

- CRE adoption of AI has skyrocketed, with 92% of firms piloting or planning AI tools by 2025.

Example Applications:

- Portfolio Monitoring: JLL's Azara platform consolidates decades of data for instant risk assessments.

- Loan Risk Management: AI flags credit risks early, enabling lenders to act proactively.

- Investment Decisions: CBRE's Capital AI suite forecasts transactions and evaluates buyer behavior.

While AI is reshaping the industry, challenges like data quality and system integration remain barriers. Platforms like CoreCast aim to address these issues by offering unified tools for underwriting, pipeline tracking, and risk forecasting. Firms investing in AI tools now are positioning themselves to respond to risks faster and more effectively than ever before.

AI Early Warning Systems in Commercial Real Estate: Key Statistics and Benefits

How to use Artificial Intelligence (AI) to Identify Real Estate Portfolio Risk

How AI Early Warning Systems Detect CRE Risks

AI early warning systems are designed to sift through vast amounts of data, searching for signals that could indicate potential risks in commercial real estate (CRE). By combining internal portfolio data with a wide range of external datasets, these systems create what many in the industry refer to as a "360-degree" view of risk. Essentially, they connect data sources that would take humans weeks to analyze, doing so in real-time. Here's how AI tracks economic trends, property-specific issues, and environmental risks to identify potential problems before they escalate.

Tracking Economic and Market Signals

AI platforms keep a constant watch on economic reports and daily news, identifying threats to specific assets as they arise. A notable example is Moody's Early Warning System, launched in partnership with Microsoft in July 2024. This system was developed to alert 70 major U.S. banks and lending institutions to adverse developments. For instance, if Walgreens announces store closures, the system immediately flags every property in a client's portfolio where Walgreens is a tenant. It then calculates potential impacts, such as changes in ratings or default risks, based on this news [1].

"The core value to me is that we connected all these different data sets to client portfolio information." - Joe McBride, Senior Director of CRE Product Management, Moody's [1]

These platforms also conduct stress tests by merging proprietary data with market data, such as rental rates and transaction trends [5][7]. Using pattern recognition, they detect early signals like declining transaction volumes or compressing rental rates, enabling investors to act before risks fully materialize [5][7].

Analyzing Property and Tenant Risks

While economic signals offer a broad view, property-specific data provides a closer look at potential vulnerabilities.

AI systems dive deep into tenant financial health across entire portfolios. They analyze credit ratings, payment histories, and financial statements, ranking risks by industry codes [1][5]. Using computer vision, these platforms review leases, rent rolls, and other documentation to uncover revenue leaks or inconsistencies in underwriting [2][3]. Some systems even examine leasing applications and bank statements to minimize fraud risks during tenant onboarding [2].

CBRE has taken this a step further by deploying AI-powered facilities management across one billion square feet and 20,000 sites as of August 2023. This initiative reduced repeat maintenance alarms by 98% - a significant improvement in operational efficiency [3].

AI also uses aerial and street-level imagery to assess property conditions in real time. Instead of relying solely on building age or replacement cost assumptions, visual AI evaluates factors like structural integrity and roof conditions. Sensors and computer vision track metrics such as occupancy rates and foot traffic, helping landlords identify underperforming assets before they become financial burdens [2][3].

Modeling Climate and Environmental Risks

Environmental data plays a crucial role in building a comprehensive risk profile. AI systems now incorporate high-resolution aerial imagery and energy usage patterns to evaluate risks from floods, wildfires, and storms - concerns for 93% of occupiers [8]. Companies like Cape Analytics and ZestyAI use this imagery to derive property-specific attributes related to environmental hazards. In fact, these firms collectively raised $2.1 billion globally in 2025, marking a 38% year-over-year increase in investment [2].

Machine learning further refines building operations by analyzing energy consumption, indoor environmental conditions, and space utilization. This helps identify inefficiencies and automate maintenance solutions [8]. Energy management has become one of the most established applications of AI in CRE, offering immediate returns on investment [8].

AI Technologies Behind Early Warning Systems

Every effective early warning system relies on three key AI technologies working in unison: processing data, interpreting language, and analyzing visual information. Together, these tools create a powerful framework that transforms raw data into actionable insights, enabling commercial real estate (CRE) professionals to identify and mitigate risks tied to their investments.

