How Migration Impacts Workforce Housing Needs

Migration directly influences workforce housing by increasing demand for homes and shaping the regional migration trends that define the labor pool. Here’s a quick breakdown:

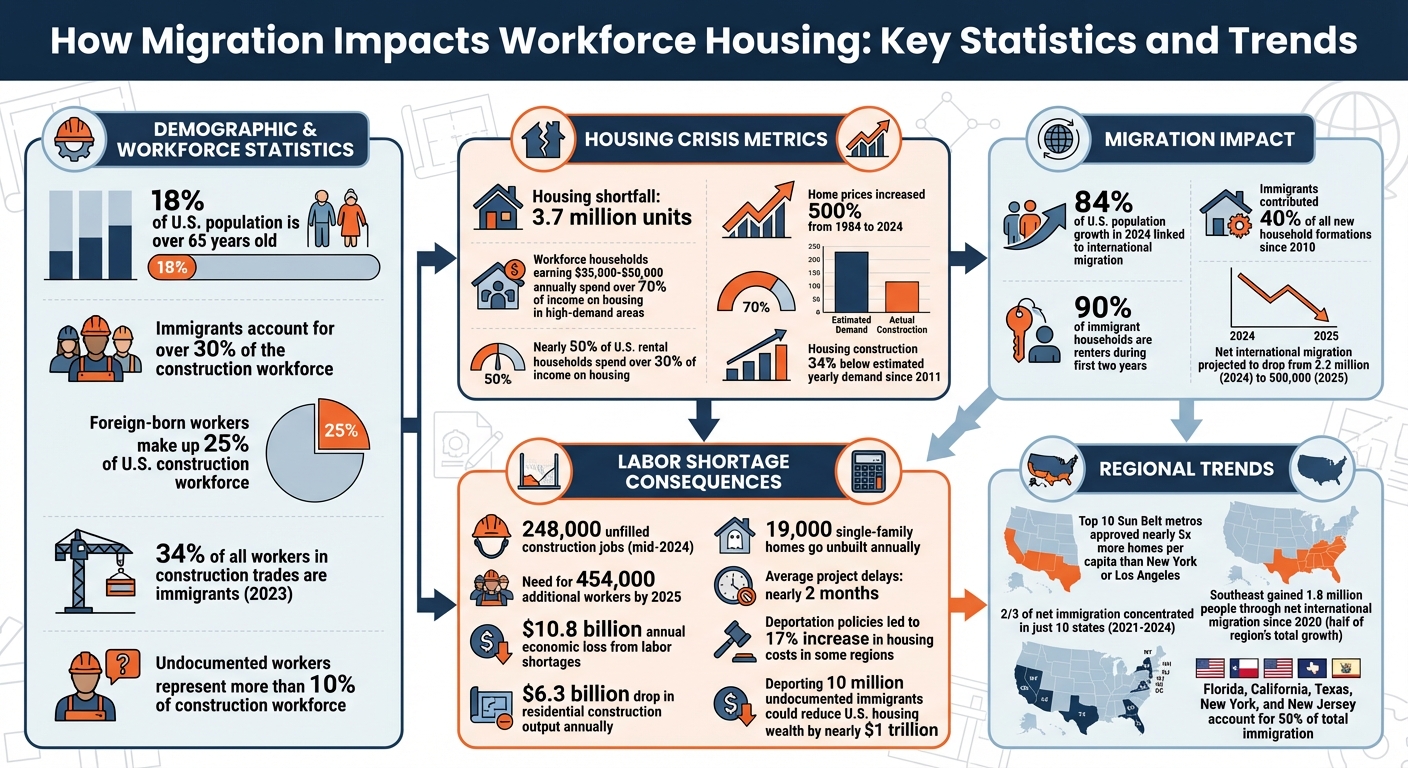

- Aging U.S. Workforce: With 18% of the population over 65, the construction industry increasingly relies on migrant labor to meet housing needs.

- Housing Affordability Crisis: Workforce households earning $35,000–$50,000 annually face rising costs, often spending over 70% of their income on housing in high-demand areas.

- Labor Shortages: Deportation policies and reduced immigration have led to fewer construction workers, driving up housing costs by 17% in some regions.

- Domestic Migration Trends: Cities like Austin and Raleigh are seeing population booms, outpacing housing development. Remote work has also shifted demand to smaller, affordable cities.

- International Migration: Immigrants account for over 30% of the construction workforce and drive rental demand, with 84% of U.S. population growth in 2024 linked to immigration.

Key challenges include a housing shortfall of 3.7 million units, regulatory barriers, and labor shortages, which delay projects and increase costs. Solutions like zoning reforms, financial incentives, and data-driven tools like CoreCast can help developers and policymakers address these issues effectively.

