Portfolio Benchmarking for Federal Real Estate Assets

Portfolio benchmarking helps federal agencies measure energy use, water consumption, and space efficiency across their real estate portfolios. This process is essential for meeting legal requirements, like those outlined in Section 432 of the Energy Independence and Security Act of 2007 (EISA 432), which mandates annual energy performance tracking for major facilities. Agencies use tools like ENERGY STAR Portfolio Manager to track energy and water usage, set performance baselines, and identify underperforming buildings.

Key Points:

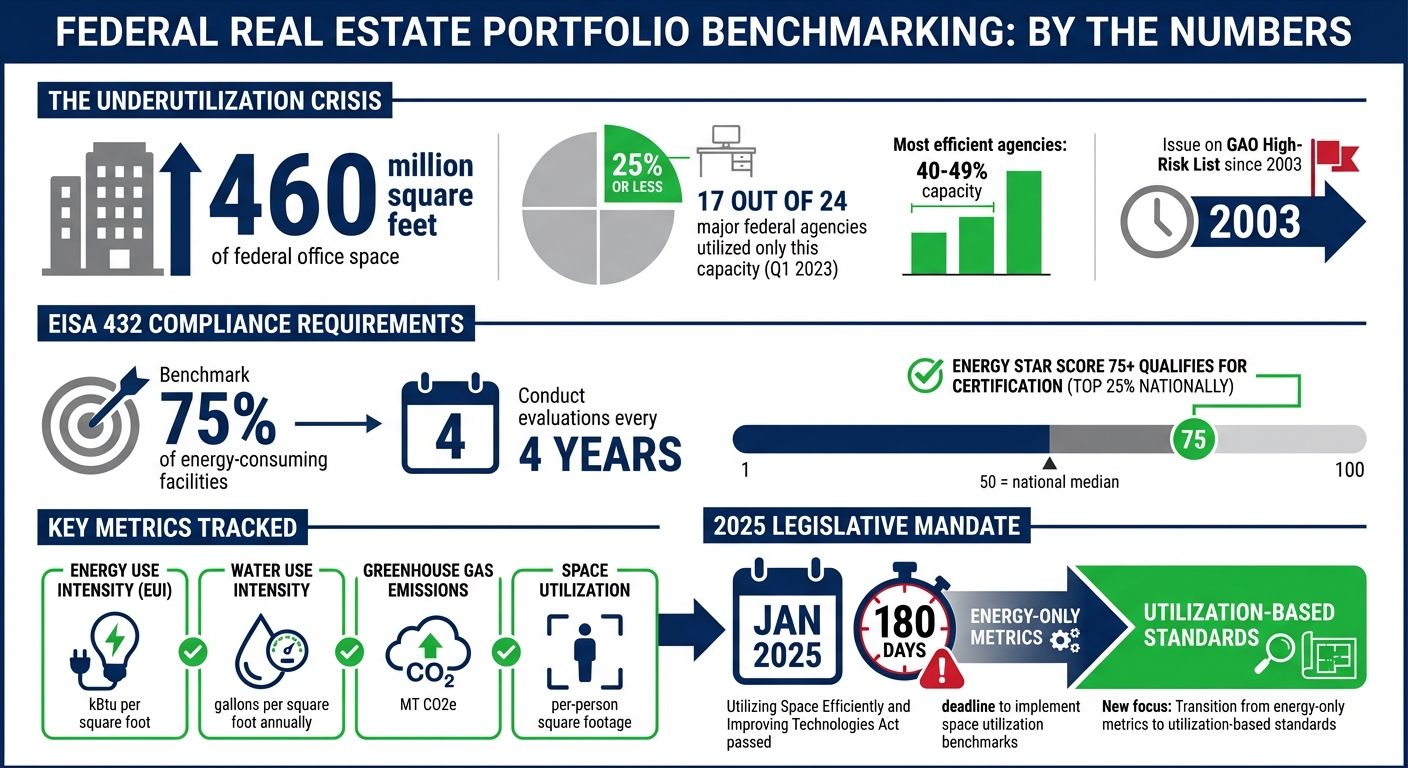

- EISA 432 Compliance: Agencies must benchmark at least 75% of their energy-consuming facilities and conduct evaluations every four years.

- ENERGY STAR Portfolio Manager: Tracks energy and water use; buildings scoring 75+ are eligible for certification.

- Challenges: Data accuracy, tenant utility data access, and inconsistent definitions complicate benchmarking efforts.

- Solutions: Automated tools, performance-based leases, and quality control processes improve efficiency and accuracy.

- New Legislation: A 2025 law requires federal agencies to implement space utilization benchmarks to address underused properties.