Machine Learning and Predictive Analytics

Machine learning is the backbone of early warning systems, capable of sifting through massive datasets to uncover patterns that would be impossible to detect manually. It analyzes factors like rental income, occupancy rates, maintenance expenses, and even unconventional data such as foot traffic and credit card transactions. This allows it to predict market downturns, property devaluation, and tenant defaults with remarkable precision. In fact, machine learning models can forecast key metrics, like household net worth, up to 20 times more accurately than traditional methods [9].

"Machine learning thrives on vast amounts of data. The more high-quality data it has, the more accurate the results."

- David Cockey, COO, Head of Consulting, Altus Group [9]

Sophisticated frameworks, like the Real Estate Construction Investment Risk (RECIR) model, combine macroeconomic trends with property-specific data to generate a "Total Risk Score" for individual assets. This score evaluates critical factors such as legal and regulatory stability (25.2%), location quality (22.5%), market volatility (18.0%), and property condition (6.3%) [10]. By leveraging neural networks and ensemble methods, these systems can capture complex relationships within the data, improving forecasting accuracy across entire portfolios. To enhance this further, natural language processing plays a complementary role by monitoring regulatory and market developments.

Natural Language Processing for Regulatory Monitoring

Natural language processing (NLP) excels at sifting through vast amounts of text-based information, such as news articles, regulatory filings, and market reports, to alert CRE professionals to potential risks. For example, NLP systems can analyze loan data across different markets and asset classes, flagging vacancies or signs of financial distress as they emerge [1].

In addition to monitoring external developments, NLP automates the extraction of critical details from complex documents like leases, tax bills, and supply chain contracts. Tasks that once required hours of manual effort can now be completed in moments, allowing analysts to focus on strategic decision-making rather than tedious data collection [9][3]. The demand for generative AI skills in real estate has surged, with job postings in the sector increasing by 64% in 2022 and another 58% through August 2023. Notably, 17% of these roles focus specifically on legal due diligence [6].

Computer Vision for Property Condition Analysis

Computer vision brings a visual dimension to early warning systems by analyzing images to assess property conditions in real time. By examining high-resolution photos, these systems can evaluate structural integrity and maintenance needs, enabling lenders and insurers to base decisions on actual physical risks rather than generic replacement cost estimates [2].

"The driver of this acceleration is performance. Visual AI is proving its ability to convert physical world complexity into structured data that improves asset income, operational efficiency and risk modeling."

- Ashkán Zandieh, Founder and Managing Director, Center for Real Estate Technology & Innovation [2]

In construction, computer vision uses 360-degree imagery to track project progress and verify completed work, helping to mitigate risks tied to delays or disputes [2]. For facilities management, it monitors occupancy trends and space utilization, allowing landlords to identify underperforming areas and address them before they impact revenue [2].

How CRE Professionals Use AI Early Warning Systems

Commercial real estate (CRE) professionals are tapping into the power of AI to identify risks early and make smarter decisions in portfolio management, credit risk, and investments. The trend is gaining momentum: 92% of commercial real estate teams are either piloting AI tools or plan to start by 2025 - a dramatic jump from just 5% in 2022 [8].

Monitoring Portfolio Risk in Real Time

AI systems have revolutionized how portfolio managers monitor risk, enabling them to oversee dozens - or even hundreds - of properties simultaneously. These tools automate the process of assessing risks by consolidating data from various sources like energy usage, occupancy rates, and financial performance into a single, easy-to-digest view [8]. A prime example is JLL's Azara platform, which, in July 2024, unified over two decades of fragmented operational data into a cloud-based system. This provided a comprehensive overview that supports data-driven strategies [8].

AI also excels in real-time news tracking, which has become a game-changer for managing portfolio risks. Generative AI tools scan breaking news - such as tenant bankruptcies, store closures, or regional economic changes - and instantly alert investors about potential impacts on their properties [12][1]. These systems can analyze tenant health data and calculate how events may affect net operating income in seconds, replacing the labor-intensive manual processes that used to take hours or even days [12][7].

"The first step is operational efficiencies and then, over time, it starts to really reveal things you didn't pick up on because you didn't have time to gather all this data."