How Migration Impacts Workforce Housing: Key Statistics and Trends

How Migration Patterns Affect Workforce Housing Demand

Domestic Migration to Growing Cities

The movement of people within the U.S. is reshaping workforce housing demand, particularly in cities with policies that encourage growth. From 2019 to 2024, cities like Austin, Charlotte, and Raleigh experienced a surge in new residents and businesses, outpacing restrictive housing markets such as New York and Los Angeles [6]. For instance, in the 12 months ending March 2025, Austin led all 77 metros in apartments permitted per capita. Additionally, the top 10 Sun Belt metros approved nearly five times more homes per capita than New York or Los Angeles [6].

However, this trend is slowing due to the "mortgage lock-in effect." Homeowners with 3% mortgage rates are hesitant to sell and take on new loans at the current 6.5% rates, even when relocating to cities with lower housing costs [5][6]. This creates a complicated situation where people are drawn to more affordable areas but are reluctant to leave their current homes.

Remote work has also changed the landscape, allowing workers to move to smaller, less expensive cities while keeping their jobs. Between 2019 and 2024, tech employment grew fastest in Dallas-Fort Worth, Nashville, and Charlotte, while San Jose saw an 8% decline in its tech workforce [6]. Many workers are now choosing suburban areas within large metros - like Austin, Dallas-Fort Worth, and Houston - seeking a more affordable lifestyle, even as urban cores see population declines. These shifts highlight the need for housing policies that match the evolving migration trends and integrated platforms for real estate professionals to manage these changes.

Take Wake County in North Carolina as an example. When Apple announced a $1 billion investment in a new research and engineering campus in April 2021, creating at least 3,000 jobs, local leaders acted quickly. The Wake County Board of Commissioners adopted "PLANWake", a strategy to promote high-rise multifamily developments along bus transit routes to keep housing affordable [3]. This kind of forward-thinking planning shows how local governments can address housing demand driven by migration. Alongside domestic migration, international labor movement also plays a vital role in shaping housing demand.

International Labor Movement

While domestic migration reshapes local housing markets, international migration significantly impacts both labor supply and housing demand. In 2024, international migration accounted for 84% of U.S. population growth [5]. This influx not only boosts housing demand but also provides much-needed labor for construction. Immigrants make up over 30% of the construction workforce nationwide, with undocumented workers representing more than 10% [7].

Since 2010, immigrants have contributed around 40% of all new household formations in the U.S. [7]. Nearly 90% of immigrant households are renters during their first two years in the country, which directly drives demand in the rental market [7]. On the flip side, deporting 10 million undocumented immigrants could reduce U.S. housing wealth by nearly $1 trillion [7]. These labor and housing dynamics are closely intertwined, affecting both the supply of workforce housing and the speed of new construction.

From 2021 to 2024, over two-thirds of net immigration was concentrated in just 10 states, with Florida, California, Texas, New York, and New Jersey accounting for 50% of the total [9]. The Southeast, in particular, has been a major destination, gaining 1.8 million people through net international migration since 2020 - half of the region's total population growth [5]. However, projections suggest a sharp decline in net international migration, from 2.2 million in 2024 to about 500,000 in 2025 [8]. This drop could worsen labor shortages in construction, potentially slowing new housing development at a time when demand remains high.

sbb-itb-99d029f

Barriers to Meeting Workforce Housing Demand

Supply and Demand Gaps

The U.S. faces a staggering housing shortfall of 3.7 million units, and the gap keeps growing [11]. This mismatch between supply and demand directly impacts the availability of affordable workforce housing. Since 2011, the nation has built an average of just 1.1 million new housing units annually - 34% below the estimated yearly demand. By 2021, construction completions had dropped to levels not seen since some of the worst periods in the past fifty years [2].

But this isn’t just about building more homes. It’s also about having enough workers to build them. Foreign-born workers make up about 25% of the U.S. construction workforce, and 34% of all workers in construction trades are immigrants as of 2023 [10][13]. Workforce shortages are made worse by enforcement actions, which disrupt labor availability and push housing costs even higher.

"Undocumented labor appears to complement domestic labor resulting in net job losses for US-born workers, especially in higher-skilled occupations."

– Troup Howard, Assistant Professor of Real Estate, University of Utah [4]

Nearly 50% of U.S. rental households now spend over 30% of their income on housing, while home prices have skyrocketed by nearly 500% from 1984 to 2024 [10]. This imbalance has left many essential workers unable to afford housing in the communities where they work. It’s a vicious cycle: limited housing supply drives up costs, and the rising costs create even more challenges for workers and builders alike.