Federal agencies are shifting their focus from energy metrics to space utilization standards, driven by new mandates and advanced technologies like real-time dashboards and occupancy monitoring tools. These efforts aim to reduce costs, improve efficiency, and meet compliance deadlines.

Federal Building Space Utilization Crisis: Key Statistics and Benchmarking Requirements

Part 1 - A Beginner’s Guide to Using Portfolio Manager for Benchmarking Law Compliance

Federal Benchmarking Requirements and Standards

Federal agencies must adhere to the regulatory framework outlined in the Energy Independence and Security Act of 2007 (EISA) Section 432 (42 U.S.C. § 8253(f)), which requires them to benchmark energy use in "covered facilities" and report performance data annually. Additionally, a Presidential Memorandum issued on December 5, 2013, titled "Federal Leadership on Energy Management", mandates the use of ENERGY STAR Portfolio Manager for tracking energy performance in all metered buildings. Agencies are required to input monthly energy and water performance data into this tool, which the U.S. Department of Energy (DOE) designates as the official system for meeting federal benchmarking requirements [2].

The data entered into ENERGY STAR Portfolio Manager integrates with the Compliance Tracking System (CTS), a DOE-developed online platform where agencies annually update and disclose building performance data. To ensure accuracy and proper tracking, buildings must be tagged with both a "U.S. Agency Designated Covered Facility ID" and a "U.S. Federal Real Property Unique Identifier" within the Portfolio Manager [2]. These requirements provide the foundation for the tools and data inputs discussed below.

Required Benchmarking Tools and Data Inputs

The ENERGY STAR Portfolio Manager requires specific data inputs to accurately benchmark a building's performance. These include details like property type (e.g., office, hospital, warehouse), location, and total gross floor area (measured in square feet). Operating details such as occupancy levels and operating hours are also essential for calculating an accurate ENERGY STAR Score [2].

For energy benchmarking, agencies must input monthly metered energy consumption data for all fuel types, including electricity, natural gas, steam, chilled water, propane, and fuel oil. If water meters are in place, water consumption data is also required. A building is considered benchmarked once 12 consecutive months of complete energy consumption and square footage data are entered into the Portfolio Manager [2]. For smaller buildings under 5,000 square feet, agencies are encouraged to focus on larger facilities first to maximize the impact of their benchmarking efforts [2].

Core Metrics and Performance Standards

Federal benchmarking relies on a range of standardized metrics to assess building performance. The most well-known of these is the ENERGY STAR Score, which rates buildings on a scale of 1–100, with 50 representing the national median [4]. As ENERGY STAR explains:

The ENERGY STAR score provides a comprehensive snapshot of your building's energy performance, taking into account the building's physical assets, operations, and occupant behavior [4].

Buildings scoring 75 or higher - placing them in the top 25% of similar buildings nationwide - qualify for ENERGY STAR certification [2][4].

In addition to the ENERGY STAR Score, the CTS tracks other key metrics. Energy Use Intensity (EUI) measures energy consumption in kBtu per square foot, with weather-normalized versions accounting for climate differences. Water Use Intensity tracks water usage in gallons per square foot annually. The system also calculates greenhouse gas emissions in metric tons of CO2 equivalent (MT CO2e), offering insight into environmental impacts [2].

These metrics allow agencies to evaluate building performance across their portfolios, pinpoint underperforming assets, and prioritize energy efficiency upgrades. Mastering these benchmarks is crucial as federal agencies work to meet compliance requirements and plan for future energy management strategies.

Recent Studies on Federal Real Estate Benchmarking

Findings from DOE/FEMP and PNNL Reports

The Department of Energy's Federal Energy Management Program (DOE/FEMP) has shifted its focus from simple energy disclosure to a more hands-on approach: active performance management. This change is designed to encourage ongoing improvements across federal property portfolios. As outlined in FEMP's guidance:

Greater transparency, through the provision of various data sets and reports... is meant to accelerate continuous improvement of energy and water measures, adoption of best practices, demonstration and achievement of savings, and optimization of energy and water efficiency measures. [2]

At the heart of this effort is the consistent collection of data, which remains a cornerstone of these initiatives. Regulations under 10 CFR 433 extend these benchmarking principles to new construction and major renovations, setting energy efficiency performance standards right from the design phase. [2] These updated protocols are also paving the way for tracking new performance indicators, such as space utilization metrics.