- Kevin Fagan, Head of CRE Economic Analysis, Moody's [1]

Facilities management is also seeing major operational improvements. For instance, CBRE's AI-powered solutions, deployed across 20,000 sites and one billion square feet of space, have slashed repeat maintenance alarms by 98% by predicting equipment failures before they happen [3]. This unified approach to risk management naturally extends to credit risk monitoring for lenders.

Managing Loan Risk for Lenders

For lenders, assessing and monitoring loan portfolios is no small task. AI early warning systems are quickly becoming essential for managing credit risk. These tools streamline the process of analyzing complex documents - like rent rolls, cash flow statements, and lease agreements - to evaluate property performance and borrower creditworthiness [13].

In July 2024, Moody's introduced its GenAI-powered Early Warning System, developed in partnership with Microsoft, specifically for 70 of the largest U.S. banks and lending firms [12][1]. The system’s predictive accuracy is impressive. For example, in October 2025, Moody's EDF-X system flagged severe credit risks for Iron Hill Brewery as early as September 2023 - two years before the company ultimately filed for bankruptcy. This early warning gave lenders ample time to respond [13].

These systems also continuously monitor loan covenant compliance and other key deal metrics, allowing lenders to step in early when assets underperform. By calculating metrics like Probability of Default (PD) and Loss Given Default (LGD), they provide a comprehensive view of loan health. Using vast datasets that include market factors like supply, demand, and absorption rates, generative AI models can process this information up to seven times faster than traditional machine learning tools [12].

Supporting Investment Decisions with Forecasting

Beyond risk management, AI is reshaping how CRE professionals approach investment decisions. These systems sift through billions of data points to forecast property transactions, rank potential buyers, and highlight emerging opportunities or risks in real time [3].

In 2025, CBRE's Capital AI suite helped brokers expand their pool of capital sources by 20%. By analyzing transaction data and buyer behavior, the tool ranks likely buyers and predicts property transactions, speeding up underwriting and due diligence processes [3].

"AI is freeing brokers' time to focus on what's important, the consultative and advisory piece."

- Laura Barr, CBRE [3]

AI also enables dynamic portfolio optimization, turning space planning into an ongoing process rather than a periodic exercise. Organizations can now assess space utilization and adjust their footprint more effectively, basing decisions on real-time usage patterns instead of outdated assumptions [8].

sbb-itb-99d029f

CoreCast's AI-Driven Risk Management Features

The commercial real estate (CRE) industry is steadily integrating AI-powered solutions to tackle risk management challenges, and CoreCast is stepping up with its upcoming end-to-end CRE intelligence platform. Launching in Q3 2025 (beta) and Q1 2026 (v1.0), CoreCast aims to replace fragmented tools with a unified platform that offers real-time risk management. With this platform, CRE professionals can underwrite deals, track their pipelines, monitor portfolio performance, and seamlessly share insights - all in one place [14]. Below, we explore CoreCast's standout features designed to simplify risk analysis and streamline deal tracking.

Real-Time Data Integration and Analysis

CoreCast simplifies data integration and analysis by connecting directly with leading property management platforms like AppFolio, Yardi, RealPage, Entrata, and Buildium. This seamless connectivity enables the platform to pull historical performance and lease data instantly, ensuring underwriting models are built on accurate, trailing information. Additionally, seller financials - regardless of format - are parsed and integrated into models within seconds.

The system also keeps an eye on critical risk metrics, automatically flagging anomalies in operating expenses and tracking key thresholds such as breakeven occupancy, expense ratios, and refinance viability based on current market conditions. Users can interact with their data using a conversational AI interface, posing questions like: "CoreCast, summarize every asset with breakeven occupancy above 88% for Monday morning." Instead of relying on manual spreadsheet reviews, users receive alerts via email, Slack, or in-app notifications, allowing for proactive risk management.

Pipeline Tracking and Asset Risk Assessment

CoreCast also provides a robust deal management interface, combining pipeline tracking with geospatial mapping. This feature allows users to visualize their deal flow on customized market maps, offering filters by product type, risk level, sponsor, or deal maturity. This functionality helps identify potential overexposure in specific submarkets before committing capital. The platform supports underwriting for major asset classes - such as multifamily, office, industrial, and retail - as well as more specialized types like RV parks, mobile home communities, and medical offices.