Economic and Regulatory Obstacles

Labor shortages are another major hurdle, pushing up project costs and delaying timelines. By mid-2024, there were still 248,000 unfilled construction jobs, with a need for an additional 454,000 workers by 2025 [11]. These shortages come with a hefty price tag: a $10.8 billion annual economic loss. A 2024 University of Denver study found that residential construction output drops by $6.3 billion each year, builders face $2.66 billion in higher costs, and 19,000 single-family homes go unbuilt annually - with average delays stretching nearly two months [12]. Smaller builders, who lack access to large-scale labor resources, are hit particularly hard. This volatility makes scenario analysis for real estate portfolios essential for navigating market uncertainty.

On top of labor issues, regulatory barriers make building workforce housing even tougher. Many local zoning rules dedicate large portions of urban land to single-family homes, leaving little room for diverse housing options like duplexes or accessory dwelling units. Parking requirements also add to the problem, taking up valuable space and driving up costs. In 2021, the median cost of a single structured parking space was $25,700 [14]. Outdated permitting processes add further delays, discouraging developers from starting new projects. To manage these complexities, developers often rely on portfolio analytics tools to track project timelines and costs.

Some cities and states are starting to tackle these obstacles. Minneapolis, for instance, eliminated single-family zoning citywide in 2015 and removed parking requirements for multifamily buildings near high-frequency transit. Meanwhile, Florida’s 2023–2024 "Live Local Act" overrides local zoning laws to allow multifamily developments in commercial or industrial areas, provided at least 40% of the units remain affordable for 30 years [14].

"Policies designed to address housing affordability may be less effective unless they also help increase labor supplied to the construction industry."

– Dayin Zhang, Assistant Professor of Real Estate and Urban Economics, University of Wisconsin-Madison [2]

Strategies to Address Workforce Housing Shortages

Zoning Changes and Financial Incentives

Tackling workforce housing shortages requires creative approaches to zoning and financial policies. One effective strategy is the implementation of Right to Build Zones (RBZs). These zones allow municipalities to designate specific areas where housing projects can proceed "by-right." This means developers can bypass the usual discretionary reviews and lengthy permitting processes, speeding up construction without needing sweeping citywide zoning reforms [15].

Financial incentives play a key role in complementing these zoning changes. For instance, the federal government has allocated $100 million in grants aimed at helping communities remove local regulatory barriers to affordable housing. Additionally, municipalities could benefit from federal dividends for every new home permitted in these reform zones [10][15]. On top of that, proposals such as converting mortgage interest tax deductions into refundable income tax credits for homeowners earning under $100,000 annually, and combining Low-Income Housing Tax Credits (LIHTC) with Section 8 vouchers, aim to keep housing affordable for the workforce while ensuring project viability [10].

Government and Private Sector Collaboration

Although financial incentives lay a strong foundation, partnerships between governments and private developers are critical to turning these reforms into reality. For these collaborations to succeed, incentives must align, and approval processes need to be streamlined. Programs like the HOME Investment Partnerships Program and Community Development Block Grants (CDBG) provide essential funding and technical support, reducing financial risks for developers working on workforce housing projects [10]. Simplifying permitting processes and updating housing codes to allow for diverse housing types can further encourage private sector investment.

Labor availability is another vital piece of the puzzle. According to the Center for American Progress:

"Immigrants play a critical role in the construction labor force necessary to increase the supply of homes, and mass deportation of undocumented immigrant workers would be completely counterproductive to the goal of increasing the supply of affordable housing"

[10]. With foreign-born workers making up roughly 25% of the U.S. construction workforce, policies that ensure a steady labor supply are essential for expanding housing production.

| Collaboration Strategy | Government Role | Private Sector Role |

|---|---|---|

| LIHTC Program | Allocates tax credits to states/developers | Finances, builds, and manages affordable units |

| Zoning Reform | Updates land use regulations and codes | Develops higher-density multifamily housing |

| Block Grants (HOME/CDBG) | Provides funding and technical assistance | Executes construction and preservation projects |

Using Real-Time Data for Better Decisions

Data analysis is a powerful tool for addressing workforce housing shortages, as it helps identify where housing is most urgently needed and where projects are likely to succeed. The Migration Match Index (MMI), for example, evaluates 16 indicators - like labor demand, housing vacancy rates, and cost of living - to determine which of the 3,144 U.S. counties are best suited for workforce housing development. Using this model, 484 counties across 44 states have been identified as having both severe labor shortages and available, affordable housing capacity [1].

Other metrics further refine these insights. For example, counties with an unemployment-to-job-opening ratio (UJOR) below 1, rental vacancy rates above 5%, rent-to-income ratios at or below 30%, and populations with more than 14% aged 65 or older present key opportunities for development [1].

Platforms like CoreCast (https://corecastre.com) make this data actionable by consolidating these metrics into a single intelligence system. Real estate professionals can use CoreCast to analyze migration trends, predict housing demand, and identify promising development sites - all while tracking their projects through various stages of completion.