Performance Trends in Federal Buildings

In addition to energy management, space utilization has emerged as a key performance metric in recent studies. The federal government owns more than 460 million square feet of office space. Yet, during the first quarter of 2023, 17 out of 24 major federal agencies utilized only 25% or less of their headquarters' capacity. Even the most efficient agencies operated at just 40% to 49% capacity. [3]

The Government Accountability Office (GAO) has long flagged this issue as a major concern:

Excess, underutilized space has kept federal real property management on GAO's High-Risk List since 2003. [3]

To address this, Congress passed the Utilizing Space Efficiently and Improving Technologies Act in January 2025. This legislation requires federal agencies to implement standardized space utilization benchmarks within 180 days. Building on ENERGY STAR metrics, agencies are now tasked with optimizing both energy and space use across their properties. Efforts led by the Federal Real Property Council aim to establish uniform utilization metrics, ensuring consistent capacity measurements and enabling meaningful comparisons across agency portfolios. [3]

sbb-itb-99d029f

Challenges and Solutions in Federal Portfolio Benchmarking

Common Compliance Challenges

Federal agencies face several hurdles when it comes to benchmarking their real estate portfolios. One major issue is data accuracy and completeness. Agencies often struggle with inconsistent definitions. For example, should occupancy be based on leased space or physically occupied space? These discrepancies make it difficult to compare properties across different agencies [6].

The problem becomes even more pronounced for agencies managing extensive portfolios, sometimes with more than 50 properties. Data often comes from various sources - property management systems, accounting software, and utility providers - and is manually entered. This fragmented approach increases the risk of errors and makes it hard to establish a reliable "source of truth" for benchmarking.

Another significant challenge is accessing tenant utility data in buildings with multiple tenants. When tenants are billed directly for utilities, it’s nearly impossible to aggregate whole-property consumption data. Without this information, agencies can’t calculate accurate energy performance metrics for these buildings. This gap is a critical roadblock to maintaining accurate and comprehensive portfolio benchmarks [8].

To tackle these challenges, agencies need to adopt better technology and refine their processes.

Practical Benchmarking Solutions

Federal agencies are turning to both established tools and newer technologies to address these issues. One widely used tool is the ENERGY STAR Portfolio Manager, which tracks energy, water, waste, and greenhouse gas emissions across building portfolios. Many third-party software solutions integrate with Portfolio Manager to automate utility data exchange, reducing the need for time-consuming manual data entry [5][9].

For agencies managing larger portfolios, platforms like CoreCast offer more advanced capabilities. These systems consolidate data from various sources into real-time dashboards, making it easier to analyze properties and their performance. They also feature tools like integrated mapping and automated reporting, which save significant time. For instance, automated reporting can reduce the effort required to prepare investor packages - from eight team members working four days to just one person completing the task in a single day [7].

"Technology has played a huge role in shortening the time it takes to both market and sell a property, and that technology has allowed investors to transact across ever-increasing distances." [7]

To address the issue of tenant utility data, agencies can adopt performance-based leasing - also known as green leases. These leases align landlord and tenant incentives by including clauses that require utility data sharing. Additionally, agencies can work directly with utility providers to gain access to complete consumption data, creating a more comprehensive approach to resolving this challenge [8].

Lastly, quality control processes are essential for ensuring data reliability. Benchmarking data should be treated with the same level of scrutiny as financial data. Regular validation checks and variance analyses can help identify anomalies, such as unexpected utility spikes or capital expenditures, before they affect reporting accuracy. By implementing robust quality controls, agencies can ensure their benchmarking efforts remain precise and dependable across diverse portfolios.

Future Trends in Federal Real Estate Benchmarking

Transition to Building Performance Standards

Federal real estate benchmarking is evolving, moving away from energy consumption metrics to focus on utilization-based standards. This shift follows the January 2025 "Utilizing Space Efficiently and Improving Technologies Act", which requires federal agencies to adopt specific building utilization benchmarks within 180 days [3]. Studies have long highlighted the issue of underutilized federal spaces, and this legislation aims to address it by introducing standardized benchmarks that reflect modern workplace trends, including increased telework [3].

"A standard for measuring utilization and a benchmark that accounts for higher levels of telework could help the federal government more consistently identify underutilized space within and across agencies." - GAO Report GAO-24-107006 [3]

The General Services Administration (GSA) has already adopted a per-person square footage benchmark to determine building capacity. This metric forms the backbone of the new federal utilization framework, giving agencies a consistent method to pinpoint underused spaces. With this shift, agencies can make informed decisions about reducing their real estate footprint. To support these changes, emerging technologies will be essential for accurate monitoring and enforcement of the new standards.

Technology's Role in Benchmarking

Technology is becoming a cornerstone of federal benchmarking efforts. The new legislation mandates specific benchmarks to measure building utilization, which will likely rely on tools like sensor technology or badge-data tracking systems to monitor occupancy patterns [3]. The GSA's Alliant 2 procurement vehicle has already prioritized advanced solutions such as blockchain and robotic process automation (RPA) for future federal IT initiatives [1].