The Output View feature delivers real-time updates on essential financial metrics, giving users immediate insights into the impact of their decisions. For stakeholders, CoreCast includes portals with customizable permissions, enabling LPs, lenders, and JV partners to access tailored information on distributions, debt coverage, and performance metrics - eliminating the need for endless email chains.

Upcoming AI Features for Advanced Risk Forecasting

CoreCast is also gearing up to roll out new AI-powered tools designed to elevate risk forecasting. Among these features is an AI Deal Review Assistant, which will allow users to upload offering memorandums and receive an instant "red/yellow/green" risk assessment, simplifying the initial deal evaluation process. Predictive sourcing tools will recommend deals based on historical performance trends and emerging market data, while cross-deal benchmarking will highlight systemic risks across portfolios.

The platform plans to integrate market data from sources like CoStar and RealPage, enabling real-time comparisons against similar properties. Additionally, smart cap table management tools will include equity modeling, dilution forecasting, and waterfall visualizations to help users better manage capital structure risks. As CoreCast co-founder Jared Stoddard explains:

"CoreCast will continue to expand in every direction where CRE operators need leverage" [14].

These upcoming features reinforce CoreCast’s commitment to shifting CRE risk management from a reactive approach to a more proactive one.

Challenges in Adopting AI Early Warning Systems

For professionals in commercial real estate (CRE), implementing AI-driven risk management systems isn't without its obstacles. While a striking 92% of CRE teams are either piloting AI initiatives or planning to do so soon, only a mere 5% report achieving the majority of their program goals [8]. The reasons for this gap boil down to two key issues: data quality concerns and the complexity of system integration. Tackling these challenges is crucial to unlocking the potential of AI in risk management for the CRE sector.

Data Quality and Accuracy Issues

The effectiveness of AI hinges entirely on the quality of the data it processes. Unfortunately, data fragmentation is a widespread issue. A survey revealed that institutional investors often store their data across multiple platforms - spreadsheets, shared drives, and outdated business intelligence tools - resulting in silos that prevent AI from delivering comprehensive risk insights [16]. This disjointed approach can lead to what experts call "AI hallucinations", where models confidently produce outputs that are factually incorrect, thereby introducing additional risks [15].

Manual data entry errors further compound the problem, undermining the reliability of AI tools. It's no surprise, then, that 98% of institutional investors have identified upgrading their data infrastructure as a top priority for becoming AI-ready within the next 12–24 months [16]. As Trepp aptly puts it:

"AI is only as powerful as the data behind it" [11].

To address these issues, firms can create a "sandbox" environment to safely test and refine AI models without compromising sensitive information. Additionally, instituting mandatory human reviews of AI-generated outputs before they are put to business use is a crucial safeguard [15][6].

Integrating AI with Existing Systems

Beyond data quality, integrating AI into existing systems presents another significant hurdle. Over 60% of companies report needing to resolve basic technology challenges - such as overlapping system functionalities and outdated infrastructure - before they can fully harness AI's capabilities [8]. This challenge is both technical and organizational, with 88% of companies simultaneously upgrading their legacy systems while rolling out AI initiatives [8].

Interestingly, while only 43% of firms consider a lack of internal expertise a primary barrier, gaining support from the C-suite dramatically increases the chances of success - by as much as threefold [16][17]. Yao Morin, Chief Technology Officer at JLLT, describes this mindset well:

"Potential risks in leveraging AI for real estate aren't barricades, but rather steppingstones. With agility, quick adaptation, and partnership with trusted experts, we convert these risks into opportunities" [15].

Practical steps to ease integration include aligning AI deployments with major business transformations, using third-party APIs to simplify the process, and starting with low-risk applications before scaling up to more complex, portfolio-wide implementations [6][8][15]. These approaches can help companies overcome integration challenges and maximize the benefits of AI in their operations.

Conclusion: The Future of AI in CRE Risk Management

AI-powered early warning systems are reshaping how risks are identified and managed in the commercial real estate (CRE) sector. By shifting from reactive approaches to proactive detection, firms can now spot tenant distress, market fluctuations, and property condition issues before they escalate into costly problems. With advanced AI processing data up to seven times faster[12], the lag between identifying risks and taking action has dramatically reduced - from days to just minutes.