How CoreCast Supports Workforce Housing Development

Tracking Demographics and Migration Data

CoreCast (https://corecastre.com) uses the MMI approach to help real estate professionals identify areas where workforce housing is critically needed. The platform analyzes 16 key indicators, such as the unemployment-to-job opening ratio (UJOR), rental vacancy rates, and rent-to-income ratios, to pinpoint regions where labor shortages align with available and affordable housing options [1].

The system also tracks local migration patterns, noting that 80% of young adults move less than 100 miles from where they grew up [16]. This highlights that workforce housing demand often clusters in specific neighborhoods or counties rather than spreading evenly across broader areas. CoreCast factors in new migration trends, such as shifts toward the Snow Belt driven by climate change, allowing users to plan ahead with better accuracy.

Additionally, CoreCast examines how immigration policies impact the availability of construction labor - a key issue since a large percentage of workers in the building trades are foreign-born. By understanding these dynamics, the platform helps users anticipate potential supply chain issues that could increase costs or delay projects [4][5]. These insights seamlessly integrate with CoreCast's project management tools, ensuring a smoother development process for workforce housing.

Managing Projects and Portfolios

Beyond demographic analysis, CoreCast functions as a comprehensive real estate intelligence platform, supporting every stage of workforce housing development - from initial underwriting to project completion. Users can manage their pipeline, analyze competing properties on a single map, and conduct portfolio reviews and benchmarking - all within one system.

The platform's stakeholder center allows developers to create branded reports that illustrate how migration trends influence local labor and housing markets. These reports simplify complex data - like areas with UJOR below 1.0 and rental vacancy rates above 5% - into clear, actionable insights for investors, lenders, and municipal leaders. By combining real-time data with project management tools, CoreCast empowers professionals to make quicker, more informed decisions about where to build, how much to invest, and when to proceed with development.

Migration Just Turned AGAINST Housing

Conclusion

Migration patterns, both within the U.S. and internationally, are reshaping workforce housing demand in profound ways. Net international migration contributed to 84% of the total U.S. population growth in 2024 [5], solidifying its role as a key driver of labor supply and housing demand. Simultaneously, domestic trends toward more affordable regions and climate-driven moves back to the Snow Belt are creating fresh opportunities for developers who stay attuned to these shifts.

As migration fuels demand, the strain on the construction labor force becomes more pronounced. This workforce remains a critical bottleneck. As Troup Howard, Mengqi Wang, and Dayin Zhang from the Philadelphia Fed observed:

"Policies designed to address housing affordability may be less effective unless they also help increase labor supplied to the construction industry" [2].

Professionals in the industry must pay close attention to regional labor dynamics and potential policy changes - particularly those tied to immigration - which could lead to a projected 17% increase in housing prices [2].

While these challenges are significant, data-driven tools offer practical solutions. Platforms like CoreCast (https://corecastre.com) help professionals identify high-priority markets and make informed investment decisions. By monitoring key metrics such as unemployment-to-job-opening ratios and rental vacancy rates, developers can focus on "receiving" markets before demand peaks and avoid overbuilding in areas facing population declines.

Moving forward, collaboration is essential. Government agencies, private developers, and economic planners must work together using real-time data to address these challenges. This unified approach, combined with zoning reforms, financial incentives, and infrastructure investments, ensures that development aligns with where workers are relocating. By leveraging integrated tools and strategies, professionals can help meet the growing need for workforce housing in communities across the country.

FAQs

How does migration change workforce housing demand?

Migration often boosts the demand for workforce housing by drawing in higher-income individuals and workers. This influx frequently drives up housing costs, creating ripple effects in regional housing markets. The impact is especially pronounced in areas experiencing a surge in new residents, often tied to remote work opportunities and expanding local economies. These changes underscore the importance of developing strategies to tackle the growing housing challenges in these regions.

How do immigration changes impact construction costs?

Immigration policy changes can drive up construction costs by limiting access to immigrant labor, which makes up a significant portion of the workforce. When labor shortages occur due to these restrictions, wages tend to rise, projects face delays, and overall building expenses climb.

Which local metrics signal a good place to build?

When evaluating locations for development, several key factors come into play: labor demand, housing availability, and demographic trends.

Areas with thriving job markets and a steady demand for workers are particularly appealing. Pair that with an adequate supply of housing, and you have the foundation for a sustainable community. Positive migration trends - where more people are moving in than leaving - are another strong indicator of a location's potential.

Regions that can accommodate affordable housing and handle population growth are especially appealing. This is even more relevant in areas seeing an influx of residents due to climate-driven migration. These places are often well-suited for workforce housing projects, making them a smart focus for development efforts.