Platforms like CoreCast are paving the way by offering end-to-end intelligence for tracking and analysis. These systems integrate data from multiple sources into unified dashboards, providing real-time insights into property portfolios. Features such as integrated mapping allow agencies to better visualize their competitive landscape, while automated reporting tools simplify the process of sharing insights with stakeholders. These capabilities not only help agencies meet the new utilization benchmarks but also ensure compliance with existing energy and sustainability goals - all while staying on track to meet the 180-day implementation deadline.

Conclusion

Managing over 460 million square feet of office space is no small feat for federal agencies, and portfolio benchmarking has become a crucial tool in this effort. By early 2023, 17 out of 24 federal agencies were using their headquarters at just 25% capacity or less, emphasizing the scale of underutilization and the financial and environmental strain it creates[3]. The introduction of the Utilizing Space Efficiently and Improving Technologies Act in January 2025 is set to change this landscape. This legislation mandates agencies to implement specific utilization benchmarks within 180 days, setting the stage for more efficient and standardized management practices[3].

To achieve meaningful results, benchmarking must cover multiple performance areas. Tools like ENERGY STAR Portfolio Manager help track energy efficiency, shedding light on environmental impacts. Utilization standards pinpoint inefficiencies in space usage, while financial benchmarks, including Internal Rate of Return (IRR) and cash-on-cash multiples, provide a clearer picture of cost-effectiveness and long-term value.

Technology plays a vital role in meeting these new requirements. Advanced platforms, such as CoreCast, bring together data from various sources into unified dashboards, offering real-time insights and simplifying operations. These tools enable agencies to monitor performance, identify inefficiencies, and make informed decisions quickly and effectively[7].

With the 180-day deadline looming, agencies must act swiftly to adopt these new benchmarks. Standardized metrics and modern technology will not only help identify and address underutilized spaces but also reduce operational costs and align with federal mandates. The urgency is clear - federal property management has been on the High Risk List since 2003, and modernization is long overdue[3]. By leveraging these tools and strategies, agencies can finally make measurable progress in optimizing their real estate portfolios.

FAQs

What challenges do federal agencies face when benchmarking real estate portfolios?

Federal agencies face several hurdles when it comes to effectively benchmarking their real estate portfolios. One of the biggest challenges is the absence of consistent metrics for measuring space utilization. With the rise of telework reshaping how office spaces are used, it’s become increasingly complicated to determine how much space is genuinely necessary to support their operations.

Another pressing issue is dealing with underutilized or surplus properties. Without reliable standards for utilization, agencies often end up holding onto buildings they no longer need. This not only racks up unnecessary costs but also contributes to environmental concerns. In fact, this problem has kept federal property management on the high-risk list for more than 20 years.

Lastly, the lack of unified benchmarks makes it tough to set performance goals and monitor progress across different agencies. A data-driven tool like CoreCast offers a practical solution by consolidating utilization data, creating standardized metrics, and delivering real-time insights. This approach can streamline benchmarking efforts and support more informed decision-making.

What changes to federal space utilization benchmarks are introduced by the 2025 legislation?

The 2025 legislation brings notable changes to federal real estate leasing policies, potentially impacting how space utilization benchmarks are set. That said, as of January 27, 2025, the exact details of these changes have not been clearly specified in the available reports.

Federal agencies and stakeholders should stay tuned for additional updates and guidance to fully grasp how these adjustments might affect portfolio management and compliance obligations.

How does technology enhance benchmarking for federal real estate portfolios?

Technology is reshaping how federal real estate benchmarking is done, making it faster, smarter, and more reliable. By automating the collection and analysis of key metrics like occupancy rates, energy usage, and financial performance, agencies can efficiently compare individual properties against portfolio-wide or industry benchmarks. This not only reduces the chance of errors but also accelerates reviews and delivers actionable insights almost instantly.

Tools like IoT sensors and cloud-based analytics take this a step further. They provide real-time data on energy consumption, equipment conditions, and how spaces are being used. With this information, agencies can identify issues faster, implement predictive maintenance, and carry out more precise cost-benefit analyses. The result? Lower operating costs and better-performing assets.

Platforms like CoreCast bring it all together. Acting as an all-in-one real estate intelligence solution, CoreCast offers features like portfolio analysis, pipeline tracking, and customized reporting. By streamlining the benchmarking process for various asset types, it helps agencies make informed, data-driven decisions without juggling multiple systems. In short, technology transforms benchmarking from a static task into a powerful tool for smarter real estate management.