The adoption of AI in CRE has skyrocketed, with usage jumping from 5% to 92% in just three years. Additionally, over 72% of property owners and investors are actively allocating funds to AI-driven solutions[8][6]. As Yuehan Wang, Global Research Director at JLL, aptly puts it:

"Occupiers that wait idly for technologies to mature in the hope of a 'second mover advantage' risk competitive obsolescence as they miss the chance to experiment and understand how AI can deliver value for their unique operations."[8]

This widespread adoption highlights the growing demand for platforms that offer comprehensive risk management solutions. A standout example is CoreCast, which is at the forefront of this transformation. CoreCast integrates underwriting, pipeline tracking, portfolio analysis, and stakeholder reporting into a single system. Its real-time risk monitoring and forecasting tools align with the industry's move toward specialized AI tailored for real estate[4][2]. As the focus shifts from generic AI models to real estate-specific solutions, platforms like CoreCast will become essential for firms aiming to stay competitive.

Looking ahead, the future of CRE risk management will blend human expertise with AI "copilots" that deliver insights faster, automate routine tasks, and enable professionals to focus on strategic decision-making. Firms that invest in robust data systems and impactful AI tools will be better prepared to navigate the complexities of risk management. By combining real-time data with AI-driven analytics, the CRE industry is positioned to embrace smarter and more proactive risk strategies.

FAQs

How do AI early warning systems help identify risks in commercial real estate?

AI-powered early warning systems are transforming risk detection in commercial real estate by processing massive amounts of data almost instantly. These systems analyze everything from market trends and tenant details to breaking news and economic updates. By cross-referencing this information with proprietary portfolio data, they can pinpoint potential risks before they escalate. For instance, they might highlight rising vacancy rates, fluctuating rental prices, or signs of tenant financial trouble.

What sets AI apart is its ability to uncover risks that might not be immediately obvious. Beyond the usual metrics, it can identify patterns pointing to issues like supply chain disruptions or increases in local crime - factors that traditional methods might miss. This kind of rapid analysis allows real estate professionals to act quickly, refine their strategies, and share timely insights with stakeholders. Tools like CoreCast bring all these capabilities together, offering a streamlined way to manage investments and mitigate risks effectively.

What challenges come with integrating AI into commercial real estate systems?

Integrating AI into commercial real estate (CRE) systems isn't without its challenges. For starters, the initial investment can be hefty. Setting up data pipelines, cloud infrastructure, and securing AI expertise often requires a significant financial commitment, which can stretch budgets thin. On top of that, many CRE systems are built on outdated or isolated data sources, making it tough to incorporate AI tools without first addressing data quality and compatibility issues.

Another major obstacle is change management. CRE professionals often rely on manual processes, and shifting to AI-driven workflows means not only introducing new tools but also building confidence in the technology. It’s crucial to ensure these tools align with existing workflows and reporting structures to avoid disruption. Then there’s the added layer of regulatory and compliance requirements. From tenant privacy to credit risk and ESG standards, these considerations can complicate AI adoption even further.

Platforms like CoreCast aim to simplify this process. By offering an integrated solution with AI-driven analytics, streamlined data management, and actionable insights, CoreCast helps teams adopt AI without juggling multiple systems. Its ability to fit seamlessly into familiar workflows makes the transition smoother and more accessible for CRE professionals.

How does AI improve investment decisions in commercial real estate?

AI is reshaping the way commercial real estate (CRE) investments are approached, turning massive, scattered data into practical insights. By leveraging machine learning, AI dives into transaction histories, tenant patterns, economic indicators, and even satellite images to provide predictive analytics. These tools can quickly and accurately project rent increases, vacancy trends, and property valuations, enabling investors to make smarter, data-backed choices.

Beyond analytics, AI simplifies everyday tasks like portfolio tracking and risk evaluation. Advanced systems scan news, regulatory changes, and proprietary data to identify potential risks early, giving investors a chance to respond promptly. Platforms such as CoreCast bring these features together in one place, offering tools like real-time forecasting, risk notifications, and portfolio assessments. This all-in-one approach helps CRE professionals make quicker, better-informed decisions while conserving both time and resources.